This connection is why many are closely monitoring the Fed’s actions, anticipating potential decreases in the Federal Funds Rate. Such decreases generally lead to lower mortgage rates. The Fed’s upcoming meeting next week will be pivotal as they assess several critical economic indicators:

- Inflation Rate: The current pace at which prices for goods and services rise.

- Job Creation: The number of new jobs being added to the economy.

- Unemployment Rate: The percentage of the workforce that is currently unemployed.

Here’s the latest data on these three essential metrics and how they might impact mortgage rates in San Diego and other parts of the country.

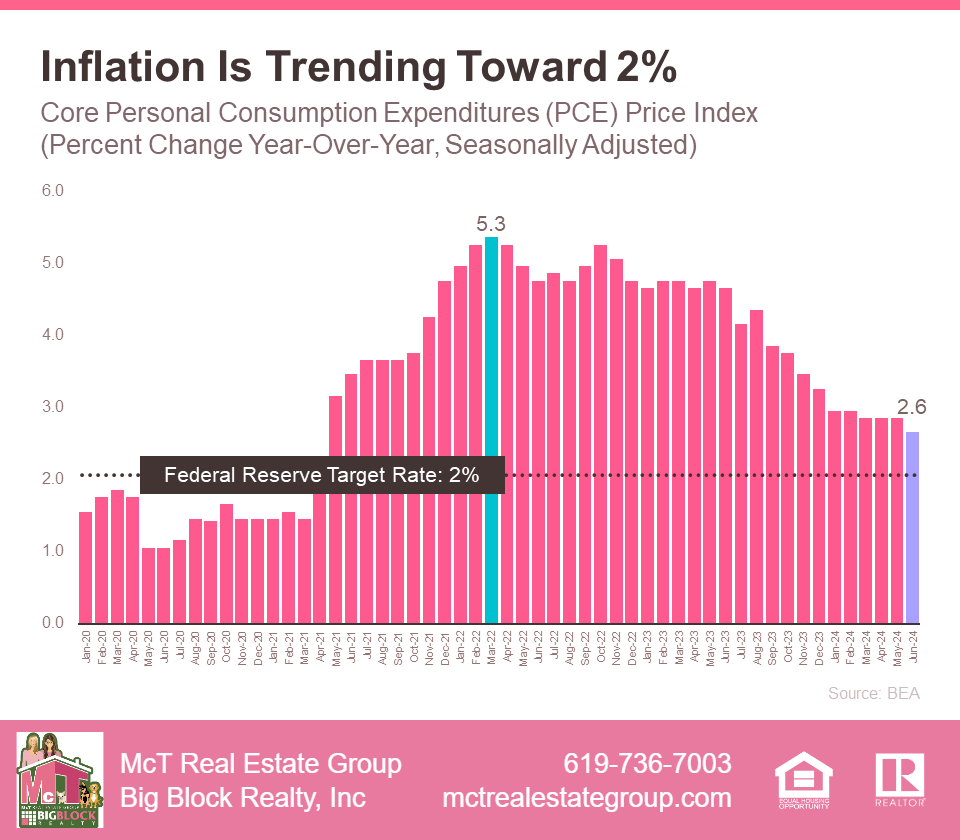

Inflation and Mortgage Rates in San Diego

Over the past year or two, inflation has been a hot topic, and its effects are felt every time we make a purchase. In San Diego, as in many other places, the rapid rise in prices is unmistakable. High inflation means that prices for goods and services increase quickly, affecting the cost of living.

The Federal Reserve has been working to reduce inflation to a target rate of 2%. Although current inflation rates are still above this goal, there’s been progress in the right direction. This ongoing effort is crucial for stabilizing the economy and, consequently, the housing market in San Diego. Understanding how inflation impacts mortgage rates can help potential homebuyers and sellers make more informed decisions in this dynamic market.

San Diego’s Job Market and Mortgage Rates

The Federal Reserve closely monitors job creation each month as it plays a crucial role in economic health and decision-making about interest rates. This dynamic is particularly relevant in San Diego, a city known for its diverse economy and thriving job market. The Fed aims to see a steady slowdown in job growth before making any changes to the Federal Funds Rate. If job creation slows, it suggests the economy remains robust but is beginning to cool down, aligning with the Fed’s objectives.

Inman mentions in a recent article:

“. . . the Bureau of Labor Statistics reported that employers added fewer jobs in April and May than previously thought and that hiring by private companies was sluggish in June.”

This trend suggests a cooling economy, even though employers continue to hire. For San Diego, this means that while businesses are still growing, they are expanding at a slower pace, which is a positive sign for economic stability.

San Diego’s job market, spanning sectors like biotech, tourism, and military, mirrors these national trends. A balanced slowdown in job growth can help stabilize mortgage rates, making it a critical factor for potential homebuyers to consider. As the economy steadies, the outlook for mortgage rates becomes clearer, offering a more predictable environment for those looking to invest in San Diego real estate.

