Let’s talk about San Diego’s Real Estate Market in August of 2024

When someone decides to bake, and they have kids helping out, there’s usually a lot of excitement and high hopes of pulling out a flawless cake from the oven. Mixing the ingredients, pouring the batter, and closing the oven door all happen with anticipation. The sweet aroma fills the kitchen as the timer counts down. However, upon opening the oven, disappointment sets in as the cake fails to rise as expected. Time seems to drag on as everyone’s excitement fades away while waiting for that cake that turns out not so perfect.

Sometimes, the baking process goes perfectly, and other days, after hours of effort, only one comes out looking right. And then there are days when nothing turns out as planned—despite trying different recipes and adjusting every ingredient, the result is disappointing, to say the least. A big part of baking is perfect measurements, observing what others do successfully, and coming prepared with an extra dose of patience.

What Does the San Diego’s Real Estate Market Have To Do With Baking?

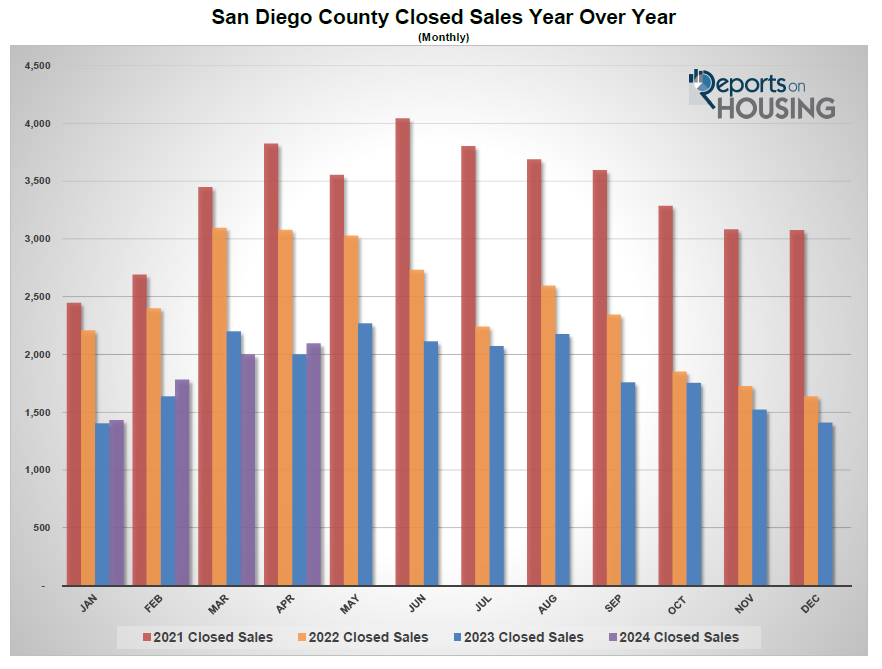

Many of today’s home sellers resemble first-time bakers. They enter the market excitedly, expecting multiple offers to roll in within days. They’ve heard stories about the market being on fire earlier this year. Back in March, homes sold at or above their list prices, and the demand seemed insatiable. However, after placing the FOR-SALE sign in the yard and opening their homes to buyers, the days stretch into weeks, and sometimes those weeks turn into months. The housing market has shifted. What was once a hot Seller’s Market has now become more balanced, where pricing your home correctly is the key to success.

52% of all homes available for sale have been listed for a minimum of 30 days. What’s more notable is that 28% of these homes have been waiting for over two months without receiving an acceptable offer. It can be quite challenging to maintain a home that is showing condition for such a period, especially if there are kids or pets in the household. While it’s common for luxury properties to remain on the market for longer, many homes in the affordable price range are also facing delays. For instance, nearly half of the homes priced under $750,000 have been listed for over 30 days, with around 28% waiting for two months.

Market Time for Homes $750,000- $2,000,000

For homes priced from $750,000 to $1 million, 20% have been listed for sale for 60 days or longer. As the price range goes up to between $1 million and $2 million, this percentage rises to between 21% and 27%. For homes priced over $2 million, the wait time gets even lengthier, with a range of 35% to 57% of sellers waiting two months to secure a buyer.

