The frequent appearance of the word “recession” in media headlines has created widespread uncertainty among people, especially those who are planning to buy or sell a home in San Diego.

Common questions that you might be wondering and asking yourself:

- Are home prices going to crash?

- Will mortgage rates skyrocket?

- Should I wait to make a move?

Your concerns about these matters are completely reasonable and valid, you’re not alone because you do share them with many others. The good news is that we can look to some history and data to get some real answers.

Let’s break it down. Shall we?

A Recession Doesn’t Automatically Mean Home Prices Will Drop

Before anything else, let’s clear up a common myth: Here’s the thing: “A recession is not the same as a housing crash.”

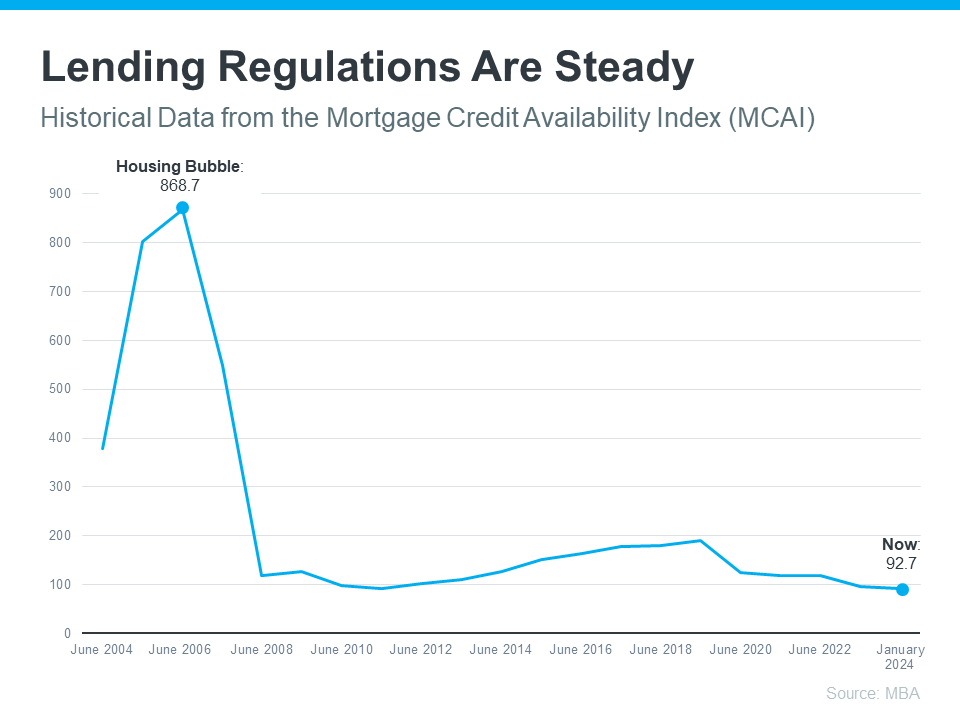

Historical data have shown that in 4 out of the last 6 U.S. recessions, home prices actually went up, and in one, home prices dropped less than 2%. The exception for this was in the year 2008—and that was a very specific situation to discuss which involved some risky loans, overbuilding, and a financial system that was already on the brink.

So, what usually happens?

- Home prices during a recession usually tend to stay on track or just slow down gradually.

- Fewer home buyers may jump into the market and take action, but that doesn’t always mean prices will plummet.

