We all know that real estate functions as a dependable long-term investment opportunity, but here’s the thing: industry leaders predict that we are approaching something even bigger. Experts predict that we could be entering what they call a “real estate supercycle.”

A supercycle operates differently from traditional short-term market fluctuations; it emerges from fundamental long-term elements, which include housing market demand, economic transformations, and policy modifications that will drive real estate expansion over multiple years.

According to Chad Tredway, Head of Real Estate Americas at J.P. Morgan Asset Management, the current forces will lead to a prolonged real estate opportunity phase, which will begin after interest rates decrease.

What is a Real Estate Supercycle?

A supercycle describes an extended market expansion phase during which economic conditions and demand patterns push prices upward even when interest rates cause brief price drops. Tredway mentioned on Bloomberg The Close to share his market predictions.

“I would tell you we could be entering a supercycle for real estate just given the current policy, the facts that rates will come down at some point and the demand drivers that we see in the economy.”

But What About Interest Rates?

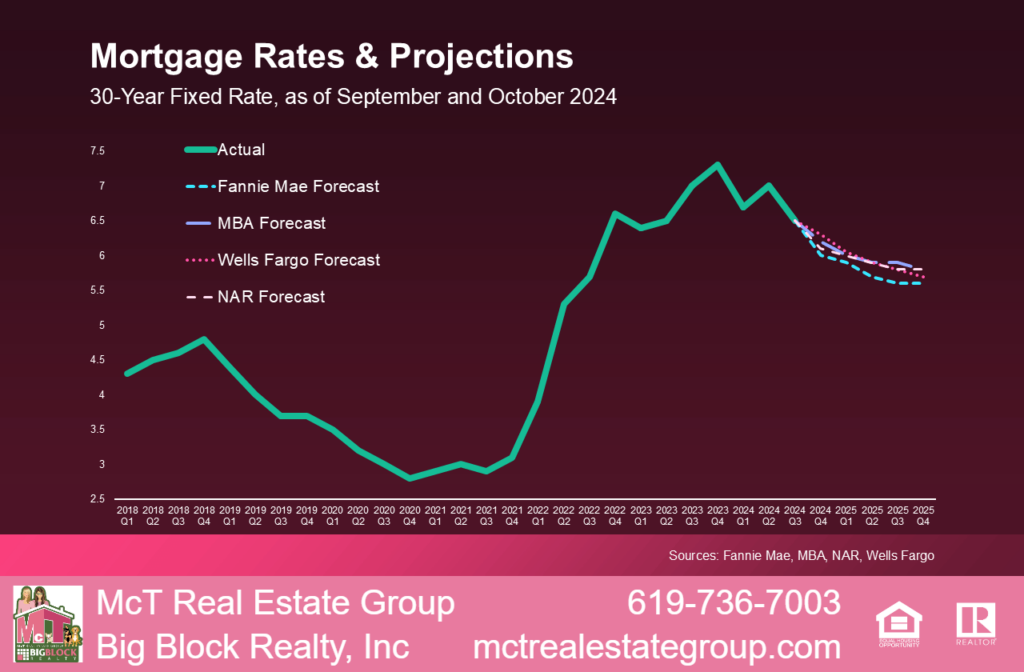

The housing market discussion has included interest rates as a primary topic for those who follow real estate developments. Many buyers, together with investors, choose to wait for interest rates to decrease before taking action and making their move.

Here’s the thing: the market will experience growth regardless of rate fluctuations because real estate demand remains strong to date. The strong market demand for logistics, industrial properties, and housing has led Tredway to explain that cash flow gains over time will create real estate as a durable, long-term investment opportunity. The drop in interest rates would provide additional benefits to investors, but honestly, it is just a bonus.

