Have you ever found yourself sipping on your morning coffee, pondering about the ripple effect of inflation on San Diego’s housing market? It might sound like a deep dive for a casual thought, but believe it or not, these two subjects are tightly woven together. Just like a dance duo per se, when one takes a step, the other is sure to follow—and vice versa. So, grab that coffee, perhaps a comfy blanket, and journey with us. We’re going to untangle and demystify this intricate relationship, breaking it down piece by piece for a clearer picture. Let’s get started, shall we?

Decoding Housing Inflation: A San Diego Perspective

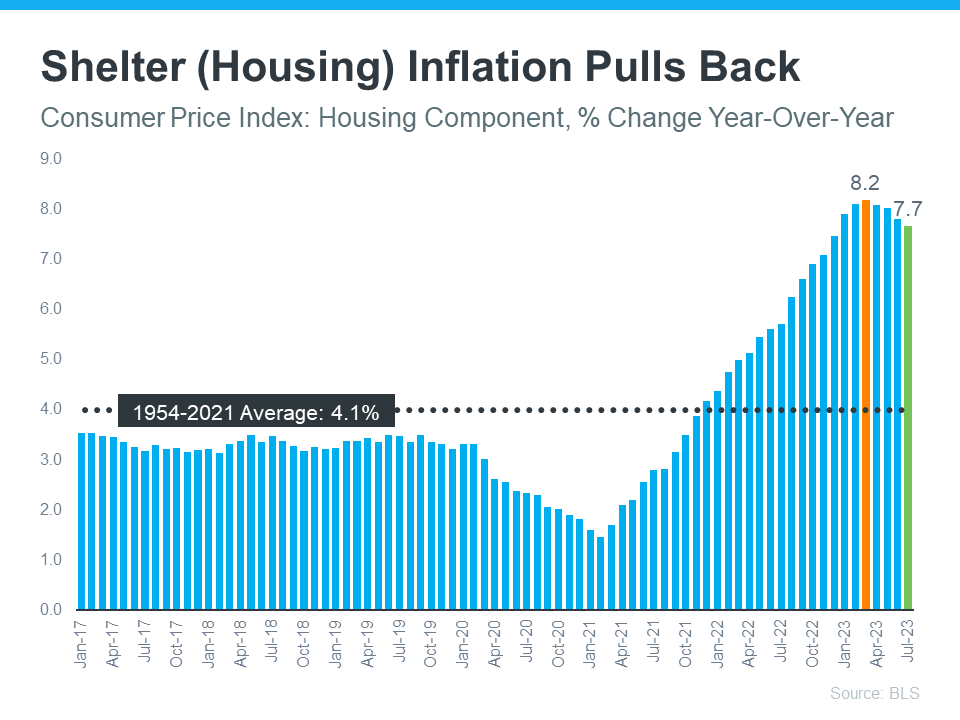

Housing inflation, often termed ‘shelter inflation,’ gauges the growth or increase in housing prices. The Bureau of Labor Statistics (BLS) conducts a survey where renters disclose how much they pay for their monthly rent, and homeowners estimate the rental value of their homes. Just as general inflation gives us insights into the fluctuating costs of daily goods and services, shelter inflation shines a light on shelter costs. Recent trusted data reveals a staggering decline in housing inflation over the past four months which was quite a breath of fresh air if you are going to refer to the data below. As you can see from the survey results housing inflation has been on a constant rise for the past few years and was finally seeing some downward slopes this year.

The big question arises: Why is this significant for San Diego residents or even the masses in general? Housing inflation contributes to roughly a third of portion on the overall inflation in total, as indicated by the Consumer Price Index (CPI). A dip in housing inflation could hint at a potential decrease in overall inflation, offering relief to our local economy in the months ahead.

The Federal Reserve has been striving to rein in inflation ever since 2022. Their efforts have seen some success, with inflation rates dropping from a peak of 8.9% to a current 3.3%. However, the ultimate goal remains a stable 2%.