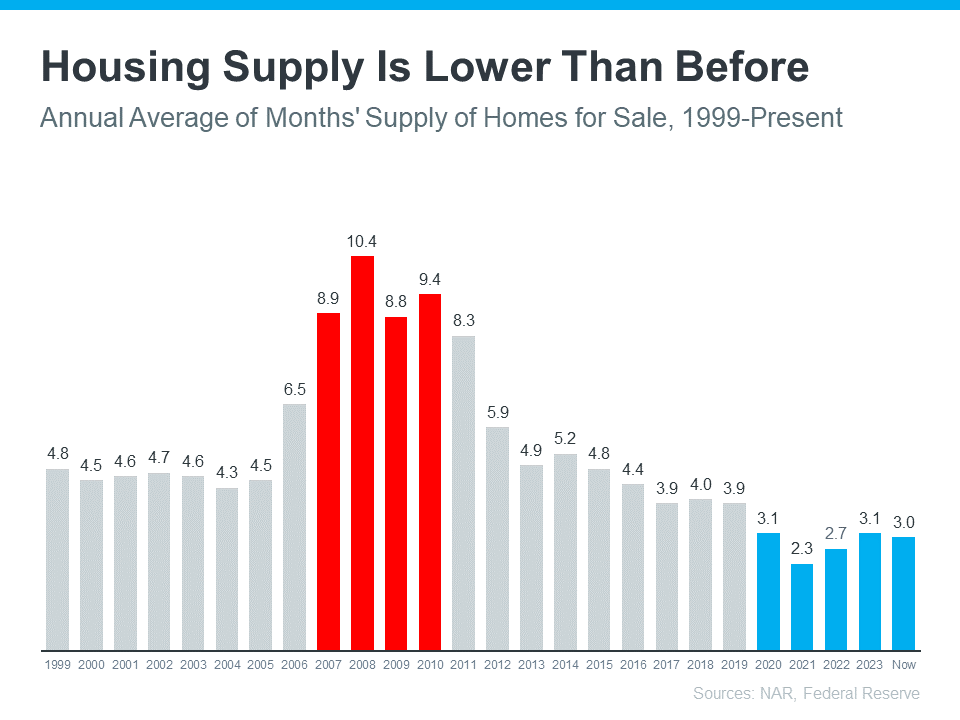

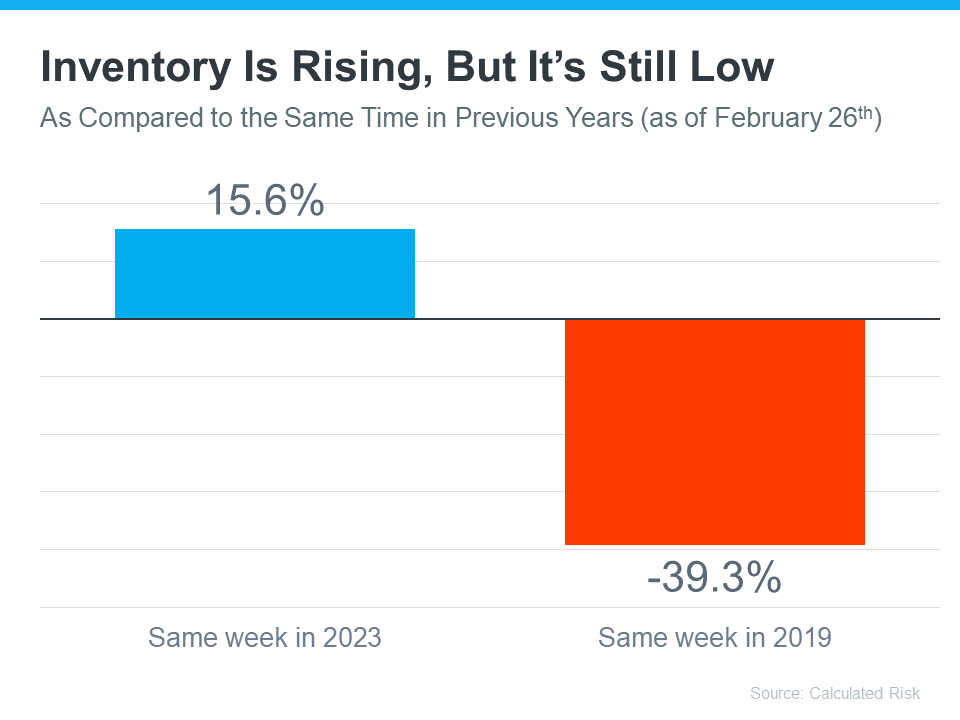

- Every local market in the United States reacts differently; it usually depends on the supply and demand of how many homes are available and how many buyers are looking to buy a home.

