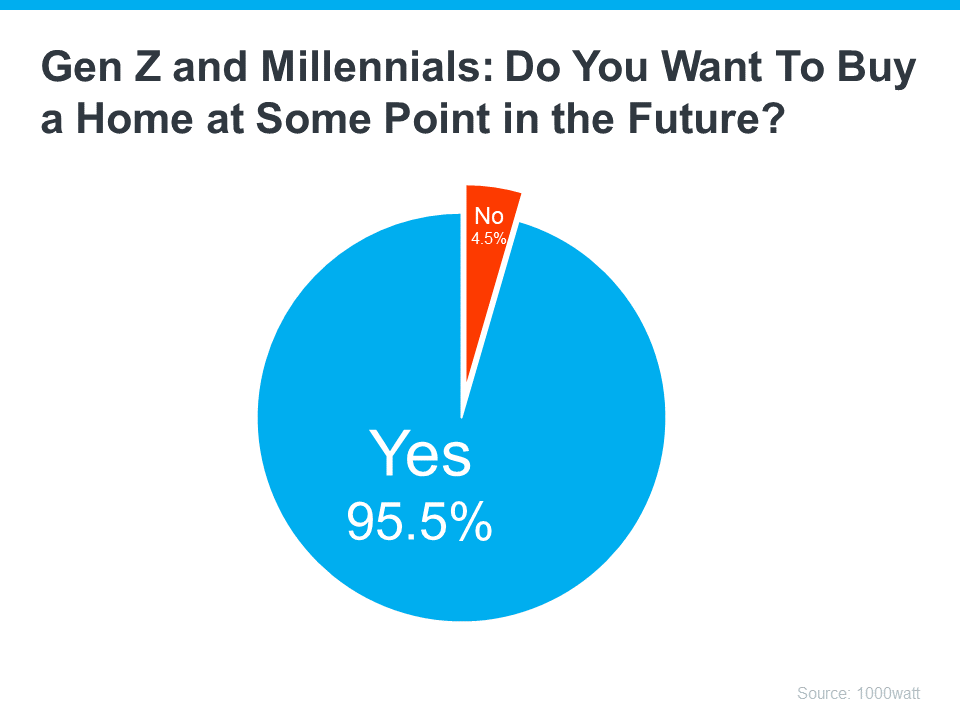

Considering becoming a homeowner in San Diego? While current mortgage rates may appear daunting right now, there are compelling reasons why buying your own home remains a wise decision if you’re prepared and financially able. Here are some of the perks of buying over renting a Home in San Diego to think about:

