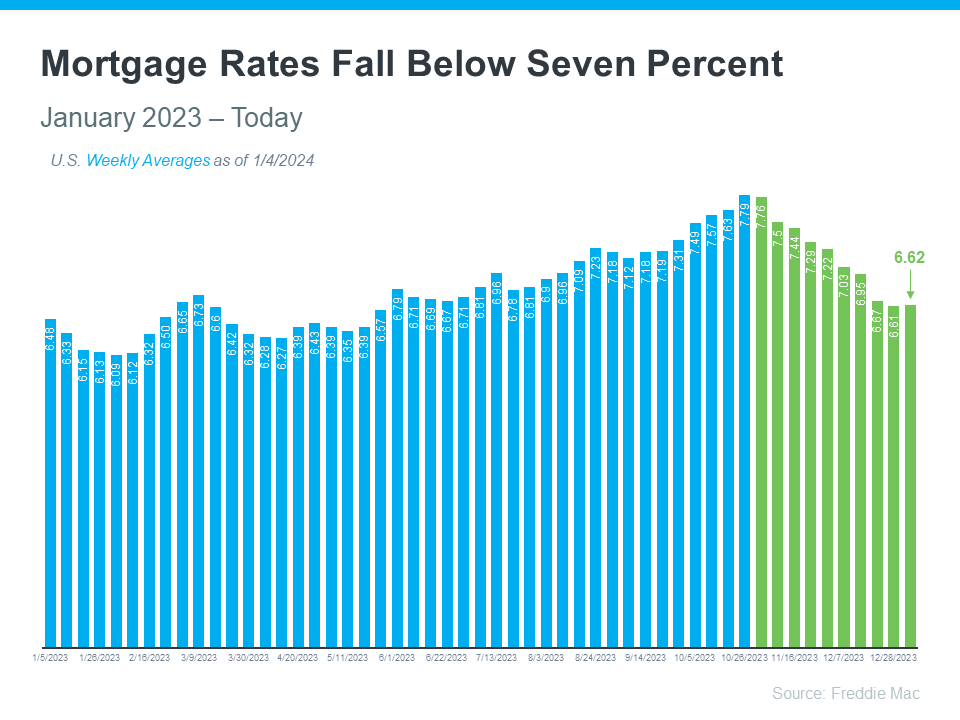

Thinking about buying a home? Understanding the influence of mortgage rates on your monthly payments and overall affordability is crucial and something to think about in the long run when you’re planning to buy a home. Here’s some good news: 30-year fixed mortgage rates have seen a notable decrease since the end of October. As per the latest data from Freddie Mac (check out the graph below), these rates have dipped below 7%. This drop in rates is a key factor to consider as you plan your home purchase, potentially making it a more manageable financial commitment. Keep this in mind as you explore your options – lower rates can significantly impact your budget and buying decisions.

This latest trend spells fantastic news for buyers, and here’s why. Reflecting on insights from a recent Bankrate article, we can see a clear shift in the market dynamics. This change is not just a fleeting moment but a significant turn of events that brings a wave of fresh opportunities for those looking to purchase a home.

“The rate cool-off somewhat eases the housing affordability squeeze.”

And also taking cues from Edward Seiler, the Associate Vice President of Housing Economics and the Executive Director at the Research Institute for Housing America, part of the Mortgage Bankers Association (MBA), we gain valuable insights. His expertise sheds light on the current trends and future predictions in the housing market, offering a unique perspective on how these changes can impact buyers and sellers alike.

“MBA expects that affordability conditions will continue to improve as mortgage rates decline . . .”

Let’s dive a bit deeper to see how this really impacts your journey towards homeownership.

