first time home buyers

Begin your journey, as first time homebuyers with confidence and anticipation.

Young Homebuyer Tips: A San Diego Home Buying Guide

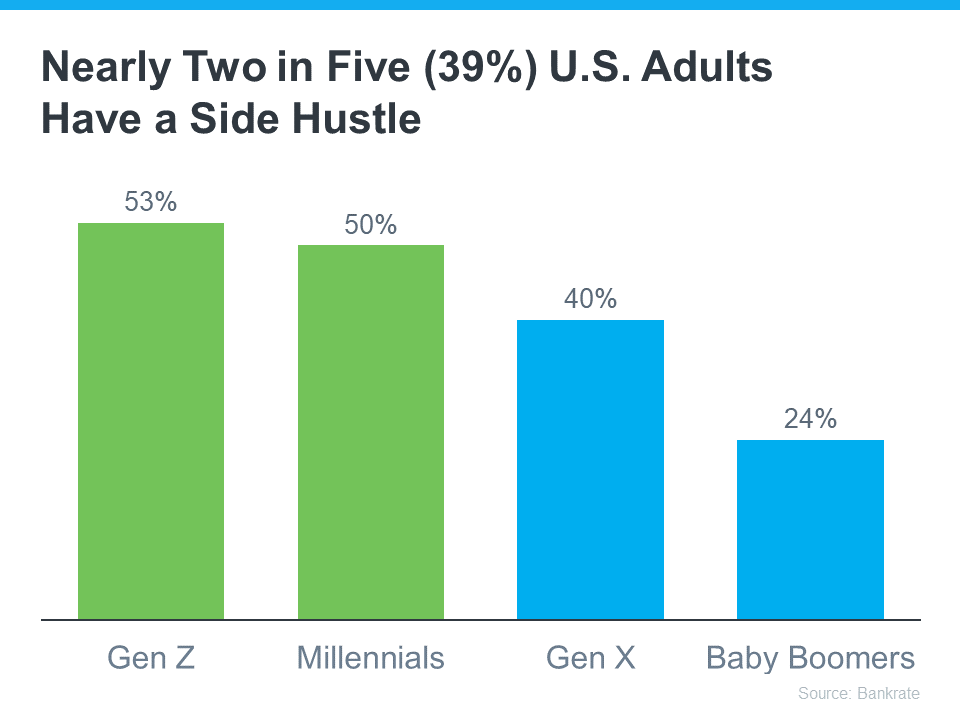

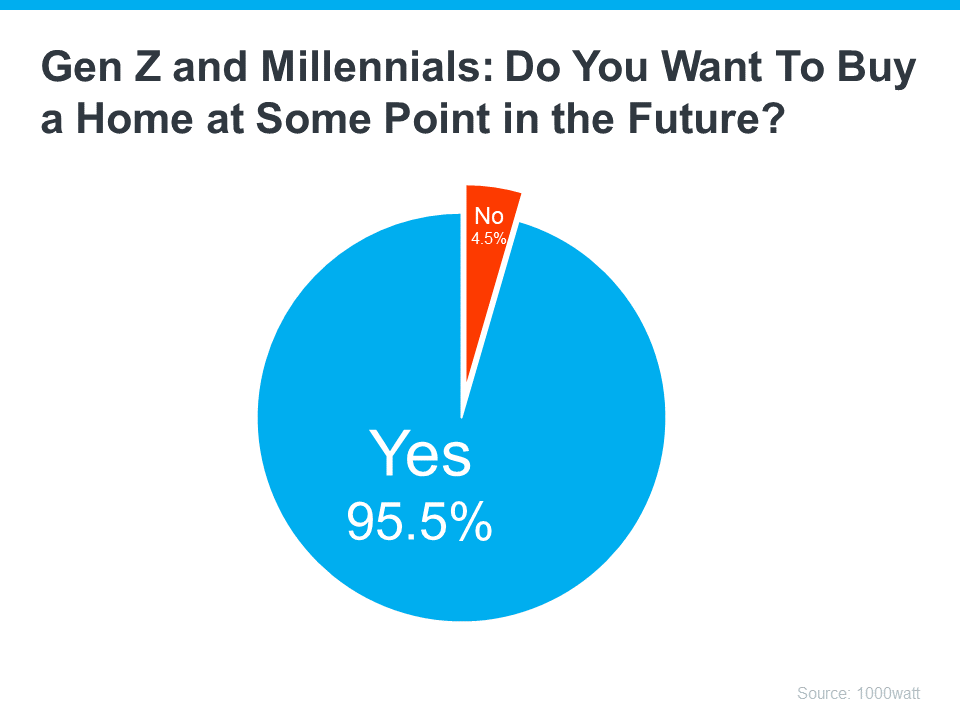

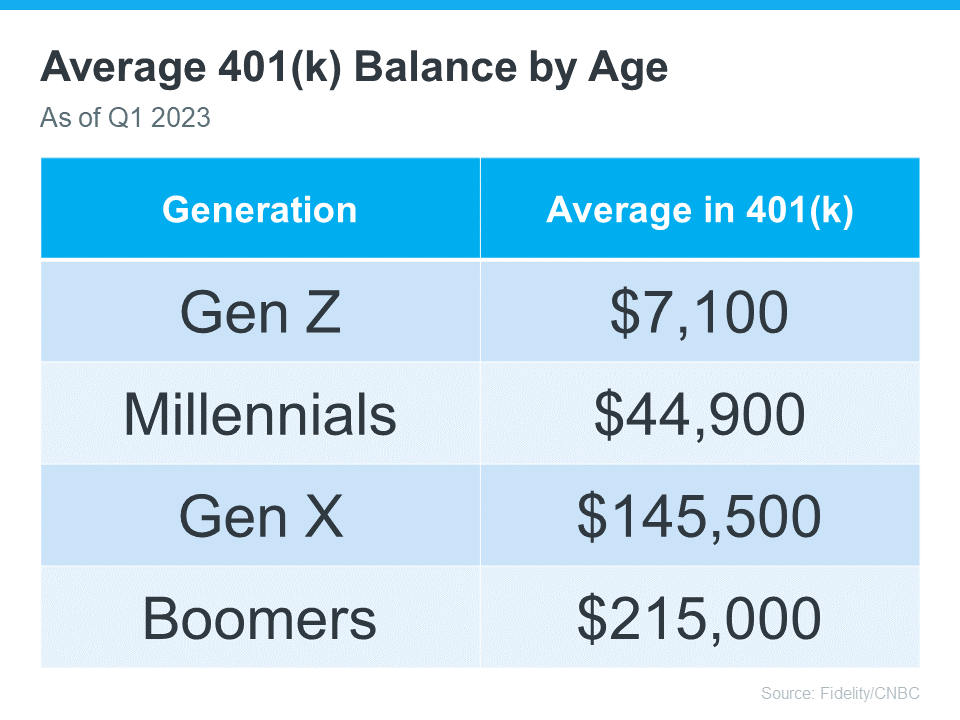

Many people, especially from the younger generation like Gen Z, often wonder if owning and buying a place to call home is within their reach, given the hurdles you usually hear, like inflation, soaring home prices, and climbing mortgage rates. It might seem like the deck is stacked against all odds on being a young homebuyer right now.

Despite these challenges, achieving homeownership in San Diego’s real estate market is still very much possible, even for a young home buyer, particularly with the right guidance from your side. With its diverse neighborhoods like North Park, South Park, and nearby, as well as its booming real estate, San Diego offers unique opportunities for first-time homebuyers.

Having a team of experienced professionals can make all the difference. Here are some expert tips that can help you navigate this complex landscape more effectively.

Exploring Down Payment Options in San Diego

Securing a down payment often presents the first major challenge for many aspiring homeowners and a young homebuyer. However, you’re not alone in this journey. Across the nation, there are more than 2,000 down payment assistance programs to make homeownership more accessible. These programs are a valuable resource for anyone looking to settle in this vibrant city.

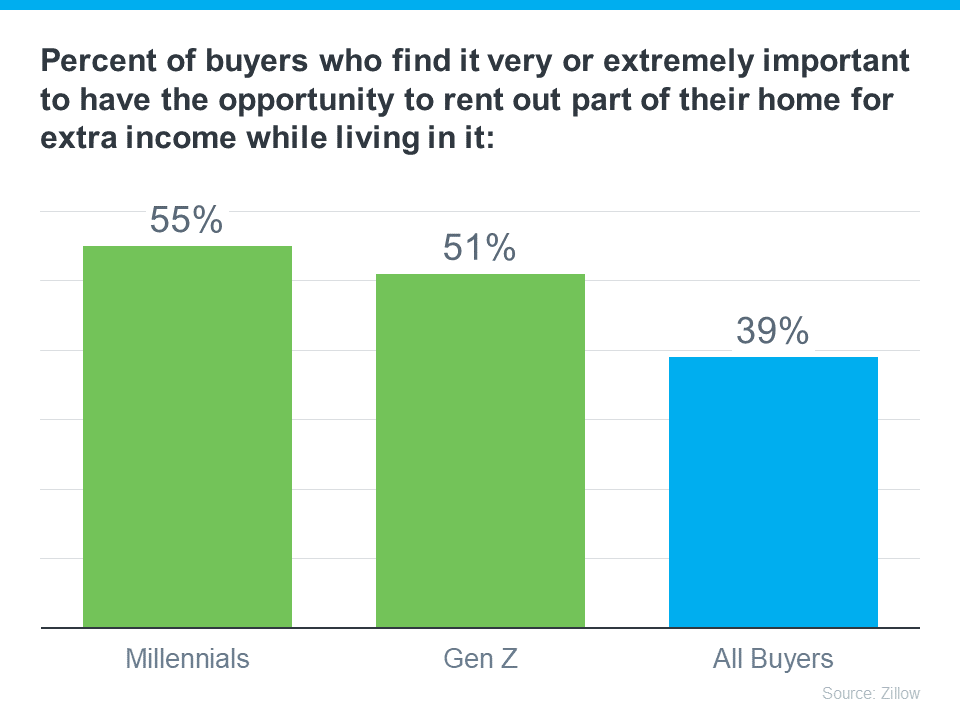

Furthermore, nearly half of Gen Z homebuyers have received financial support from family or friends to enhance their down payment funds, as noted by LendingTree. It’s worth considering if this could be an option for you too.

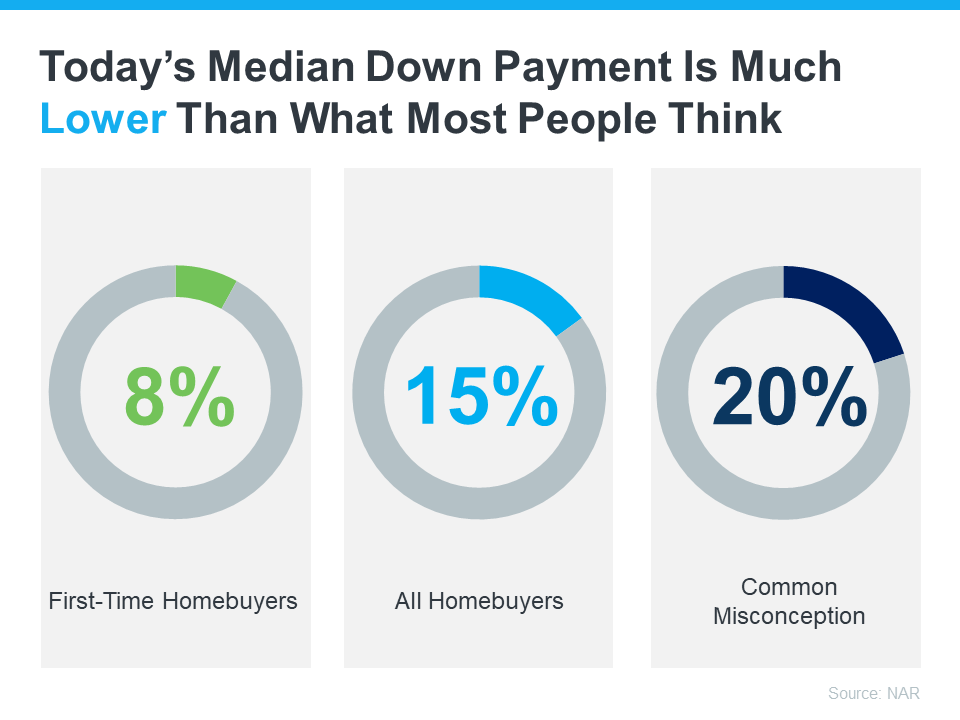

Most importantly, you might not even need to save up for a 20% down payment—this is a common misconception most first-time home buyers have. Loan requirements vary, and in many cases, you could qualify with a significantly lower percentage. Engage with a reputable mortgage advisor in San Diego to review your options thoroughly. They can help you determine the amount you’ll need and guide you on the acceptable ways to incorporate gifts from family into your home-buying strategy. This proactive approach can put you on a clear path to owning a home in one of California’s most desirable locales.

