Despite the recent uptick in foreclosure filings, experts unanimously agree that San Diego is far from facing a repeat of the 2008 crisis. While some headlines may raise concerns, the broader perspective reveals that our current foreclosure rates remain significantly lower than those observed during typical housing market conditions. According to a report by BlackKnight, San Diego’s housing market is resilient, showing promising signs of stability despite minor fluctuations in foreclosure data. This underscores the city’s robust real estate landscape, characterized by its ability to weather economic challenges with resilience and adaptability.

“The prospect of any kind of near-term surge in foreclosure activity remains low, with start volumes still nearly 40% below pre-pandemic levels.”

Great news! This signifies that the number of homeowners facing potential foreclosure is significantly lower compared to the usual trend. However, there remains a small percentage who could find themselves confronting the looming threat of foreclosure. This situation often arises due to unexpected hardships that can unexpectedly arise in any market.

For these homeowners, there are still viable options available to circumvent the foreclosure process. If you’re currently navigating such challenges, Bankrate offers insightful guidance on avenues to explore:

Forbearance Programs

If your loan is backed by Fannie Mae or Freddie Mac, you might qualify for this type of program, providing temporary relief from mortgage payments.

Loan Modification

Alternatively, consider requesting a loan modification. Your lender may be open to adjusting your loan terms to lower your monthly payments, making them more manageable.

Repayment Plan

Another option is to establish a repayment plan. Your lender could potentially arrange a deferral or payment plan if you’re unable to meet your current payment obligations.

Moreover, it’s worth assessing whether you possess adequate equity in your home to pursue a sale and safeguard your investment. This proactive step could offer a strategic solution to mitigate potential financial hardships. In times of uncertainty, exploring these options can provide a pathway toward financial stability and peace of mind for homeowners facing adversity.

Unlocking Hidden Wealth: Leveraging Home Equity to Prevent Foreclosure in San Diego

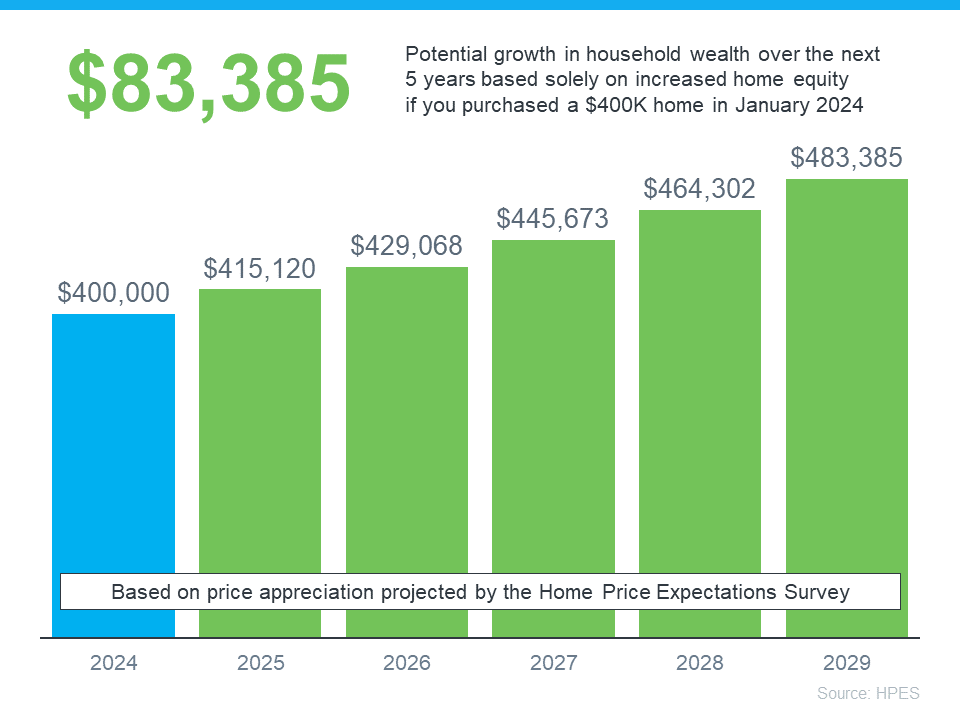

Looking to sell your house in San Diego? You might be pleasantly surprised by the equity you’ve built up over the years. With the rapid rise in home prices in our city, many homeowners find themselves sitting on a substantial amount of equity without even realizing it. If you’ve been in your home for some time, chances are its value has appreciated significantly. Additionally, your regular mortgage payments have steadily decreased your loan balance, further boosting your equity.

This increased equity can be a valuable asset when it comes to selling your home. If the current market value of your property exceeds the remaining balance on your loan, you have an opportunity to leverage this equity for your benefit. By tapping into this equity, you can potentially secure better terms for your next home purchase or use the funds for other financial goals.

Freddie Mac sheds light on how this strategy can work in your favor. With San Diego’s thriving real estate market, now is an opportune time to explore your options and make the most of your home equity. Reach out to our team today to learn how you can leverage your equity to achieve your real estate goals!

“If you have enough equity, you can use the proceeds from the sale of your home to pay off your remaining mortgage debt, including any missed mortgage payments or other debts secured by your home.”

Rely on Local Experts for Guidance

When facing the possibility of foreclosure, it’s crucial to seek support from knowledgeable professionals in your area. By collaborating with a trusted San Diego real estate agent, you gain access to valuable insights into your property’s equity. These experts can provide a realistic estimate of your home’s market value by analyzing recent sales data of comparable properties in your neighborhood.

Through this collaborative effort, you’ll gain clarity on your options and potential pathways to prevent foreclosure. Selling your house may emerge as a viable solution, allowing you to proactively address your financial challenges and secure a brighter future for yourself and your family. Don’t navigate this challenging situation alone—lean on the expertise of local professionals who understand the intricacies of the San Diego real estate market and are committed to helping you achieve the best possible outcome.

Wrapping All Things Up to Prevent Foreclosure in San Diego

In conclusion, for San Diego homeowners grappling with financial challenges, reaching out to a seasoned real estate expert can be the key to navigating through tough times. By seeking guidance from professionals who understand the local market intricacies, you can uncover viable solutions and potentially sell your property to evade foreclosure. Don’t hesitate to take proactive steps towards safeguarding your financial well-being. Connect with the McT Real Estate Group today, and let’s work together to secure a brighter future for you and your home.