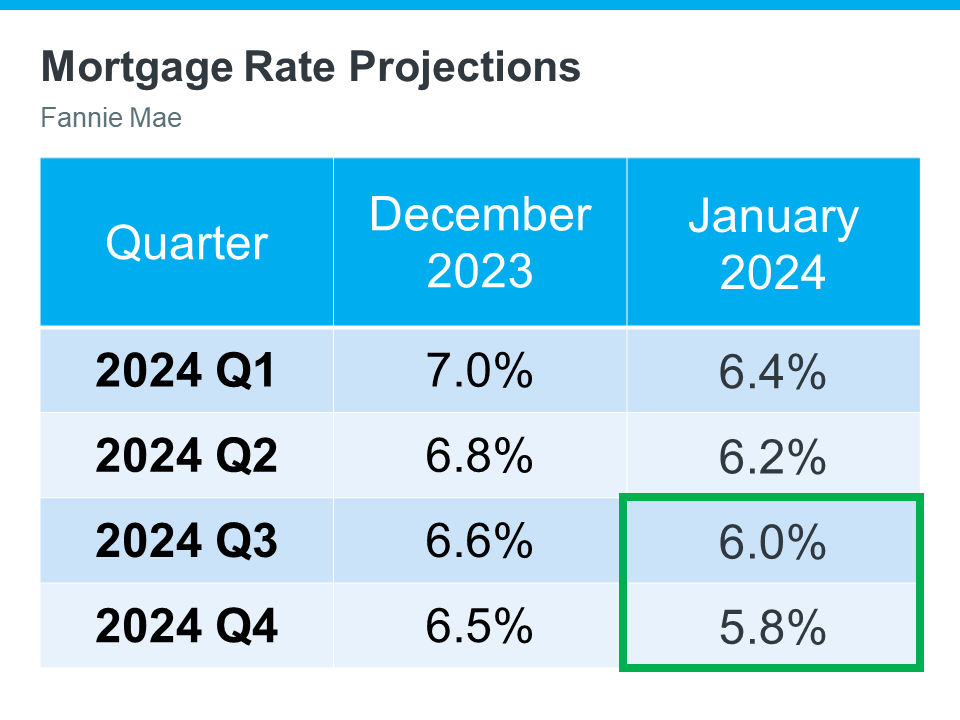

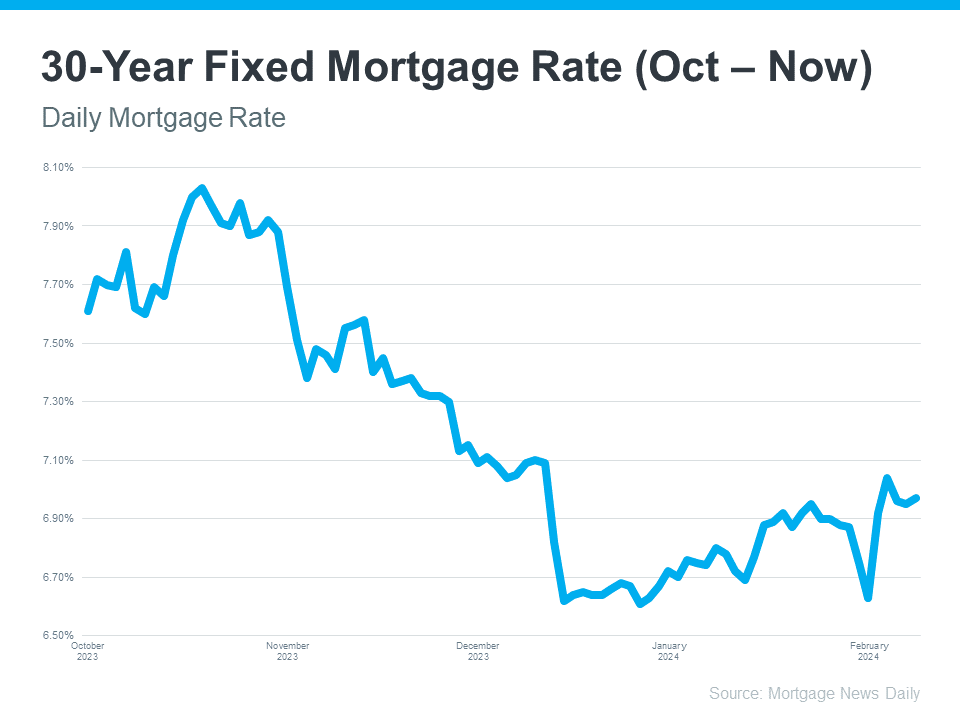

Recent headlines might have stirred questions about the trajectory of mortgage rates and what’s going on. Perhaps you’ve also heard murmurs of potential cuts this year, promising a downward shift in rates. This speculation typically revolves around the actions of the Federal Reserve (the Fed) and its management of the Fed Funds Rate. While adjustments to the Fed Funds Rate don’t directly dictate mortgage rates, they often exert influence. However, during the Fed’s recent meeting, no cut materialized — at least, not yet.

