If you’re eagerly awaiting a housing market crash to bring San Diego’s home prices back down, it’s time to reassess and look at some data. The current data that we have paints a clear picture: a downturn isn’t on the horizon anytime soon. In fact, real estate experts predict that home prices will continue their upward trajectory through the coming months and years. Comparing today’s market to the pre-2008 housing crash reveals stark differences. This distinction is crucial in understanding why a repeat scenario is unlikely.

San Diego’s Evolving Mortgage Landscape: Navigating Stricter Standards for Homebuyers

Securing a home loan has become a more rigorous process in today’s real estate landscape, and surprisingly, this shift towards stricter lending criteria is a positive development. This is unlike the prelude to the 2008 housing crisis, where obtaining a mortgage was relatively effortless due to lenient standards set by banks. Banks have tightened their lending standards considerably, presenting a more selective environment for potential homebuyers. Unlike the past era, where almost anyone could qualify for a mortgage, today’s borrowers encounter heightened requirements from mortgage companies.

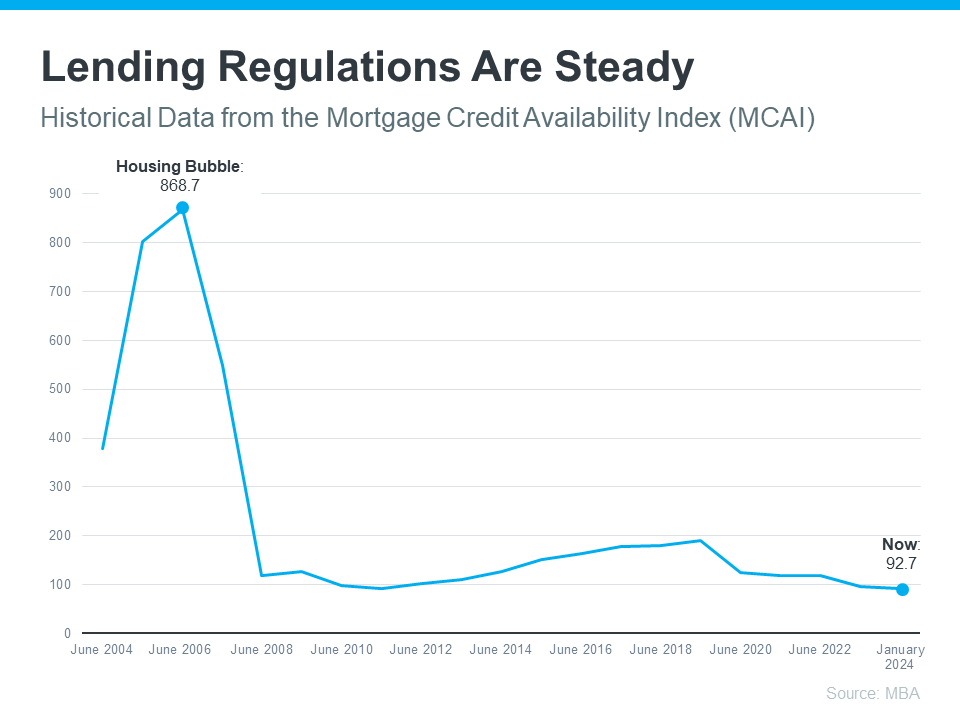

The Mortgage Bankers Association (MBA) data clearly shows this evolution in lending practices. A glance at the graph reveals a significant contrast in lending standards between then and now. The peak in the graph reflects a time when obtaining a mortgage was far less arduous, indicating lower barriers to entry into the housing market. However, the lax lending standards of the past era came with severe consequences. The surge in mortgage approvals without thorough vetting exposed borrowers and lending institutions to substantial risks. As a result, the market witnessed a wave of defaults and foreclosures, contributing to the infamous housing crash of 2008.

