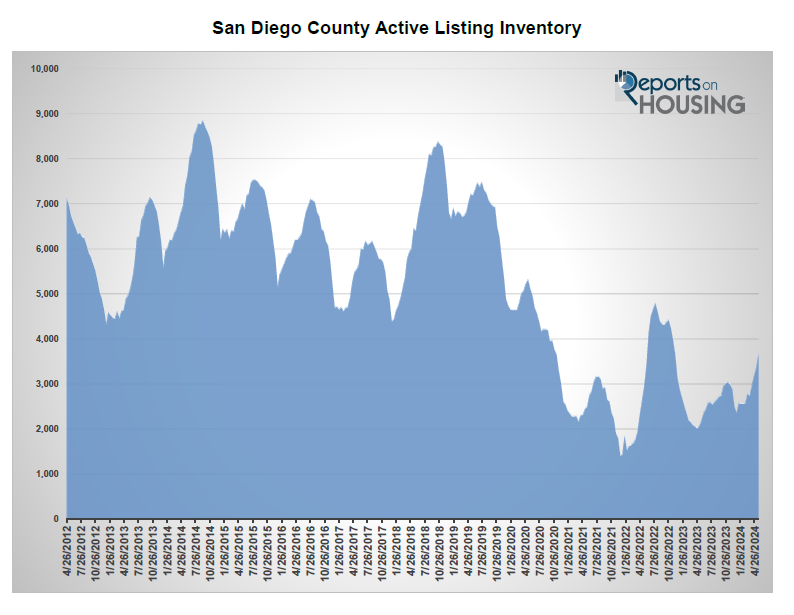

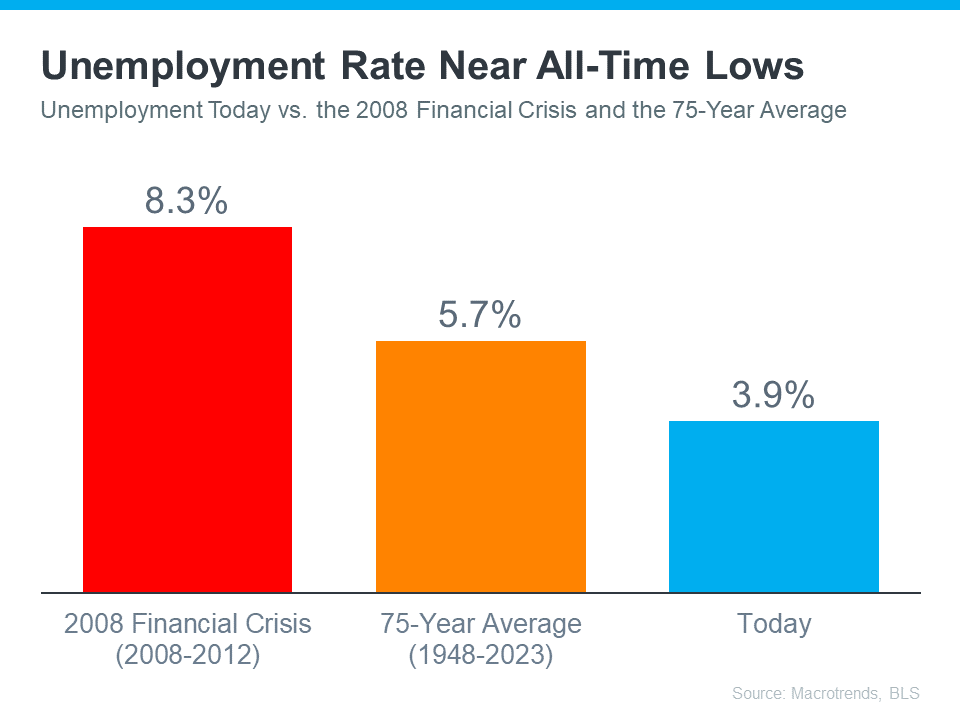

Even if you didn’t own a home in San Diego during the 2008 housing crisis, you likely remember the turmoil it caused. The crash affected countless lives, and it’s natural to worry about a repeat scenario. However, you can rest easy, as today’s market conditions and housing inventory in 2024 are vastly different from those in 2008. According to Business Insider:

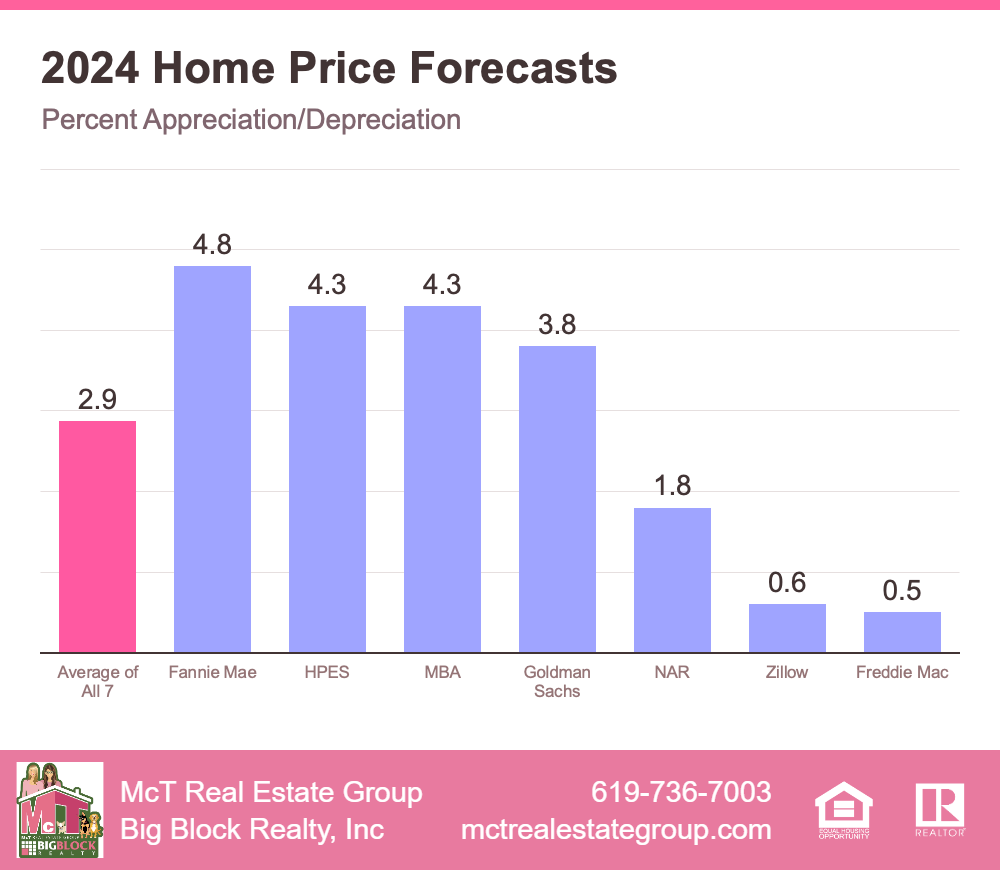

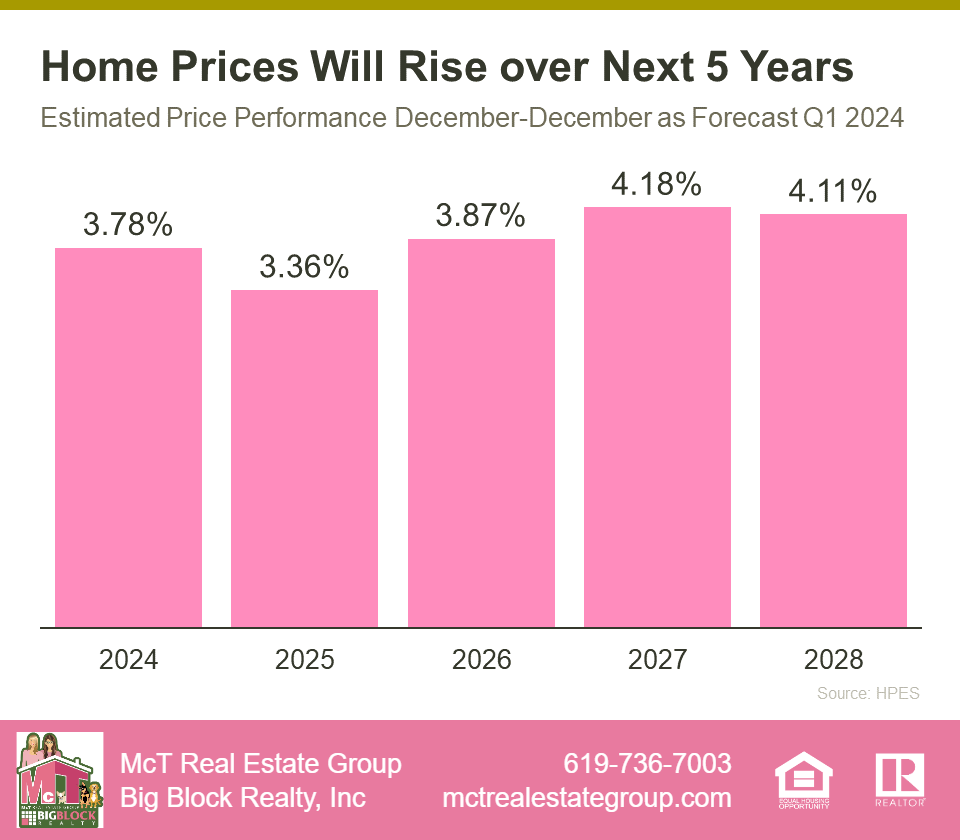

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

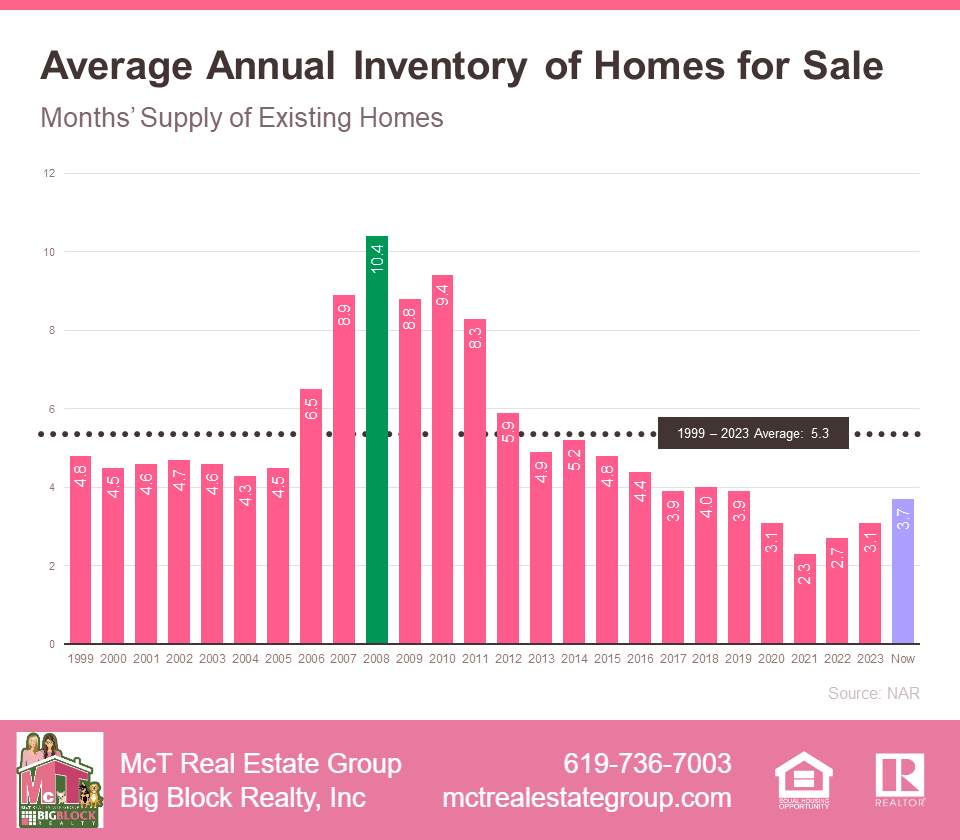

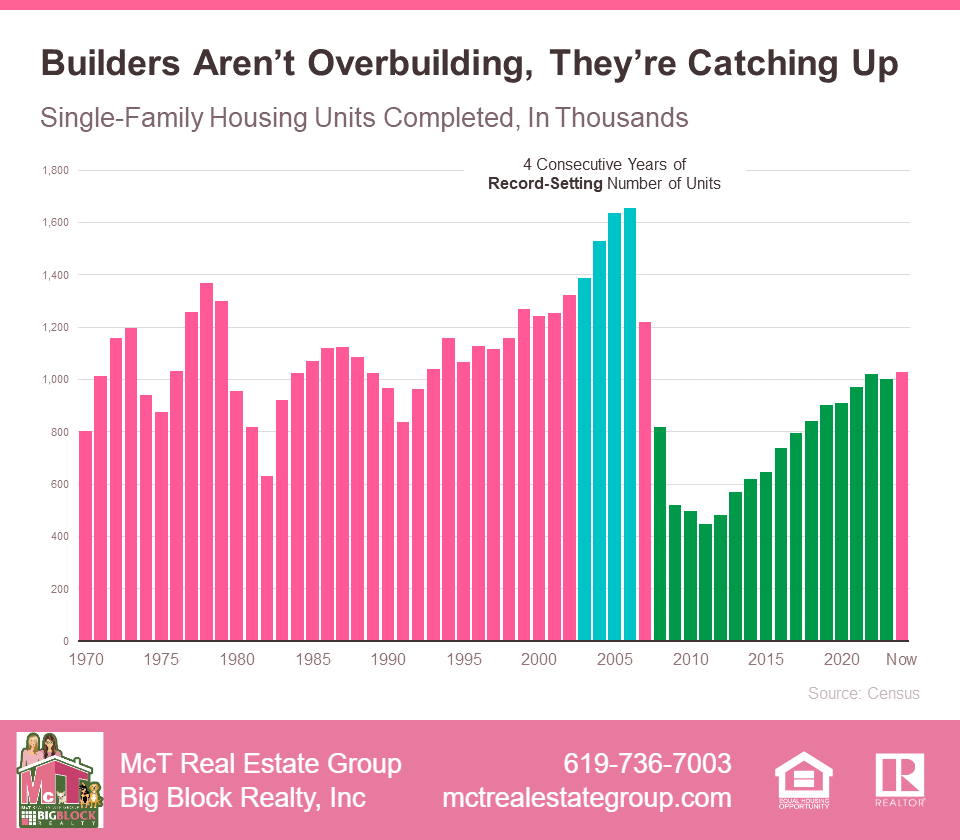