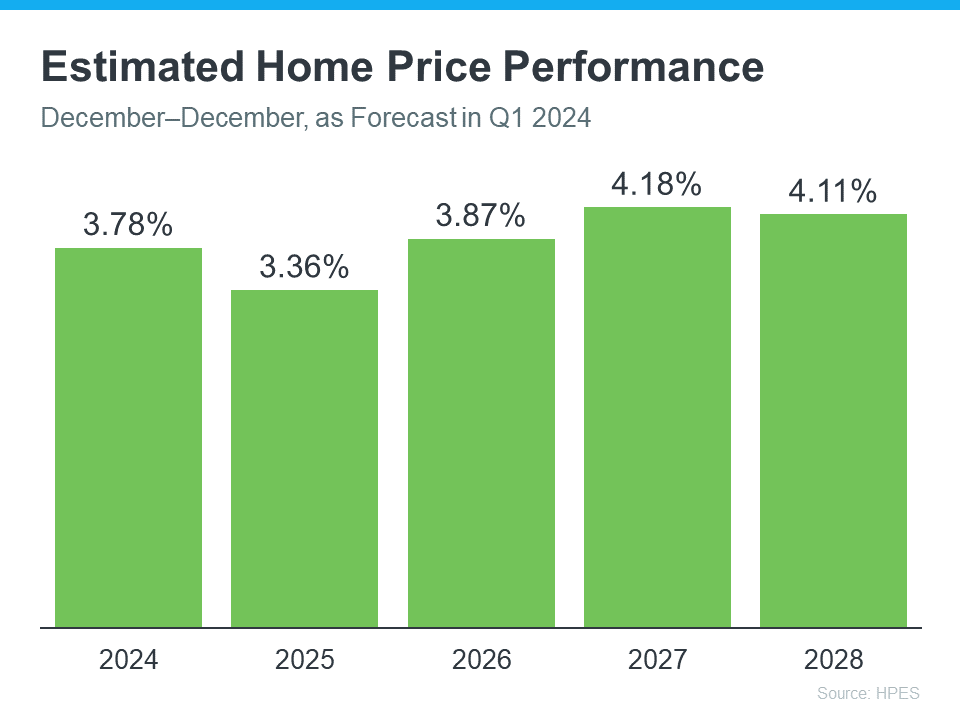

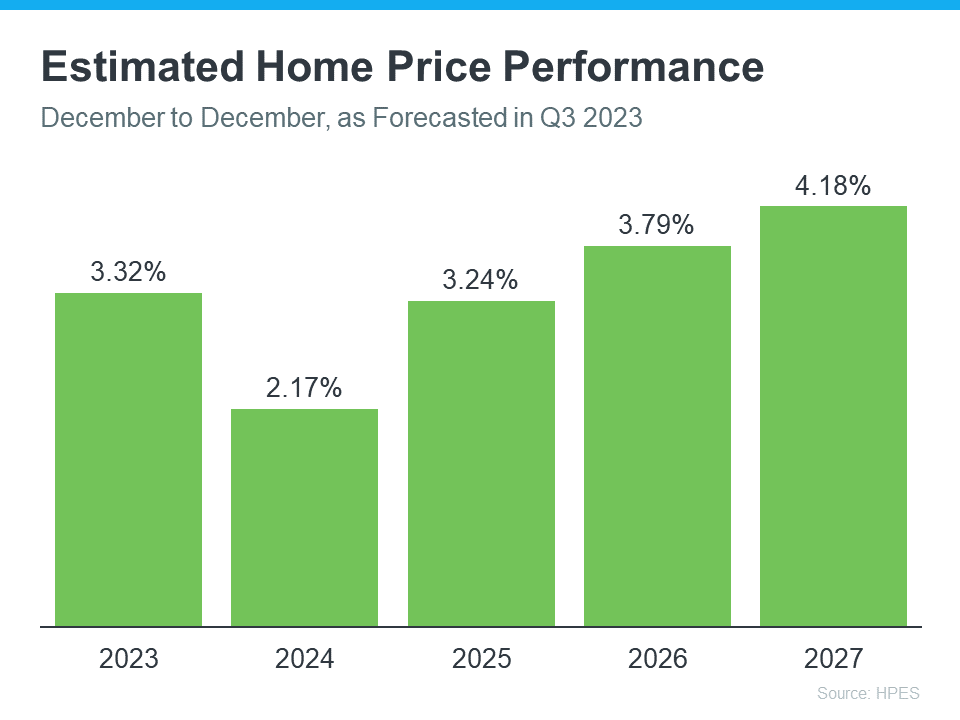

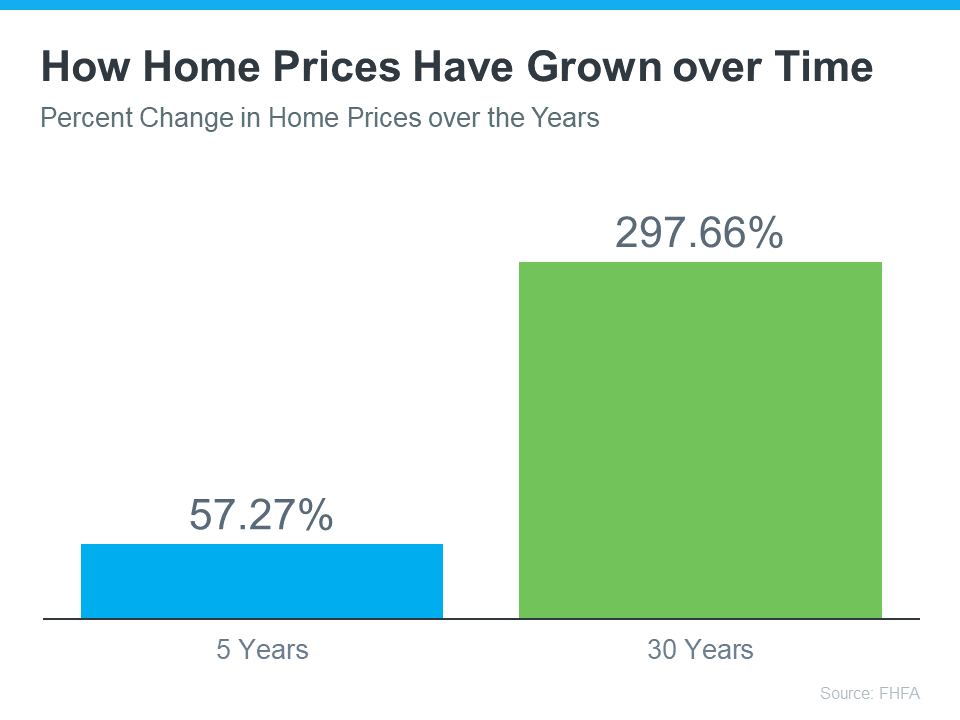

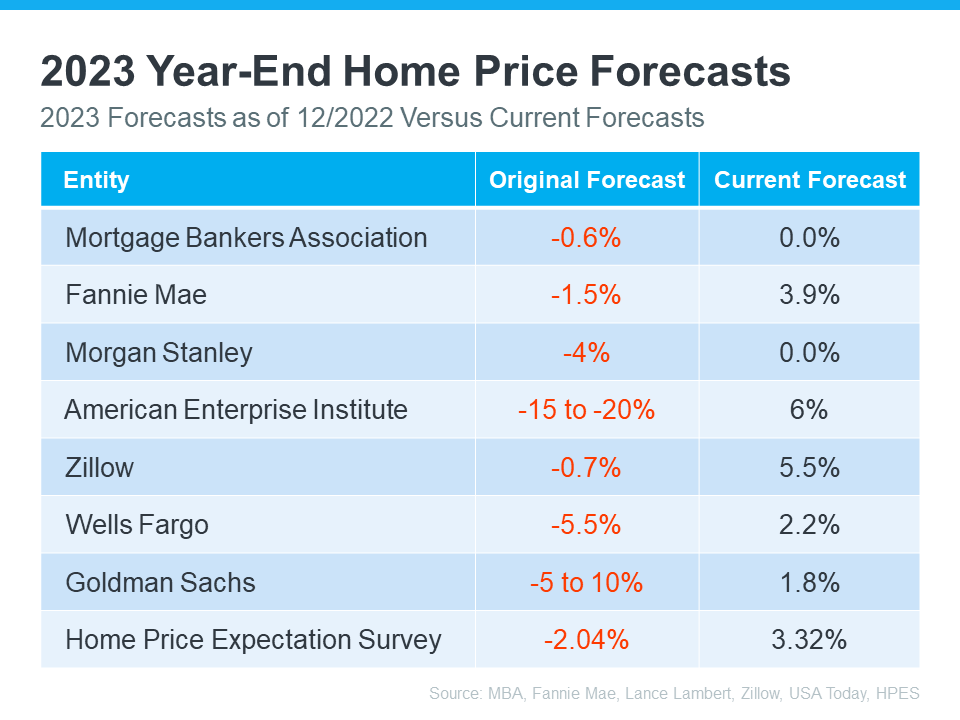

1. Home Values Generally Increase Over Time