Today, San Diego’s real estate landscape is characterized by a more cautious approach, with lending institutions prioritizing responsible lending practices. This shift not only protects borrowers from entering unsustainable financial commitments but also safeguards the stability of the housing market. By imposing stricter standards, lenders mitigate the likelihood of another housing crisis, ensuring a more sustainable and resilient real estate environment for all stakeholders involved.

San Diego’s Housing Market Stability: A Closer Look at Inventory Trends

In today’s San Diego real estate market, we’re witnessing a significant shift from the conditions that led to the housing crash of the past. Back then, the market was flooded with an excess of available homes, many of which were distressed properties like short sales and foreclosures. This surplus in inventory drove home prices to plummet dramatically, causing widespread economic turmoil.

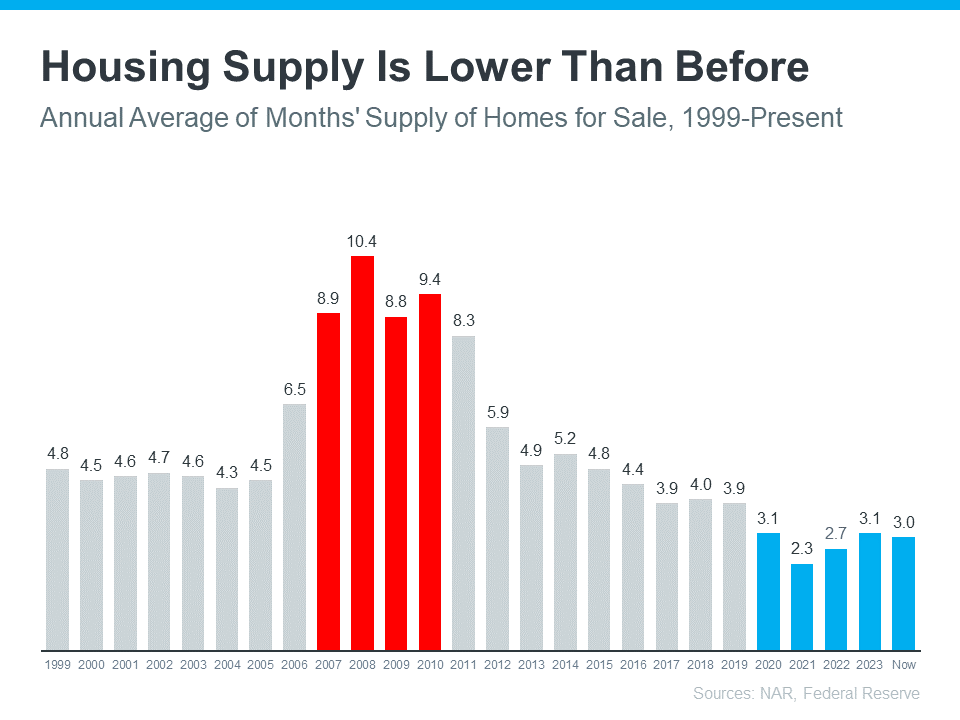

However, the landscape looks much different now. There’s a noticeable shortage of available homes for sale, creating a vastly different scenario from the conditions that precipitated the housing crisis. According to data sourced from reputable organizations such as the National Association of Realtors (NAR) and the Federal Reserve, the current inventory levels are strikingly low compared to the peak of the crisis.

For instance, the graph below illustrates the contrast between the months’ supply of homes available now (depicted in blue) versus during the housing crash (highlighted in red). Today, the unsold inventory hovers at a mere 3.0-months’ supply, a stark comparison to the peak of 10.4 months’ supply witnessed in 2008. This significant disparity indicates that there’s currently insufficient inventory on the market to precipitate a collapse in home prices akin to the events of the past.

In essence, the limited supply of homes for sale throughout the country safeguards against the risk of a housing crash, offering stability and confidence to buyers and sellers. As we navigate these evolving real estate dynamics, it’s evident that San Diego’s housing market is resilient and poised for continued growth and prosperity.