The Fed’s decision-making process involves numerous intricate factors, but you needn’t be overwhelmed by the complexity. What truly matters is the bottom line: does this signify a halt in the potential decline of mortgage rates? Here’s what you should keep in mind.

Anticipating Mortgage Rates Relief: Insights for San Diego Homebuyers

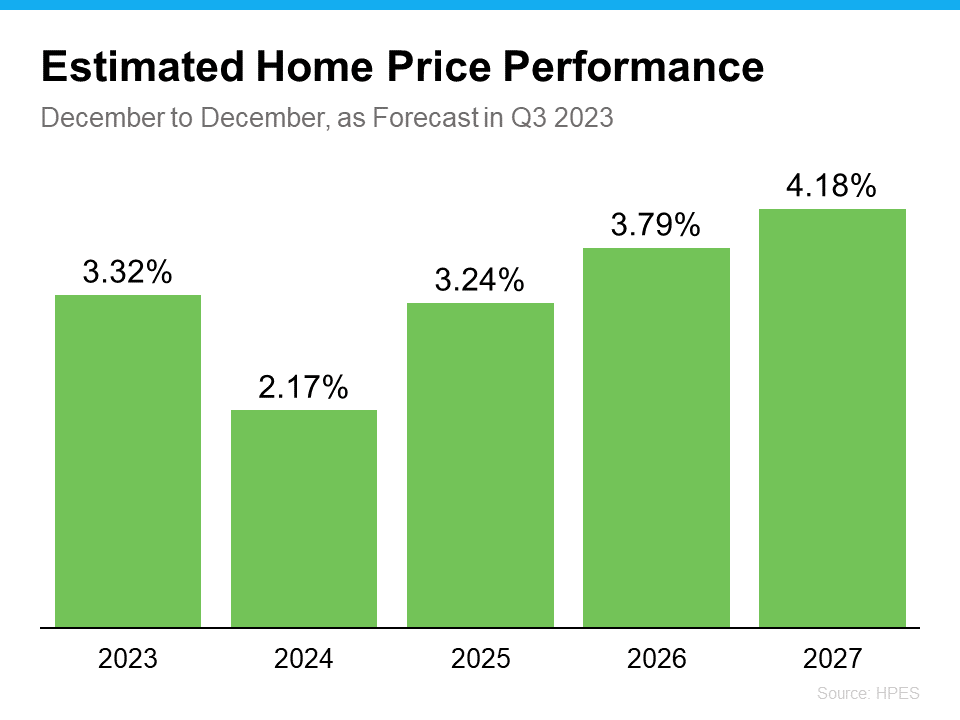

Mortgage rates are anticipated to decrease further this year, although the drop has yet to materialize. However, this delay doesn’t rule out the possibility of future reductions. Even Jerome Powell, the Chairman of the Fed, has affirmed the intention to implement cuts this year, contingent upon the moderation of inflation. This signals potential relief for prospective homebuyers in San Diego and beyond.