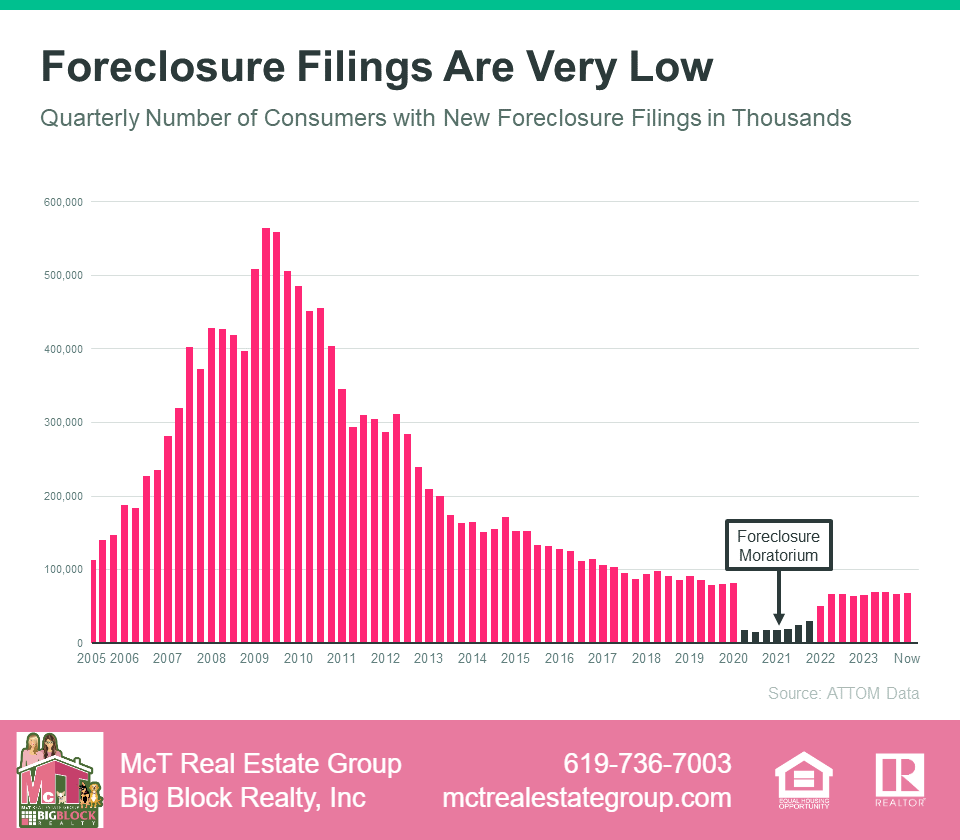

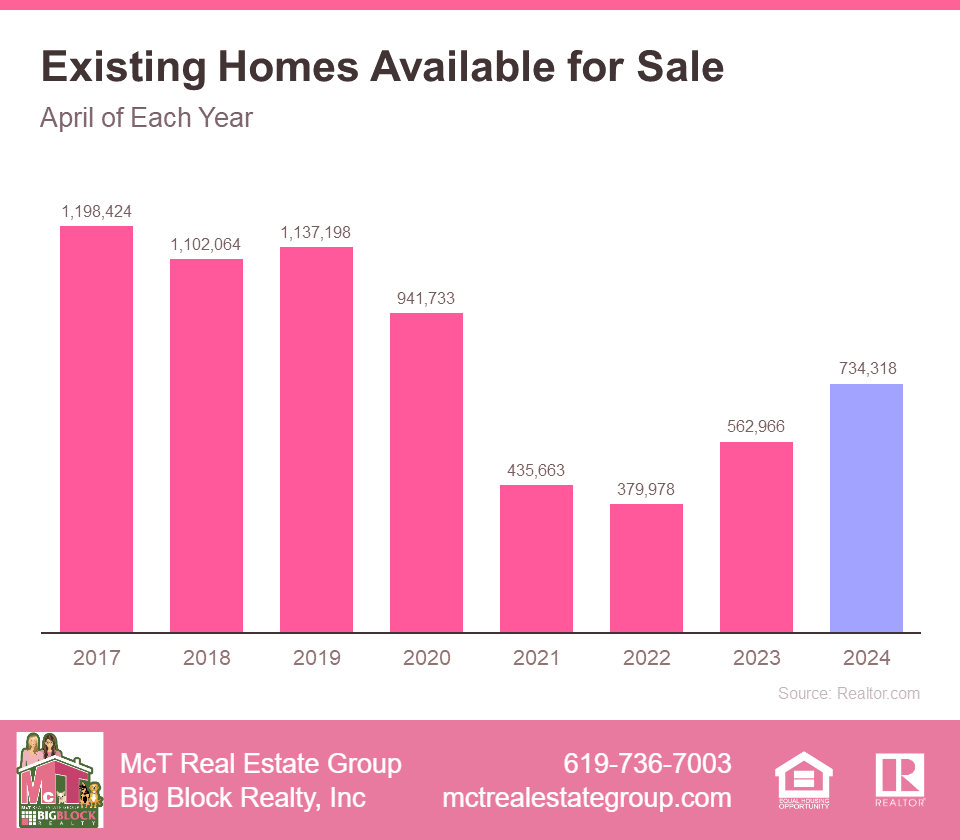

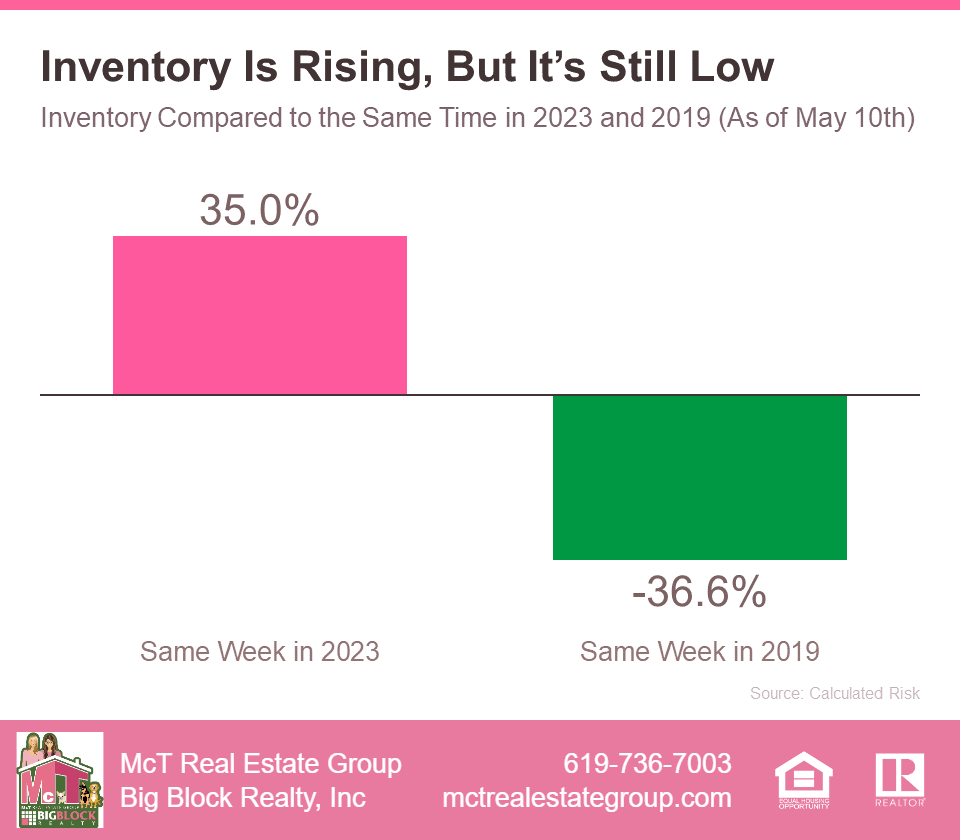

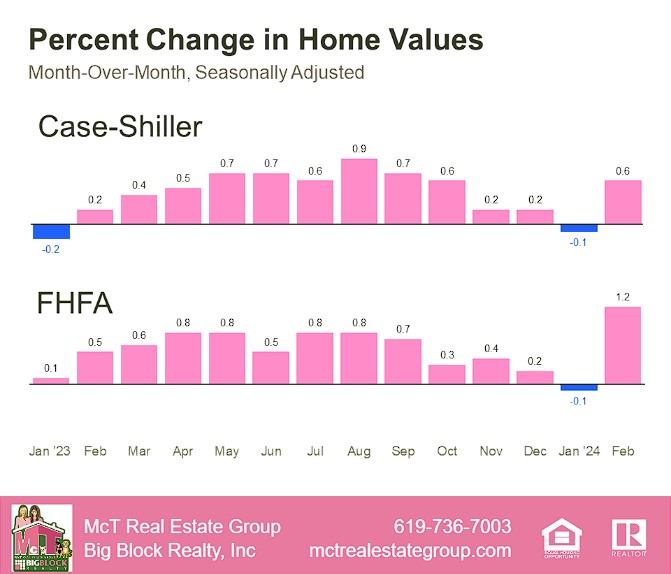