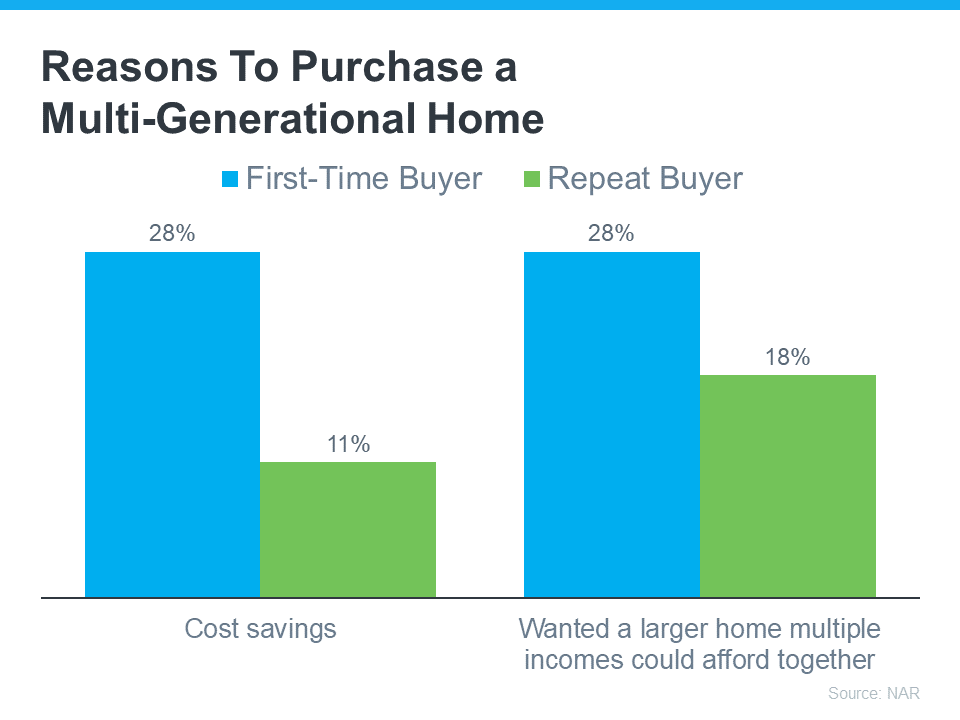

Boost Your Savings by Living with Loved Ones as a Young Homebuyer

Many young buyers in San Diego and in other parts of the country are choosing a smart financial strategy: they’re temporarily moving out of rentals and back in with family or friends. This change can significantly reduce your living expenses, accelerating your savings growth. For example, as noted by Bankrate, a substantial number of Gen Z homebuyers are forgoing rent to enhance their savings.

“. . . many have opted to stop renting and live with family in order to boost their savings. Thirty percent of Gen Z homebuyers move directly from their family member’s home to a home of their own, according to NAR.”

This move helps with financial accumulation and aligns well with the close-knit community culture prevalent in San Diego, making it a practical and enjoyable living arrangement, also known as multi-generational living.

Expand Your Home Search Horizons in San Diego

Once you’re financially prepared to buy a home, working with a seasoned real estate professional in your area can significantly broaden your search horizons, especially in a competitive market like San Diego. With home inventory remaining tight and affordability challenging, your realtor can introduce you to strategies and lesser-known markets that might otherwise escape your notice.

For instance, while urban areas like downtown San Diego buzz with vibrancy and excitement, the suburbs or even semi-rural areas might offer more budget-friendly options. Exploring neighborhoods slightly outside the usual hotspots, like the tranquil settings of South Park or the family-friendly streets of Golden Hill, could provide you with a cost-effective pathway to homeownership. Additionally, considering smaller properties such as condos or townhouses can further diversify your choices, allowing you a smoother entry into the real estate market. As noted by Colby Stout, a Research Analyst at Bright MLS, exploring these alternatives can open up several viable avenues for securing your first home in San Diego.

“An open-minded approach to house-hunting may be one way for Gen Z homebuyers to maintain some edge. This could mean buying in areas that are less expensive. Differentiating needs vs. wants may help in this area as well.”

Working with a real estate agent in San Diego can streamline your home-buying journey. They’ll assist you in identifying key features you desire in a home and guide you toward properties that meet your top priorities. Additionally, they will explain how building equity can set you up for future success, potentially enabling you to upgrade to your dream home as your financial situation improves. This understanding is crucial, especially in dynamic markets like San Diego, where local knowledge and experience can make all the difference.

Wrapping Up with Young Homebuyer Tips

Navigating the San Diego real estate market can be thrilling yet complex, especially for young homebuyers. Local real estate experts like the McT Real Estate Group based here in San Diego are well-versed in what’s working for buyers just like you. They’re your go-to resource for tailored advice and strategies that can make your home buying process smoother. As Directors Mortgage says:

“The path to homeownership may not be a straightforward one for Gen Z, but it’s undoubtedly within reach. By adopting the right strategies, like exploring down payment assistance programs and sharing living costs with relatives, you can bring your dream of owning a home closer to reality.”

Ready to take the first step towards homeownership in San Diego? Let’s connect and set the stage for your long-term success.

Life in San Diego: Are People Really Leaving ?

Fed Tax Return for Home Buying in San Diego

Planning on buying a home in San Diego this year? Saving up for such a significant investment involves various expenses, including your down payment and closing costs. However, leveraging your federal tax return can alleviate some of these financial burdens. According to Credit Karma, your tax refund can be valuable in covering these expenses. So, if you’re eyeing that dream home in San Diego, your tax refund might be the boost you need to make it a reality.

“If one of your goals is to stop renting and buy a home, you’ll need to save up for closing costs and a down payment on the mortgage. A tax refund can give you a start on the road to homeownership. If you’ve already started to save, your tax refund could move you down the road faster.”

Maximizing Your San Diego Tax Refund: Strategic Moves for Home Buying Success

Excited about the possibilities? Your refund may vary, but if you receive one, here’s how to maximize it for your home-buying journey, especially in sunny San Diego.

- Saving for a Down Payment: The dream of homeownership often starts with the daunting task of saving for a down payment. Leveraging your tax refund can accelerate your savings and inch closer to your homeownership goal.

- Covering Closing Costs: Closing costs, typically ranging from 2% to 5% of the home’s total purchase price, can add up. Consider allocating a portion of your tax refund towards covering these expenses, making the home-buying process smoother and more manageable.

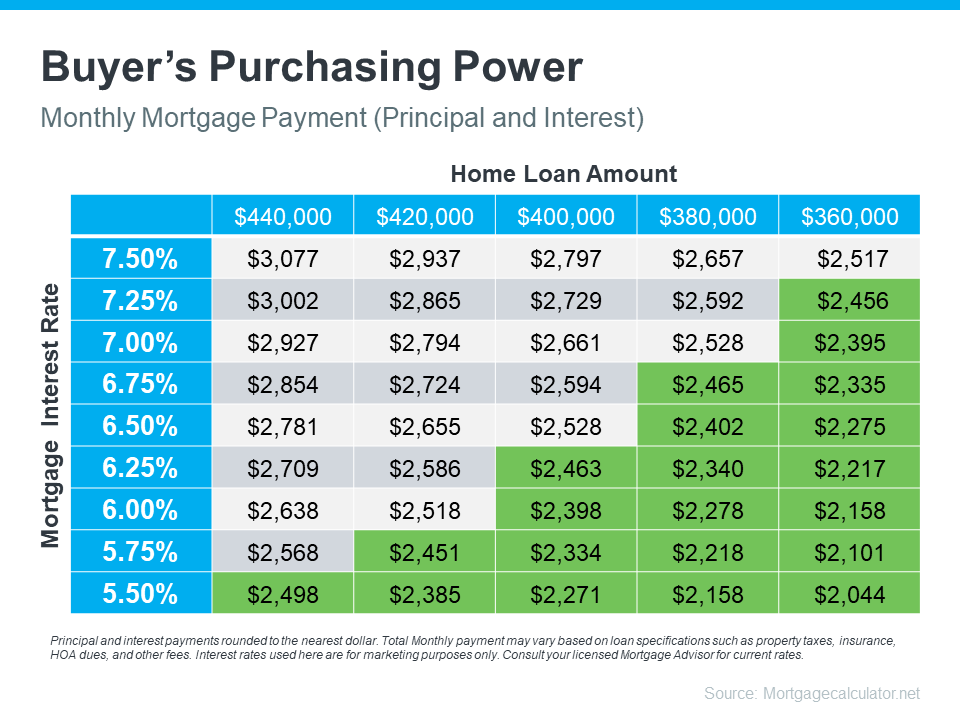

- Lowering Mortgage Rates: Securing a favorable mortgage rate in today’s dynamic market is crucial. Some lenders offer the option to buy down your rate, providing long-term financial benefits. If affordability is a concern, investing your tax refund upfront to secure a lower mortgage rate could be wise.

Partnering with knowledgeable real estate professionals who are well-versed in San Diego’s unique market nuances is key to your home-buying success. They’ll guide you through the process, ensuring you’re fully prepared to embark on this exciting journey. Let’s make your homeownership dreams a reality together!

Wrapping All Things Up with Using Tax Refund for Home Buying in San Diego

In conclusion, your federal tax return holds significant potential to bolster your home-buying savings. By leveraging this financial windfall, you’re one step closer to securing your dream home in San Diego. Let’s delve deeper into your preferences and aspirations for your ideal home, as your desired property may be well within your grasp. Let’s initiate a conversation about your homeownership journey today and explore the possibilities together.

Current Rate for Mortgages: Is Now the Right Time to Move?

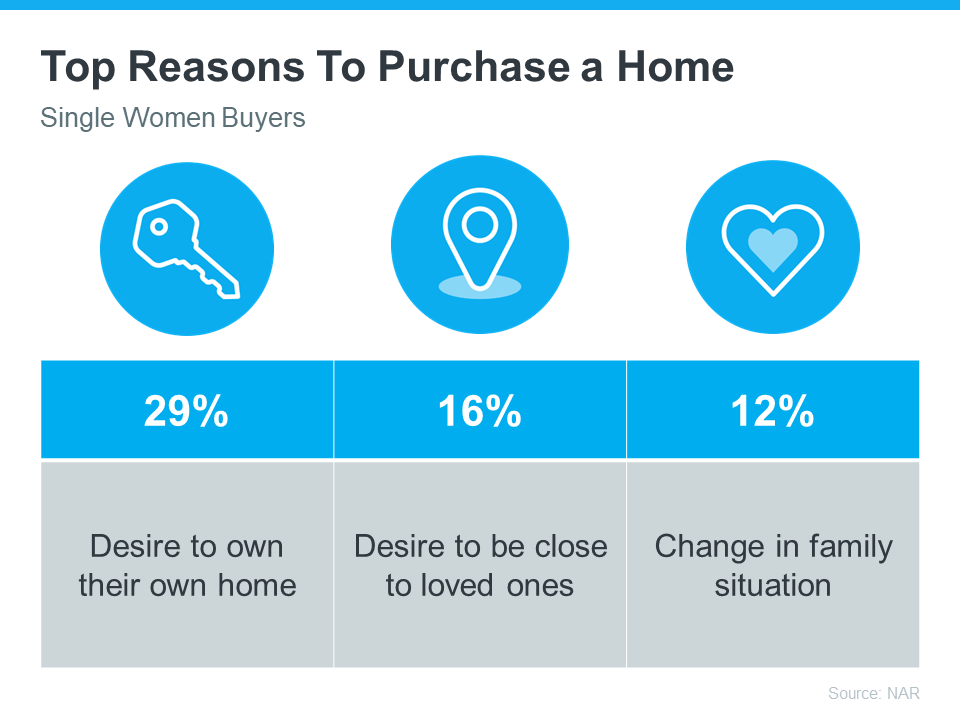

San Diego Single Women Embrace Homeownership

In San Diego’s active housing scene, more single women are seizing the opportunity to become homeowners. Recent statistics from the National Association of Realtors (NAR) reveal that 19% of homebuyers in the area are single women. This surpasses the 10% represented by single men.

For single women aspiring to purchase their first home, this trend serves as a source of motivation and empowerment. Seeing others turning their homeownership dreams into reality signals that you can do the same.

Why Homeownership is Vital for Women in San Diego

Owning a home is of significant importance to numerous single women in San Diego. Beyond simply providing shelter, it represents a strategic investment for the future. With homes typically appreciating in value over time, they serve as a means to accumulate equity and enhance overall financial standing. According to Ksenia Potapov, Economist at First American, the decision to own a home is a prudent step towards securing long-term financial stability.

“. . . single women are increasingly pursuing homeownership and reaping its wealth creation benefits.”

In essence, homeownership can transform lives, regardless of your background. Reach out to a trusted local realtor like the McT Real Estate Group today, and let’s discuss your housing aspirations, especially in the vibrant city of San Diego.

San Diego Home: A Powerful Investment

San Diego Home Offers: 4 Tips for Success

Are you planning on buying a home in San Diego in the near future? Well, buckle up your seatbelts because the current real estate landscape is anything but a leisurely stroll. With San Diego’s housing market in full swing, competition is fierce, especially given the limited inventory of available homes. Brace yourself for the possibility of engaging in multiple-offer showdowns as you navigate through this dynamic market.

As we gear up for the bustling spring homebuying season, the intensity is only expected to escalate further. But no worries! Armed with the right strategies, you can be a formidable contender for your dream home. At the McT Real Estate Group, we have the tools and experience to help you navigate the process.

Here are four invaluable tips to ensure you put forth your strongest offer:

1. Guidance in San Diego’s Real Estate Terrain and the Offer Process

Consider teaming up with a trusted real estate agent to champion your objectives. San Diego, with its diverse and competitive market, demands a savvy guide to navigate its intricacies. By enlisting the expertise of a seasoned professional, you gain access to invaluable insights and resources, enhancing your chances of success. In this vibrant cityscape, where opportunities abound, and competition is fierce, having a dedicated ally by your side can make all the difference. PODS mentioned in a recent article:

“Making an offer on a home without an agent is certainly possible, but having a pro by your side gives you a massive advantage in figuring out what to offer on a house.”

Local real estate agents possess invaluable expertise in the San Diego market. They’re well-versed in successful strategies employed by buyers and understand seller preferences. This insight can significantly influence your decision-making process when crafting an offer. Leveraging their knowledge could be the key to securing your dream home in San Diego.

2. Get a Handle on Your Budget

Understanding your financial parameters is paramount, especially in San Diego’s real estate landscape. Take the reins by collaborating with a lender to secure pre-approval for your home loan. This step fosters a deeper financial assurance and signals your unwavering commitment to sellers. Armed with this pre-approval, you gain a decisive advantage in San Diego’s competitive market. As highlighted by Investopedia, being financially prepared positions you for success in securing your dream home.

“. . . sellers have an advantage because of intense buyer demand and a limited number of homes for sale; they may be less likely to consider offers without pre-approval letters.”