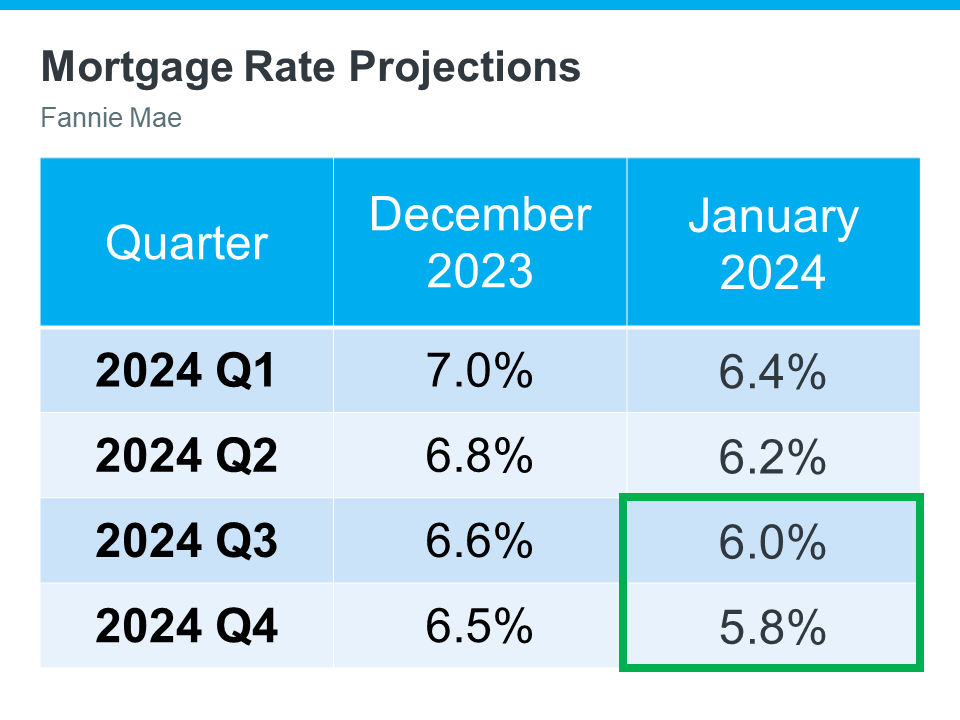

Mortgage Rates Tend to Go Down During a Recession

Here’s something most home buyers are excited to hear: Most of the time during a recession, mortgage rates, based on Freddie Mac data, it has shown that rates have declined by a certain percentage in all six of the last U.S. recessions:

This is due to the fact that the Federal Reserve has often lowered interest rates to help the economy, which can make borrowing a tad bit cheaper than what we’re used to in today’s housing market.

Now, let’s be real for a second and face the facts, we’re probably not heading back to that super-low 3% mortgage rates we saw last 2020, but here’s something to consider, even the slightest dip in rates can make a big difference in your monthly mortgage payment if you are buying a house in San Diego, so that’s still something to look forward to.

