Are you considering buying a home in San Diego this year? If so, you’re likely keeping a keen eye on the housing market more than ever before. You’re gathering insights from numerous sources – the daily news, social media buzz, discussions with your trusted real estate agent, and even chats with friends and family. It seems like everywhere you turn, topics like fluctuating home prices and mortgage rates are at the center of the conversation. Now, let’s dive into the two critical questions you should ask before home buying. We’ll also provide you with the essential data to help you sift through the myriad of information. This way, you can make a well-informed and confident decision about your future home.

Where are Home Prices Heading?

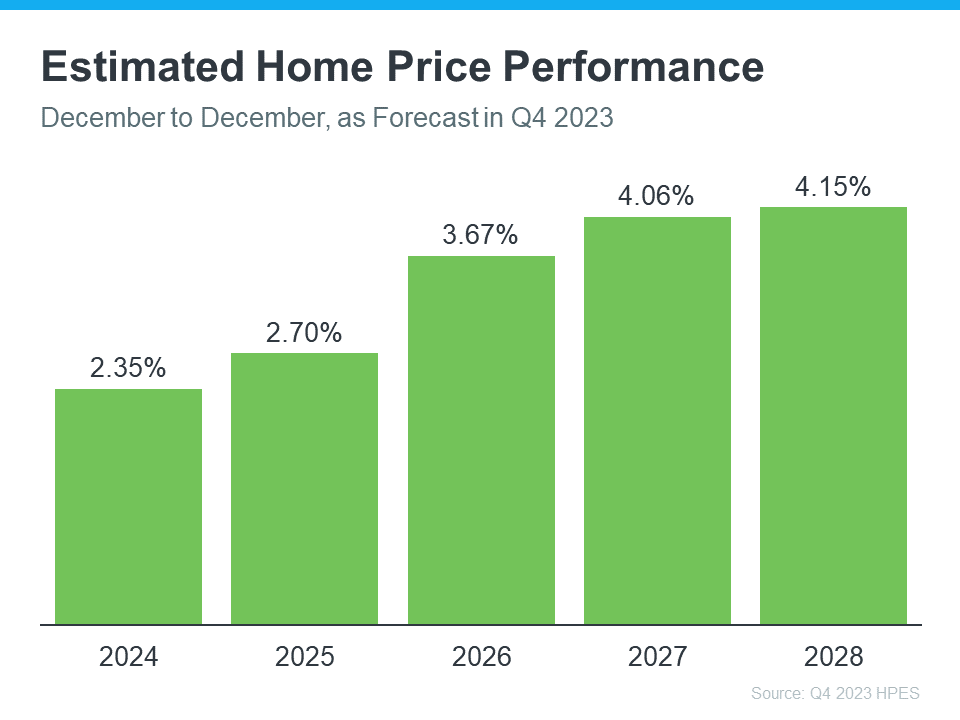

When you’re considering buying a home, it’s crucial to think about where home prices might be heading. A great resource for this is the Home Price Expectations Survey conducted by Fannie Mae. This comprehensive survey pools insights from more than a hundred economists, real estate experts, and investment and market strategists.

Their collective expertise offers a valuable perspective on the future of home prices. The latest findings suggest that we can expect home prices to continue their upward trend at least until 2028. This projection is not just a number; it’s a reflection of various economic factors and market dynamics (as shown in the graph below). Understanding these trends helps you make an informed decision about when and where to invest in your next home.

Remember, staying informed about market trends is key in real estate, and this survey is a crucial tool in gauging the future of home prices.

Why should this matter to you as a prospective homeowner in San Diego? Let’s break it down. Although the rate of appreciation might not be skyrocketing like in recent years, the key takeaway here is the continued upward trend. Experts predict that, for at least the next five years, we’re going to see home prices climbing, not dipping.

This gradual increase in home values is actually great news for both the market and you as a buyer. Here’s why: deciding to purchase a home now positions you to potentially benefit from this steady growth. Your property’s value is likely to rise, building your home equity over time. On the flip side, if you decide to wait, these same forecasts suggest you might end up paying more down the line. So, in essence, buying sooner rather than later could be a smart financial move in this evolving San Diego real estate landscape.

Before Buying a Home: Where are Mortgage Rates Heading?

In the last year, we’ve watched mortgage rates climb, reacting to a mix of economic challenges including inflation. But, there’s good news on the horizon for the housing market, especially in terms of mortgage rates. Here’s the scoop: as inflation begins to ease, mortgage rates typically follow suit and decrease. That’s exactly the trend we’ve been noticing lately.

Moreover, with the Federal Reserve indicating a pause in hiking the Federal Funds Rate – and possibly even reducing it in 2024 – many experts are optimistic about mortgage rates dropping further. This is a vital point for those thinking about buying a home.

Danielle Hale, Chief Economist at Realtor.com, sheds light on this topic:

“. . . mortgage rates will continue to ease in 2024 as inflation improves and Fed rate cuts get closer. . . . a key factor in starting to provide affordability relief to homebuyers.”

Drawing insights from a piece by the National Association of Realtors (NAR), we’ve uncovered some fascinating details.

“Mortgage rates likely have peaked and are now falling from their recent high of nearly 8%. . . . This likely will improve housing affordability and entice more home buyers to return to the market . . .”

It’s tough to predict exactly how mortgage rates will move in the future. However, there’s a glimmer of optimism with the recent downturn in rates. This change, coupled with the Federal Reserve’s decision to halt their rate hikes, hints at brighter days ahead. We might encounter a bit of ups and downs along the way, but overall, as these rates gradually become more manageable, the affordability of homes is likely to get better. This is good news for anyone looking to buy a home, as it could mean more budget-friendly options are on the way.

Final Thoughts: Navigating Your Home Purchase

Are you considering stepping into the world of homeownership? It’s crucial to stay informed about the current trends in home prices and mortgage rates. Predicting the exact future of these factors is tricky, but having the most up-to-date information at your fingertips is vital in making a well-informed decision. That’s where the expertise of a local trusted realtor comes in handy. Connect with the McT Real Estate Group and discuss how the latest market developments are turning out to be great news for you as a potential homebuyer. With our guidance, you’ll be well-equipped to navigate this exciting journey with confidence and ease.