3. Crafting Your Offer: Finding the Sweet Spot in San Diego’s Real Estate

Crafting a robust yet equitable offer is paramount when navigating San Diego’s bustling real estate market. While securing an affordable deal is undoubtedly a priority, it’s essential to strike the right balance. Submitting an excessively low offer may jeopardize your chances of success. Instead, opt for an offer demonstrating your seriousness and respect for the seller’s property. As highlighted by Realtor.com, a strategically structured offer not only showcases your commitment but also increases the likelihood of acceptance. So, when making your move in San Diego’s competitive market, aim for a strong offer that reflects both your financial prudence and appreciation for the value of the home.

“. . . an offer price that’s significantly lower than the listing price, is often rejected by sellers who feel insulted . . . Most listing agents try to get their sellers to at least enter negotiations with buyers, to counteroffer with a number a little closer to the list price. However, if a seller is offended by a buyer or isn’t taking the buyer seriously, there’s not much you, or the real estate agent, can do.”

4. Trust Your Agent in Negotiations

Once your offer is in, the seller might counter, but fear not! Understanding the seller’s priorities is key. Flexibility on aspects like move-in dates or home conditions can sweeten your deal. Your real estate agent is your go-to guide in these negotiations. Rely on their expertise to steer you through and craft the winning strategy. According to insights from the National Association of Realtors (NAR), trusting your agent is pivotal in securing the best outcome. In San Diego’s dynamic market, where every detail counts, your agent’s local knowledge and negotiation prowess are invaluable assets. So, lean on their guidance and expertise to navigate the twists and turns of the negotiation process smoothly.

“There are many factors up for discussion in any real estate transaction—from price to repairs to possession date. A real estate professional who’s representing you will look at the transaction from your perspective, helping you negotiate a purchase agreement that meets your needs . . .”

Wrapping All Things Up on Successful San Diego Home Offers

In today’s fiercely competitive San Diego real estate scene, teamwork is key. Let’s collaborate to discover your dream home and develop a winning offer that sets you apart from the crowd. The McT Real Estate Group’s goal is simple: to ensure you secure a property you adore in this vibrant city. So, let’s roll up our sleeves and embark on this exciting journey together.

A Real Estate Agent’s Expertise when Moving to San Diego

Buying a Home in San Diego: Is Now the Right Time?

Why Buying a Home Now in San Diego Could Be Your Best Move?

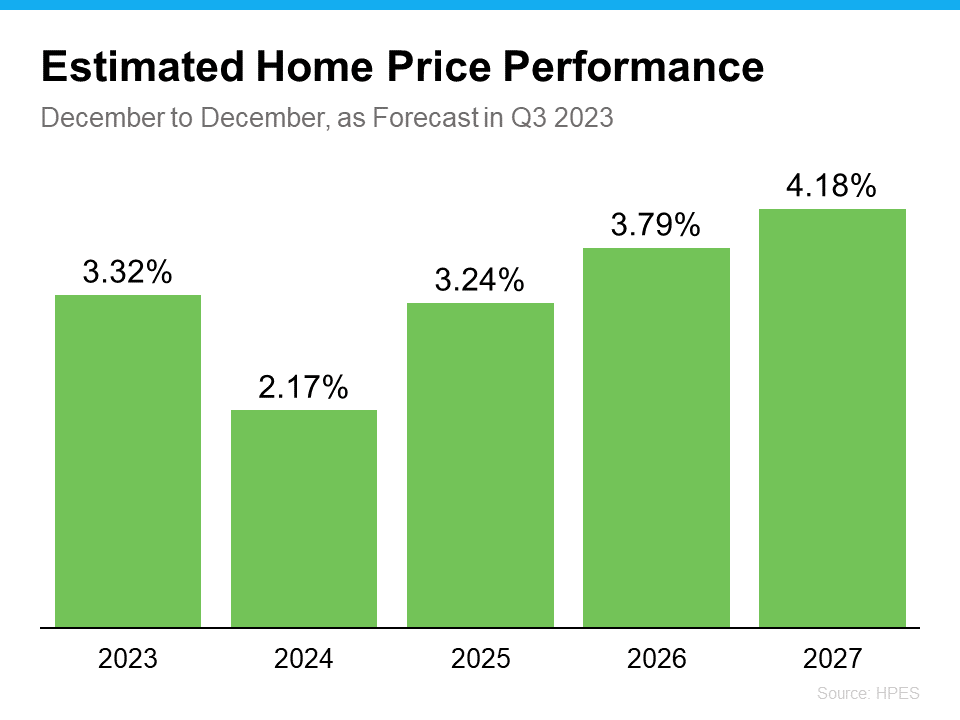

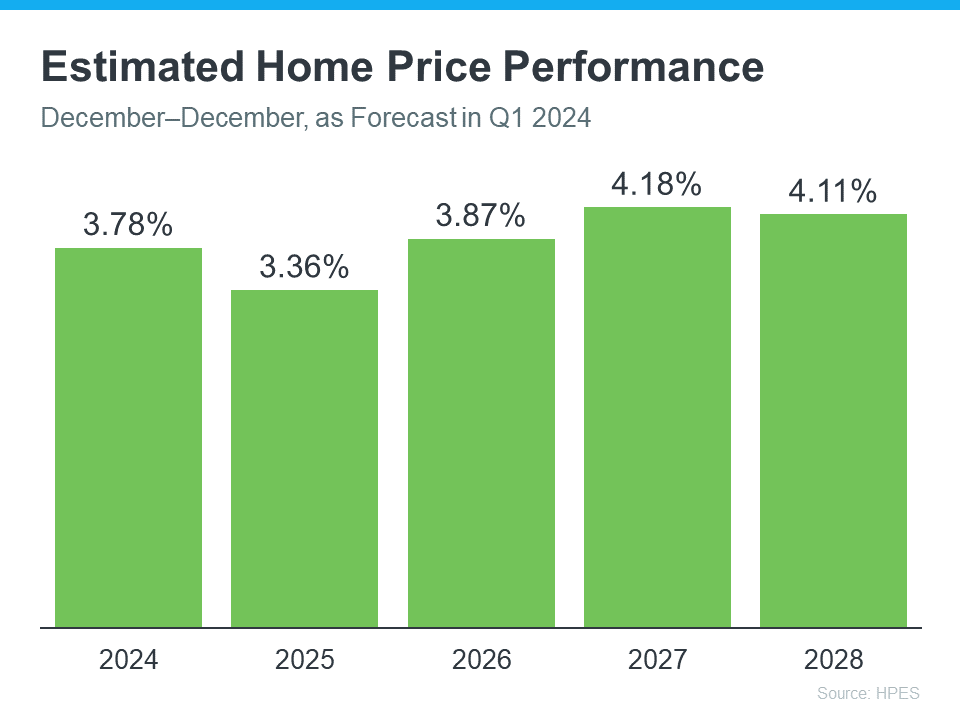

So, what does all this mean for you, especially if you’re considering buying a home in San Diego? Well, it’s actually pretty promising. The forecasted rise in home prices suggests that investing in a home now could be a smart move for your financial future. Essentially, buying a home now means acquiring an asset anticipated to appreciate in value over time.

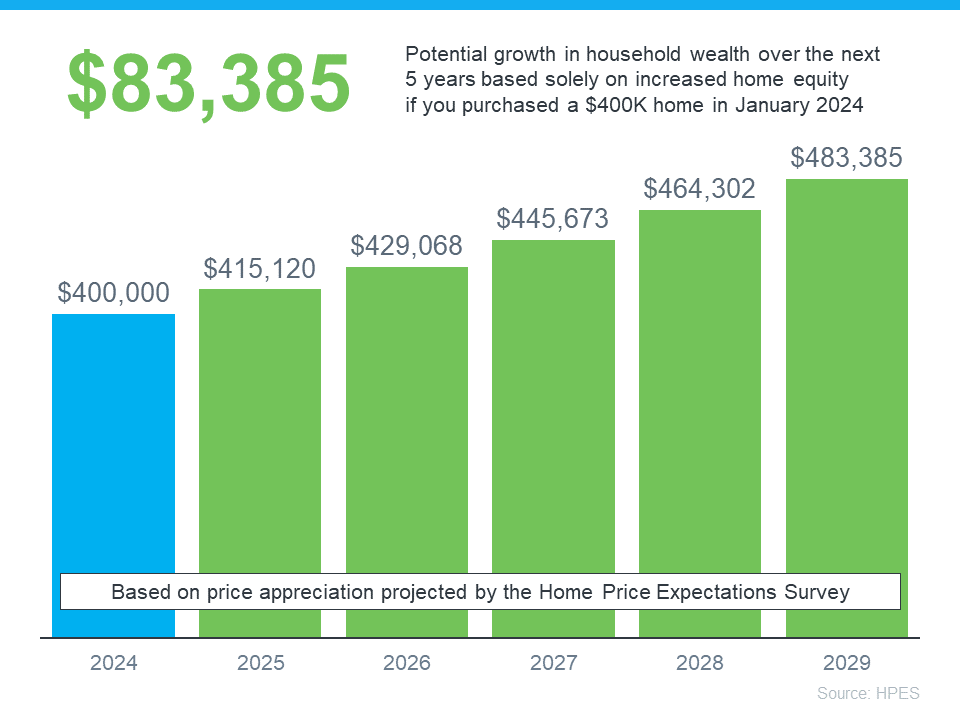

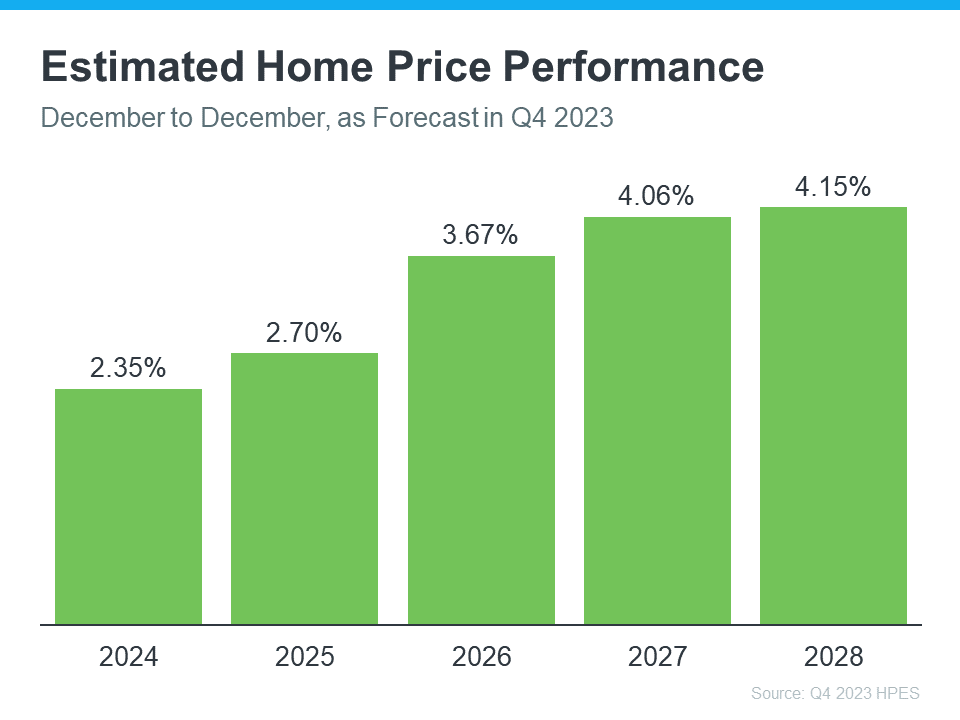

Still not convinced? Let’s break it down further with some concrete numbers. By examining expert projections from the Home Price Expectation Survey (HPES), we can paint a clearer picture of how a typical home’s value might evolve in the coming years. Take a look at the graph below for a visual representation.

For instance, let’s say you decided to buy a home for $400,000 at the beginning of this year. According to these projections, you could potentially see an increase in household wealth of over $83,000 within the next five years as your home’s value appreciates.

Now, of course, you might be thinking about holding off on purchasing a home. But here’s the thing – waiting might actually end up costing you more in the long run. With prices expected to continue rising, delaying your home purchase could mean paying a higher price down the road. So, why wait when the opportunity to secure your financial future is right here, right now?

Wrapping All Things Up

In conclusion, if you’re considering taking the plunge into homeownership and you have the means to do so, now could be an opportune moment to make your move. The real estate landscape in San Diego continues to show promising signs of growth, with property values on an upward trajectory. By taking action now, you position yourself to potentially benefit from the ongoing appreciation of your investment. Let’s join forces and embark on the journey of finding your ideal home together. Reach out to the McT Real Estate Group today, and let’s kickstart the search for your dream home in beautiful San Diego!

The Key to Seamless Moving: San Diego Mortgage Rates

The Fixer-Upper – Your San Diego Dream Home

If you’re in the market to buy a home in San Diego but struggling to find one within your budget, it might be worth exploring the idea of buying a fixer-upper. These properties require some TLC or upgrades but often boast solid foundations. Opting for a fixer-upper can be an excellent choice for those eager to enter the housing market or seeking to maximize their budget. As per insights from NerdWallet, these properties present a viable opportunity to secure a home that aligns with your financial goals.

“Buying a fixer-upper can provide a path to homeownership for first-time home buyers or a way for repeat buyers to afford a larger home or a better neighborhood. With the relatively low inventory of homes for sale these days, a move-in ready home can be hard to find, especially if you’re on a budget.”

With the current scarcity of available homes on the market in San Diego, restricting your search solely to properties with all your desired features could significantly limit your options. The fixer-upper approach might inadvertently increase the challenge of finding your ideal home. Therefore, it might be prudent to broaden your scope and explore a wider range of properties. Doing so increases your chances of discovering hidden gems that may not initially meet all your criteria but could still fulfill your needs and preferences.

