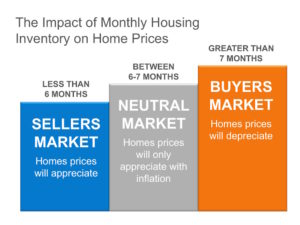

Are you planning on buying a home in San Diego in the near future? Well, buckle up your seatbelts because the current real estate landscape is anything but a leisurely stroll. With San Diego’s housing market in full swing, competition is fierce, especially given the limited inventory of available homes. Brace yourself for the possibility of engaging in multiple-offer showdowns as you navigate through this dynamic market.

As we gear up for the bustling spring homebuying season, the intensity is only expected to escalate further. But no worries! Armed with the right strategies, you can be a formidable contender for your dream home. At the McT Real Estate Group, we have the tools and experience to help you navigate the process.

Here are four invaluable tips to ensure you put forth your strongest offer:

1. Guidance in San Diego’s Real Estate Terrain and the Offer Process

Consider teaming up with a trusted real estate agent to champion your objectives. San Diego, with its diverse and competitive market, demands a savvy guide to navigate its intricacies. By enlisting the expertise of a seasoned professional, you gain access to invaluable insights and resources, enhancing your chances of success. In this vibrant cityscape, where opportunities abound, and competition is fierce, having a dedicated ally by your side can make all the difference. PODS mentioned in a recent article:

“Making an offer on a home without an agent is certainly possible, but having a pro by your side gives you a massive advantage in figuring out what to offer on a house.”

Local real estate agents possess invaluable expertise in the San Diego market. They’re well-versed in successful strategies employed by buyers and understand seller preferences. This insight can significantly influence your decision-making process when crafting an offer. Leveraging their knowledge could be the key to securing your dream home in San Diego.

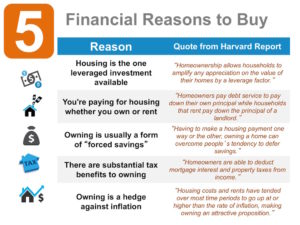

2. Get a Handle on Your Budget

Understanding your financial parameters is paramount, especially in San Diego’s real estate landscape. Take the reins by collaborating with a lender to secure pre-approval for your home loan. This step fosters a deeper financial assurance and signals your unwavering commitment to sellers. Armed with this pre-approval, you gain a decisive advantage in San Diego’s competitive market. As highlighted by Investopedia, being financially prepared positions you for success in securing your dream home.

“. . . sellers have an advantage because of intense buyer demand and a limited number of homes for sale; they may be less likely to consider offers without pre-approval letters.”

3. Crafting Your Offer: Finding the Sweet Spot in San Diego’s Real Estate

Crafting a robust yet equitable offer is paramount when navigating San Diego’s bustling real estate market. While securing an affordable deal is undoubtedly a priority, it’s essential to strike the right balance. Submitting an excessively low offer may jeopardize your chances of success. Instead, opt for an offer demonstrating your seriousness and respect for the seller’s property. As highlighted by Realtor.com, a strategically structured offer not only showcases your commitment but also increases the likelihood of acceptance. So, when making your move in San Diego’s competitive market, aim for a strong offer that reflects both your financial prudence and appreciation for the value of the home.

“. . . an offer price that’s significantly lower than the listing price, is often rejected by sellers who feel insulted . . . Most listing agents try to get their sellers to at least enter negotiations with buyers, to counteroffer with a number a little closer to the list price. However, if a seller is offended by a buyer or isn’t taking the buyer seriously, there’s not much you, or the real estate agent, can do.”

4. Trust Your Agent in Negotiations

Once your offer is in, the seller might counter, but fear not! Understanding the seller’s priorities is key. Flexibility on aspects like move-in dates or home conditions can sweeten your deal. Your real estate agent is your go-to guide in these negotiations. Rely on their expertise to steer you through and craft the winning strategy. According to insights from the National Association of Realtors (NAR), trusting your agent is pivotal in securing the best outcome. In San Diego’s dynamic market, where every detail counts, your agent’s local knowledge and negotiation prowess are invaluable assets. So, lean on their guidance and expertise to navigate the twists and turns of the negotiation process smoothly.

“There are many factors up for discussion in any real estate transaction—from price to repairs to possession date. A real estate professional who’s representing you will look at the transaction from your perspective, helping you negotiate a purchase agreement that meets your needs . . .”

Wrapping All Things Up on Successful San Diego Home Offers

In today’s fiercely competitive San Diego real estate scene, teamwork is key. Let’s collaborate to discover your dream home and develop a winning offer that sets you apart from the crowd. The McT Real Estate Group’s goal is simple: to ensure you secure a property you adore in this vibrant city. So, let’s roll up our sleeves and embark on this exciting journey together.