Planning on buying a home in San Diego this year? Saving up for such a significant investment involves various expenses, including your down payment and closing costs. However, leveraging your federal tax return can alleviate some of these financial burdens. According to Credit Karma, your tax refund can be valuable in covering these expenses. So, if you’re eyeing that dream home in San Diego, your tax refund might be the boost you need to make it a reality.

“If one of your goals is to stop renting and buy a home, you’ll need to save up for closing costs and a down payment on the mortgage. A tax refund can give you a start on the road to homeownership. If you’ve already started to save, your tax refund could move you down the road faster.”

Maximizing Your San Diego Tax Refund: Strategic Moves for Home Buying Success

Excited about the possibilities? Your refund may vary, but if you receive one, here’s how to maximize it for your home-buying journey, especially in sunny San Diego.

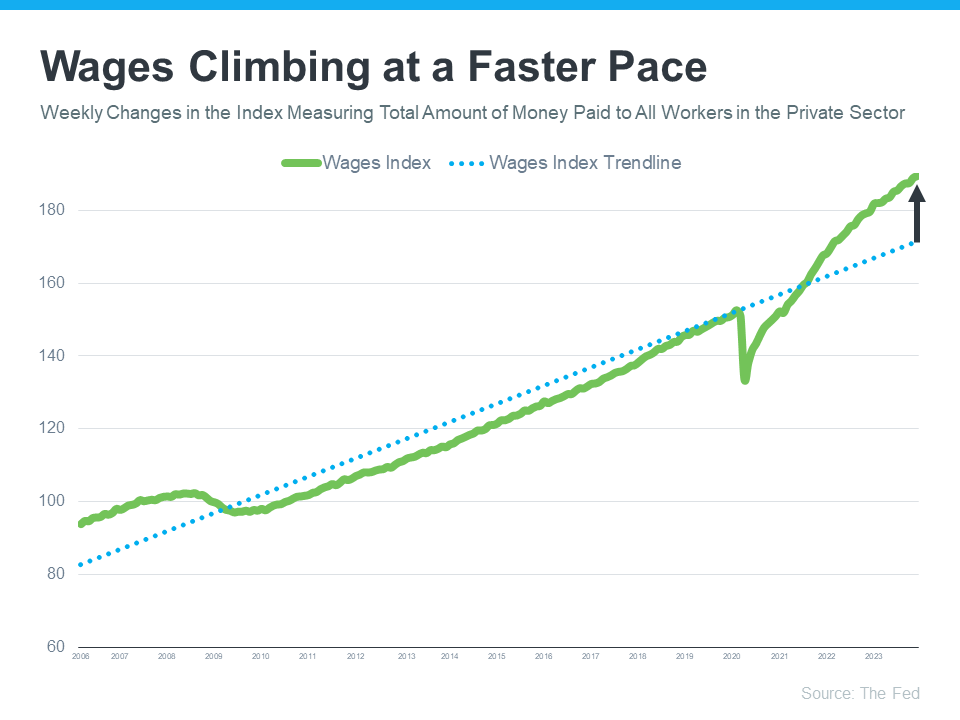

- Saving for a Down Payment: The dream of homeownership often starts with the daunting task of saving for a down payment. Leveraging your tax refund can accelerate your savings and inch closer to your homeownership goal.

- Covering Closing Costs: Closing costs, typically ranging from 2% to 5% of the home’s total purchase price, can add up. Consider allocating a portion of your tax refund towards covering these expenses, making the home-buying process smoother and more manageable.