Sometimes, Your Ideal Perfect Home is The One You Enhance After Purchasing

Here’s some valuable guidance to effectively streamline your home search process before considering the fixer-upper journey route. Begin by compiling a list of essential features you desire in your future home. Then, categorize these features into three main groups:

- Must-Haves: These are non-negotiable features integral to your lifestyle and satisfaction. Homes lacking these elements won’t meet your needs.

- Nice-To-Haves: While not essential, these features would enhance your living experience. They’re not deal-breakers, but finding a property encompassing your must-haves and some nice-to-haves is advantageous.

- Dream State: Envision your ideal home without limitations. These features represent your ultimate desires, even if they’re not immediate necessities. If you discover a property that ticks off your must-haves, several nice-to-haves, and any dream state features, it’s a remarkable find.

Once you’ve organized your preferences, communicate them clearly to your real estate agent. They possess the expertise to match you with homes that align with your current needs while offering the potential for a fixer-upper transformation into your dream abode with some renovation effort. Rely on their insights to evaluate feasibility, identify modifiable features, and devise strategies to turn your vision into reality. Trusting in their guidance can lead you to the perfect home tailored to your specifications. Also, an article from Progressive mentioned:

“Many real estate agents specialize in finding fixer-uppers and have a network of inspectors, contractors, electricians, and the like.”

Your agent is your trusted ally in navigating the world of home upgrades and renovations. They provide invaluable insights into which improvements will yield the highest returns when it comes time to sell. From advising on strategic upgrades to guiding you through renovation projects, your agent ensures you make informed decisions that maximize your investment potential. With their expertise, you can confidently enhance your home’s value while creating a space tailored to your needs and preferences.

Wrapping All Things Up on The Fixer-Upper Journey

If you’re still on the hunt for that ideal home within your budget, it’s wise to consider all avenues, including fixer-uppers. Indeed, the perfect home for you could be the one you mold and shape after buying it. Ready to explore what’s out there in our local market? Reach out, and let’s start the conversation.

San Diego Home Equity: Maximize Your Sale

San Diego Home: A Powerful Investment

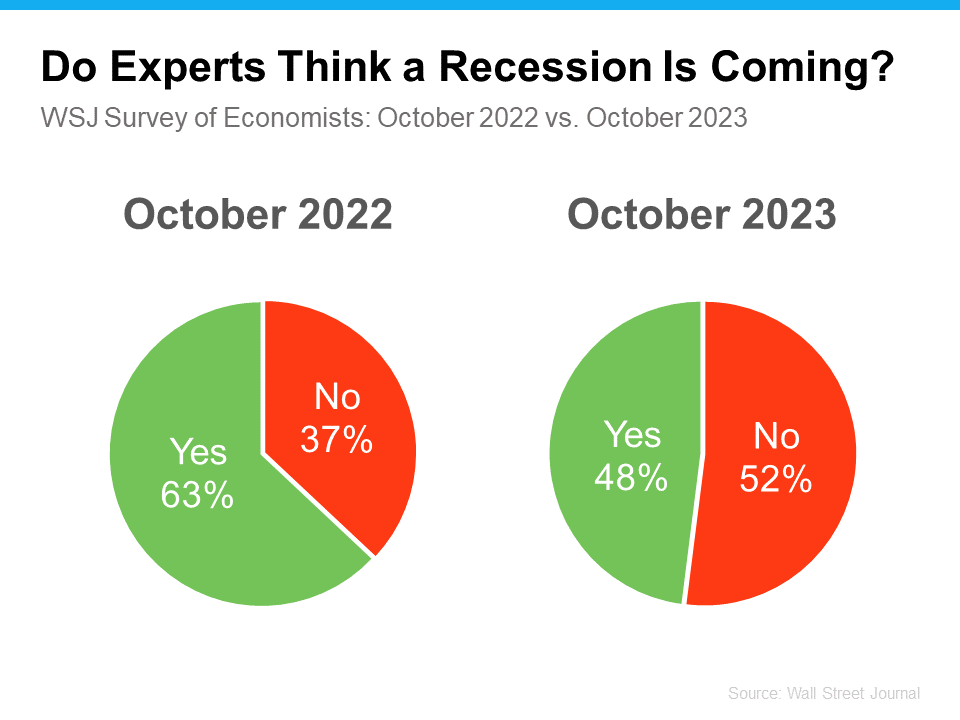

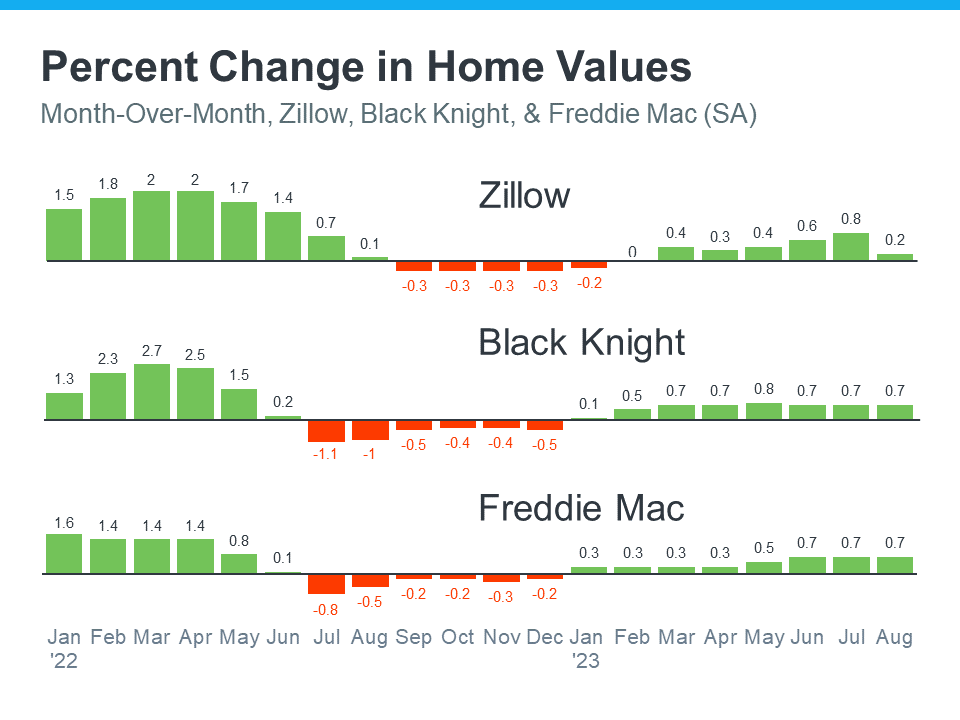

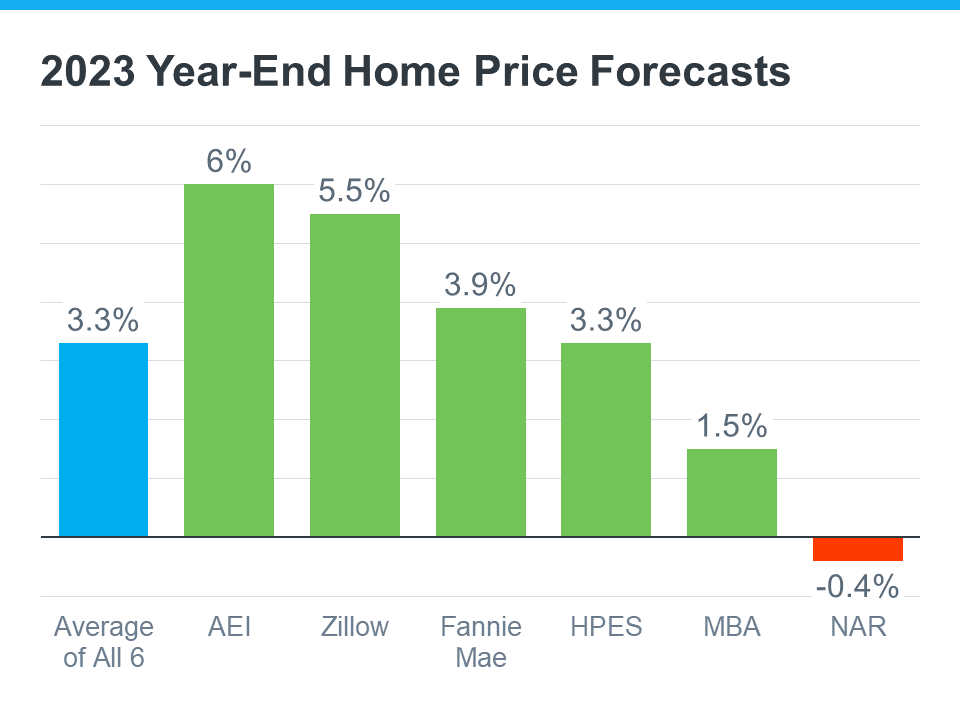

As 2023 approached, speculation about an impending recession loomed large, with concerns mounting about its potential impact on the housing market and if owning San Diego Home is still an investment to consider. Media reports were rife with predictions of a significant downturn, with some forecasting alarming drops of 10-20% in home prices. Understandably, such forecasts may have left prospective homebuyers feeling hesitant and uncertain.

However, the reality and the truth of the matter turned out quite differently. Instead of plummeting, home prices surged, defying the gloomy prognostications. Brian D. Luke, Head of Commodities at S&P Dow Jones Indices, sheds light on this unexpected turn of events.

“Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years.”

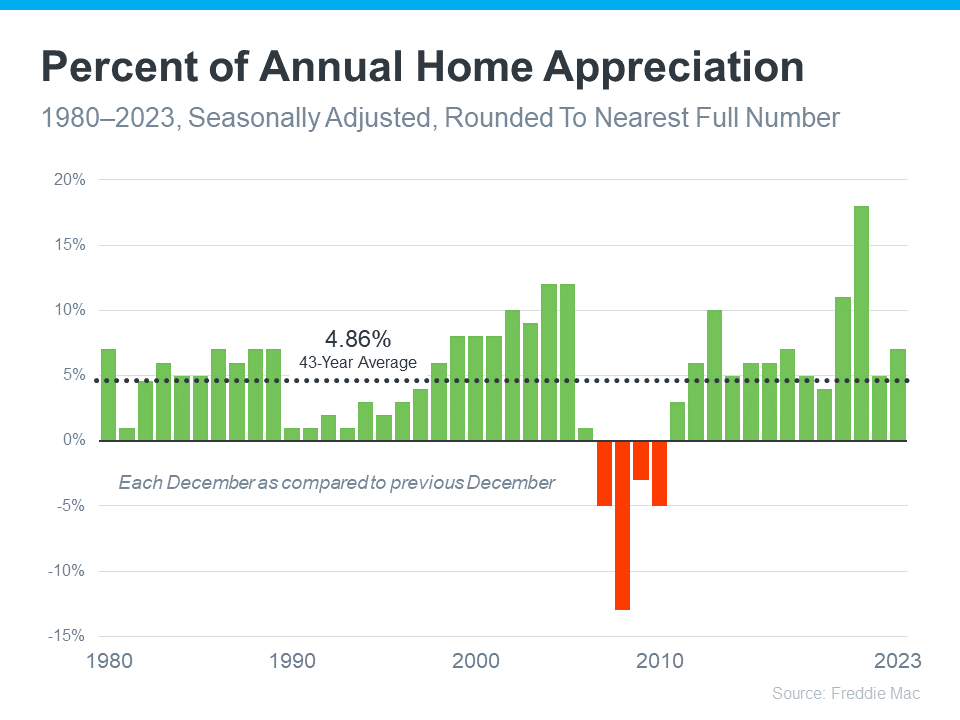

Let’s dive into last year’s remarkable growth by examining data from Freddie Mac, highlighting the evolution of home prices since 1980. The graph below provides a visual representation, showcasing the annual fluctuations in home prices. Additionally, we’ve incorporated the long-term average for appreciation, depicted by the dotted line. This data not only illustrates the recent surge in home values but also offers valuable insights into the broader trends shaping the San Diego real estate market.

Home Balues Consistently Appreciate over time.

According to a recent article by Forbes, the trend is clear – home prices tend to rise steadily. This means owning a home is not just about having a place to live; it’s also a smart investment.

“. . . the U.S. real estate market has a long and reliable history of increasing in value over time.”

Since 1980, San Diego’s real estate market has shown remarkable resilience, with home prices consistently rising yearly, barring the notable exception of the housing market crash depicted in red on the accompanying graph. However, it’s important to note that today’s market bears little resemblance to the tumultuous conditions of 2008. Presently, there’s a scarcity of available homes, failing to keep pace with the robust demand from prospective buyers. This is not like the flood of homes on the market back then. Furthermore, homeowners currently possess substantial equity in their properties, placing them in a far more stable position than during the previous downturn.

The sustained upward trajectory of home values, with the exception of those challenging years highlighted in red, underscores the enduring appeal and potential of real estate investment, especially in San Diego. Owning a home not only provides a place to live, it also serves as a valuable asset that typically appreciates over time, contributing to the growth of one’s net worth.

Considering the consistent appreciation of home values in San Diego, buying a home represents a prudent financial decision for those who are financially secure and prepared for the responsibilities and expenses of homeownership. By taking advantage of the current market conditions and investing in real estate, individuals can position themselves to capitalize on the city’s thriving housing market and secure their financial future.

To Wrap Things Up

Investing in a home is a wise decision due to the consistent rise in property prices, especially in dynamic markets like San Diego. If you’re prepared and capable, now is an opportune moment to delve into homeownership. Reach out to us to discuss your objectives and explore the diverse range of options available in our vibrant San Diego market.

San Diego 2024 Home Price Forecast: Expert Revision

San Diego First Home Buying Guide: Strategic Tips & Insights

Purchasing your San Diego First Home marks a significant leap toward a brighter future, filled with possibilities and personal fulfillment. San Diego, with its vibrant culture and diverse neighborhoods, offers an enticing backdrop for this life-changing endeavor. Yet, navigating today’s real estate landscape poses its own set of challenges, particularly with the constrained inventory of available homes and persistent affordability concerns.