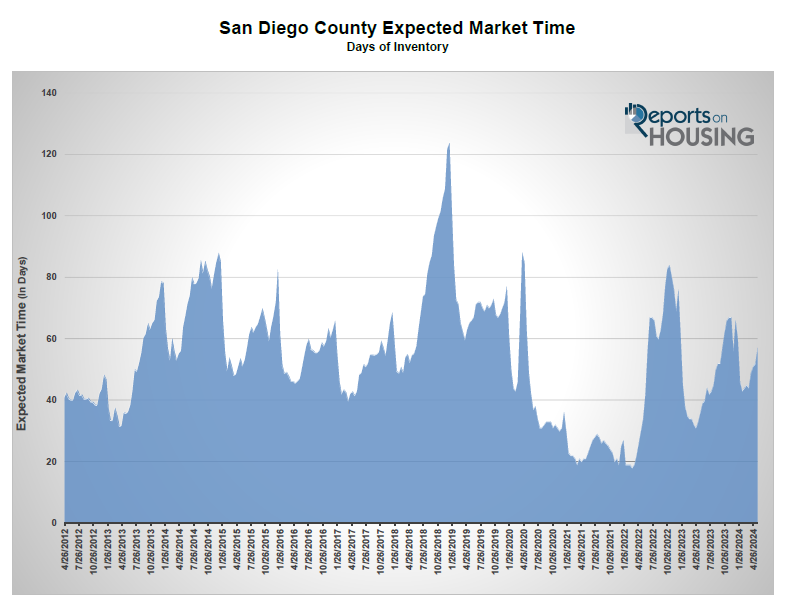

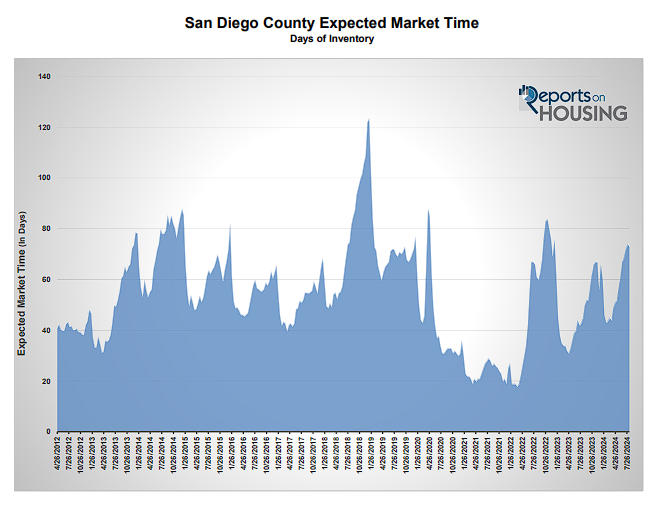

Homes in San Diego County are currently taking longer to sell compared to this year and last year. The Expected Market Time, which indicates the duration needed to sell all listings at the buying rate, now stands at 73 days. In February, this figure was 43 days, marking the pace in 2024. This shift reflects a change in the market dynamics. Around this time last year, homes were sold within 45 days, showing a faster selling process than what we are observing today.