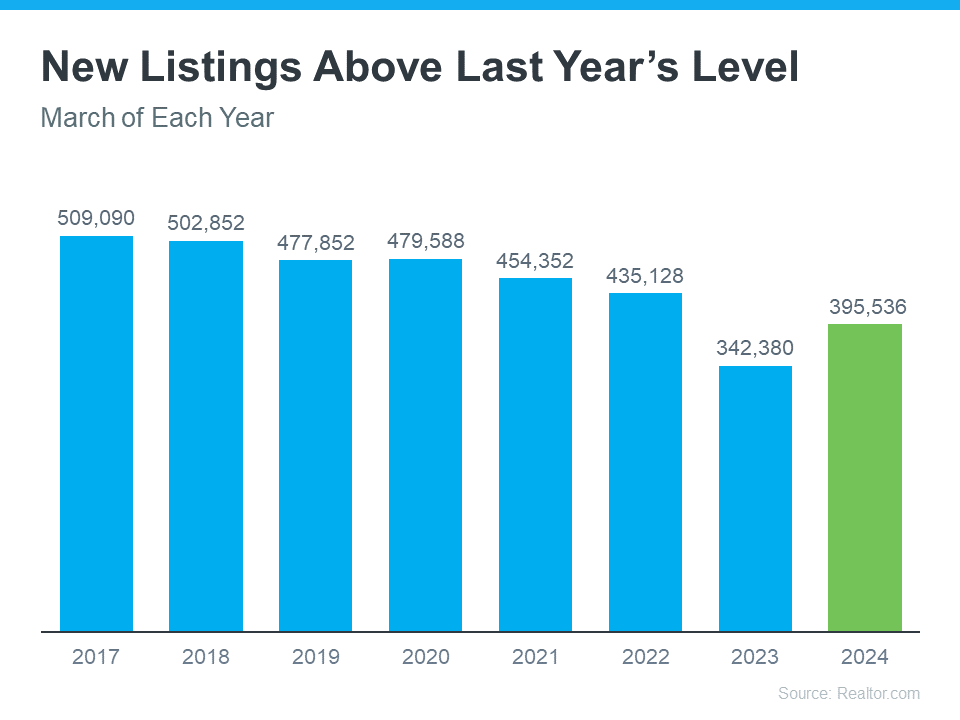

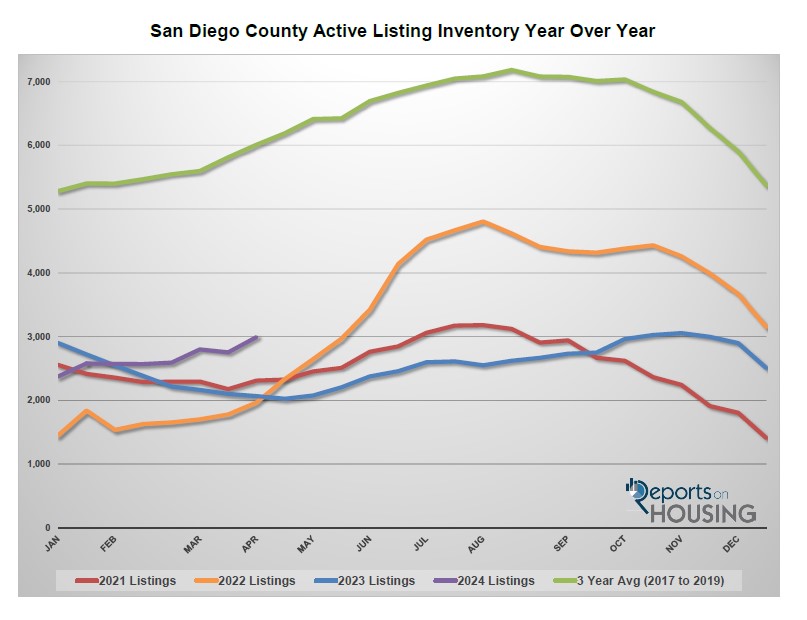

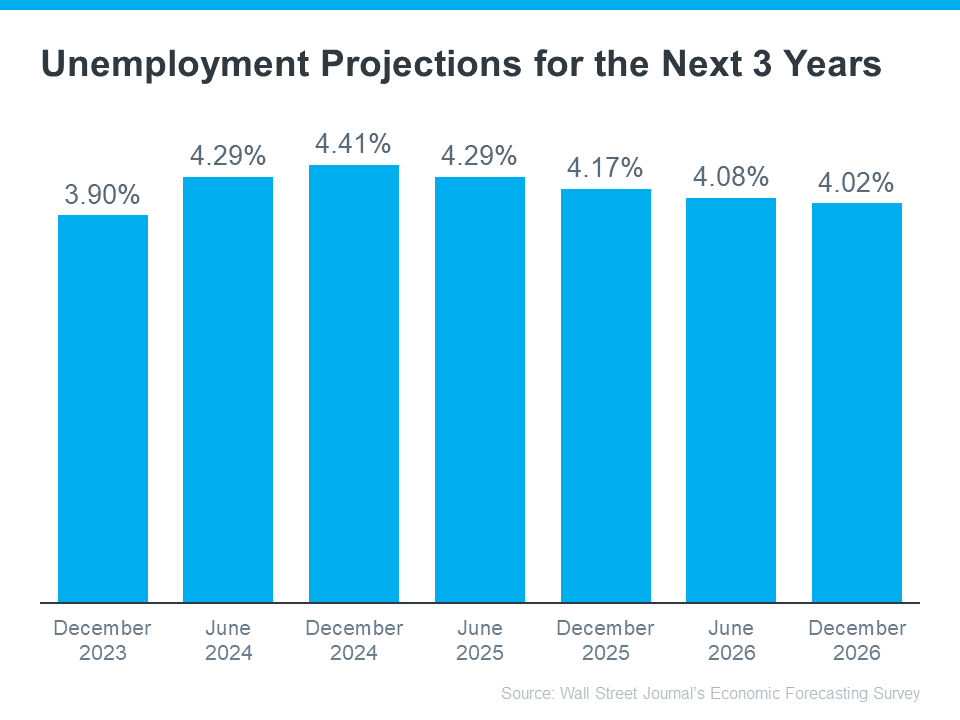

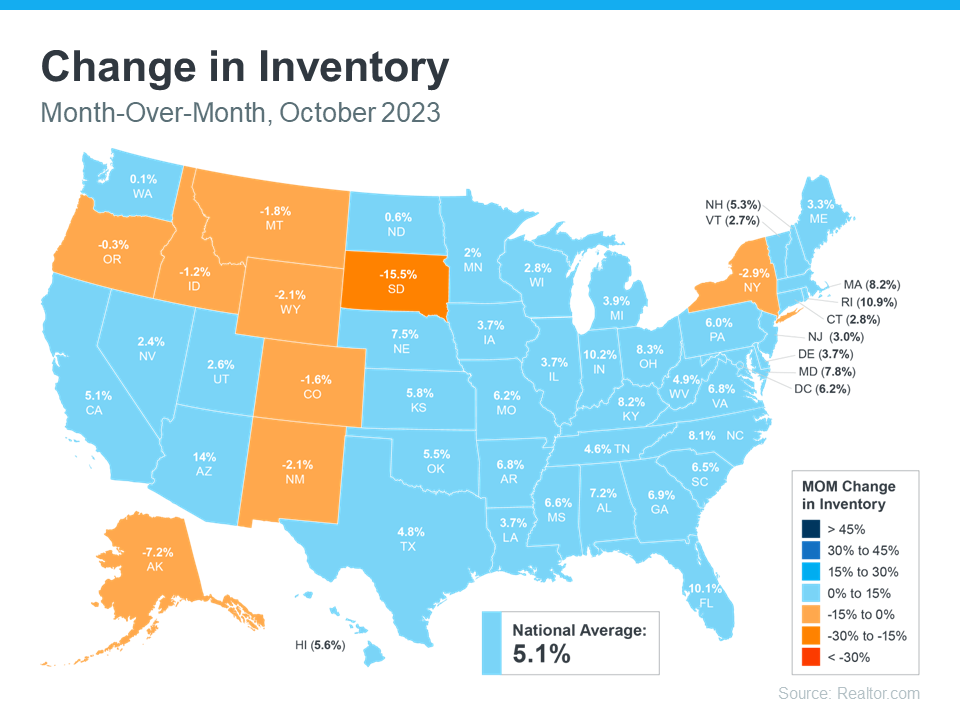

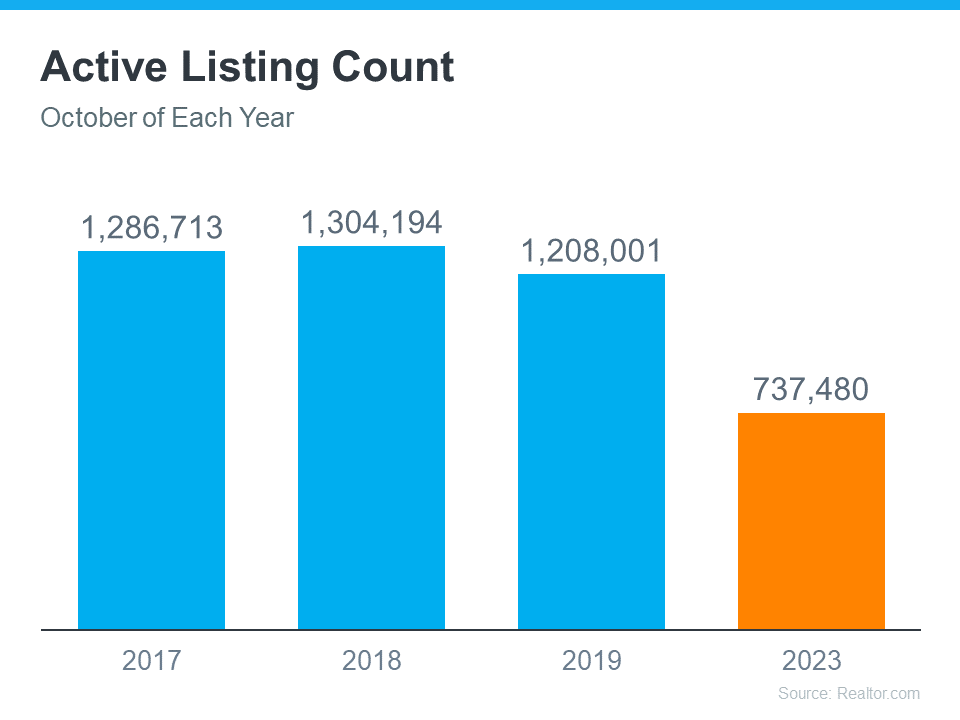