But fear not, aspiring homeowner! With determination and strategic planning, you can transform your dream of homeownership into a tangible reality. Here are three actionable tips to guide you along this exciting journey:

Discover How to Save Money with First-Time Homebuyer Programs in San Diego

Are you feeling overwhelmed by the upfront costs of homeownership, such as the down payment and closing expenses? Fear not! San Diego offers a plethora of assistance programs tailored specifically for first-time homebuyers, making it easier than ever to secure a loan with minimal or no upfront costs. According to Bankrate, these programs can significantly alleviate the financial burden associated with purchasing your first home.

“. . . you might qualify for a first-time homebuyer loan or assistance. First-time buyer loans typically have more flexible requirements, such as a lower down payment and credit score. Many help buyers with closing costs and the down payment through grants and low-interest loans.”

To uncover further details, engage with your state’s housing authority, or explore resources such as Down Payment Resource. Additionally, for tailored insights on San Diego’s real estate landscape, consider reaching out to local real estate agents who possess in-depth knowledge of the area. They can provide invaluable guidance tailored to your specific needs and preferences.

Diversify Your Choices with Condos and Townhomes

Diversify Your Choices with Condos and Townhomes

Currently, the San Diego housing market faces a shortage of available homes, leading to escalating prices and limited affordability. To navigate this challenge and secure a home promptly, it’s wise to explore the option of condos and townhomes. According to Realtor.com, these properties present viable alternatives amidst the competitive landscape.

“For many newbies, it might just be a matter of making a shift toward something they can better afford—like a condo or townhome. These lower-cost homes have historically been a stepping stone for buyers looking for a less expensive alternative to a single-family home.”

Affordability is one key advantage often associated with smaller homes, a characteristic frequently observed in San Diego’s real estate market. Despite their compact size, these properties offer a golden opportunity for aspiring homeowners to enter the market and start building equity. This equity serves as a valuable asset, providing leverage for future endeavors, such as upgrading to a larger residence as needs evolve. According to insights from Hannah Jones, Senior Economic Analyst at Realtor.com, this strategic approach to homeownership not only facilitates your immediate housing needs but also lays the groundwork for future expansion within San Diego’s dynamic housing landscape.

“Condos can help prospective homebuyers who perhaps have a smaller budget, but who are really determined to get a foothold in the market and start to accumulate some equity. It can be a really great entry point.”

Joining Forces with Friends or Family Members on Investing in a Multi-Generational Home

Thinking about purchasing a home with friends or family members? It’s a smart strategy, especially in a competitive market like San Diego. Pooling your resources and investing in a Multi-Generational Home allows you to share the financial burden, making homeownership more accessible. By splitting expenses like the mortgage and utilities, you can stretch your budget further and potentially afford a larger or more desirable property. Money.com highlights the benefits of this approach, emphasizing its effectiveness in helping buyers enter the housing market. So, consider teaming up with loved ones to embark on your homeownership journey together.

“Buying a home with another person has some obvious advantages in the mortgage department. With two incomes in the mix, buyers can likely qualify for a larger mortgage — a big help in today’s high-cost market.”

Wrapping Up

In summary, delving into resources tailored for first-time homebuyers, along with considering the diverse housing options such as condos, townhomes, and properties accommodating multi-generational living, facilitates the journey towards securing your inaugural home in San Diego. When you feel prepared to take the next step, reach out to a local real estate expert in the area like the McT Real Estate Group, and let’s initiate the conversation.

San Diego’s Market Trends: Home Price Headlines

San Diego Residents Love Homeownership: Discover Why

You’ve probably heard the saying, “Home is where the heart is,” and there’s a good reason it resonates with so many. Owning a home evokes so many strong emotions and a sense of belonging that renting often can’t match. If you’re on the fence about whether to continue renting or take the leap into homeownership, let’s explore why San Diego Residents Love Homeownership in this vibrant city.

Crafting Your Perfect Sanctuary

Your home ought to reflect your personality and style effortlessly. Yet, as a tenant, achieving this ideal can prove challenging. Rental properties often restrict personalization, limiting you to bland white walls and minimal upgrades. Moreover, you’re constantly cautious about the number of holes you drill into the walls. However, embracing homeownership offers boundless opportunities for self-expression. With San Diego’s vibrant real estate market, you can transform a house into your dream home. As highlighted by the National Association of Realtors (NAR), the allure of homeownership lies in the freedom it affords.

“The home is yours. You can decorate any way you want and choose the types of upgrades and new amenities that appeal to your lifestyle.”

Imagine the joy of returning home after a long day, stepping into a space that perfectly reflects your personality and style. In San Diego, where the sun-kissed beaches and vibrant culture inspire creativity, homeowners have the freedom to design interiors that resonate with their unique vibe. Whether you prefer the cheery brightness of coastal hues or the cozy warmth of earthy tones, San Diego’s diverse landscape provides endless inspiration for interior design. Picture yourself surrounded by colors and textures that uplift your spirits and rejuvenate your soul. In a city known for its laid-back lifestyle and artistic flair, your home becomes more than just a place to live—it becomes an expression of who you are. Embrace the opportunity to create a sanctuary that celebrates your individuality and enhances your daily life in beautiful San Diego.

Feeling a Sense of Belonging

Owning a home in San Diego not only provides shelter but also fosters a profound sense of belonging within the community. When you make the decision to invest in a property, you’re not just acquiring a physical space; you’re declaring your place in the neighborhood. Suddenly, you’re more than just a resident – you’re an integral part of the vibrant tapestry of San Diego life. From casual chats with neighbors to lively block parties, homeownership opens doors to a world of social connections and shared experiences. Embracing the local community becomes second nature, enriching your life in ways you never imagined.

As highlighted by the International Housing Association, the bond between homeowners and their communities is a cornerstone of vibrant neighborhoods. By becoming a homeowner in San Diego, you’re not only securing a roof over your head but also embarking on a journey of belonging and connection that enhances the very essence of living in this diverse and dynamic city.

“. . . homeowning households are more socially involved in community affairs than their renting counterparts. This is due to both the fact that homeowners expect to remain in the community for a longer period of time and that homeowners have an ownership stake in the neighborhood.”

Experience the Emotional Thrill of Achieving Your Dream

Experience the Emotional Thrill of Achieving Your Dream

Starting on the journey to homeownership is an exhilarating adventure that often involves overcoming obstacles and persevering through challenges. As you contemplate transitioning from renting to owning, it’s essential to recognize the emotions that accompany this significant life decision. The feelings tied to owning a home are nothing short of powerful; each day, you’ll approach your front door with a palpable sense of accomplishment, warmly greeted by the realization of your dreams.

Conclusion on Why San Diego Residents Love Homeownership

In essence, your home embodies your identity, providing a sanctuary for cherished moments with loved ones while symbolizing your achievements. It serves as a canvas for your aspirations and a haven for your dreams to flourish. Ready to transition from renting to owning? Reach out today to the McT Real Estate Group, and let’s embark on the journey to find your perfect abode in beautiful San Diego, where the vibrant culture and breathtaking scenery await you.

Should You Buy a House Now in San Diego?

San Diego Home Buying Guide: Simplifying Homeownership

For many, owning a home isn’t just an investment; it’s a cornerstone of the American Dream, symbolizing stability and success. But the path to achieving this dream isn’t always smooth, especially for minority homebuyers who face distinct challenges. While progress has been made toward equal housing opportunities, disparities persist. This is where knowledgeable real estate professionals come in and where a simple San Diego Home Buying Guide comes into play, offering tailored guidance and support to navigate the journey with confidence.

San Diego, a city buzzing with vibrant communities and a dynamic real estate market, embodies the allure of homeownership. Yet, it’s crucial to acknowledge that not everyone experiences the same path to achieving this goal. Statistics reveal a persistent gap, with Black households facing the lowest homeownership rates nationwide. This highlights the need for targeted efforts to bridge the gap and ensure everyone in San Diego, regardless of background, has the opportunity to own a piece of this diverse city.

Owning a home is more than just a personal milestone; it’s a key building block for family wealth, laying a foundation for future generations. The National Association of Realtors (NAR) sheds light on a significant trend: in 2023, nearly half of Black homebuyers were first-time buyers. This group lacks the advantage of existing equity, creating a crucial hurdle in their journey.

This challenge becomes even more pronounced in San Diego’s competitive housing market. Jessica Lautz, NAR’s Deputy Chief Economist, emphasizes the unique struggles faced by first-time buyers, especially in vibrant markets like San Diego. While the city boasts stunning beaches, dynamic communities, and a thriving economy, it also presents a competitive arena for aspiring homeowners.

“It’s an incredibly difficult market for all home buyers right now, especially first-time home buyers and especially first-time home buyers of color.”

Opening Doors: Down Payment Assistance Programs

Recognizing these challenges, numerous down payment assistance programs have been established to make the dream of homeownership more accessible for minority buyers in San Diego:

-

3By30 Initiative: This groundbreaking program empowers Black homebuyers in San Diego by providing essential tools and knowledge. Join us as we make saving for a down payment and buying a home not just achievable, but empowering.

-

Downpayment Resource: Native American homebuyers seeking a haven in sunny San Diego can explore this treasure trove of resources. With over 42 programs across 14 states, including California, it offers valuable support for down payments and other expenses. Imagine owning a cozy spot in North Park or a sunny retreat in La Jolla – these programs can make it a reality.

-

Fannie Mae: Extending a helping hand to eligible Latino first-time homebuyers, Fannie Mae offers down payment assistance, smoothing the path to homeownership.

Remember, these are just a few examples. Explore the rich landscape of federal, state, and local assistance options available. Partnering with a local real estate professional is key, as they can help you navigate these options and find programs that perfectly fit your needs.

Your San Diego Home Buying Guide: Real Estate Professionals Who Make a Difference

In San Diego’s diverse real estate market, having a knowledgeable and empathetic team by your side is crucial. These professionals aren’t just seasoned advisors; they’re passionate educators and advocates dedicated to protecting your interests throughout the journey. Their guidance transforms challenges into stepping stones, leading you toward homeownership with clarity and confidence.

Ready to Make Your Homeownership Dreams a Reality?

Let’s embark on this journey together! We’re here to provide the essential insights and unwavering support you need, especially in the vibrant San Diego market. Together, we’ll empower you to navigate the path to homeownership with confidence and knowledge, unlocking the doors to your dream.

San Diego’s Hidden Gems: 12 Most Affordable Neighborhoods in 2024

San Diego Pre-Approval in 2024: Why It’s So Important

San Diego Homes for Sale by Price Range

Are you on the journey to owning your dream home? If yes, you’ve likely come across the term “pre-approval.” But what exactly does it mean, and why does it carry such significance, especially for homebuyers in San Diego this year?

Pre-approval is more than just a buzzword in the real estate realm. It’s a crucial step that can significantly streamline your home buying process and give you a competitive edge in San Diego’s dynamic market. So, what exactly is pre-approval, and why should it be a top priority for aspiring homeowners in 2024?

Understanding Pre-Approval

In the journey of buying a home, your lender assesses your financial situation to determine the amount they’re comfortable lending you. This evaluation encompasses various aspects such as your W-2 forms, tax returns, credit score, bank statements, and additional financial documentation.

Once this assessment is complete, you receive a pre-approval letter outlining the borrowing capacity available to you. Simplifying the process, Freddie Mac describes pre-approval as a pivotal step, providing clarity on your financial standing and empowering you to make informed decisions in your homebuying journey.

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Now, let’s focus on this crucial aspect. Despite some improvements in home affordability, the market remains competitive. Thus, gaining clarity on your borrowing capacity enables you to grasp the financial dynamics better. Remember, it’s not about maxing out your borrowing potential but understanding your limits with that particular lender.

This step lays the groundwork for informed decision-making regarding your finances. Consequently, you can align your home search precisely with your budgetary comfort zone and swiftly seize opportunities when you discover a property that resonates with your preferences.

Importance of a Pre-Approval in 2024 in the San Diego Real Estate Market

In 2024, securing pre-approval for your home purchase is not just advisable; it’s imperative. Partnering with a reliable lender and obtaining pre-approval should be at the top of your priority list.

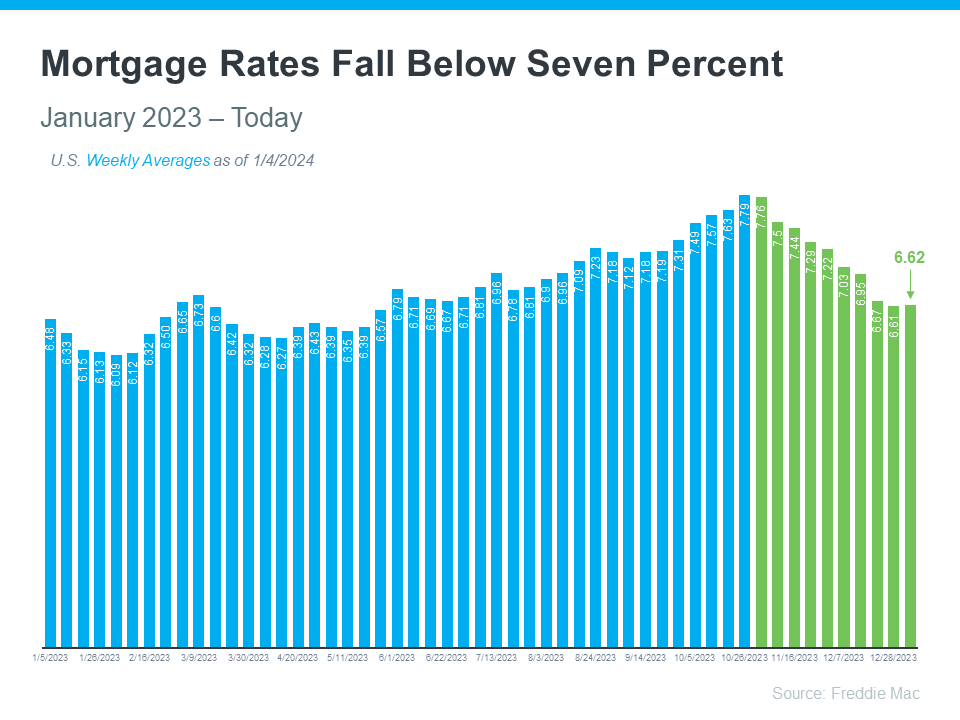

With an increasing number of homes hitting the market, there seems to be a glimmer of hope. However, the inventory remains below the usual levels. Meanwhile, the recent decline in mortgage rates compared to the previous year has reignited interest among prospective buyers, intensifying competition.

