Lately, the thought of a looming recession has been on many people’s minds, and perhaps you might be feeling the same thing that they are feeling. It’s no secret that the conversation about a potential economic downturn has been a hot topic for the last few years, especially since it’s all the buzz coming from the media. Understandably, this raises concerns among many, especially around the possibility of a rising unemployment rate. Furthermore, there’s even a lingering fear that this could lead to a wave of foreclosures, echoing the distressing events we witnessed about 15 years ago.

However, there’s a glimmer of hope behind all of this news. According to the latest Economic Forecasting Survey from the Wall Street Journal (WSJ), optimism is slowly returning. Remarkably, for the first time in over a year, less than half of the economists surveyed – specifically, 48% – now believe that a recession is likely to hit within the next year. This shift in perspective marks a significant change in economic expectations and offers a ray of hope amidst the uncertainty.

“Economists are turning optimistic on the U.S. economy…economists lowered the probability of a recession within the next year, from 54% on average in July to a more optimistic 48%. That is the first time they have put the probability below 50% since the middle of last year.”

Unemployment Trends and Predictions

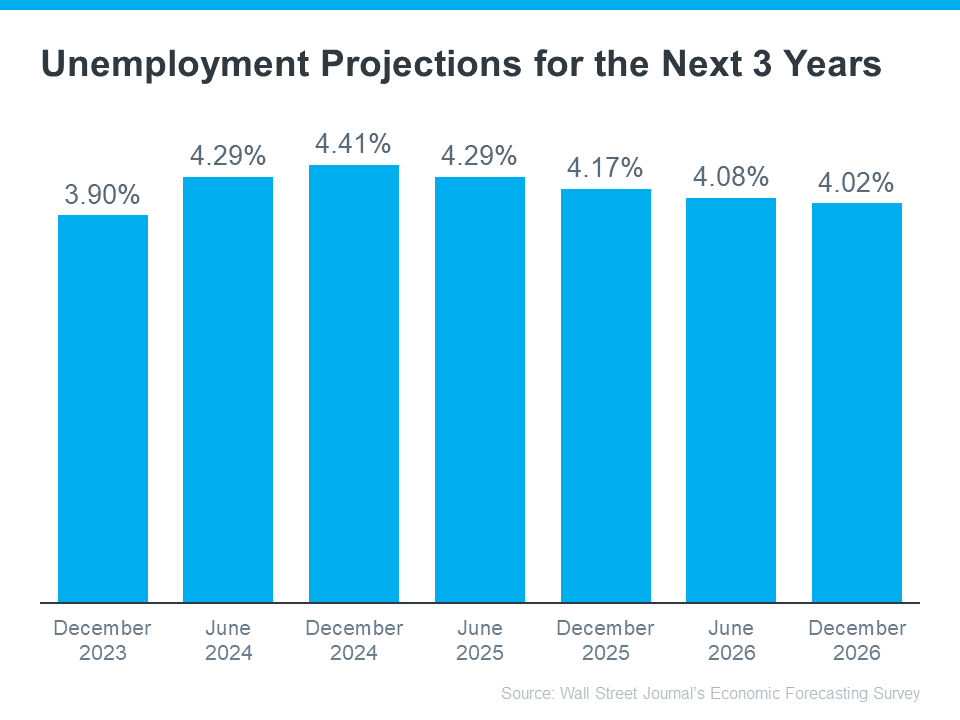

Imagine this: if more than 50% of economic experts are now ruling out a recession in the upcoming year, then it’s logical to assume they’re also not forecasting a significant rise in unemployment rates. Indeed, you’re spot on with that thought. To paint a clearer picture, let’s now take a look at the graph below. This graph draws from the same Wall Street Journal survey and vividly illustrates what these economists predict for the unemployment rate over the next three years. The trends and projections outlined here offer valuable insights into the anticipated stability of the job market.