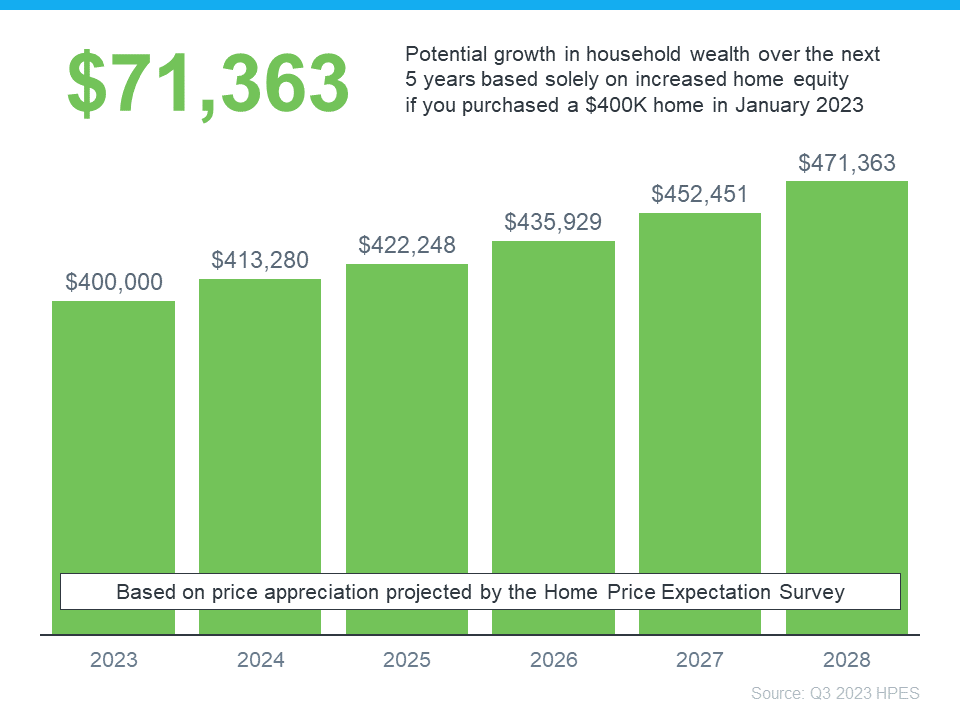

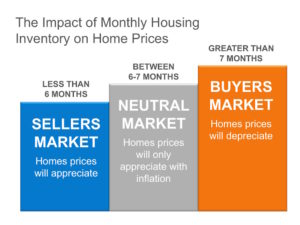

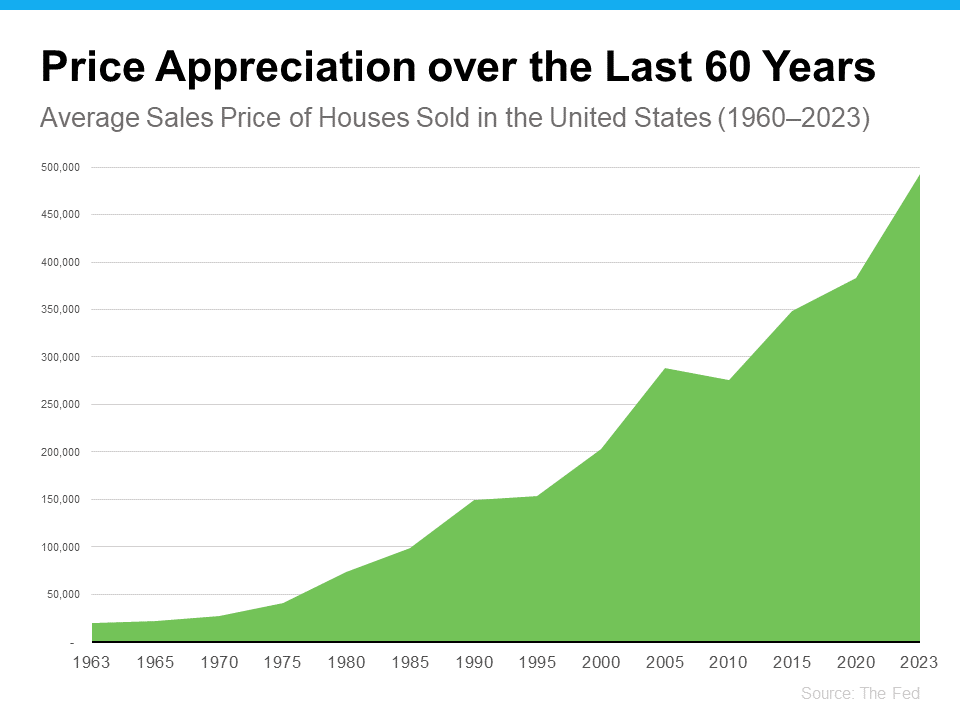

Amidst recent uncertainties about the direction of home prices, rest assured that, historically, they tend to rise. This is clearly illustrated when examining long-term data from the Federal Reserve: Despite a notable dip during the 2008 housing crisis, home values have consistently appreciated over the past six decades.