Fortifying Financial Resilience in Today’s Market

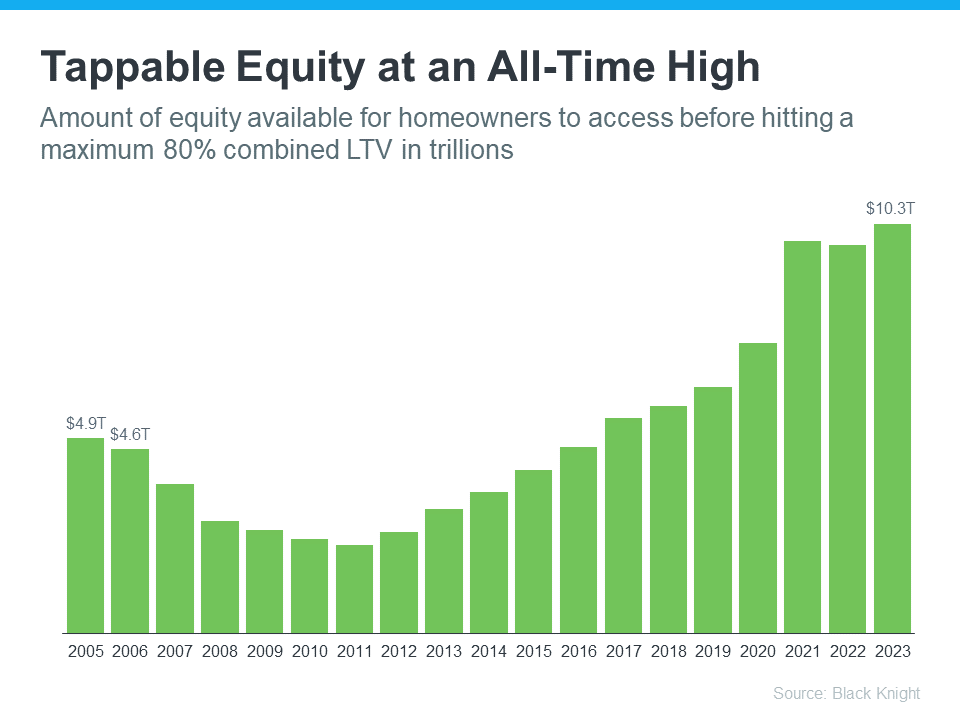

In the era leading up to the housing crash of the early 2000s, many homeowners utilized their homes as financial reservoirs, tapping into equity to fund various expenditures like new cars, boats, and extravagant vacations. Consequently, when property values plummeted, and housing inventory surged, numerous homeowners found themselves submerged in mortgages exceeding the value of their homes.

Fast forward to today’s real estate landscape in sunny San Diego, and a marked shift in homeowner behavior is evident. Despite the meteoric rise in property prices over recent years, homeowners exhibit a newfound prudence, refraining from extensive equity extraction akin to the pre-crash era.

According to data from Black Knight, tappable equity—representing the amount of equity accessible to homeowners before reaching an 80% loan-to-value ratio—has presently reached unprecedented levels. This surge in equity signifies that homeowners collectively possess more financial leverage than ever before, bolstering their financial resilience in the face of market fluctuations.

Moreover, Black Knight’s findings underscore this positive trend, revealing a significant decline in underwater mortgages.

“Only 1.1% of mortgage holders (582K) ended the year underwater, down from 1.5% (807K) at this time last year.”

With homeowners on firmer financial ground, the prospect of foreclosure diminishes, thereby curbing the influx of distressed properties into the market. Consequently, the absence of a deluge of inventory serves as a buffer against precipitous price declines, safeguarding the stability of San Diego’s real estate market.

Wrapping All Things Up

In summary, it’s normal to expect housing prices to drop, particularly in a lively city like San Diego. However, recent data shows otherwise. Unlike past downturns, San Diego’s real estate market is strong today. The newest studies clearly show that we’re not about to experience a housing crash like before. So, while people still want cheaper housing, the proof indicates that a crash isn’t coming soon.