This surge in demand poses a challenge for homebuyers as they find themselves amidst a competitive landscape. The resurgence of buyers, previously deterred by higher mortgage rates, amplifies the competition in the market.

Fortunately, pre-approval can provide you with a competitive edge. By undergoing a credit and financial assessment beforehand, pre-approval signals to sellers that you are a serious contender. As Greg McBride, Chief Financial Analyst at Bankrate, emphasizes:

“Preapproval carries more weight because it means lenders have actually done more than a cursory review of your credit and your finances, but have instead reviewed your pay stubs, tax returns and bank statements. A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.”

Sellers appreciate this approach as it boosts the likelihood of a smooth transaction, minimizing unforeseen delays or complications. Moreover, when vying with other buyers for your ideal property, taking this step can significantly tilt the odds in your favor. So, why hesitate to seize this advantage? It’s a strategic move that could make all the difference in securing your dream home in San Diego.

In Conclusion

For anyone considering buying a home in San Diego this year, securing pre-approval is absolutely essential. As mortgage rates remain favorable, drawing in a surge of potential buyers, obtaining pre-approval sets you apart in a competitive market. It’s not just a formality; it’s your ticket to crafting a compelling offer that catches the attention of sellers. So, if your sights are set on owning property in San Diego in 2024, don’t overlook the importance of pre-approval—it could make all the difference in your home-buying journey.

San Diego Foreclosure Rates Remain Below Average

Multi-Generational Home in San Diego and its Advantages

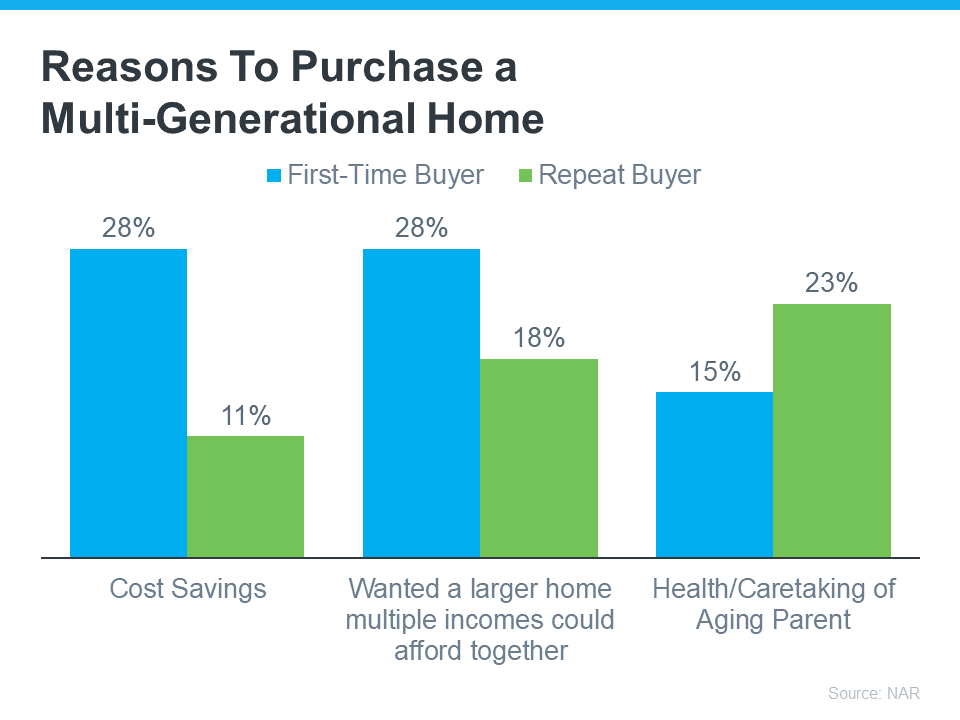

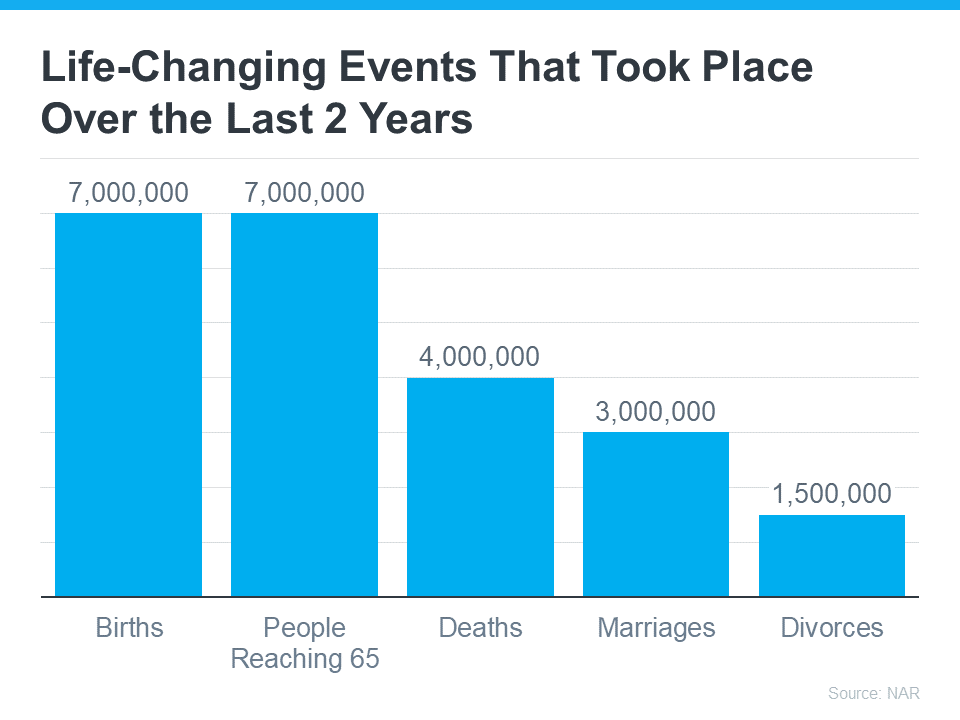

Has the thought of exploring multi-generational living in San Diego crossed your mind lately? Well, you’re in good hands and company, of course. Currently, we are working with more and more homebuyers who are looking into homes that can comfortably house their extended family. It may or may not be for everyone, but let’s talk about why this trend is currently on the rise and find out if it suits your needs. In the current real estate scene in San Diego, multi-generational homes are becoming more and more popular for some very good reasons. As per insights and data from the National Association of Realtors (NAR), affordability is one of the key driving forces behind this phenomenon. So, let’s dissect the factors behind this trend:

Cost Savings for First-Time Buyers and Accumulated Income

For first-time buyers, cost savings are paramount. A significant 28% of them consider this a crucial factor in why they are leaning towards multi-generational homes. They understand that by teaming up with family or friends, they can share financial responsibilities in the long run, such as their monthly mortgage payments and utility bills. Let’s be honest: the cost of living in San Diego and the United States in general these days is no joke. This collaborative approach this opens up significantly improves the feasibility of homeownership, especially in today’s competitive market. It has more flexibility compared to renting as you and a family member own the home together, and you make your own rules for owning the home.

Multi-generational living isn’t just all about the living arrangement; it’s a strategic financial move that empowers individuals to navigate the complexities of the real estate market together with family. This trend underscores the importance of adaptability and shared responsibilities, ultimately making homeownership accessible to a broader range of aspiring buyers.

Both first-time and repeat buyers are increasingly exploring multi-generational homes to realize their dream of owning a spacious house and get away from the renting side of real estate. Among first-time buyers, a significant 28% choose to share living spaces, while 18% of repeat buyers also embrace this trend. By pooling their resources and combining their accumulated income together, the prospect of affording that coveted dream home becomes significantly more attainable. This collaborative approach not only provides financial advantages but also fosters a sense of community and shared responsibility among residents.

A Multi-Generational Home living goes beyond just finances

Surprisingly, as per data from NAR, a whopping 23% of repeat buyers are choosing multi-generational homes over the usual standard ones on the market. Why? It’s about simplifying life for those caring for their older parents. These homes enable older adults to age comfortably in their familiar surroundings rather than just parents pushing grandparents into retirement homes, maintaining their quality of life while remaining near their cherished family members. Imagine that rather than driving a few states just to visit, your parents are now just a few steps away. This trend reflects changing preferences and highlights the importance of family bonds and convenience in today’s real estate market.

As Axios points out:

“Financial concerns and caregiving needs are two of the major reasons people live with their parents (and parents’ parents).”

Conclusion and Relying on a Pro on Getting a Multi-Generational Home

Searching for the perfect multi-generational home isn’t your typical house hunt. It’s more like solving a complex puzzle where different preferences and needs come into play. Each piece must fit seamlessly, as you will need to consider the needs and wants of the other homeowners and not just your own. If you’re eager to explore the benefits of multi-generational living, partner with a trusted local real estate agent. They possess the expertise to guide you effectively on this unique journey.

Whether your reasons for considering a multi-generational home revolve around financial benefits or creating a harmonious living space for your family or loved ones, this housing option could be an ideal fit for you. It may or may not be for you specifically because we do know that the American culture can be a lot different, but If you’d like to dive deeper into this topic or have any questions, please don’t hesitate to reach out and connect with the McT Real Estate Group. We’re here to assist you every step of the way,

Improving Your Credit Score to Help You Buy a Home

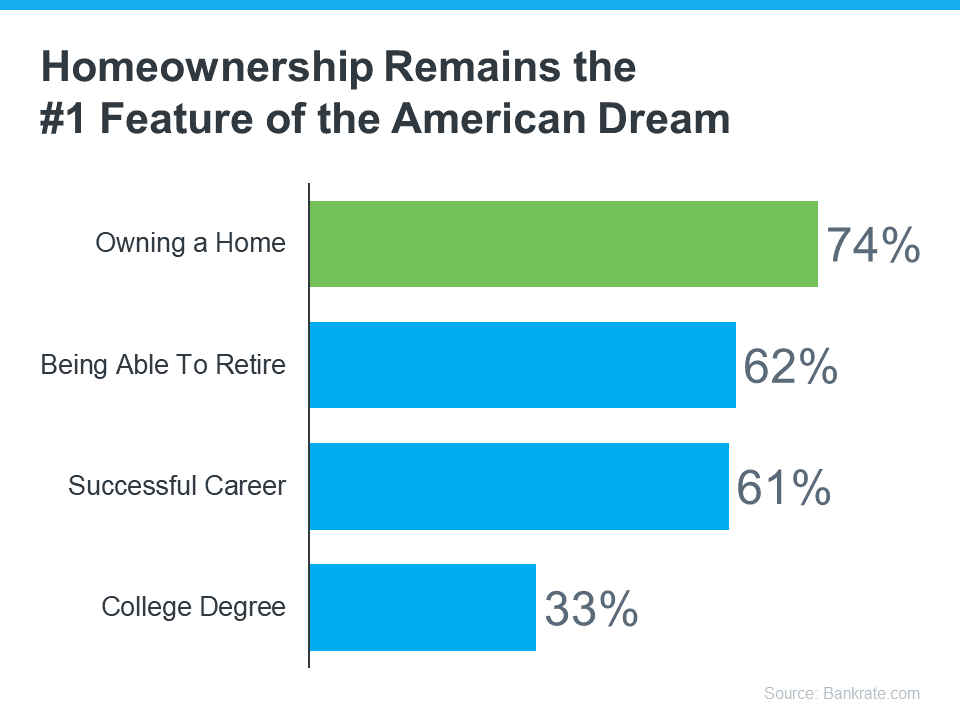

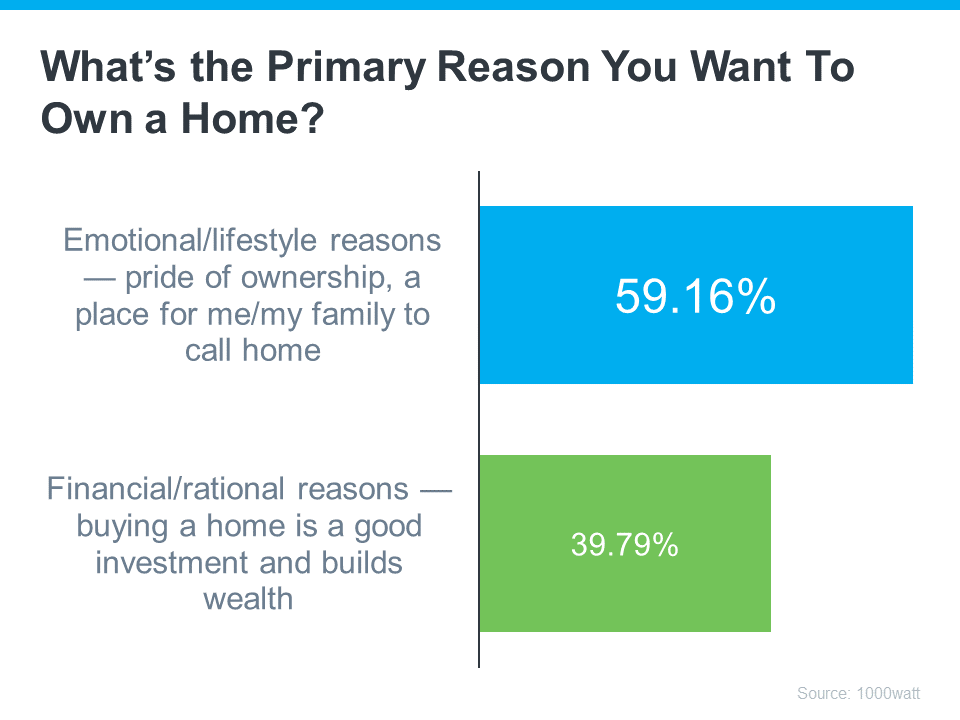

A Place to Call Your Own: The American Dream’s Core

Buying a home is a significant step that continues to embody the essence of the American Dream and a tranquil place to call your own. Unlike the temporary nature of renting, being a homeowner in San Diego provides something deeper than just a roof over your head. It gives you a sense of belonging, a stable foundation for your life, and the freedom to make a space your own. As Nicole Bachaud, Senior Economist at Zillow, notes:

“The American Dream is still owning a home. There’s a lot of pent-up demand for ownership; that isn’t going to go away.”