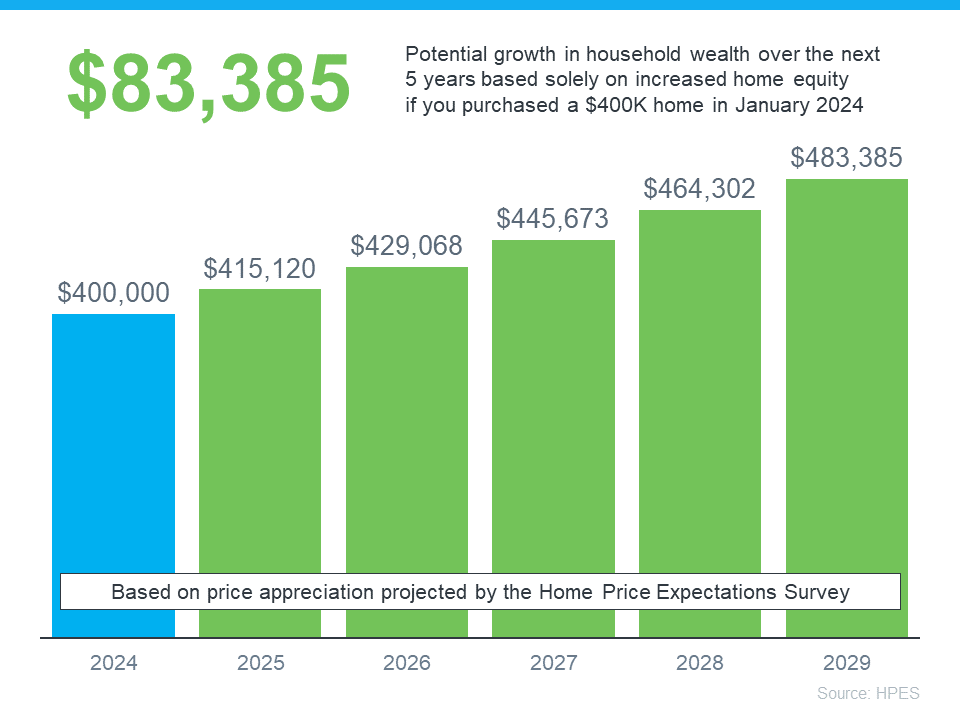

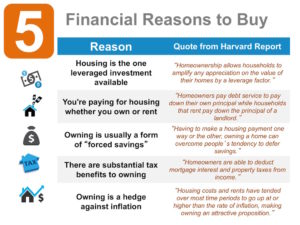

This enduring upward trend is particularly evident in San Diego, a city known for its dynamic real estate market. Investing in a home and being a homeowner here not only offers a scenic lifestyle but also a smart financial move as you gradually build equity. Over the years, as property values increase and you continue to pay down your mortgage, the equity you accumulate can significantly boost your financial standing. According to the Urban Institute:

“Homeownership is critical for wealth building and financial stability.”

This makes being a homeowner a potentially more advantageous option than renting, where payments might go towards a landlord’s equity, not your own. As you consider your next steps, remember that in San Diego, investing in real estate is not just about finding a place to live—it’s about setting the foundation for your financial future.