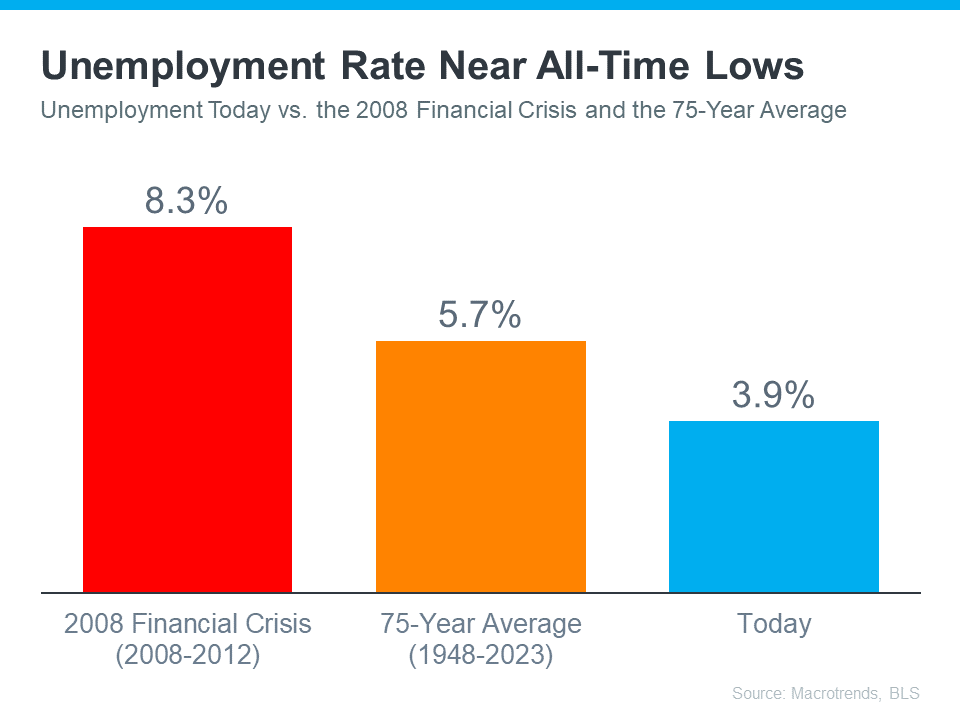

The forecast from industry experts suggests we might see an uptick in unemployment in the coming year. It’s crucial to recognize the impact this has – job losses are not just statistics; they deeply affect individuals and their families. So then, let’s shift our focus to a crucial question: Will this potential increase in unemployment lead to a surge in foreclosures, potentially destabilizing the housing market? Upon delving into historical data from sources like Macrotrends and the Bureau of Labor Statistics, we find reassuring evidence. Currently, the unemployment rate is hovering near record lows. This context strongly suggests that a housing market crash, driven by widespread foreclosures, is unlikely under these conditions.

Understanding Historical Unemployment Trends

Let’s examine the graph. The orange bar represents the average unemployment rate since 1948, which sits at about 5.7%. Now, cast your eyes to the red bar. This highlights the spike in unemployment following the 2008 financial crisis, where it reached 8.3%. In contrast, today’s unemployment rate is shown by the blue bar, noticeably lower than these past figures.

Looking ahead, current forecasts suggest that the unemployment rate is expected to remain below the 75-year average. This is a key indicator that a surge in foreclosures, which could drastically affect the housing market, is unlikely shortly. Indeed, it’s a sign of a stable job market, which is always good news for housing stability.

Final Thoughts

As we continue navigating through these times, it’s heartening to see that most economists are now steering away from the prediction of a recession in the upcoming year. This shift in perspective brings with it a wave of relief, especially concerning the job market. Experts aren’t foreseeing a significant surge in unemployment rates, a factor that often triggers an increase in foreclosures and can lead to instability in the housing market.

Understanding the intricate relationship between employment trends and the housing market can be quite complex. If you’re curious about how fluctuations in unemployment might affect your real estate decisions, remember the McT Real Estate Group is here to help. Together, let’s connect and dive into these topics, ensuring you have all the information you need for your real estate journey.