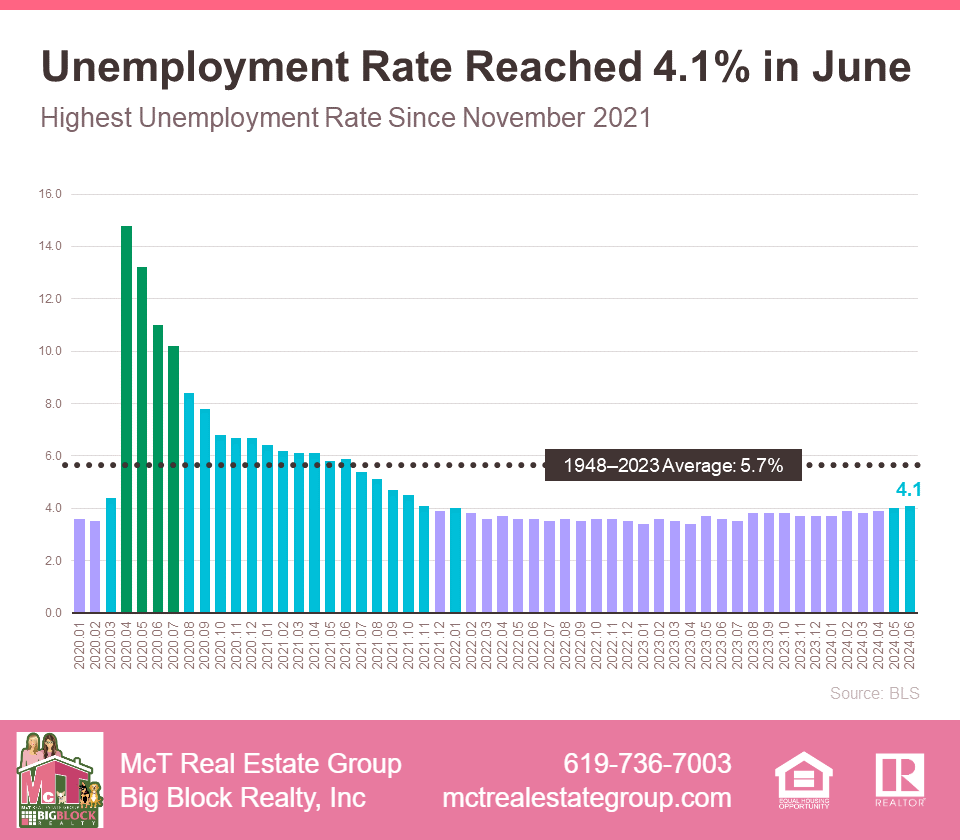

The Impact of the Unemployment Rate

The unemployment rate measures the percentage of people actively seeking work but unable to find employment. A low unemployment rate signifies a robust job market with many residents employed, which is generally positive news for the community.

However, a thriving job market can also lead to higher inflation. When more people have jobs, they tend to spend more money, which can drive up prices. Currently, San Diego’s unemployment rate remains low but has shown a slight increase in recent months.

This gradual rise in unemployment is closely monitored by the Federal Reserve. A consistently increasing unemployment rate can be a signal for the Fed to consider lowering the Federal Funds Rate. The rationale is that higher unemployment leads to reduced consumer spending, which can help control inflation.

Understanding these dynamics is crucial for anyone interested in San Diego’s real estate market. As employment trends impact mortgage rates, staying informed can help you make better financial decisions when buying or selling a home.

San Diego’s Economy and What it Means Moving Forward?

As we move forward, it’s clear that mortgage rates will continue to fluctuate in the coming days and months. However, there are indications that the economy is heading in the direction the Federal Reserve aims for. Despite this, it’s unlikely that the Federal Funds Rate will be cut in the next meeting. Jerome Powell, Chair of the Federal Reserve, emphasized the need for more consistent data, stating:

“We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing or loosening policy.”

In simple terms, although we’re seeing positive signs now, the Fed needs additional data and time to ensure this trend is steady. If the economy continues in this direction, the CME FedWatch Tool predicts a 96.1% chance that the Fed will lower the Federal Funds Rate at their September meeting.

It’s important to note that the Fed doesn’t directly set mortgage rates. Nonetheless, when they decide to cut the Federal Funds Rate, mortgage rates are expected to respond accordingly. The timing of the Fed’s actions can be influenced by new economic reports, global events, and other factors. Therefore, trying to time the market is generally not advisable.

Bottom Line on How San Diego’s Economy Affects Mortgage Rates

Recent economic data suggests that there may be hope for lower mortgage rates on the horizon. In San Diego, understanding these trends is crucial for making informed decisions. Let’s connect, and we will keep you updated on the latest developments and what they mean for you. As your local real estate experts, we’re here to help you navigate the ever-changing market and find the best opportunities.