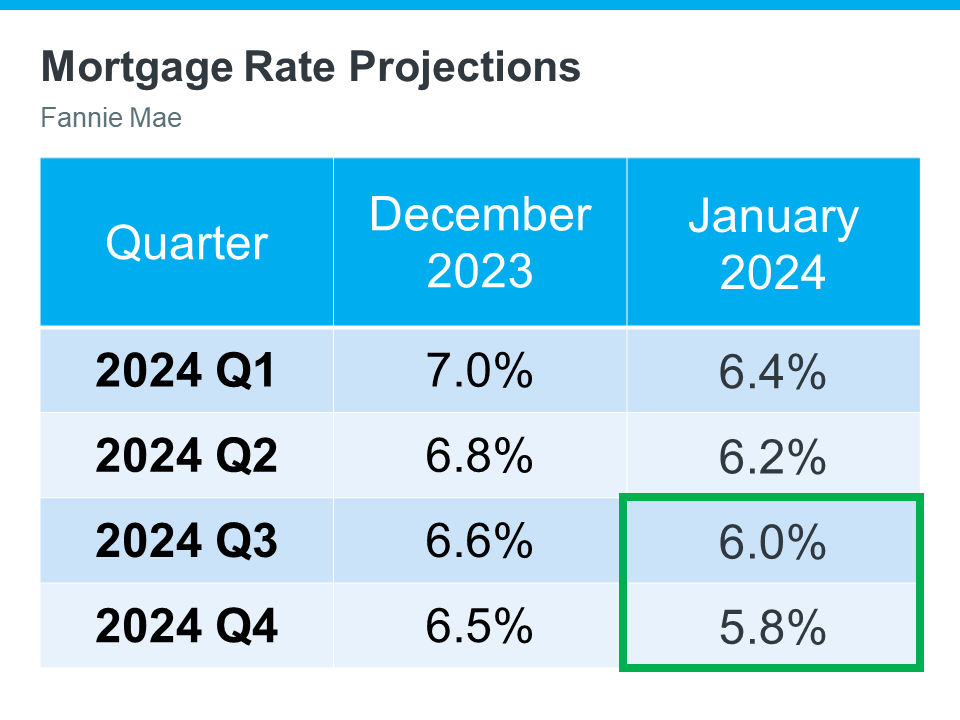

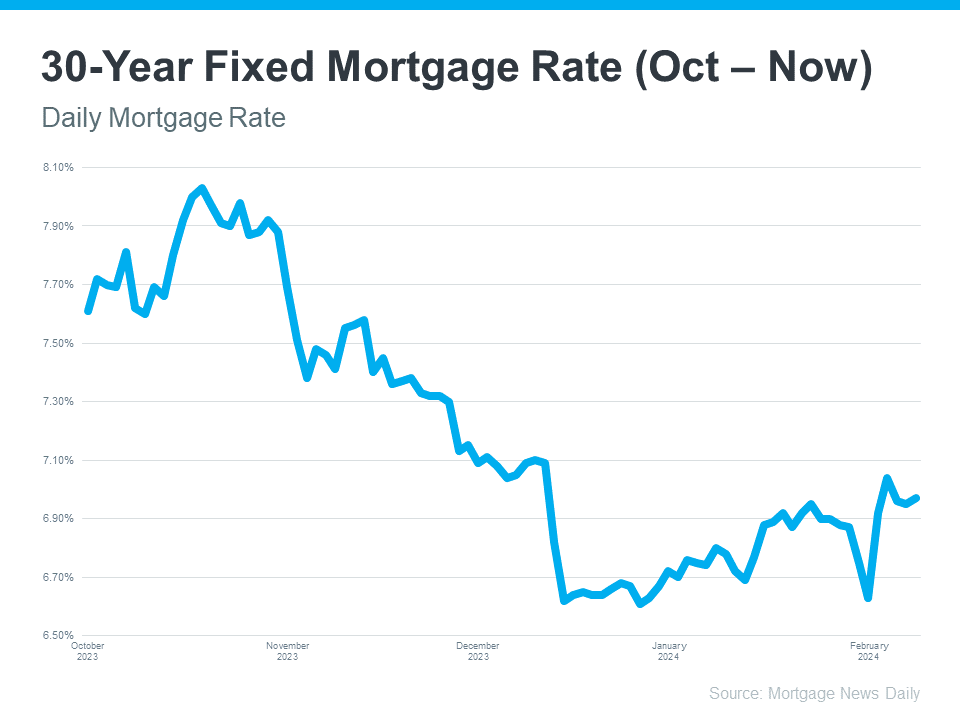

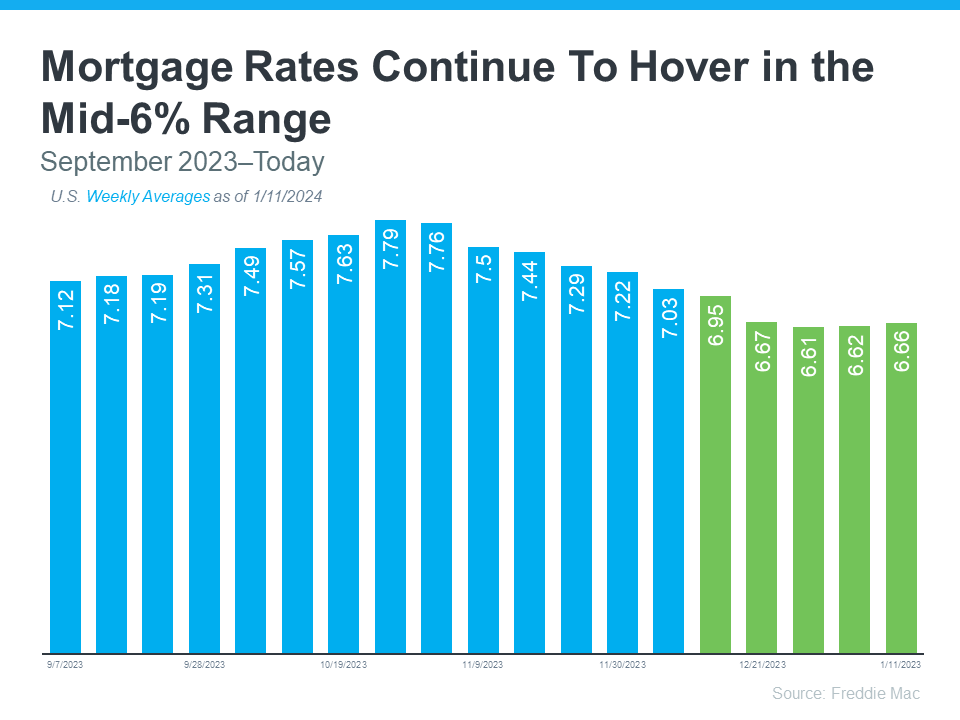

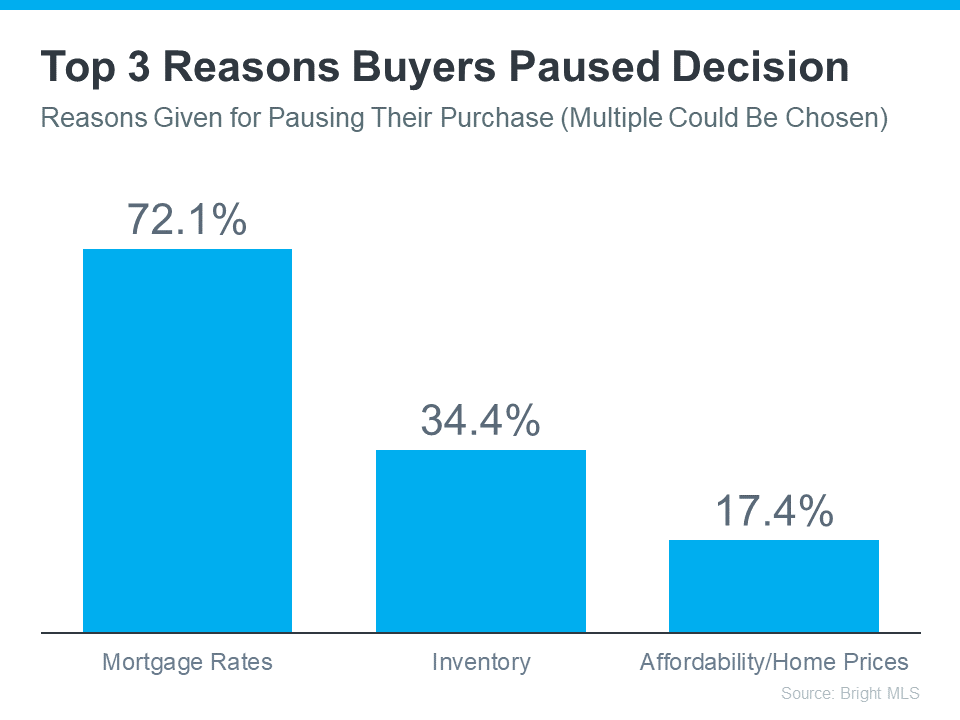

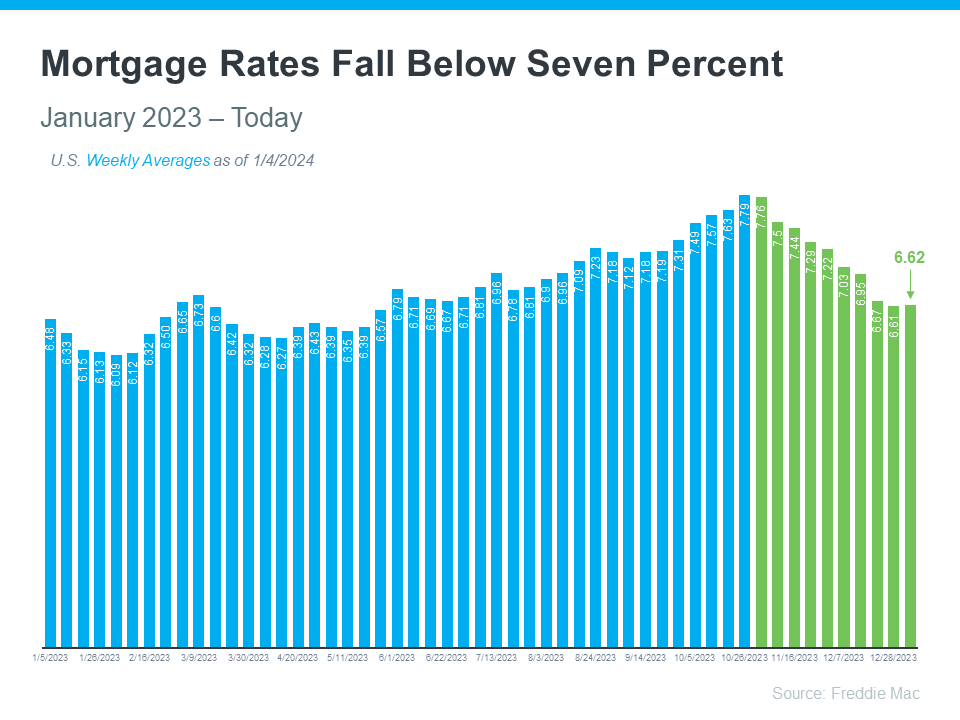

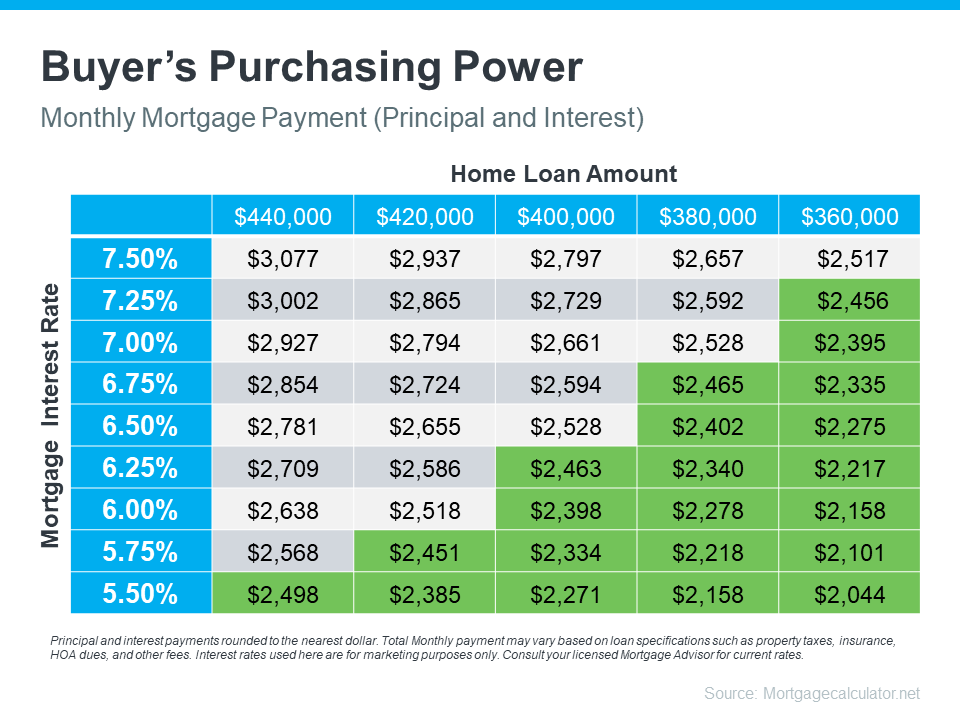

- Lowering Mortgage Rates: Securing a favorable mortgage rate in today’s dynamic market is crucial. Some lenders offer the option to buy down your rate, providing long-term financial benefits. If affordability is a concern, investing your tax refund upfront to secure a lower mortgage rate could be wise.

Partnering with knowledgeable real estate professionals who are well-versed in San Diego’s unique market nuances is key to your home-buying success. They’ll guide you through the process, ensuring you’re fully prepared to embark on this exciting journey. Let’s make your homeownership dreams a reality together!

Wrapping All Things Up with Using Tax Refund for Home Buying in San Diego

In conclusion, your federal tax return holds significant potential to bolster your home-buying savings. By leveraging this financial windfall, you’re one step closer to securing your dream home in San Diego. Let’s delve deeper into your preferences and aspirations for your ideal home, as your desired property may be well within your grasp. Let’s initiate a conversation about your homeownership journey today and explore the possibilities together.