In the ever-evolving landscape of San Diego mortgage rates, clarity amidst the confusion is crucial, especially for those eyeing the real estate market. Amidst the fluctuations, one trend stands out: a downward trajectory in mortgage rates compared to the near 8% peak experienced last fall. This trend bears significance for both prospective buyers and sellers alike, signaling a favorable environment.

While short-term volatility may sway rates based on economic indicators like inflation and reactions to the consumer price index (CPI), it’s essential not to lose sight of the bigger picture. Experts concur that the overarching trend points downwards, a reassuring sign for those navigating the housing market.

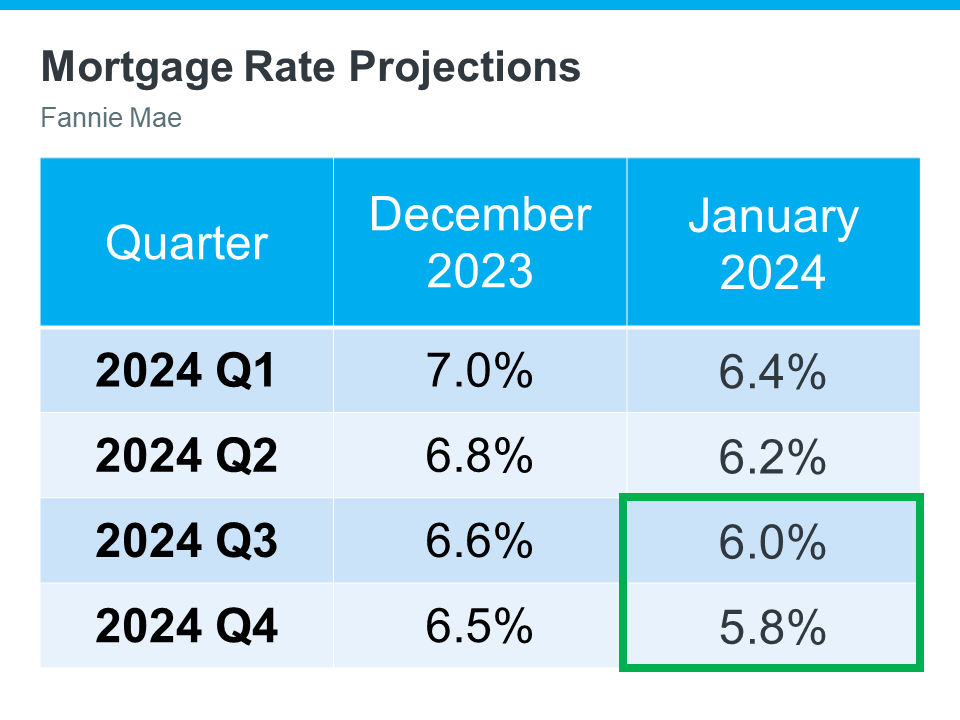

Looking ahead, projections hint at a potential milestone: mortgage rates dipping below the 6% mark later this year. Senior Economist Dean Baker of the Center for Economic Research lends credence to this outlook, suggesting a notable decrease from pre-Great Recession standards. Moreover, Fannie Mae’s latest projections align with this sentiment, offering optimism for prospective homebuyers (as illustrated in the chart below, highlighting projections in the green box).

“They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

Take a glance at the latest mortgage rate predictions for 2024, straight from Fannie Mae. This chart compares their December projection with the updated forecast just a month later. What catches the eye? A clear downward trend in the projections.

It’s standard practice for experts to revise their forecasts as they closely monitor market dynamics and broader economic indicators. What’s evident here is a growing confidence among experts that mortgage rates will keep sliding, particularly if inflation eases.

In San Diego, where real estate trends often mirror national patterns, this shift could have significant implications for homebuyers and sellers alike. Lower mortgage rates typically mean increased affordability and heightened market activity, potentially sparking a surge in housing demand across the region.