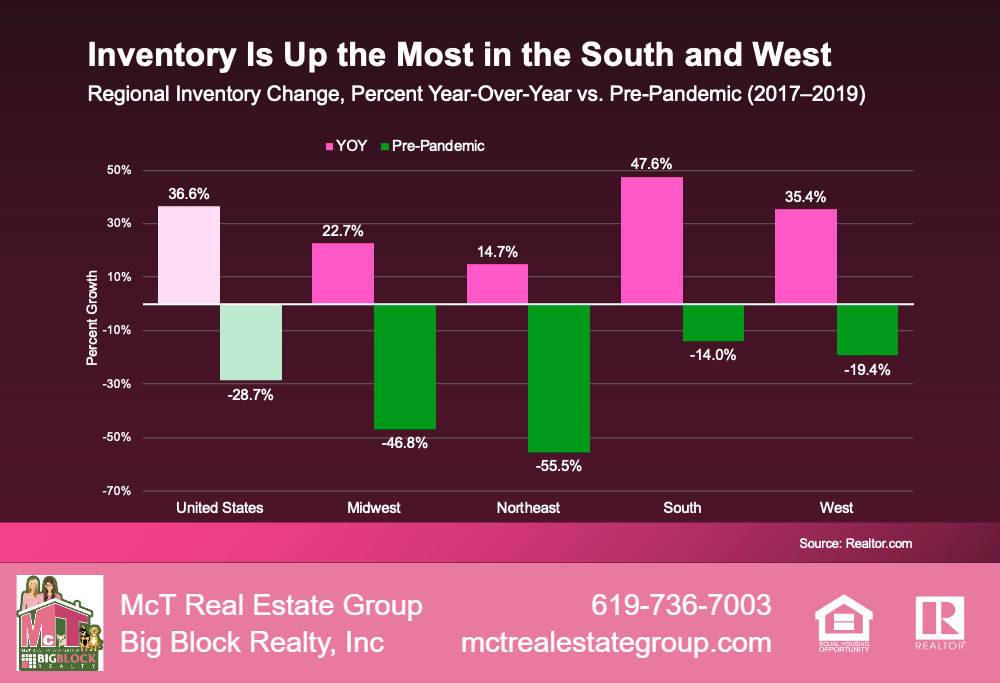

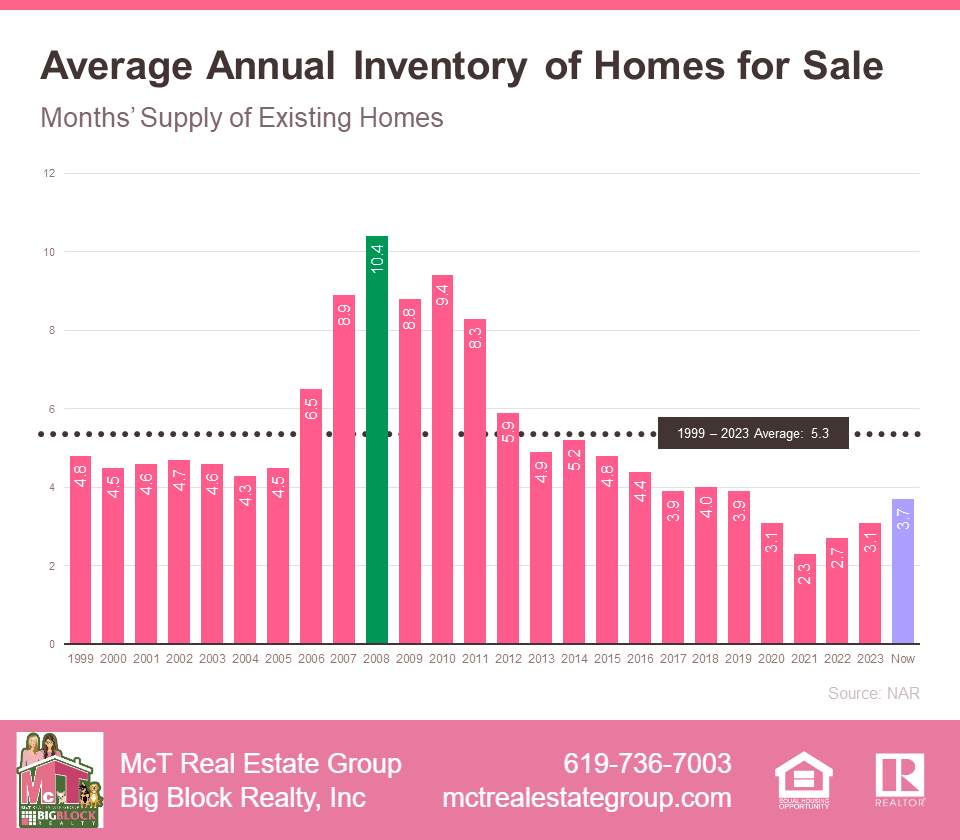

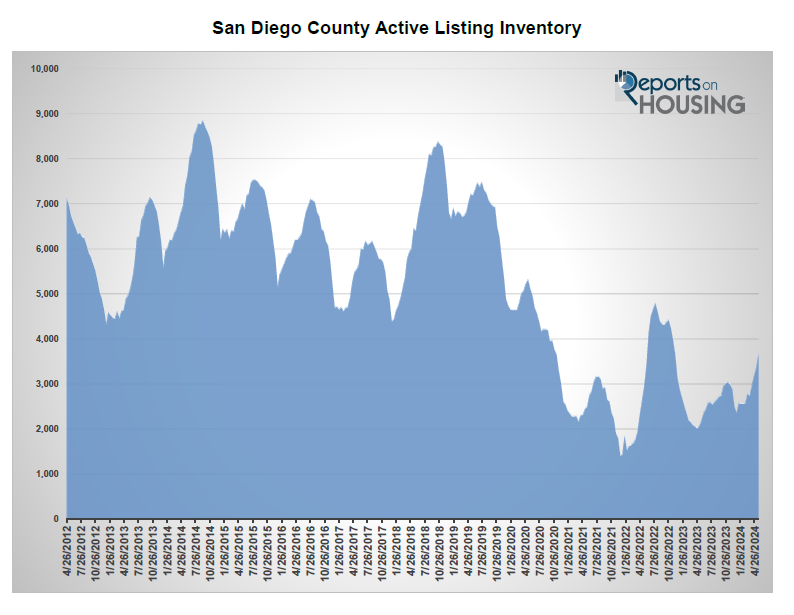

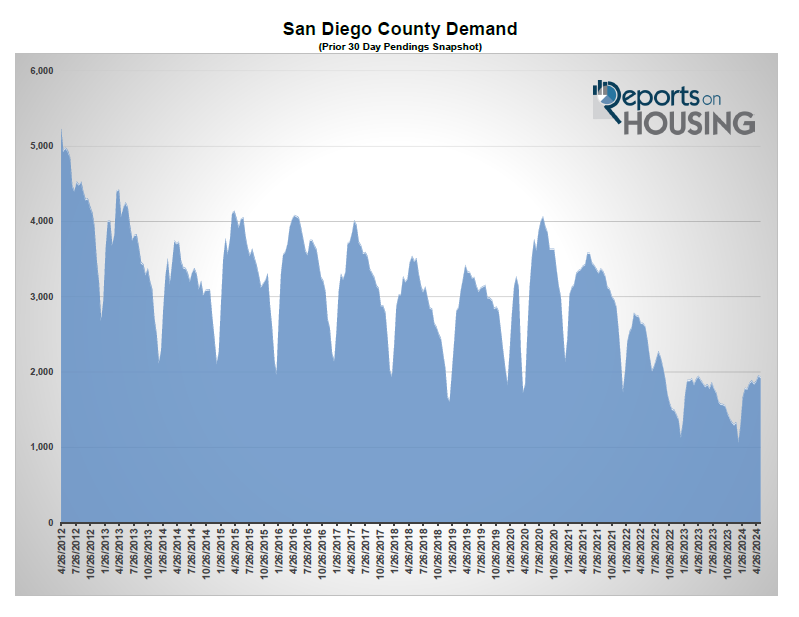

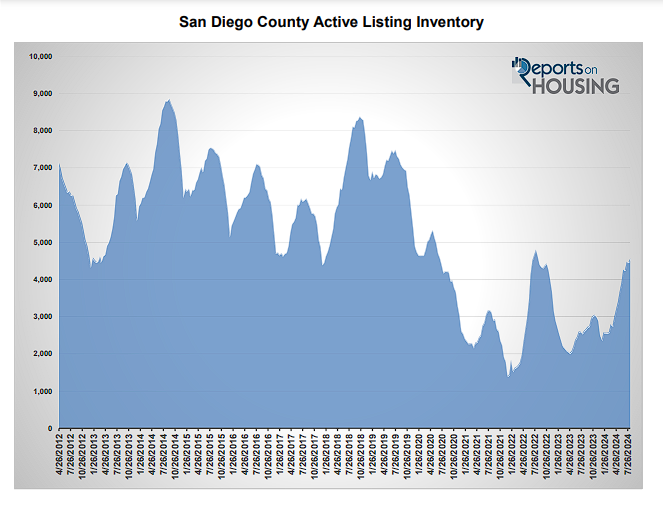

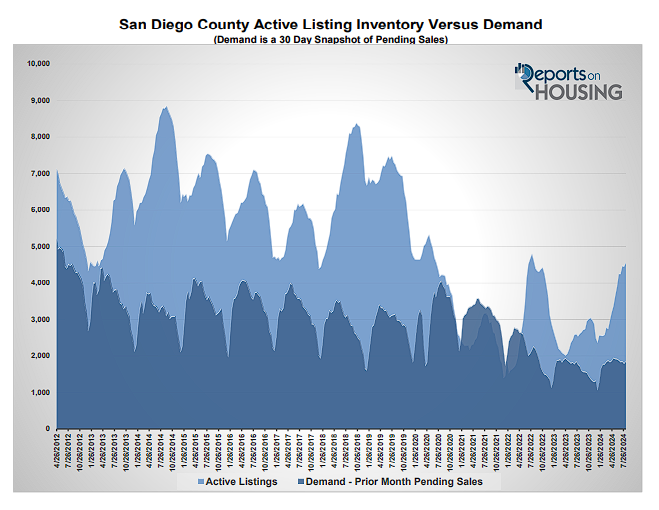

The housing market in San Diego County has experienced a slowdown since the beginning of spring. Even though there is an 8% increase in demand compared to the year, more homes are being put up for sale. Despite listings than before the pandemic, this year has seen a 22% rise in listings compared to 2023—resulting in an inventory growth from 2,569 homes in February to 4,570, marking