“We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

When such occurrences unfold, historical trends indicate that mortgage rates will likely adjust accordingly. This implies that there is still optimism to be had. A recent article from Business Insider elaborates on this phenomenon.

“As inflation comes down and the Fed is able to start lowering rates, mortgage rates should go down, too. . .”

What Does This Mean for You?

However, waiting for this shift may not be the best strategy. Predicting mortgage rates is notoriously difficult due to the multitude of influencing factors. Any fluctuation in the economy can swiftly alter projections. That’s why experts advise taking proactive steps. Mark Fleming, Chief Economist at First American, emphasizes the importance of staying informed and acting decisively.

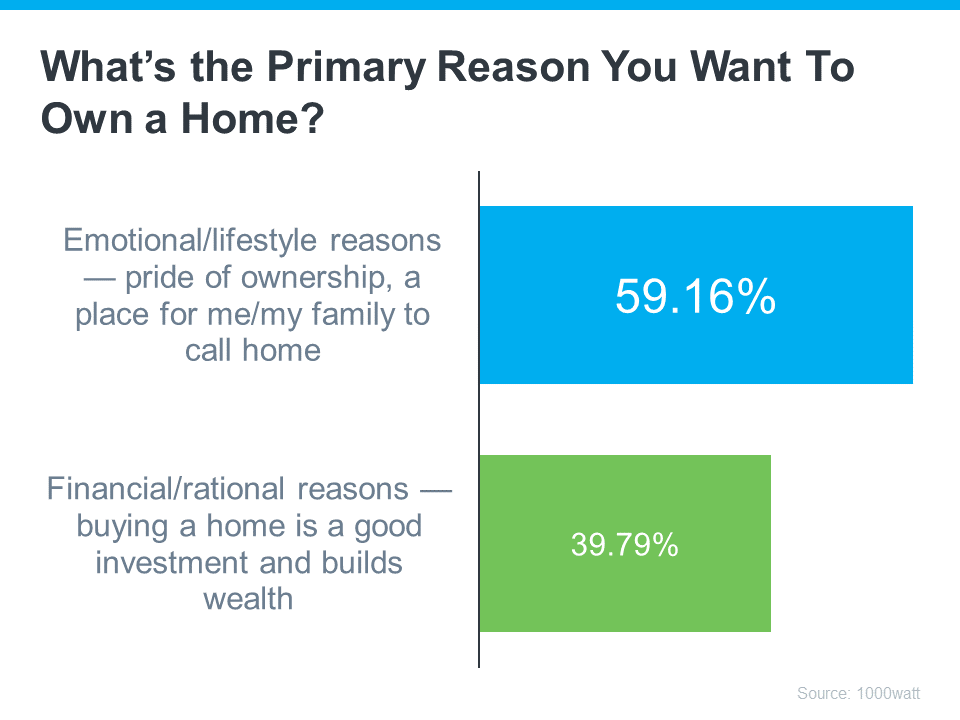

“Well, mortgage rate projections are just that, projections, not promises and don’t forget how hard it is to forecast them. . . So my advice is to never try to time the market . . . If one is financially prepared and buying a home aligns with your lifestyle goals, then it could be the right time to purchase. And there’s always the refinance option if mortgage rates are lower in the future.”

If you’re considering a move and wondering about market timing, the best advice is: don’t wait. If you’re prepared, eager, and capable of making a move, seizing the opportunity now could prove beneficial, particularly if you discover the perfect home. In San Diego, where housing dynamics are vibrant, taking action when you’re ready can lead to securing your dream property.

Wrapping All Things Up on Mortgage Rates in San Diego

For those in the market to buy a home in San Diego, it’s crucial to stay informed about mortgage rates and make well-informed decisions. By reaching out and connecting with a trusted local realtor like the McT Real Estate Group, you’ll have a dedicated partner who will ensure you’re always in the loop regarding the latest mortgage rate updates. Let us guide you through the process, providing expert insights tailored to your needs and helping you confidently navigate the dynamic San Diego real estate market.