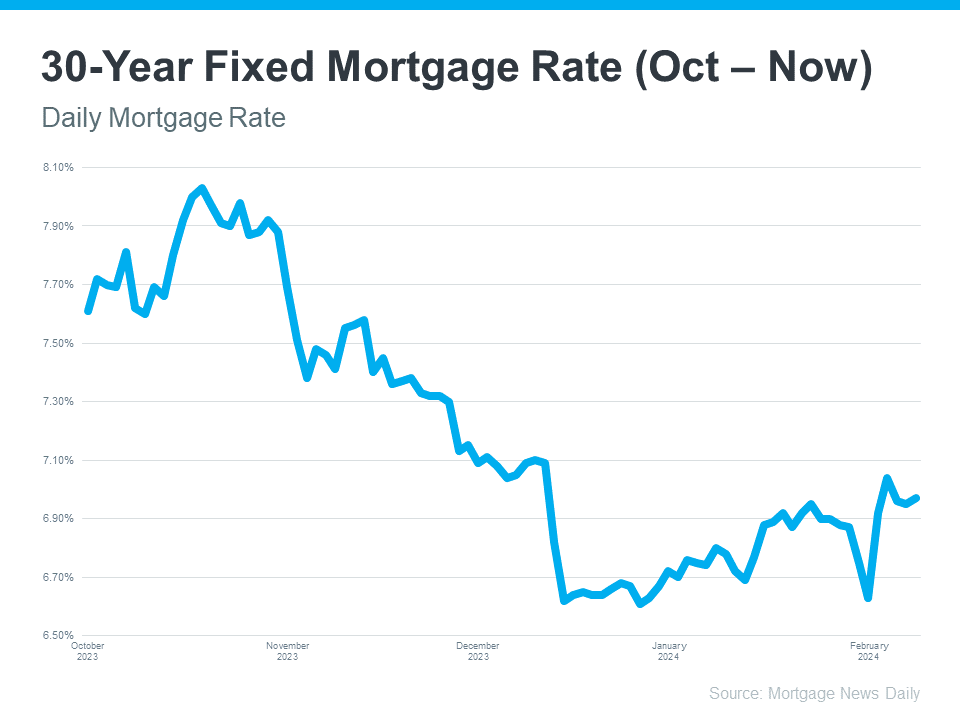

If you’re keeping an eye on the real estate market, you might be wondering about the trajectory of mortgage rates. Lately, it seems they’re poised to remain elevated for a while longer than expected. The reason? Recent economic indicators provide some clues.

Understanding the Influence of Economic Factors on Mortgage Rates

Several factors influence mortgage rates, from the job market and consumer spending to inflation rates and geopolitical tensions. A significant player in this scenario is the Federal Reserve (the Fed), particularly its decisions regarding monetary policy. Currently, these decisions are pivotal in discussions about economic forecasts.

In early 2022, the Fed began increasing the Federal Funds Rate, aiming to temper the economy and curb inflation. This rate affects the cost for banks to lend money to each other, which in turn influences mortgage rates. As a result, mortgage rates have surged significantly since the policy shift.

Despite efforts to reduce inflation, it has not yet reached the Fed’s target of 2%. The accompanying graph illustrates the inflation trend since its peak in early 2022 and its current status in relation to the Fed’s goal. Although we’re closer to achieving this target, recent months have seen a slight increase in inflation, which continues to shape the Fed’s strategies. As Sam Khater, Chief Economist at Freddie Mac, notes:

“Strong incoming economic and inflation data have led the market to reassess the trajectory of monetary policy, resulting in higher mortgage rates.”

Greg McBride, Chief Financial Analyst at Bankrate, emphasizes the long-term perspective:

“It’s the longer-term outlook for economic growth and inflation that have the greatest bearing on the level and direction of mortgage rates. Inflation, inflation, inflation — that’s really the hub on the wheel.”

Mortgage Rates in San Diego Market Context

In San Diego, a city known for its vibrant economy and dynamic real estate market, these national trends can have localized impacts. Understanding these economic undercurrents helps potential buyers and sellers in San Diego make informed decisions, enhancing their ability to navigate the complexities of the housing market amidst fluctuating mortgage rates.

This understanding is crucial, especially in a thriving urban area like San Diego, where the real estate market is as diverse and vibrant as the city itself. As we monitor these economic indicators, we remain committed to providing you with the most relevant and up-to-date information to guide your real estate decisions in San Diego.

When Will Mortgage Rates Decrease?

Are you wondering when mortgage rates will start to drop? With a vibrant backdrop of San Diego’s bustling economy and stunning coastal scenery, understanding the local real estate market is crucial. Current market trends suggest that inflation might stabilize, prompting experts to anticipate a potential decrease in the Federal Funds Rate later this year—albeit later than initially expected. As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), noted following the recent Federal Open Market Committee (FOMC) meeting:

“The FOMC did not change the federal funds target at its May meeting, as incoming data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the timing of a first rate cut. We expect mortgage rates to drop later this year, but not as far or as fast as we previously had predicted.”

This outlook means that, despite potential shifts in employment figures, economic data, or geopolitical events, mortgage rates are expected to decrease as the year progresses. However, as the market remains unpredictable, trying to pinpoint the perfect moment to engage in the market is not advisable. A Bankrate article advises:

“ . . . trying to time the market is generally a bad idea. If buying a house is the right move for you now, don’t stress about trends or economic outlooks.”

Bottom Line

If you have questions about the housing market or need guidance on how these trends could affect your plans, connect with a trusted local realtor like the McT Real Estate Group and explore your options in San Diego’s dynamic real estate landscape.