a significant 78% surge. At this time of year, 43% of homes were available for sale on the market.

Pricing Your Home Right: The Key to Success in San Diego’s Real Estate Market

Our housing market has changed significantly compared to earlier this year and last year. If you are a Seller, be patient and set your asking price carefully. You have to factor in the home’s condition, location, upgrades, and amenities. And then there may be times that you and your Realtor thought the price you were going to go on the market with was the correct price, but for whatever reason, the market says differently. Make sure to make the adjustment quickly and jump in front of the market. Unfortunately, some sellers resist expert advice and refuse to price their homes at Fair Market Value. As a result, they’re still waiting without any offers.

San Diego’s Active Inventory

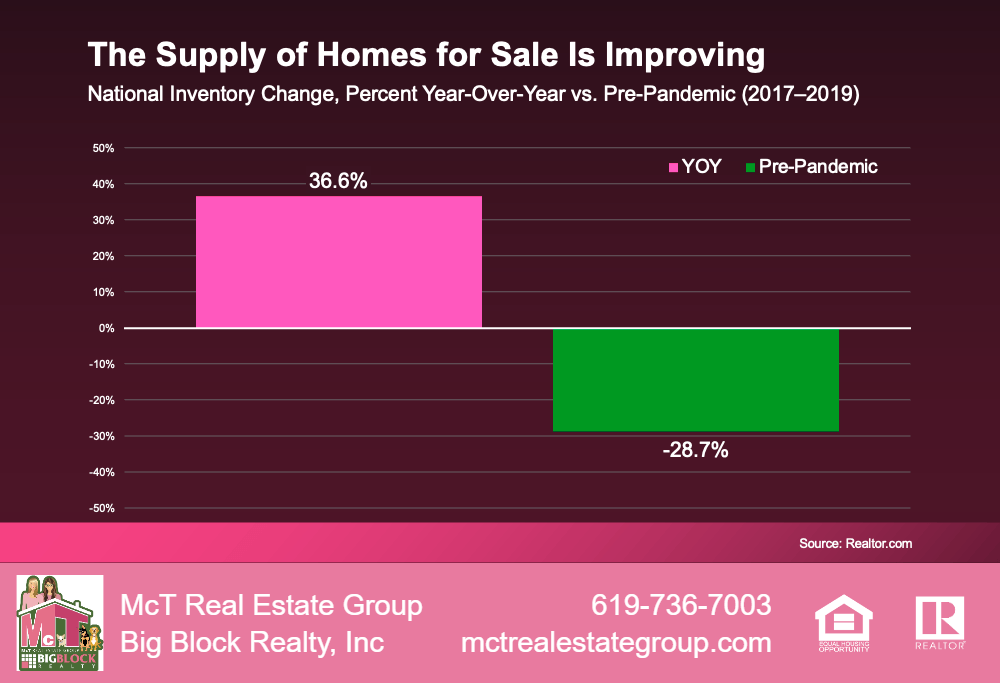

The active listing inventory in San Diego County increased by 111 homes over the past two weeks, reaching 4,570—the highest since August 2022. Inventory growth is slowing, with a peak expected soon, followed by a decline in the fall and a sharp drop during the holidays. Last year, the inventory was 43% lower, and pre-pandemic levels had 57% more homes.