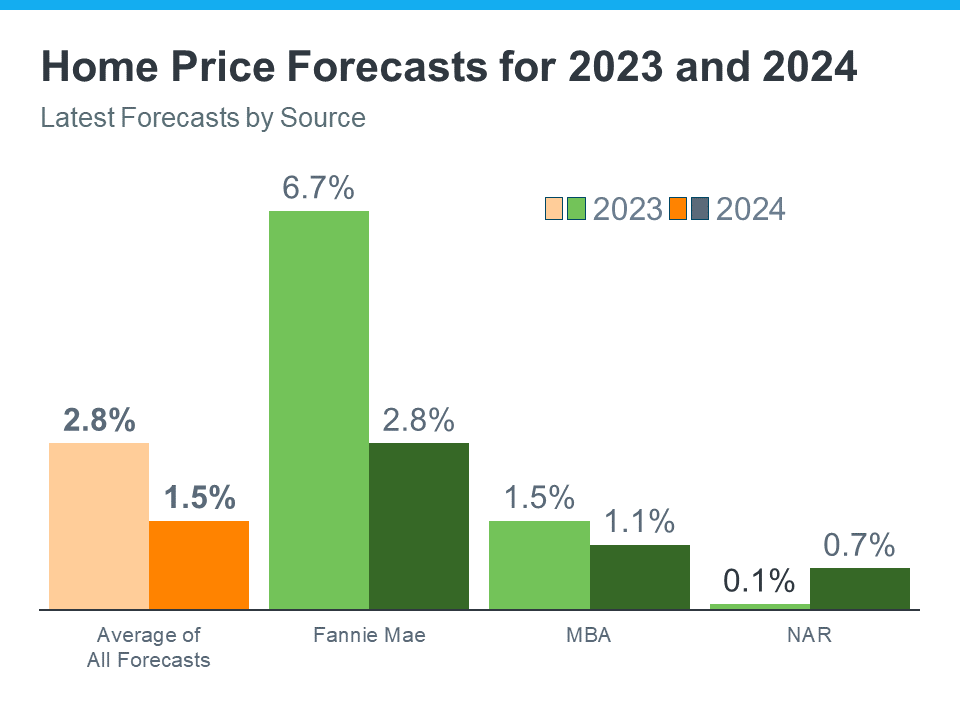

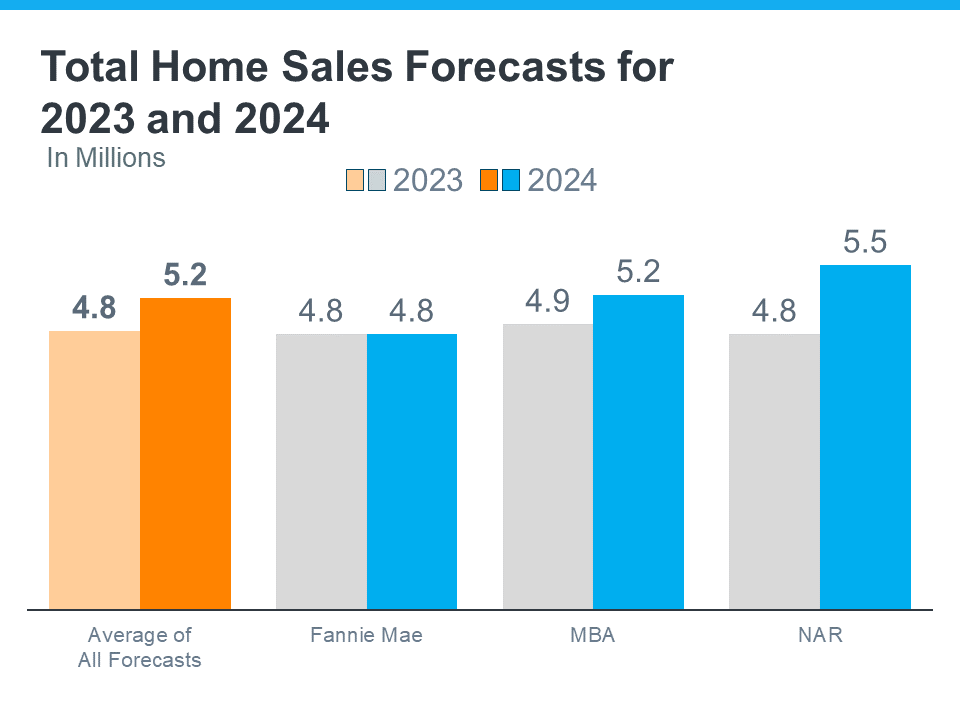

Experts are confident in this outlook for several reasons. For the market and home prices to crash, there would need to be an