You’ve probably seen and heard the scary headlines in the media lately, screaming about a sudden rise in foreclosures and bankruptcies. We totally get it; if we were in your position, we probably would’ve been biting our nails off on this; it’s going to be nerve-wracking for sure, especially if you’re thinking of buying or selling your home in the current real estate market right now. But let’s take a short breather and look at the bigger picture. Shall we? Sure, those numbers are going up, but that doesn’t necessarily mean we’re heading for a housing meltdown or crash. There’s actually no solid proof or evidence to say we’re on the edge of a real estate disaster.

Navigating the Headlines: A Closer Look at Rising Foreclosure Rates

Even though today’s news is buzzing about a slight uptick in foreclosures, it’s not all doom and gloom for the housing market. Just think back to 2020 and 2021. Those were rough years, no doubt, but there were lifelines given, like special programs, that really helped homeowners stay afloat and keep their heads above the water.

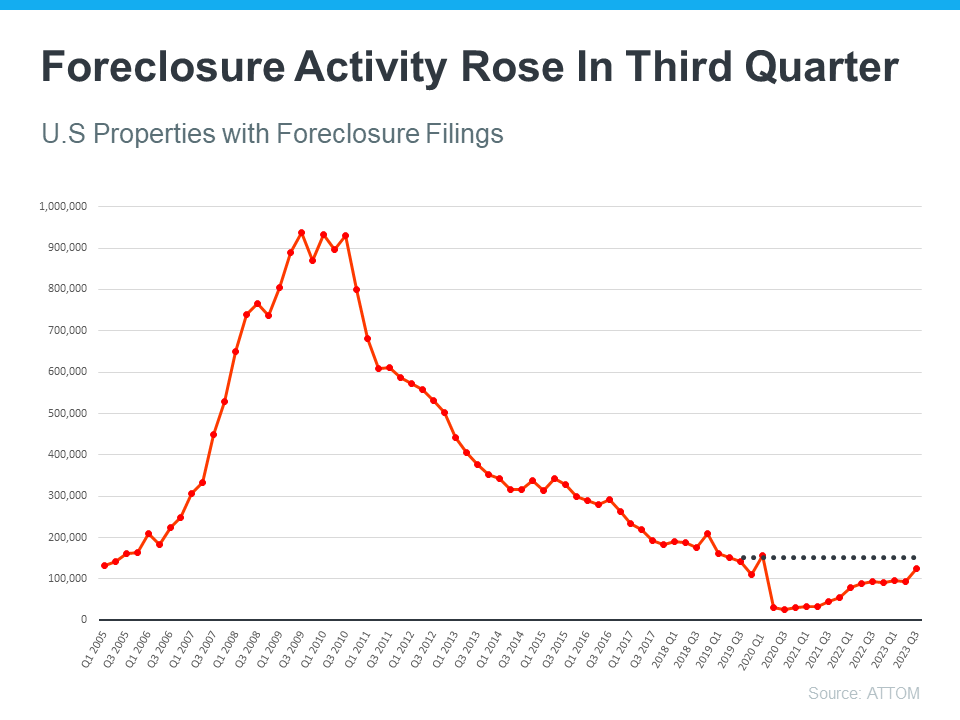

So, as these safety nets start to disappear, we’re definitely noticing an uptick in foreclosures. But wait a second—let’s not jump to conclusions just yet. To help you see the full picture and understand what we are talking about, we’ve cooked up a graph for you below based on the data and research of ATTOM. It traces foreclosure rates all the way back to 2005. And guess what? Even with the recent rise, foreclosures are still way lower than they were during the 2008 mess.

So what’s happening now? Foreclosure numbers are slowly getting back on track to what we saw before COVID-19 and the pandemic effects hit the real estate market. But keep this in mind though: These numbers are still way lower than what we saw in 2008. Jumping to the present, there’s a silver lining. Many homeowners have built up good equity in their homes. That’s a financial safety net, making it easier to sell their homes instead of facing foreclosure.