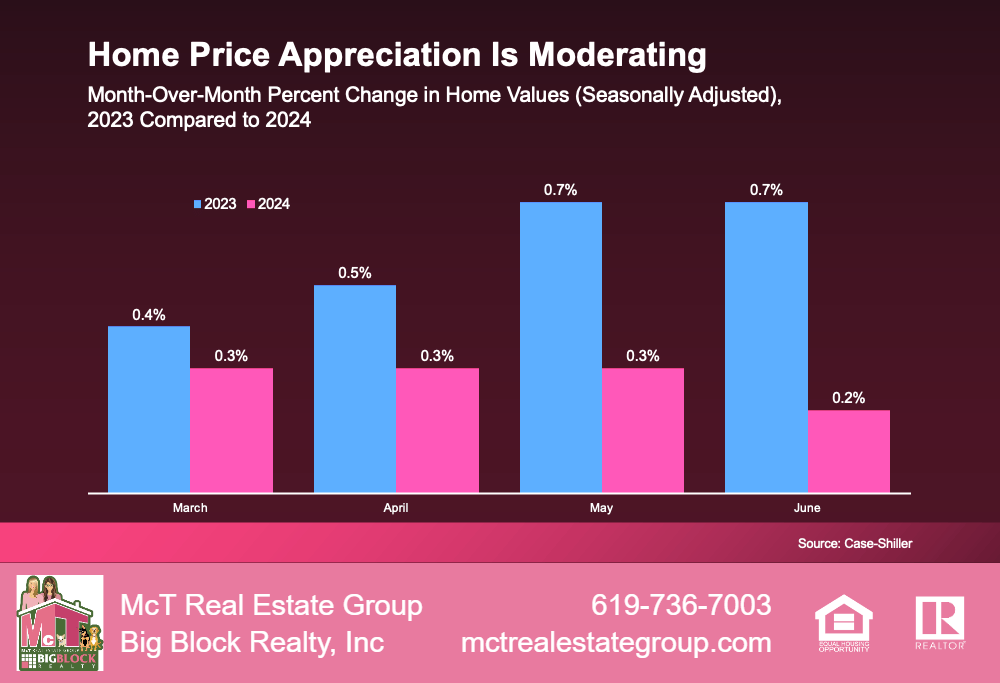

2025 is Poised for Home Price Growth

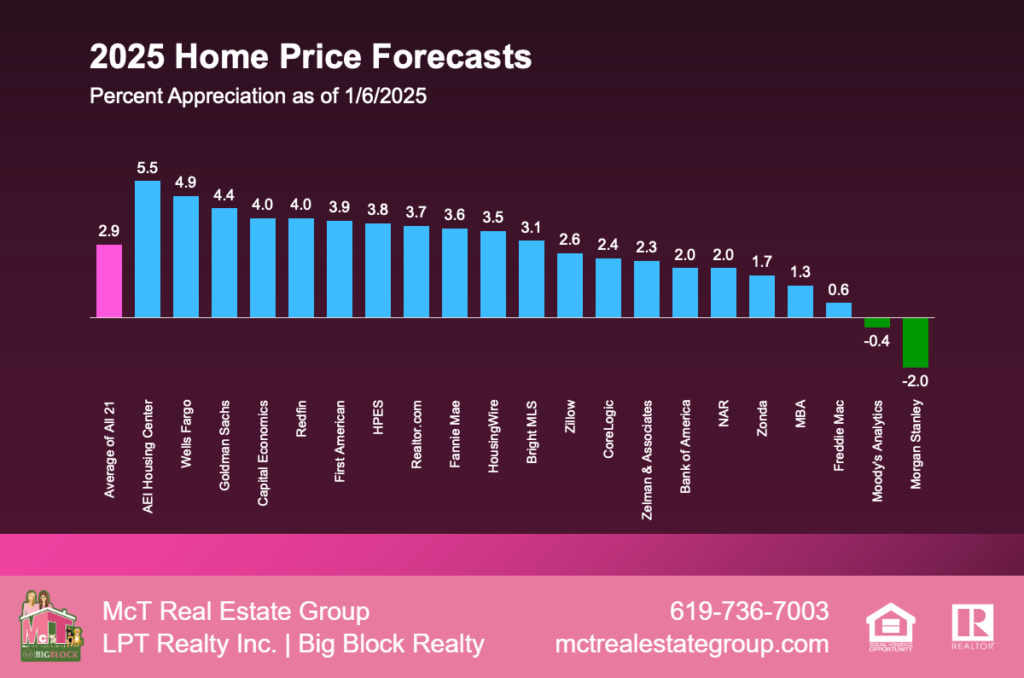

J.P. Morgan has already released their 2025 housing market outlook, which shows that home prices will increase by 3% this year. Home prices that seem costly now will appear affordable when viewed a couple of years from now and make future homebuyers think that the prices today is a steal.

The current housing market conditions show that waiting to buy will result in higher costs for potential homeowners. The market shows no signs of slowing down while maintaining solid fundamentals, regardless of interest rate changes. People who act now will have the most promising opportunity to enjoy future market appreciation.

What the Real Estate Supercycle Means for You

Real estate has always been a business for long-term thinkers. The data, demand, and economic outlook suggest that we could be entering a period of sustained growth, making now a great time to evaluate your options.

Key Takeaways:

- Real estate industry professionals believe that a supercycle may be emerging because of solid market demand and economic conditions.

- Real estate remains positive for the long term, even if interest rates rise more slowly than anticipated.

- The Housing, industrial, and logistics sectors are already showing strong investor confidence.

- Today’s opportunities risk being lost by those who choose to wait for the “perfect” moment.

While some hesitate, those who understand long-term market fundamentals are already positioning themselves for what’s next.