2. Escaping Rising Rents in San Diego

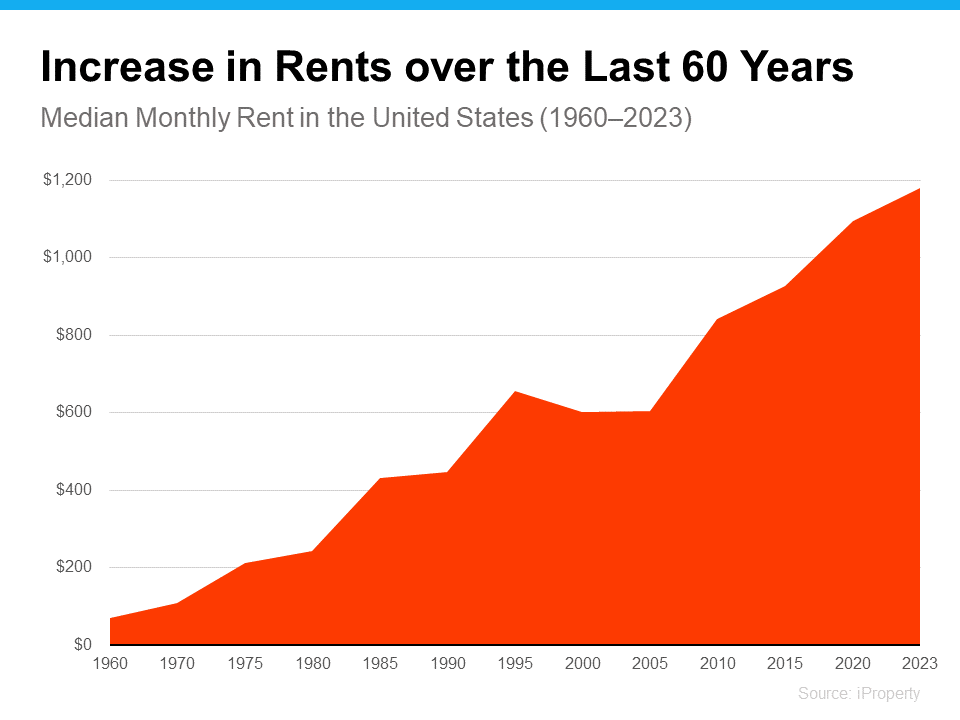

In San Diego, where the sun meets innovation, the cost of living can be high. One significant expense? Rent. It often seems more manageable in the short term to rent, but each lease renewal could bring a sting as rent prices climb. In fact, historical data from IProperty Management shows a steady increase in rents nationwide over the past six decades.

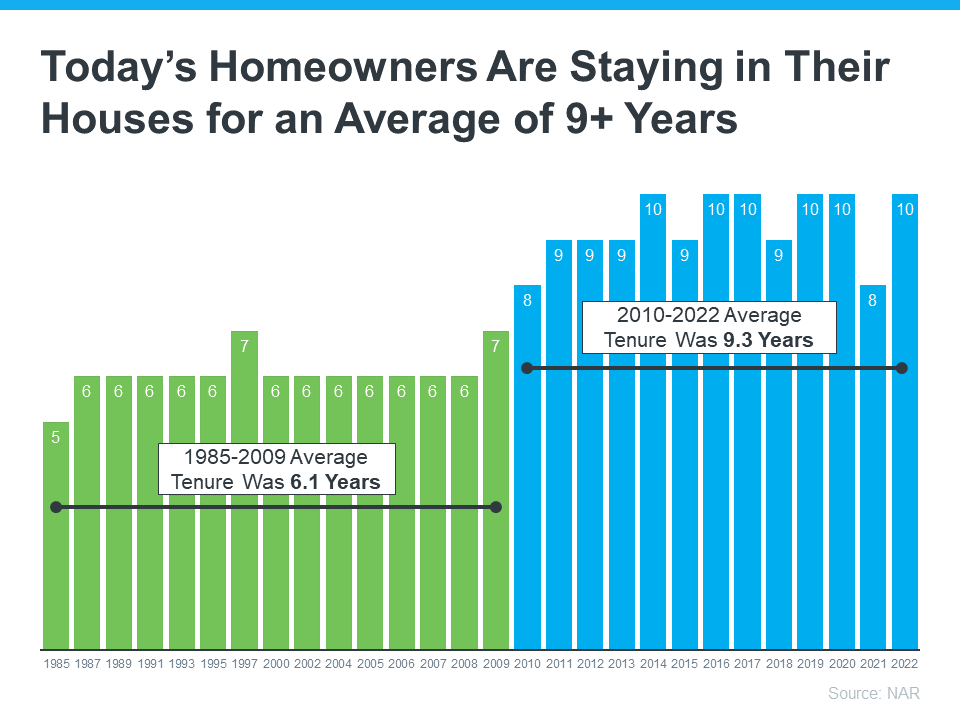

So, how can you break free from the endless cycle of rent hikes? Being a homeowner and securing a home with a fixed-rate mortgage in San Diego offers a solution. It locks in your housing expenses, freeing you from the unpredictability of renting. This stability isn’t just about comfort; it’s a financial strategy that pays off in the long run and of the main perks if buying over renting a home.

Consider your monthly housing payment as an investment in your future in being a homeowner. With each payment, you’re building equity—investing in yourself rather than lining your landlord’s pockets. Although renting might seem less expensive at first, the money spent doesn’t contribute to your financial growth.

Dr. Jessica Lautz, Deputy Chief Economist and VP of Research at the National Association of Realtors, advises:

“If a homebuyer is financially stable, able to manage monthly mortgage costs, and can handle the associated household maintenance expenses, purchasing a home is a wise decision.”

In San Diego’s dynamic market, buying a home means planting roots in a community poised for growth, where every mortgage payment enhances your financial security and personal wealth.

Wrapping It All Up with The Perks of Buying over Renting a Home in San Diego

Are you fed up with rising rent prices? Being a homeowner in San Diego offers numerous benefits, from building equity to enjoying more stability and freedom. Let’s discuss how you can transition from renting to owning and fully explore the opportunities that homeownership in this vibrant city brings.