Many homeowners are choosing to remain in their homes because of the low mortgage rates, resulting in a decrease in new property listings. In the month of July, a total of 3,287 sellers decided to put their homes on the market. This number reflects a 33% drop compared to COVID levels but represents a 21% increase from the same period last year.

Increase Demand From Home Buyers

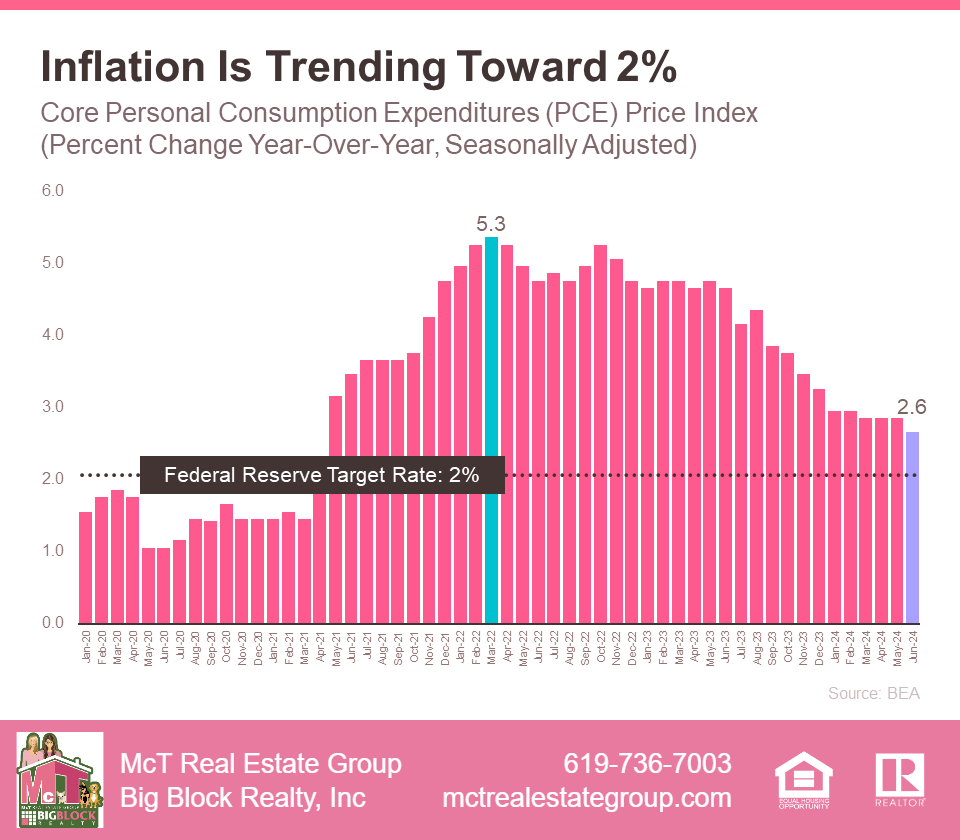

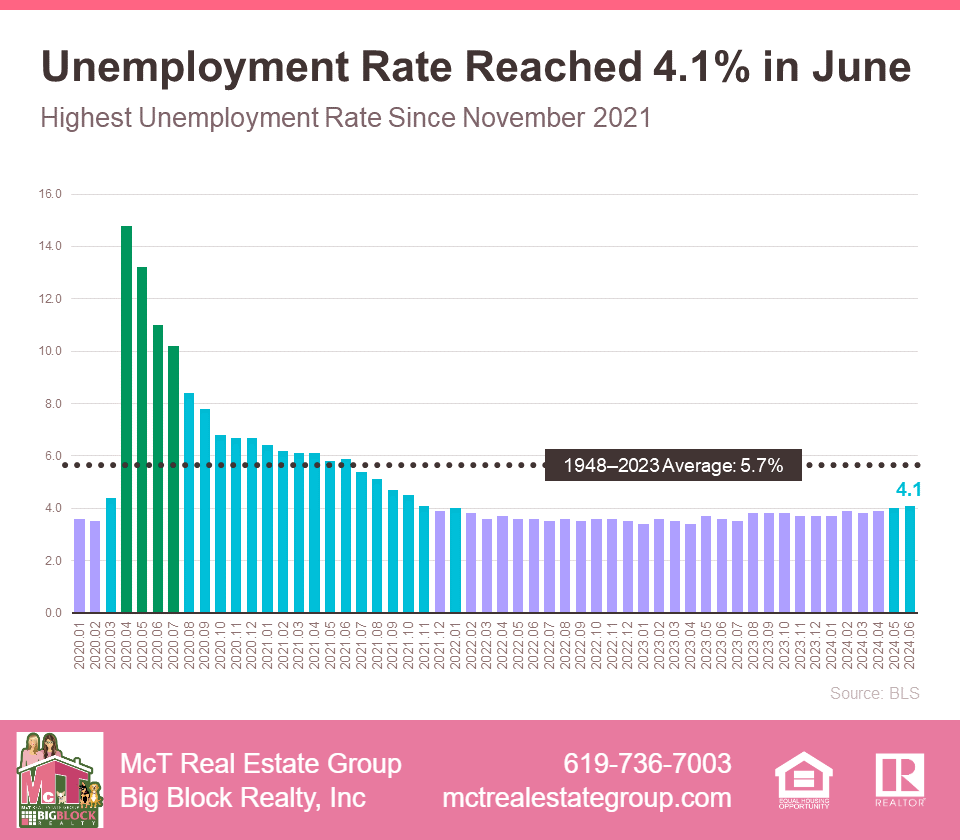

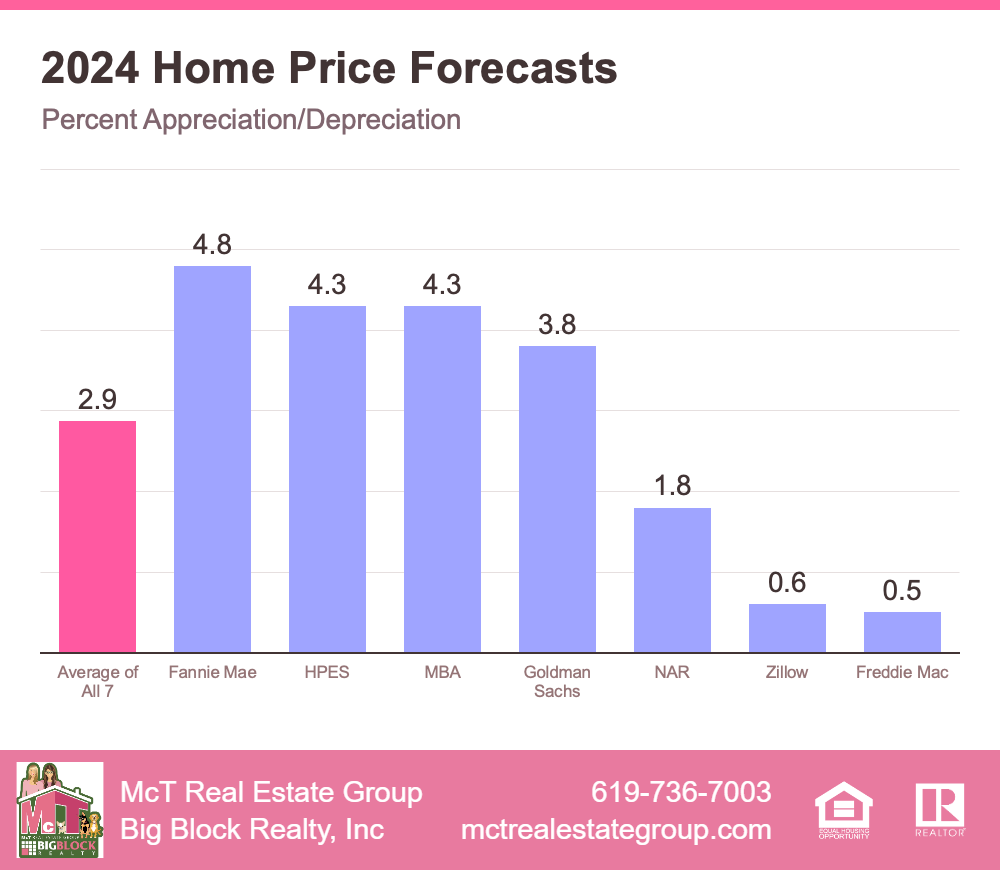

