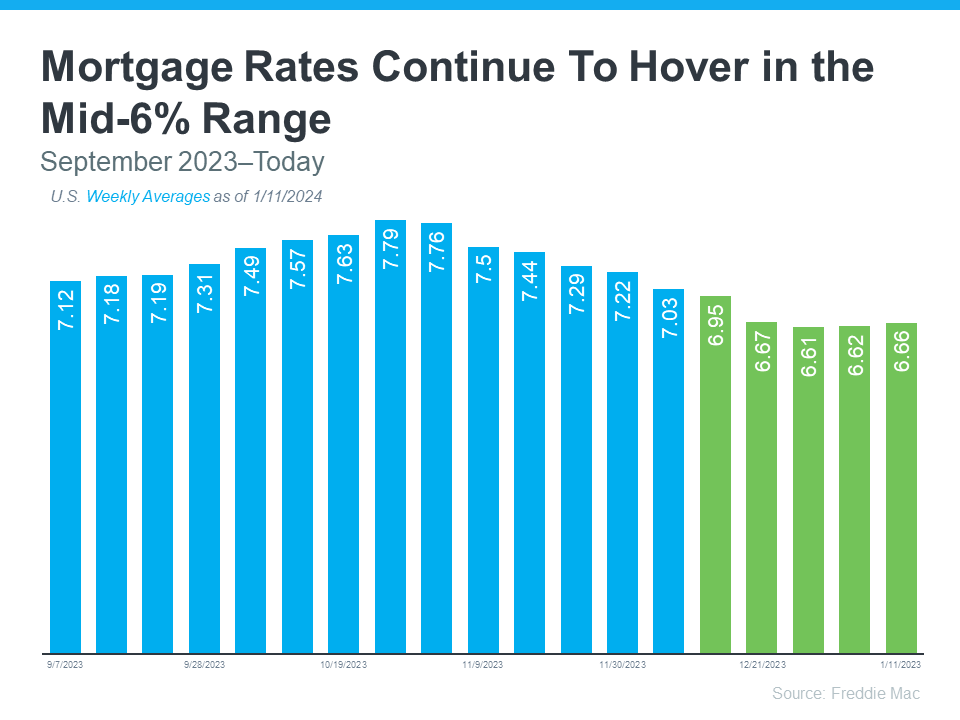

Hey there, if you’ve been delaying the sale of your house, thinking that mortgage rates were just too darn high, we’ve got some fantastic news to share with you! The recent trend in mortgage rates is definitely something to get excited about. Let’s break it down: Last October, mortgage rates peaked at a whopping 7.79%, making many potential sellers hesitate. But guess what? Fast forward to today, and we’re looking at some seriously good news. For the past month or so, mortgage rates have consistently stayed below the 7% mark (check out the graph below for a side-by-side comparison). This downward shift in rates is like a green light for those of you who’ve been waiting to make your move. It’s time to seize the opportunity and consider selling your home while these favorable rates are on your side!

Now, let’s talk about those interest rates. They’re not going to skyrocket back to the 3% levels like what we saw during the ‘unicorn’ years, but here’s the scoop: they’re actually on a downward trend right now. Dean Baker, the Senior Economist at the Center for Economic Research, breaks it down for us. He says that, in the near future, we can expect those rates to keep on heading south.

“It also appears that mortgage rates are now falling again. They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

Here are a couple of reasons why this recent trend, and the belief that it will keep going, is fantastic news for you:

You Might Not Feel as Trapped by Your Current Mortgage Rate

Mortgage rates have recently taken a significant dip, which may make you feel less bound to your existing mortgage rate. In the past, when mortgage rates were soaring, relocating to a new home could have meant exchanging a low rate for one approaching 8%.