excess of houses for sale. However, the current data shows the opposite: there is an undersupply of homes, even with the inventory growth we’ve seen this year. The housing supply primarily comes from three sources:

- Existing Homes: Homeowners deciding to sell.

- Newly Built Homes: New home construction.

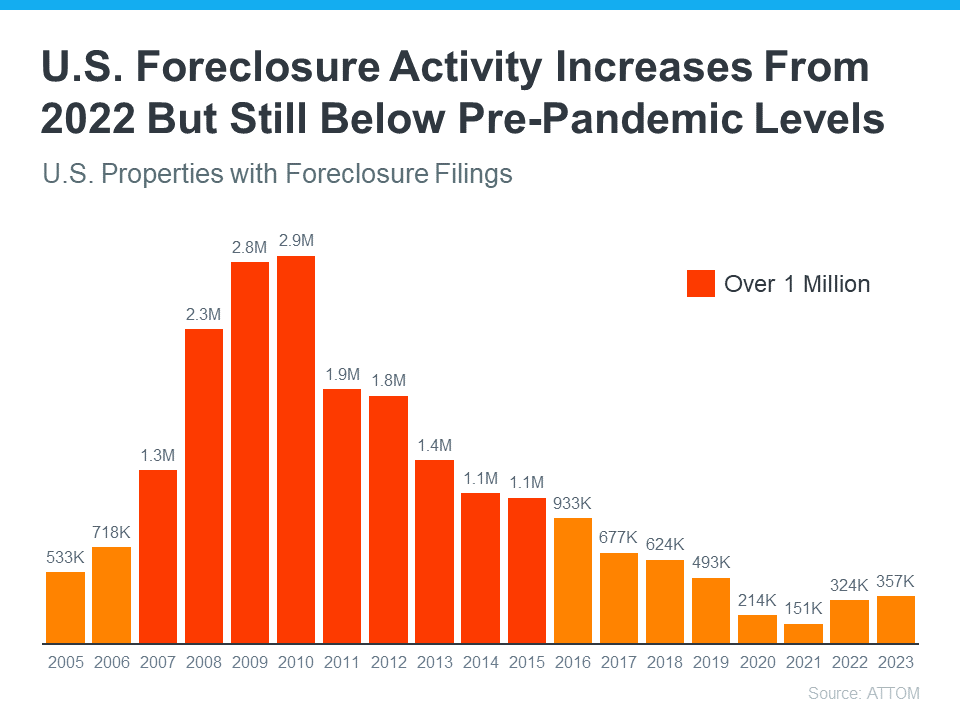

- Distressed Properties: Foreclosures or short sales.