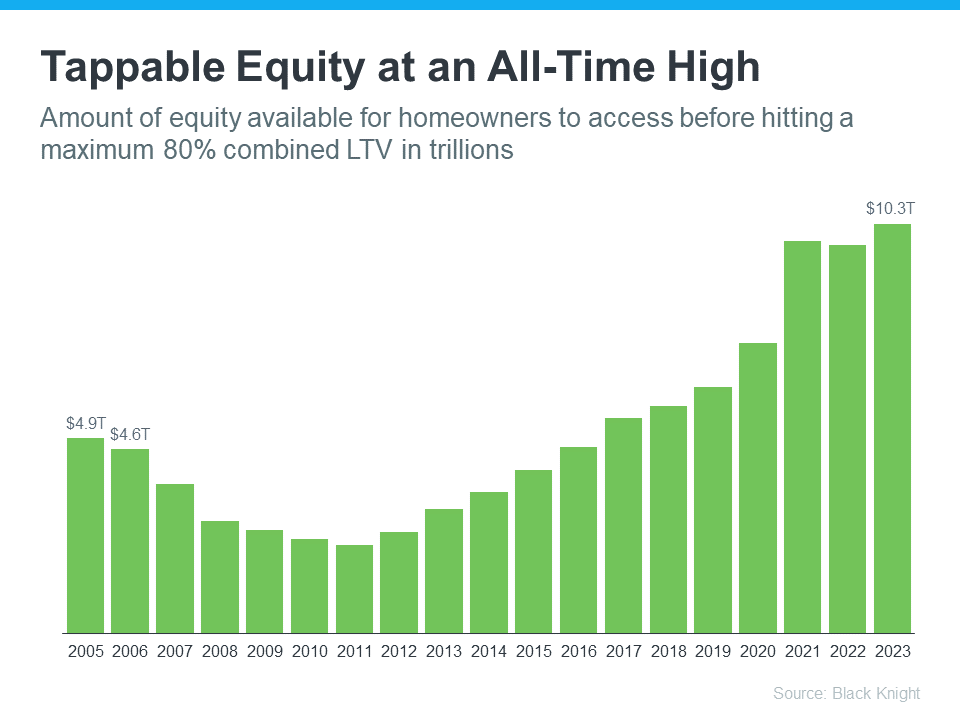

Today’s Homeowners Have Strong Equity Positions

One of the biggest differences between now and the 2008 housing crisis is that homeowners today have managed to build up more of their home equity. Years of solid home price appreciation have created substantial equity cushions for most property owners.

Realtor.com’s analysis of Federal Reserve data shows that:

- Even if home prices have dropped 10%, today’s homeowner equity would still be at 69.5% of total value (similar to 2021)

- A 20% drop would bring equity levels back to what we saw in 2019

- More than half of homeowners ( around 54%) have mortgage rates below 4%, which means they’re not likely to be forced into selling anytime soon.

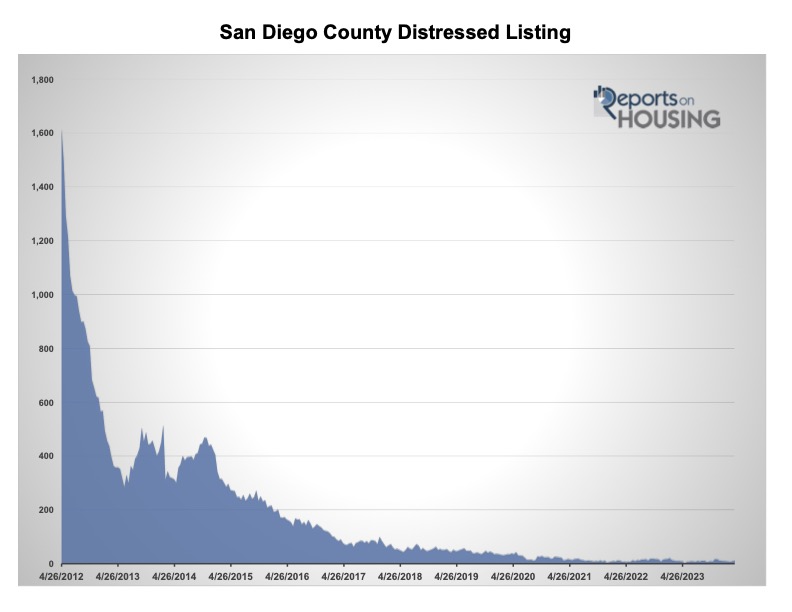

This is good news for the housing market, as today’s homeowners’ strong equity position means we are unlikely to see waves of distressed sales flooding the market, as we did in 2008. This helps maintain price stability even during challenging economic times.

Final Thoughts

Well, economic downturns often bring up uncertainty and fear, and that’s completely normal since we’re talking about one of your biggest investments. But if we look at and understand the historical data, it has shown that home prices tend to hold steady (or increase), and mortgage rates usually go down. In today’s housing market, we can safely say that homeowners are in an incredibly strong position.

If you’re wondering how this might impact your own plans to buy or sell, let’s chat. The McT Real Estate Group is always here to help you make the best decision for your future—not just based of the headlines.