The Federal Funds Rate: The Fed’s Tool Against Inflation

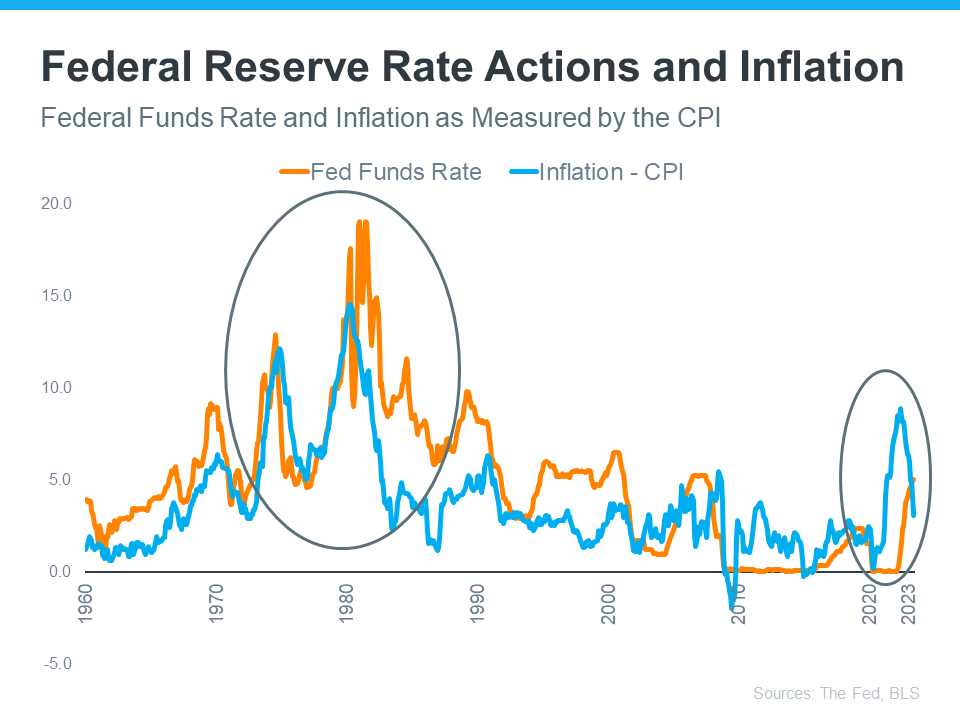

In response to surging inflation, the Federal Reserve took action by tweaking the Federal Funds Rate. This isn’t just any rate; it’s the heartbeat of our banking system, setting the pace for how much banks charge each other when they lend and borrow funds. As the inflation juggernaut marched on, the Fed stepped up, raising the Federal Funds Rate in a strategic bid to keep our economy on an even keel. Now, if you’re a visual learner like many of us, take a gander at the graph below. The blue line paints a picture of inflation’s trajectory, while the orange line gives you a play-by-play of the Fed Funds rate adjustments.

The graph above illustrates and gives us an idea of the Fed’s proactive approach. Whenever inflation surges, the Federal Funds Rate is adjusted to bring it closer to its usual 2% target. The recent moderation in inflation suggests that we might see fewer rate hikes in the near future.

What Does This Mean for San Diego’s Mortgage Rates?

While the Federal Reserve’s decisions don’t directly set mortgage rates, they certainly influence and set a certain standard for them.

As explained by Mortgage Professional America (MPA):

“mortgage rates and inflation are connected, however indirectly. When inflation rises, mortgage rates rise to keep up with the value of the US dollar. When inflation drops, mortgage rates follow suit.”

For potential homeowners in San Diego, the current trend of moderating inflation brings a glimmer of hope for more favorable mortgage rates in the near future. This is good news and totally in your favor.

Conclusion:

Whether you’re considering dipping your toes into the investment pool, pondering over buying or selling a cherished home, or merely aiming to stay updated with the latest real estate trends, now couldn’t be a more opportune moment to chat. San Diego’s property landscape is ever-evolving, and a seasoned perspective can make all the difference. Don’t hesitate to connect with the McT Real Estate Group. We’re not just in the business of real estate; we’re passionate about helping our San Diego neighbors make informed decisions. So, whenever you’re ready, give us a shout. We’re here, eager and happy to assist!