Let’s Talk About More Homes on the Market and What You Need to Know.

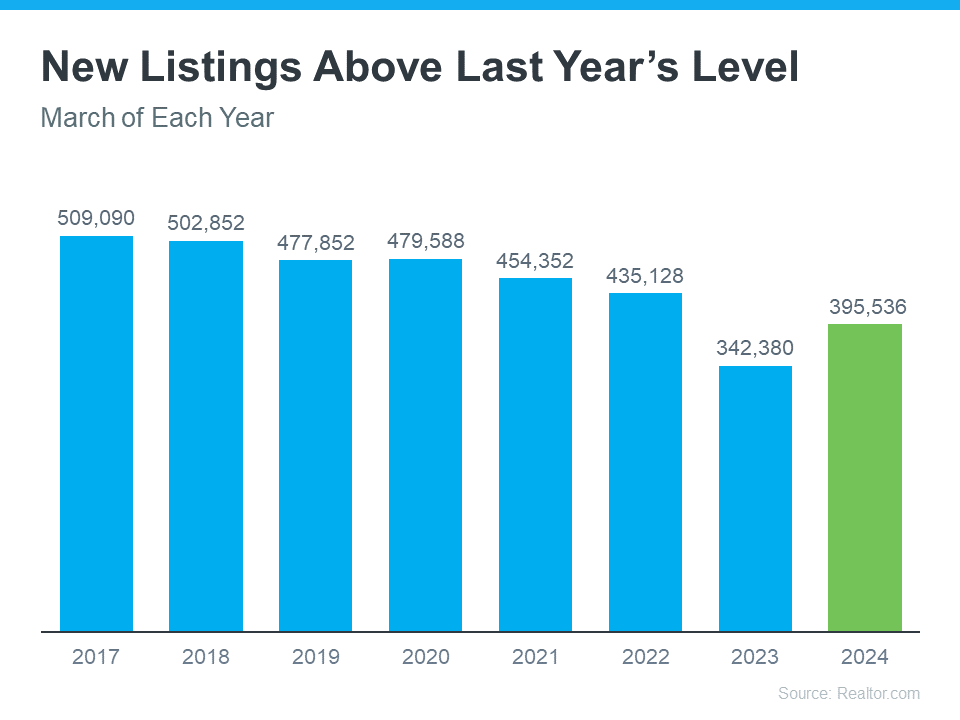

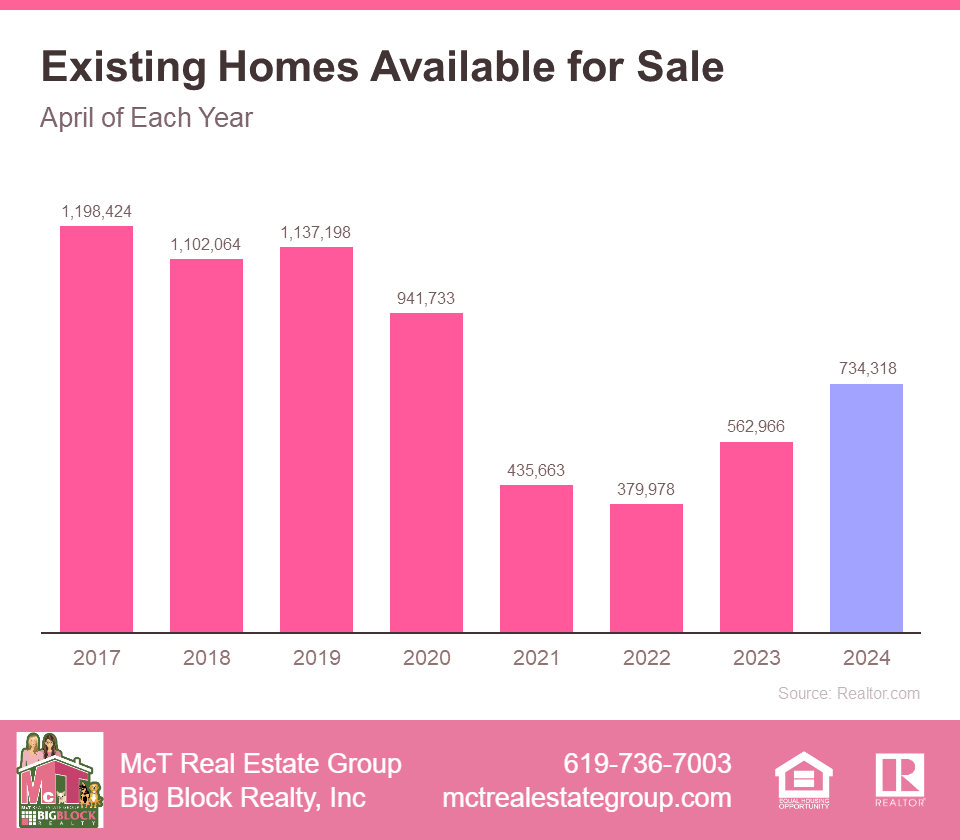

According to Realtor.com:

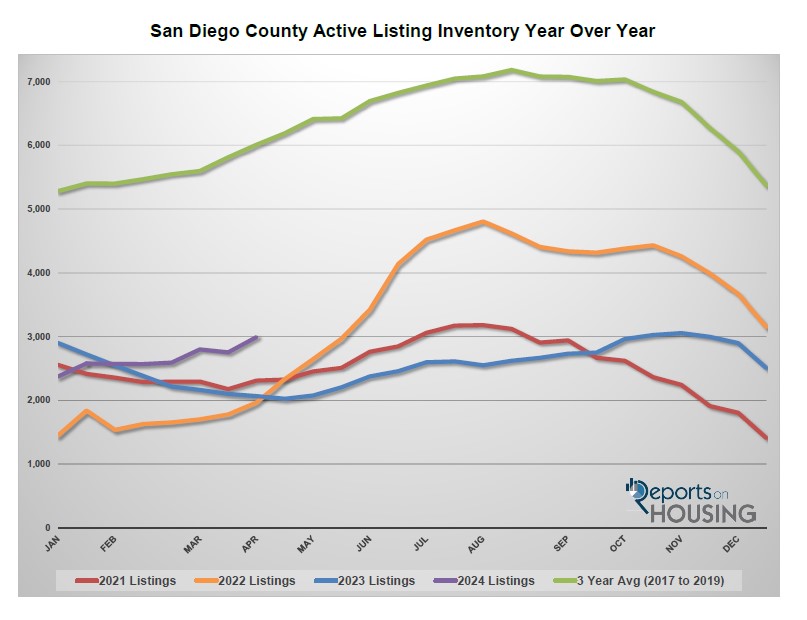

“There were 30.4% more homes actively for sale on a typical day in April compared with the same time in 2023, marking the sixth consecutive month of annual inventory growth.”