Let’s delve into the myriad of reasons why homeownership remains a cherished goal for many Americans.

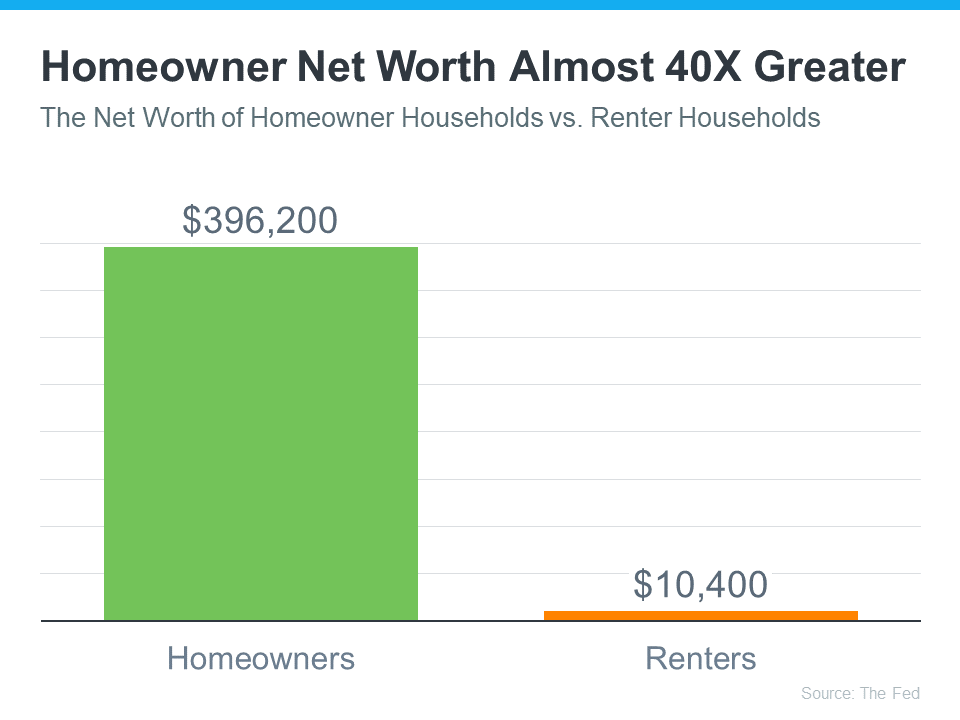

Unlocking the Financial Perks of Homeownership

Homeownership is often celebrated for a good reason: it’s a powerful way to build wealth. This sentiment is echoed by Jessica Lautz, Deputy Chief and Vice President of Research at the National Association of Realtors (NAR). She points out that owning a home is not just about having a place to live; it’s a critical step towards financial stability. The value of a home typically appreciates over time, turning it into a valuable asset. Moreover, with every mortgage payment, homeowners essentially contribute to their financial future rather than paying rent that offers no return. This process of building equity can be a game-changer in a person’s financial journey.

“Homeownership is the number one way to build wealth in America.”

Owning a home in San Diego is more than just a personal achievement; it’s a valuable asset that contributes significantly to your net worth. This kind of investment benefits you and paves the way for future generations. As you build and then pass down this wealth, you’re laying a foundation for your family’s success. In the words of Habitat for Humanity, owning a home is a stepping stone towards long-term financial stability and prosperity.

“Overall, homeownership promotes wealth building by acting as a forced savings mechanism and through home value appreciation. Homeowners make monthly payments that increase their equity in their homes by paying down the principal balance of their mortgage. . . . In addition, owning a home promotes intergenerational homeownership and wealth building. Children of homeowners transition to homeownership earlier — lengthening the period over which they can accumulate wealth . . .”

Owning a home in San Diego isn’t just about having a place to call your own; it’s also a smart financial move. Unlike renting, where your monthly payments can fluctuate, buying a home with a fixed-rate mortgage offers a big advantage. You get the peace of mind of knowing exactly what your housing costs will be for the entire duration of your loan. This stability means you can confidently plan your finances, knowing your most significant expense won’t change.

The Many Advantages of Owning a Home Beyond Finances

Owning a home isn’t just about the financial perks; it’s a journey that enriches your social and emotional life as well. A home is more than a financial asset; it’s a personal achievement that instills a sense of responsibility and pride. Fannie Mae’s recent survey sheds light on these often overlooked, yet emotionally significant benefits. This includes a sense of…

“The top three were having control over what you do with your living space (94%) to having a sense of privacy and security (91%) and having a good place for your family or to raise your children (90%) . . .”

What Can This Mean for Your Future?

Imagine the American Dream as a tapestry of freedom, security, and prosperity. In this vision, owning a home plays a pivotal role in weaving these threads together. With mortgage rates dipping, it could be the perfect opportunity for you to embark on this exciting journey.

Are you prepared and eager to buy a home in San Diego? If so, understand that a world of incredible rewards is waiting for you. Owning a home is more than just acquiring a property; it’s about creating a personal haven where your wealth can flourish and where you can proudly say, “This is mine.” As Ksenia Potapov, an Economist at First American, points out:

“…homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.”

Final Thoughts on A Place to Call Your Own

Purchasing a home is not just a decision; it’s a pivotal step towards fulfilling the American Dream. Owning a place where memories are made and futures are built is a journey many aspire to. If this year is when you want to make your mark and find a home that resonates with your dream, get in touch with the McT Real Estate Group. San Diego has many great neighborhoods, such as North Park, South Park, University Heights, and so many more. Let’s begin this exciting journey together, starting today!

San Diego Real Estate Expert for Home Buying: Its Advantages

Improving Your Credit Score to Help You Buy a Home

As we welcome the new year, you might be thinking about buying a home in San Diego.It’s a thrilling journey to enter into, and the perfect time to start planning is now. Improving your credit score is a key part of getting ready to own a home.

Why is this important? Well, lenders look at your credit to see if you’re good at making payments on time and managing debts. This isn’t just about getting approved for a mortgage; it also affects the interest rate you’ll get. Think of your credit score as a snapshot of your financial health that lenders use to gauge how risky it would be to lend you money. According to a CNBC article:

“When it comes to mortgages, a higher credit score can save you thousands of dollars in the long run. This is because your credit score directly impacts your mortgage rate, which determines the amount of interest you’ll pay over the life of the loan.”

Understanding Your Credit Score

Understanding the importance of your credit score is crucial, especially in today’s housing market in San Diego. Mortgage rates, a significant component in determining how affordable a home is, are directly influenced by your credit score. As reported by the Federal Reserve Bank of New York, the average credit score for new mortgage holders in the U.S. is around 770. However, it’s important to remember that perfection isn’t necessary. Your FICO score range plays a big part in this, as highlighted in a Business Insider article. The better your score, the more favorable your mortgage rates could be, making your dream home more attainable.

“. . . you don’t need a perfect credit score to buy a house. . . . Aiming to get your credit score in the ‘Good’ range (670 to 739) would be a great start towards qualifying for a mortgage. But if you’re wanting to qualify for the lowest rates, try to get your score within the ‘Very Good’ range (740 to 799).”

Partnering with a reliable lender is key to understanding how your credit score can influence your home loan and mortgage rate. It’s a crucial step, and as FICO often highlights, your credit score plays a significant role in this process. A trusted lender will guide you through understanding the impact of your credit score and offer tailored advice to help secure the best possible mortgage rate.

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.”

Are you aiming to boost your credit score? Let’s dive into some key areas highlighted by Experian that deserve your attention:

Keeping an Eye on Your Payment History

Remember, late payments can drag down your credit score. To keep your score healthy, always aim to pay your bills on time. If you’ve missed any payments, try to clear those late charges as soon as possible. Staying on top of your payment history is key to maintaining a strong credit profile.

Understanding Your Debt-to-Credit Ratio

It’s all about how much of your available credit you’re actually using. The golden rule? The lower, the better. Aim to keep this figure minimal. It’s a smart move to maintain a healthy financial profile and can really boost your credit score. Regularly check in on your credit balances and strive to keep them well under your limits. This active approach is key to managing your finances effectively.

Credit Card Applications

Thinking about making a big purchase? It’s crucial to hold off on applying for new credit. Why? Each time you apply, it typically triggers a hard inquiry. This can actually lower your credit score. When you’re in the market to buy something significant, keeping your credit score stable is key. Avoid new credit applications – it’s a smart move to protect your score and keep your buying power strong.

Working with a lender is like having a personal guide through the maze of home financing. They start by evaluating where your credit score fits in the grand scheme of things. This is key in determining which loan options are best for you. Then, they’ll walk you through each loan type, explaining the details in a way that’s easy to understand. It’s all about making the journey from start to finish smooth and stress-free for you.

Bottom Line on Improving Your Credit Score

As you look towards the exciting journey of buying a home in the coming year, consider the significant impact of improving your credit score. A higher score not only makes you more appealing to lenders but can also secure you a more favorable mortgage rate. This step is crucial in making your home-buying experience smoother and more affordable. To understand more about this process and how it benefits you, don’t hesitate to reach out to a reliable lender. They can provide personalized advice and help set you on the path to homeownership success.

Lower Mortgage Rates in San Diego and How it Impacts You

Home Buyer Saving Guide: 2024 Essential Tips

Thinking about buying a home in San Diego soon? The thought of budgeting and saving might seem daunting at first, but let’s break it down to make it more manageable. A great first step is getting familiar with the potential upfront costs. That’s where turning to experienced real estate pros comes in handy. As part of your team, they’ll guide you in crafting a solid plan, giving your budget and the entire home-buying process a thorough look from the get-go.

Let’s dive into a few key areas that experts recommend you consider. By keeping these in mind, you’ll be well on your way to making informed decisions on your home-buying journey.

1. Saving on a Down Payment

Embarking on the journey to homeownership, the down payment often stands out as a pivotal step. You might be wondering, though, how much should you be saving. It’s a common belief that a 20% down payment is a must, but this isn’t necessarily true for everyone. A lot of potential buyers are surprised to learn that the required down payment can vary significantly. According to insights from the Mortgage Reports, the traditional 20% is more of a myth than a mandate. This flexibility in down payment size opens the door to homeownership for many, especially first-time buyers who might find the idea of saving 20% quite daunting. Understanding this can significantly shift your strategy and approach when saving for your new home.

“The idea that you have to put 20% down on a house is a myth. . . . The right amount depends on your current savings and your home buying goals.”

It’s crucial to arm yourself with knowledge, and there’s no better way to do this than by teaming up with experienced real estate experts. Our team is here to guide you through the diverse array of mortgage options and down payment assistance programs available. We’ll break down what each program entails and how it fits into your unique situation. By getting a head start on understanding these details, you’re setting the stage for a smoother, more straightforward home-buying process. Trust us to illuminate the path towards your dream home and be a home buyer saving guide.

2. Closing Costs

When planning your budget, it’s crucial not to overlook closing costs. You’ll need to settle these fees and payments with different parties involved in your real estate transaction. Think of closing costs as the final step in your home-buying journey. They cover a variety of expenses, from attorney fees to title searches, and can vary depending on your specific situation. To give you a clearer picture, Bankrate offers detailed insights into these costs. Remember, understanding and preparing for these costs upfront can make your home-buying process smoother and more predictable.

“Closing costs are the fees you pay when finalizing a real estate transaction, whether you’re refinancing a mortgage or buying a new home. These costs can amount to 2 to 5 percent of the mortgage so it’s important to be financially prepared for this expense.”

When it comes to navigating the complexities of closing on a home, partnering with a reliable lender is invaluable. They play a crucial role in simplifying the process, actively guiding you through each step. By working closely with your lender, you gain clarity and confidence. They are there to tackle any questions you have, ensuring you’re fully prepared when it’s time to finalize your home purchase. This hands-on approach demystifies the closing process, making it a smoother, more understandable journey for you.

3. Earnest Money Deposit

In the journey of home buying, it’s smart to also start saving and set aside funds for an earnest money deposit (EMD). Think of an EMD as your way of saying, “I’m serious about this purchase.” When you find that perfect house and decide to make an offer, presenting an earnest money deposit is a strong signal of your commitment. This isn’t just a random amount; typically, it ranges from 1% to 2% of the home’s total price, as noted by Realtor.com.

“It tells the real estate seller you’re in earnest as a buyer . . . Assuming that all goes well and the buyer’s good-faith offer is accepted by the seller, the earnest money funds go toward the down payment and closing costs. In effect, earnest money is just paying more of the down payment and closing costs upfront.”

Now, here’s the great part: the earnest money deposit isn’t an extra burden on your wallet. It’s more like putting a part of your existing home-buying savings to immediate use. When you pay this deposit, you’re essentially kick-starting your home purchase, showing the seller that you’re not just interested but also ready and able to proceed. Realtor.com explains that this deposit acts almost like a credit. It’s not an additional cost but rather a portion of your home payment made in advance. By doing this, you reinforce to the seller that your offer is strong and genuine, setting you apart from other potential buyers. This proactive step can be a key factor in successfully navigating the home-buying process, especially in a competitive market like San Diego.