Don’t Sweat the Small Rise in Bankruptcies

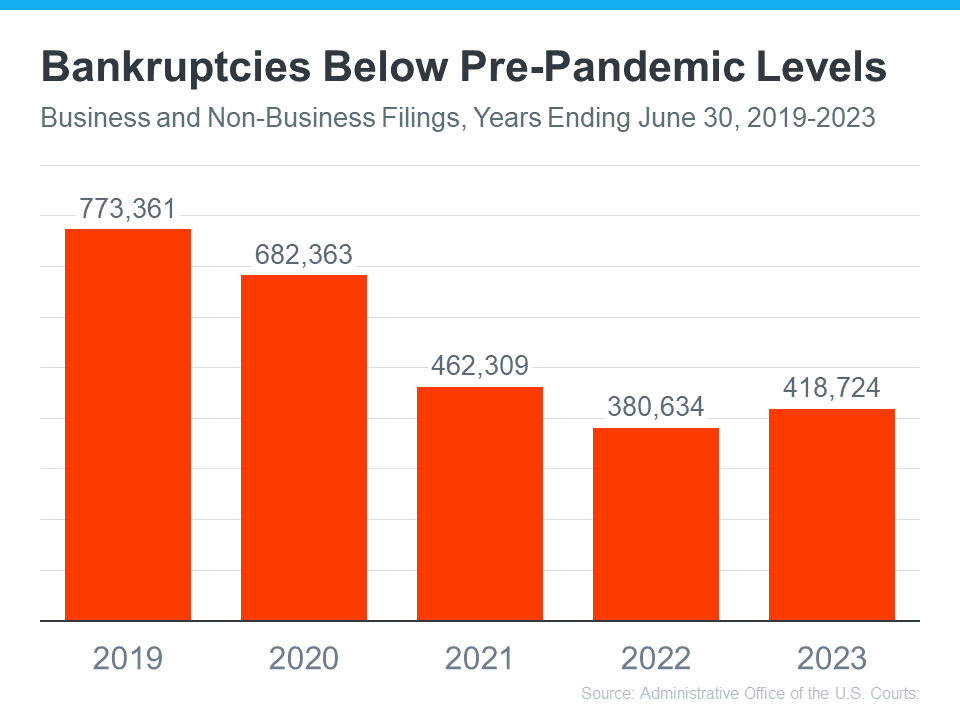

So, you might have noticed that there’s been some recent buzz and rumors about more bankruptcies occurring lately as well. However, let’s put things into better perspective. While it’s true that there’s been a minor uptick since last year, we’re pretty much back to where we were in 2021. So, there’s really no reason to hit the panic button just yet.

So, what’s been happening these past couple of years? You might’ve noticed that 2021 and 2022 were, let’s just say, not your average years. Why’s that? A big chunk of it boils down to the government stepping in with a helping hand during the COVID-19 crisis. Yep, all that financial aid made a total difference in the graph. But hang on, let’s flip the script and take a trip down memory lane to 2019. Ah, the good old days, right? When you stack this year up against 2019, it becomes pretty clear that the bankruptcy numbers we’re seeing now are way lower than they were before the whole pandemic thing shook us up. So, when you add it all up, there’s really no reason to be tossing and turning at night worried about a housing crash happening anytime soon.

In Conclusion Regarding Foreclosures and Bankruptcies

So, let’s level with each other and summarize everything in a nutshell. It’s true that foreclosures and bankruptcies are on the rise as you have seen in the data and from what we have gathered in this article. Yeah, we totally get it it’s unsettling and something to give you some goosebumps at times. But listen up, because this is important: these factors alone aren’t enough to sound the alarm bells for a total housing market meltdown. While they’re something to keep an eye on, they’re not a slam-dunk signal that we’re headed for a housing market crash. So, let’s not jump to conclusions just yet.

With so much chatter and headlines predicting a looming real estate crash, having someone you can trust to give you the real scoop is invaluable. Why not get in touch with us at the McT Real Estate Group? We use local and national data trends to provide honest, up-to-date insights on what’s actually happening in the housing market.