Demand increased by 70 pending sales, up 4%, driven by lower mortgage rates. At 6.5%, rates are a full percent lower than in April, making homes more affordable and boosting buyer interest. We expect demand to strengthen as rates drop further.

The Federal Reserve is monitoring indicators such as the PMI and jobless claims, which have the potential to influence mortgage rates. Depending on the results of this week’s reports, rates may increase or decrease. Most people are eagerly waiting for this.

Demand was 8% lower last year, while pre-COVID averages were 70% higher. As demand rose, the Expected Market Time dropped slightly to 73 days, compared to 45 days last year and 68 days.

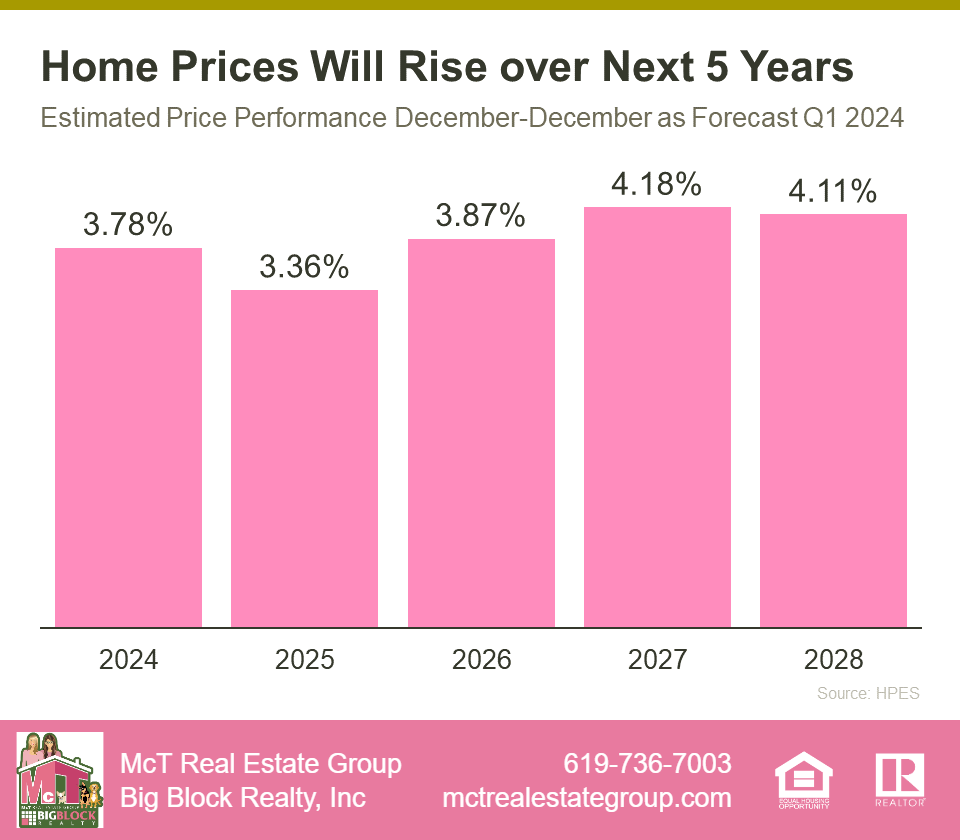

Conclusion: Adapting to the New Market

As we approach the half of the year, it’s evident that there have been changes in the San Diego real estate market. Sellers should maintain patience. Set prices thoughtfully to achieve outcomes. Given the evolving demand and varying mortgage rates, being well-informed and flexible is crucial. Whether you’re in the process of buying or selling, being aware of these developments will empower you to navigate the market.