Remember, putting down an Earnest Money Deposit (EMD) isn’t a must, and it doesn’t always mean your offer will get the nod. It’s crucial to team up with a knowledgeable real estate advisor who knows the ins and outs of your local market. They’re there to guide you, tailoring their advice to fit your unique situation. Your advisor will help you navigate each step, ensuring you’re making informed, savvy decisions during your home-buying journey and help you save in the long run. This way, you can move forward with confidence, knowing you’ve got expert insights backing your every move.

Home Buyer Saving Guide Final Thoughts

Embarking on the journey of buying a home is exciting, yet knowing exactly what you need to save for makes a huge difference. It’s all about being well-informed and prepared. This is where connecting with a seasoned expert like the McT Real Estate Group becomes invaluable. We’re here to guide you through every step, ensuring all your questions and concerns are addressed. Let’s team up to make your home-buying experience smooth and successful. Reach out today, and let’s start this adventure together!

Turning Homeownership Profitable in San Diego

Post-Mortgage Application: Essential Steps for Home Buyers

We totally get the excitement of envisioning your life in a new home – it’s like you’re already planning where to put your favorite couch, right? But hold on, there’s a crucial phase between applying for your mortgage and finally getting those keys. Let’s dive into some essential pointers you must remember during this critical period. These tips will help you navigate the time between your mortgage application and the closing day, ensuring a smoother journey toward owning a home. Remember, being informed and prepared can make all the difference in turning your home-buying experience from good to great. So, let’s take a closer look at what you should keep on your radar after applying for your home loan.

Be Mindful About Depositing Big Amounts of Cash

When you’re in the process of securing a mortgage, every move counts, especially when it comes to your finances. Your lender is like a detective, tracing the path of every dollar in your account. Now, here’s the thing with cash – it’s a bit of a mystery guest in the world of finance. It’s hard to pin down where it came from. So, before you go depositing a large chunk of cash, have a quick chat with your loan officer. They’ll guide you on how to document these transactions properly. This way, you keep everything transparent and above board, making your lender’s job easier and your mortgage process smoother.

Steer Clear of Big Buys Before Your Mortgage Closes

Here’s a key tip to keep in mind – avoid splurging on big-ticket items. You might think it’s just the home-related purchases that count, but that’s not the case. Any significant spending can send warning flags to your lenders. Let’s break it down a bit: when you take on new debt, your debt-to-income ratio – that’s the balance between what you owe and what you earn monthly – takes a hit. This shift makes your loan seem riskier to lenders. As a result, you might suddenly not qualify for the mortgage you thought was in the bag. So, whether it’s that chic sofa set or the latest home appliance, hold off on those major purchases until after your loan is securely in place. It’s all about playing it safe and keeping your mortgage approval on track.

Steer Clear of Cosigning Loans

It’s crucial to avoid cosigning loans for others when you’re in the process of a mortgage application. By cosigning, you’re essentially taking on responsibility for that loan. This move can significantly increase your debt-to-income ratio. Remember, even if you’re not the one making the payments, your lender still needs to consider this additional liability. This means they’ll factor it into your financial profile, potentially impacting your mortgage approval.

Keep Your Bank Accounts Steady

When you’re in the middle of securing a mortgage, sticking with your current bank accounts is crucial. Why? Well, lenders have to verify and follow your assets closely. This process becomes a breeze when your accounts show a consistent history. It’s tempting to shuffle funds around but hold off on that. Have a chat with your loan officer before making any moves. They’ll guide you on what’s best to keep your application smooth and hassle-free.

Don’t Apply for New Credit

Here’s a key tip to keep in mind: avoid applying for any new credit, like a fresh credit card or a car loan, while you’re in the process of getting a mortgage. Why is this important? Well, each time your credit report gets pulled by different financial entities – whether it’s for a mortgage, a credit card, or a car loan – it nudges your FICO® score. This isn’t just a small detail; a lower credit score can significantly affect your interest rates and might even influence whether you get approved at all. So, play it safe and put those credit applications on hold to keep your score steady and strong

Don’t Close Any Accounts

A common misconception among homebuyers is that less available credit equals a safer bet for mortgage approval. However, this isn’t the case. In reality, a key element of your credit score hinges on the duration and variety of your credit history, not solely on your record of timely payments. It’s also influenced by how much credit you use in relation to what’s available to you. So, when you close accounts, it can actually hurt these critical aspects of your score. Keeping older accounts open, therefore, might work in your favor by demonstrating a long and varied credit history, as well as a healthier credit utilization ratio.

Do Discuss Changes with Your Mortgage Lender

Keeping the lines of communication open with your lender is absolutely crucial. If there’s any shift in your income, assets, or credit situation, it’s really important to let your loan officer know right away. By being proactive and upfront about these changes, you and your lender can work together more effectively. This teamwork helps in tackling any issues head-on, paving the way for a smoother approval of your home loan. Especially if there have been recent shifts in your job or employment status, sharing these updates with your lender as soon as they happen can make a big difference. It’s all about staying on the same page to ensure everything moves forward without a hitch

Final Thoughts on Your Post-Mortgage Application

Your journey to buying a home should be as seamless and stress-free as possible. To ensure this, it’s crucial to play it smart with your finances. Before you think about splurging on a big-ticket item, shuffling your funds, or even embarking on significant life shifts, pause and have a chat with your lender. They’re the experts who can clearly outline how these financial choices could affect your mortgage. Remember, a quick conversation with your lender or your realtor can be the key to a smooth home-buying experience. Remember these tips, and you’re on your way to a successful home purchase. If you’re looking for a trusted partner, feel free to reach out to the McT Real Estate Group.

Home Didn’t Sell in San Diego? Here are the Top Reasons Why

Pre-Approval : Boost Your Home-buying Success in San Diego

Are you dreaming of buying a home in San Diego? Hold that thought of relaxing in your cozy new living room or enjoying meals on your all-season patio. There’s an important first step you shouldn’t overlook: getting pre-approved for a mortgage. Partnering with a reliable lender to tackle this vital task should be at the top of your list, and here’s why.

Recently, we’ve seen some shifts in the housing market. Home prices are starting to stabilize, and mortgage rates are gradually becoming more favorable. However, the reality is that homes are still quite a stretch for many budgets. Plus, with the current limited housing inventory, buyers are finding themselves in a bit of a scramble to secure their dream homes. This is where being prepared can really make a difference. Pre-approval isn’t just a preliminary step; it’s a strategic move that can set you apart in this competitive market. It’s your secret weapon to navigate these challenging conditions with confidence and ease.

Unlocking the Benefits of Pre-Approval in Homebuying

Embarking on the journey of buying a home in San Diego can be thrilling yet complex. A crucial step in this adventure is understanding the role of pre-approval. Imagine pre-approval as a key that unlocks your true buying potential. When you start the homebuying process, a lender reviews your financial situation meticulously. It’s like they’re peering into your financial health, assessing how much they believe you can responsibly borrow.

This review culminates in a pre-approval letter, which is essentially your financial green light in the real estate world. Think of this letter as a clear, concise statement showcasing the amount you can comfortably spend. Freddie Mac, a giant in the home loan industry, breaks it down simply.

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Starting with pre-approval sets you on a journey toward a clearer financial vision, guiding you one step at a time. But there’s more to it than just obtaining a pre-approval letter from a lender. It’s about merging this pre-approval with smart budgeting strategies. This approach is like finding a golden ticket – it opens your eyes to what’s truly within your financial grasp. By knowing your limits early on, you avoid the heartache of setting your heart on a home that might just be beyond your reach. It’s a practical way to dream big yet stay grounded in reality.

The Power of Pre-Approval in a Competitive Housing Market

Starting your homebuying journey with a pre-approval isn’t just a smart move – it’s a game-changer. In the bustling and competitive world of real estate, especially in markets like ours in San Diego, standing out as a buyer is crucial. Why? Because there’s a simple truth we’re all facing: there are more people eager to buy homes than there are homes on the market. This imbalance naturally leads to fierce competition among buyers. Imagine this: you’ve found your dream home, but so have multiple other buyers. How do you ensure your offer gets the attention it deserves?

This is where pre-approval steps in as your ace in the hole. It’s much more than a financial green light for a mortgage; it’s a signal to sellers that you mean business. Being pre-approved is like walking into a seller’s world with a badge of credibility. It shows them you’re not just browsing – you’re ready to buy. And in a sea of bids, this can make a significant difference.

Think of it this way, as highlighted in an insightful article from the Wall Street Journal (WSJ):

“If you plan to use a mortgage for your home purchase, preapproval should be among the first steps in your search process. Not only can getting preapproved help you zero in on the right price range, but it can give you a leg up on other buyers, too.”

Getting pre-approved shifts you from a casual browser to a serious buyer in the eyes of sellers. It means you’ve already passed through the essential credit and financial checks. This step reassures sellers, as it signals a smoother and more predictable sale process, with fewer surprises or hold-ups. For them, your offer stands out as dependable and solid. It’s a clear win-win situation, right? You get to present yourself as a committed buyer, while sellers enjoy the peace of mind of knowing your offer is backed by solid financial groundwork.

Final Thoughts

Now, before you begin visualizing how your favorite sofa will look in the living room of your dream home, it’s crucial to take a proactive step. Partner with a reliable lender to secure your pre-approval. This key move will not only save you valuable time but also significantly reduce stress and prevent potential headaches that often arise unexpectedly during the home-buying journey. In essence, being thoroughly prepared enhances your chances of acquiring the home you’ve been dreaming of. It’s a smart strategy to ensure you’re ahead in the competitive real estate market, especially in vibrant areas like San Diego. Remember, the right preparation leads to the best outcomes, particularly when it comes to making such an important life decision.

Home Didn’t Sell in San Diego? Here are the Top Reasons Why

San Diego Real Estate Expert for Home Buying: It’s Advantages

Stepping into the world of homeownership is an exciting journey, and it’s completely normal to feel a little bit unsure about where to begin at first. If you’re feeling a tad overwhelmed, take a deep breath, and you can rest easy knowing you don’t have to go through this adventure all alone. Having the right real estate agent by your side during the home-buying process can be a complete game-changer and might be a hit or miss at times, depending on who you choose as your partner.

Navigating today’s housing market, with its myriad intricacies, can be complex and daunting. The real estate market is dynamic, characterized by a limited number of homes for sale, alongside persistently high home prices and mortgage rates. In such a scenario, having a reliable expert by your side is not just helpful – it’s crucial. This is where the role of a San Diego real estate expert becomes invaluable and a total asset to your home ownership quest.

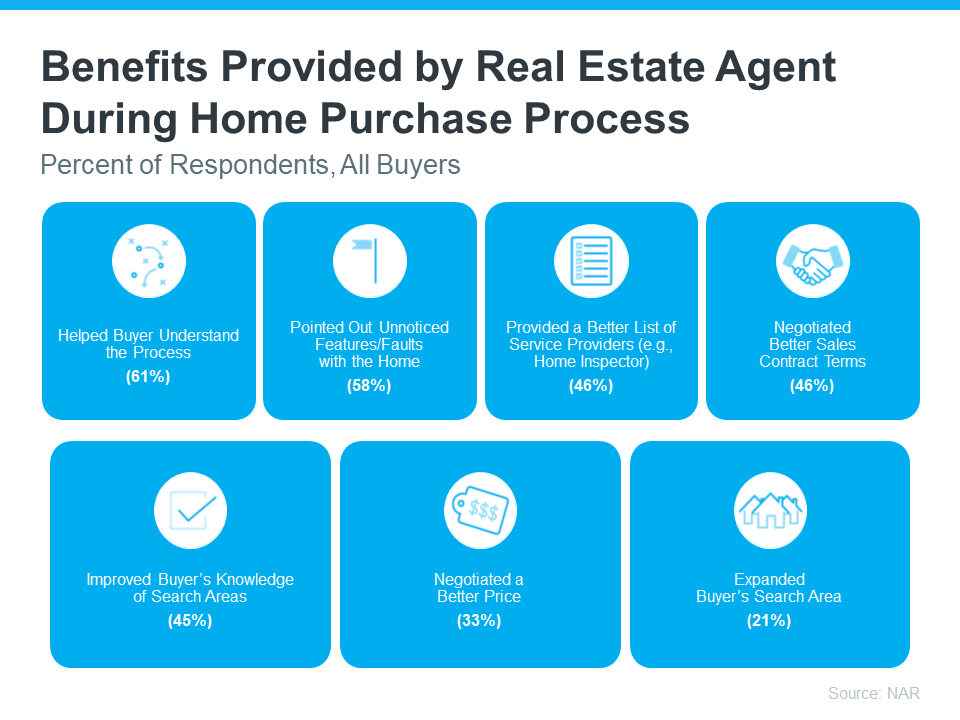

Real estate agents are not just helpful; they’re essential. According to the latest report and survey data from the National Association of Realtors (NAR), homebuyers overwhelmingly agree that their real estate agent is the most valuable resource in their home-buying journey. But what exactly makes an agent so indispensable? Let’s delve deeper.

The Multi-Faceted Role of a San Diego Real Estate Expert

When we think of real estate agents, we usually picture them showing homes or handling paperwork. However, that is just the tip of the iceberg; their role extends far beyond these common tasks. They are not just facilitators but also your comprehensive guides, accompanying you at every stage of your home-buying journey.

Let’s take a look at some key findings from the NAR report, highlighting the diverse ways in which agents add a huge value to the home-buying process:

Guiding and Helping the Buyer Understand the Process

Navigating the home-buying process can often feel overwhelming, especially when it comes to grasping the finer details. For instance, many find themselves puzzled by the distinction between a home inspection and an appraisal. Additionally, knowing the dos and don’ts after applying for a mortgage is equally important yet can be confusing.