Exploring How Mortgage Rates Shape Your Home Search

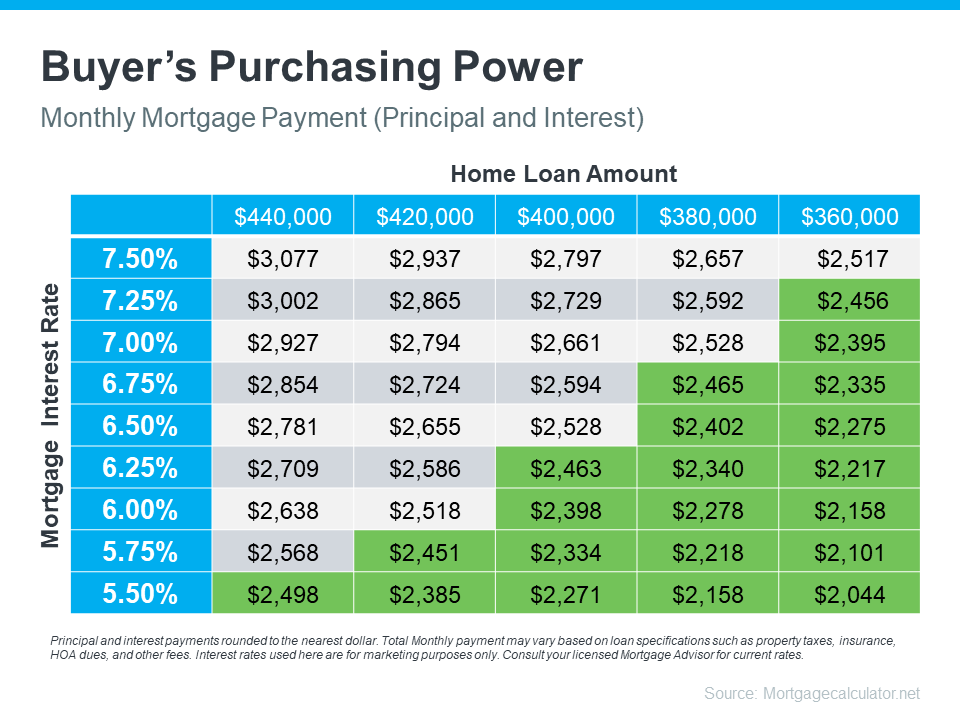

Grasping the link between mortgage rates and your potential monthly payments is vital as you map out your path to owning a home. To put this into perspective, consider the chart below. It’s designed to show how shifts in mortgage rates can alter what you can afford. Picture this: you have a budget that fits a monthly payment of about $2,400 to $2,500. In the chart, you’ll notice the green section. This area highlights the range of payments that fall within or below your budget (refer to the chart below for a visual guide):

It’s pretty clear that even slight shifts in mortgage rates can significantly impact your budget and the loan amount you’re eligible for. Let’s break it down a bit. When rates dip, even by a small margin, it can open up your options, allowing you to consider homes that might have been just out of reach before. On the flip side, when rates creep up, it tightens your budget, nudging you to look at more affordable options. Understanding this dynamic is crucial in making informed decisions about your home purchase. It’s all about finding that sweet spot where your dream home aligns with what you can comfortably afford. So, keeping a close eye on these rate changes can really make a difference in your home-buying journey.

Navigate Home-Buying with Expert Guidance: Budgeting and Strategic Planning

Embarking on the journey to buy a home can be thrilling, yet it’s crucial to start on the right foot. Partnering with a knowledgeable local real estate agent and a reliable lender is your first step towards success. They are your go-to resources for navigating the maze of mortgage options. More importantly, they can demystify the factors that cause mortgage rates to fluctuate and explain how these changes can affect your specific situation.

Together, you’ll dive into the numbers, examine the most recent market data, and tailor your home-buying strategy to align with the current mortgage landscape. This approach ensures you’re not just prepared but also proactive in your quest to find the perfect home.

Bottom Line: Your Home-Buying Advantage in Today’s Market

If you’re gearing up to buy a home, here’s some encouraging news – the recent dip in mortgage rates is a positive sign for your home-buying journey. Let’s get together with McT Real Estate Group team and carefully plot out your next steps. With the right plan, your dream home is within reach.