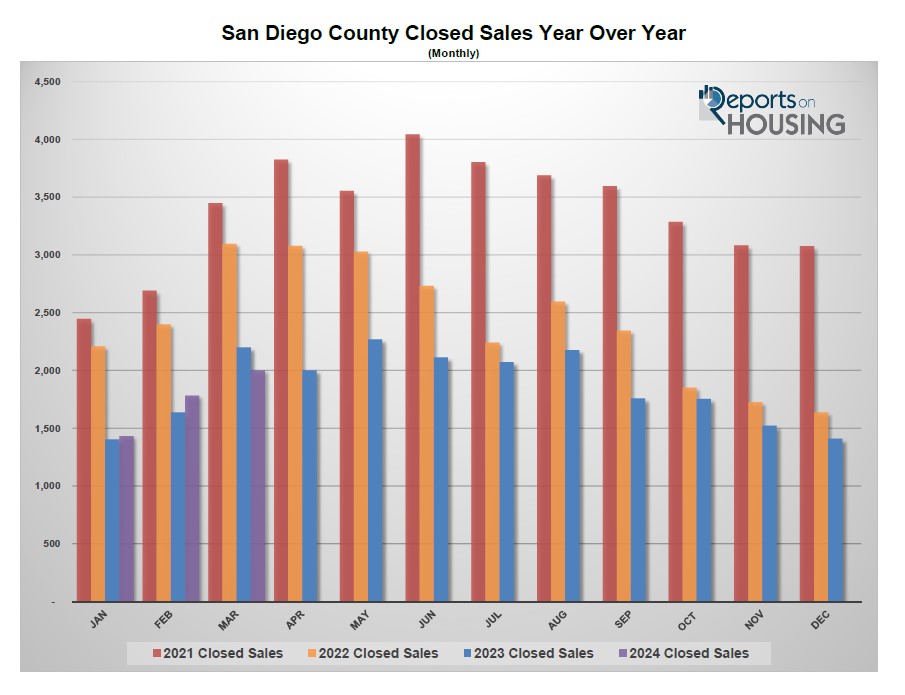

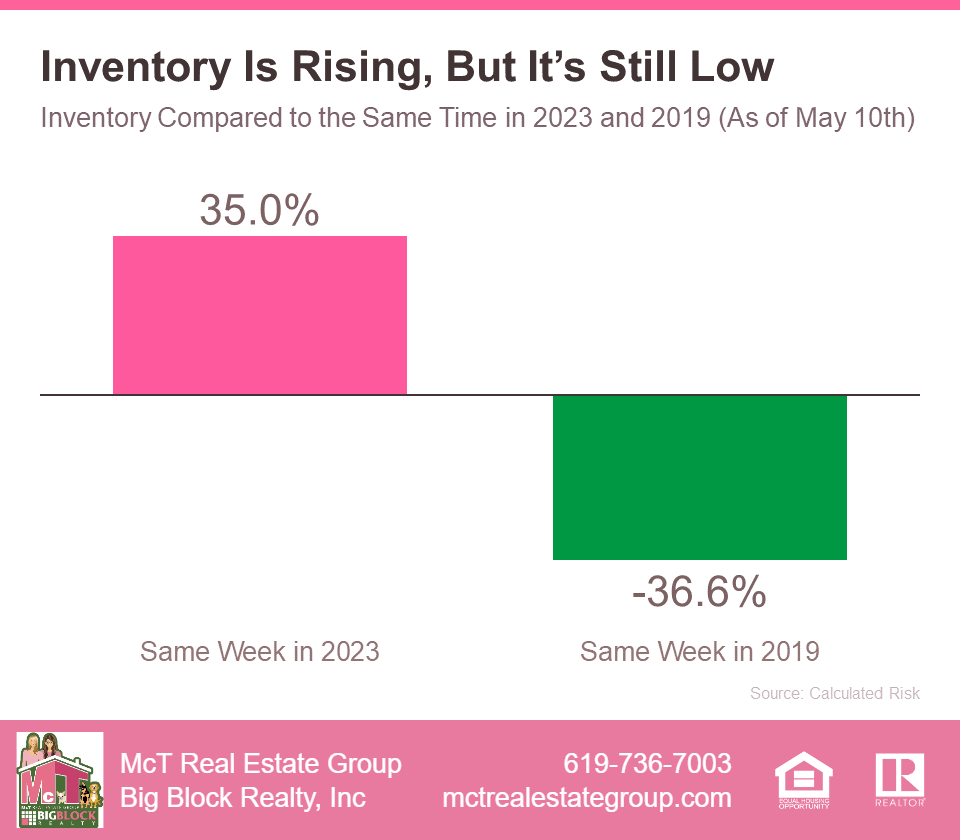

This expanding inventory is a positive sign for those navigating the housing market. But does this increase in available homes make house hunting easier? The answer is both yes and no. Using recent weekly data from Calculated Risk, the graph below shows that despite the recent growth in listings, the number of homes for sale is still significantly lower than during the last normal year in the housing market.

San Diego, known for its beautiful beaches, vibrant neighborhoods, and year-round pleasant weather, is a highly desirable place to live. As more homes come onto the market, potential buyers have a better chance of finding their dream home in this dynamic city. Our team is here to help you navigate these changes and find the perfect home that meets your needs.

What Does This Mean for You?

If you’ve been looking to buy a home but put your plans on hold because you couldn’t find what you were searching for, now might be the right time to start again. You’ll see more options than you did over the past few years, although the selection is still limited.

To explore these growing options, it’s wise to work with a trusted local real estate agent. Real estate is all about location, and an agent with local expertise can provide valuable insights on homes available in your desired area and show you more homes in the market. San Diego, with its beautiful weather and vibrant neighborhoods like North Park and South Park, offers unique opportunities for buyers.

As Bankrate explains:

“In today’s homebuying market, it’s more important than ever to find a real estate agent who really knows your local area — down to your specific neighborhood — and can help you successfully navigate its unique quirks.”

Partnering with a knowledgeable agent can make all the difference in finding the perfect home in San Diego. They can guide you through the intricacies of the market and help you uncover hidden gems you might not have found on your own. So, if you’re ready to take advantage of the increasing home inventory, reach out to a local expert today.

Bottom Line on More Homes on the Market in San Diego

Let’s team up to keep you informed about the San Diego real estate market and the latest updates on available homes for sale.

When you partner with the McT Real Estate Group you’ll have a dedicated expert by your side, providing you with the latest information and insights. San Diego is a vibrant and diverse city with many unique neighborhoods, each offering its own charm and amenities. Staying updated on the market trends here is crucial, whether you’re looking to buy your dream home or sell your current one.

With our expertise, you’ll always be in the loop about the factors that could impact your move. From understanding market dynamics to finding hidden gems, we’re here to make your real estate journey smooth and successful. Let’s navigate the San Diego market together with ease and confidence, ensuring you make the best decisions every step of the way.

Places to Live in San Diego for Cheap