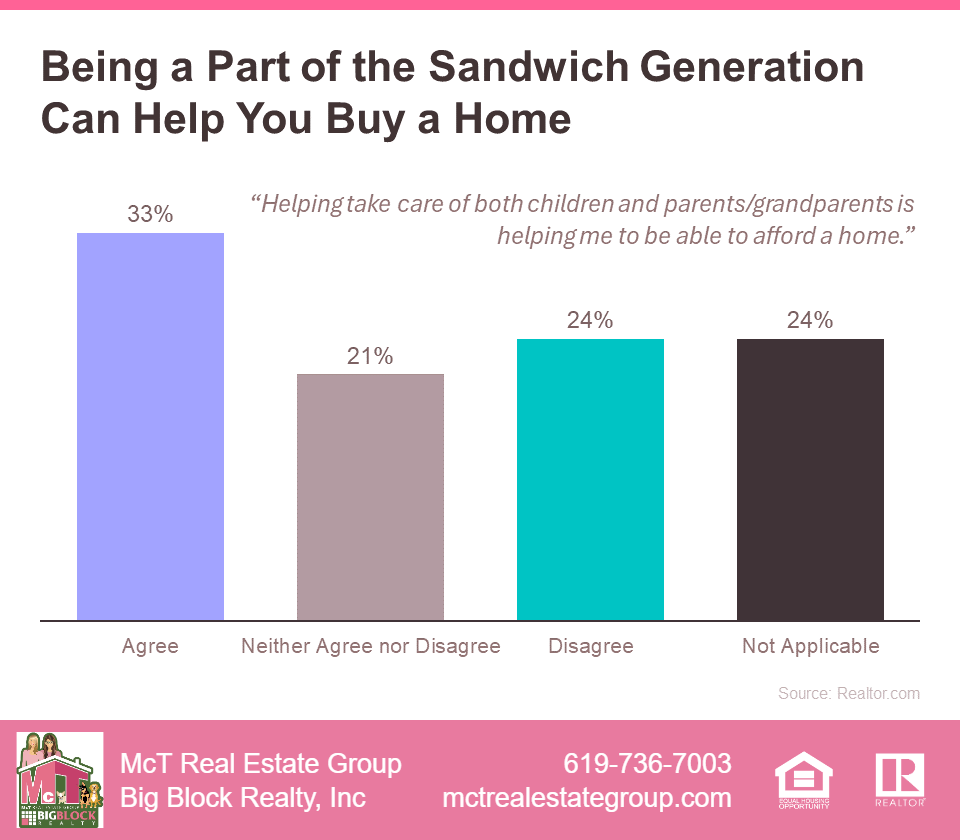

Are you familiar with the term “Sandwich Generation”? This group, highlighted by Realtor.com, consists of about one in six Americans who simultaneously care for both their children and parents or grandparents. Managing the myriad responsibilities can be daunting if you find yourself in this unique position. However, there’s a silver lining. Living in San Diego, with its family-friendly communities and strong support networks, can simplify the process of buying a home. This benefit is particularly advantageous for multi-generational living seeking to balance the demands of caring across generations. Whether you’re drawn to the vibrant culture of North Park or the quiet charm of South Park, San Diego offers a range of properties that can meet the diverse needs of your family.