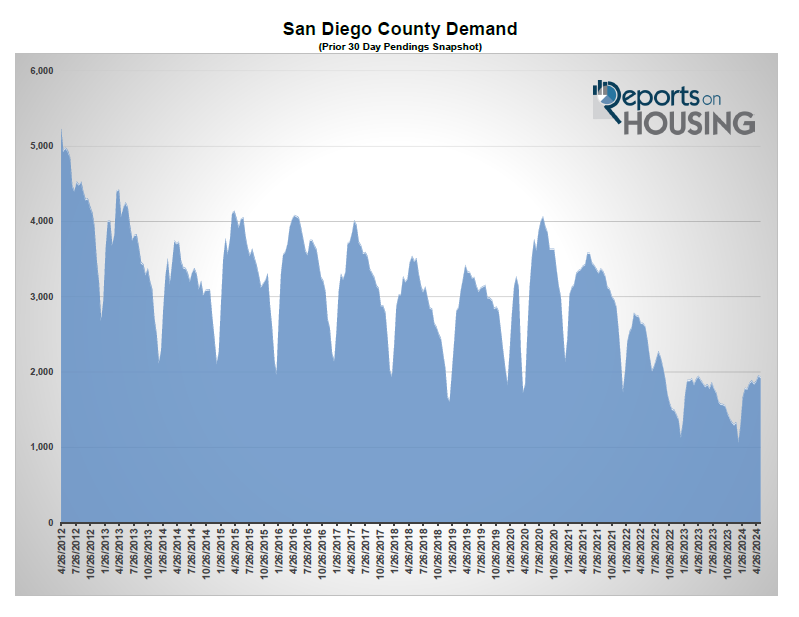

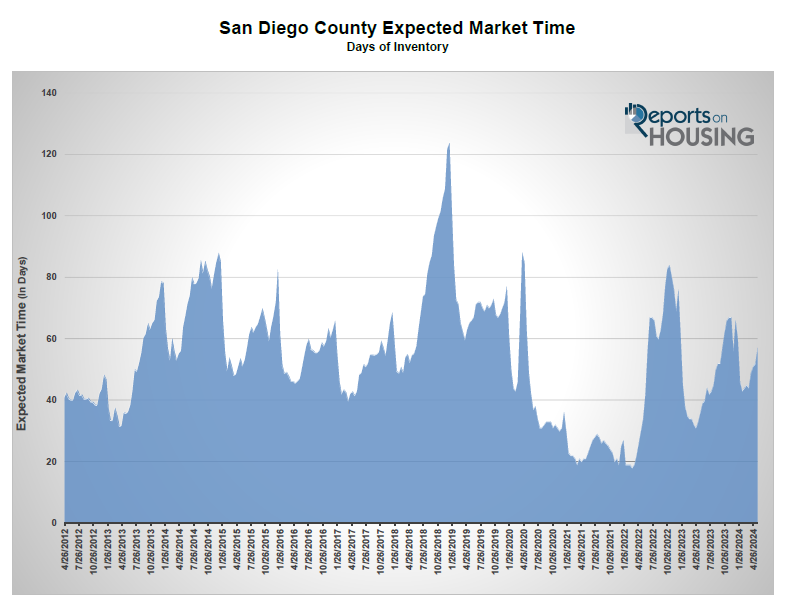

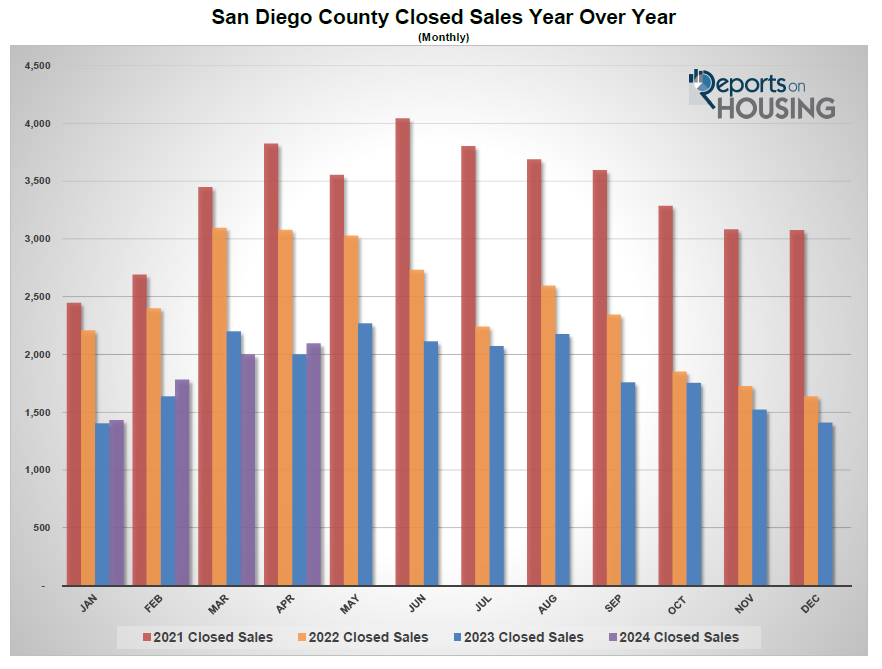

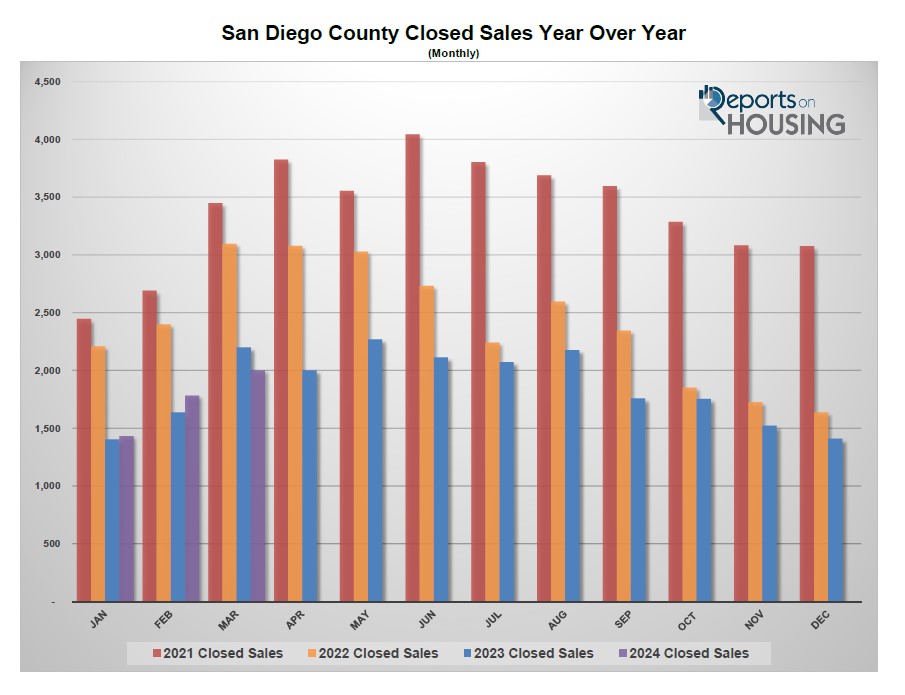

When we examine these sources, it’s clear that today’s market doesn’t resemble 2008. For example, the local market in San Diego has seen a steady demand for homes, supported by the area’s desirable lifestyle and economic opportunities. The supply of existing homes remains tight, new construction is carefully managed, and distressed properties are not flooding the market.

This balanced inventory in San Diego and nationwide contributes to the stability that economists and real estate experts predict. So, while it’s wise to stay informed and cautious, there’s no need to fear a repeat of the 2008 housing crash.