Fortunately, with rates on the decline, the gap between your current mortgage rate and the potential new rate you’d secure isn’t as substantial as it once was. This shift is making the prospect of moving more economically viable than it was just a few months ago. Lance Lambert, the Founder of ResiClub, elaborates on this trend:

“We might be at peak “lock-in effect.” Some move-up or lifestyle sellers might be coming to terms with the fact 3% and 4% mortgage rates aren’t returning anytime soon.”

More Buyers Are Heading to the Market

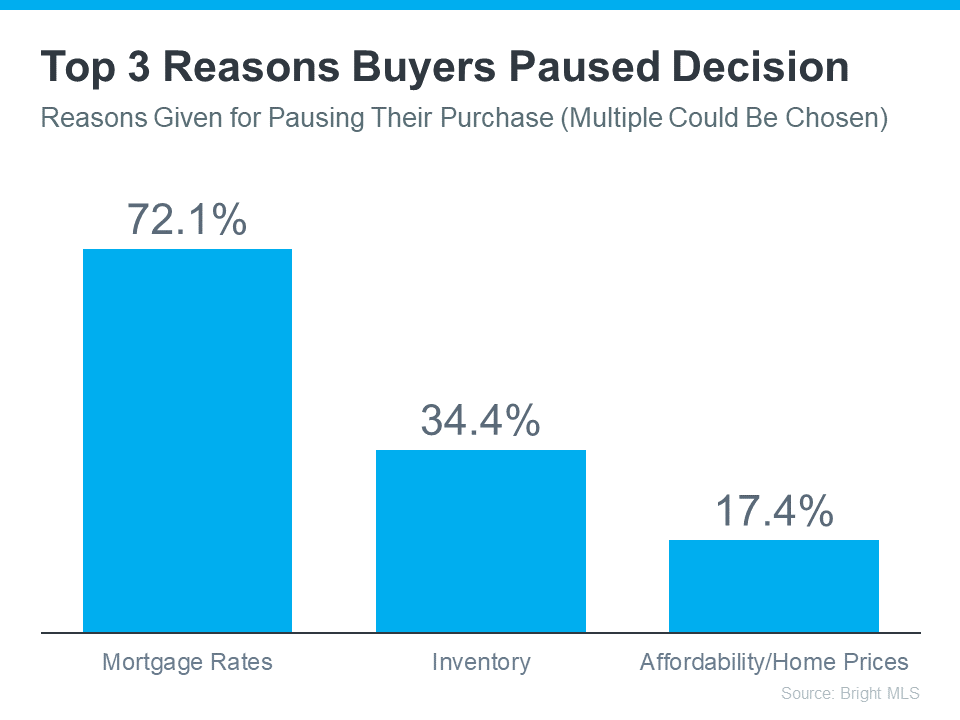

Bright MLS data reveals that an increasing number of potential buyers are gearing up to enter the realm of homeownership. The primary deterrent that had been holding them back has been the prevalence of high mortgage rates, as indicated in the graph below

So, what does this mean for sellers in the San Diego real estate market? Well, it’s important to recognize that as mortgage rates continue to rise, more buyers are recognizing the urgency of making their move into homeownership. This increased demand can create a favorable environment for sellers looking to list their homes, potentially leading to quicker sales and even more favorable offers.

For San Diego homeowners who have been considering selling their properties, this shift in buyer sentiment could represent a valuable opportunity. As rates climb, buyers may be more motivated than ever to secure a home before affordability becomes an even greater challenge. Therefore, for those who have equity built up in their homes and are looking to capitalize on it, now might just be the ideal time to take action.

With lower mortgage rates, buyers can save money on their home loans, making buying a home more appealing and affordable. As rates continue to decrease, more buyers may gain the confidence to re-enter the market and take the plunge. This surge in buyer activity translates to increased demand for your property

The Key Takeaway on Mortgage Rate Trends for Sellers

If you’ve held off on selling due to concerns about higher mortgage rates or doubts about finding potential buyers, the recent drop in mortgage rates could be your signal to take action. When you’re prepared, reach out to the McT Real Estate Group team. We’re here to assist you every step of the way.