Are you feeling anxious about the current buzz surrounding San Diego’s Market Trends on Home Prices? It’s crucial to remember that these headlines only provide a glimpse of the overall narrative.

Contrary to what you might have heard, the national data paints a different picture. In fact, home prices exhibited positive growth throughout the year. While there were minor fluctuations in certain markets and occasional dips in some months on a national scale, these instances were more of an anomaly than a trend.

The bottom line? Last year saw an upward trajectory in home prices, not a decline. It’s time to delve deeper into the data to gain a clearer understanding of the situation in San Diego and beyond. Let’s separate fact from fiction and explore the real story behind the numbers.

Understanding 2024 Return to Normal Home Prices

In 2023, we witnessed a return to more typical home price growth, marking a step toward normalization in the housing market. Understanding this trend requires delving into the predictable ebbs and flows inherent in residential real estate, a phenomenon known as seasonality.

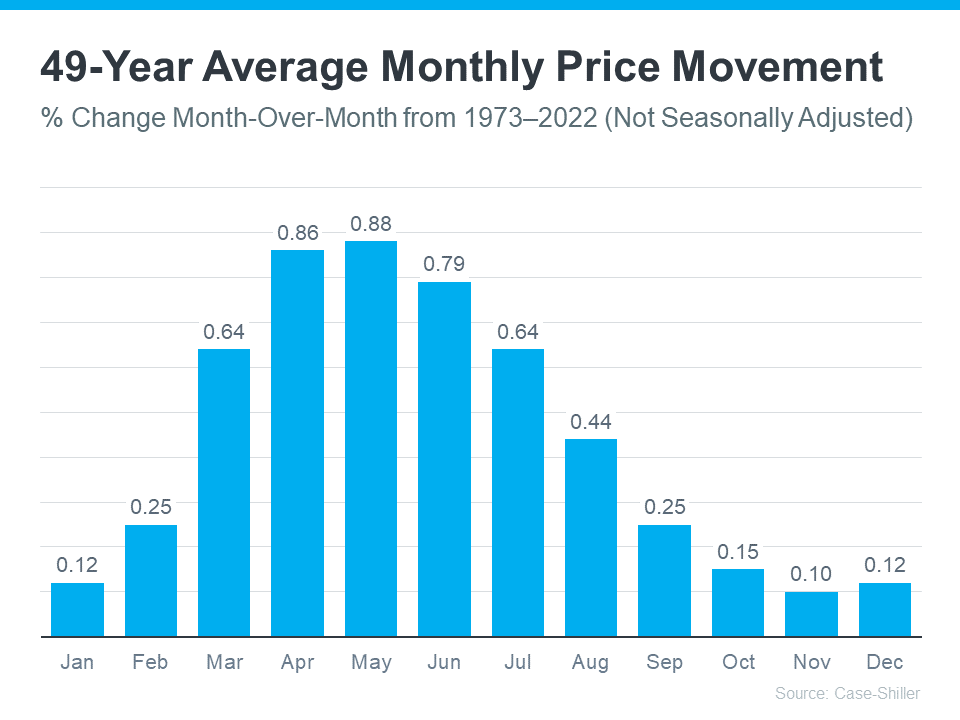

Traditionally, spring emerges as the peak homebuying season, characterized by heightened market activity. Summer maintains this momentum before a gradual decline sets in towards the year’s end. Correspondingly, home prices tend to surge during periods of high demand, aligning with the ebbs and flows of the market.

Analyzing data from Case-Shiller spanning nearly five decades unveils a consistent pattern of home price fluctuations mirroring market seasonality. At the onset of each year, prices exhibit moderate growth, reflecting decreased market activity during the winter months. As spring ushers in the peak homebuying season, both market activity and home prices escalate. Conversely, as autumn approaches, market activity recedes, resulting in slower price growth.

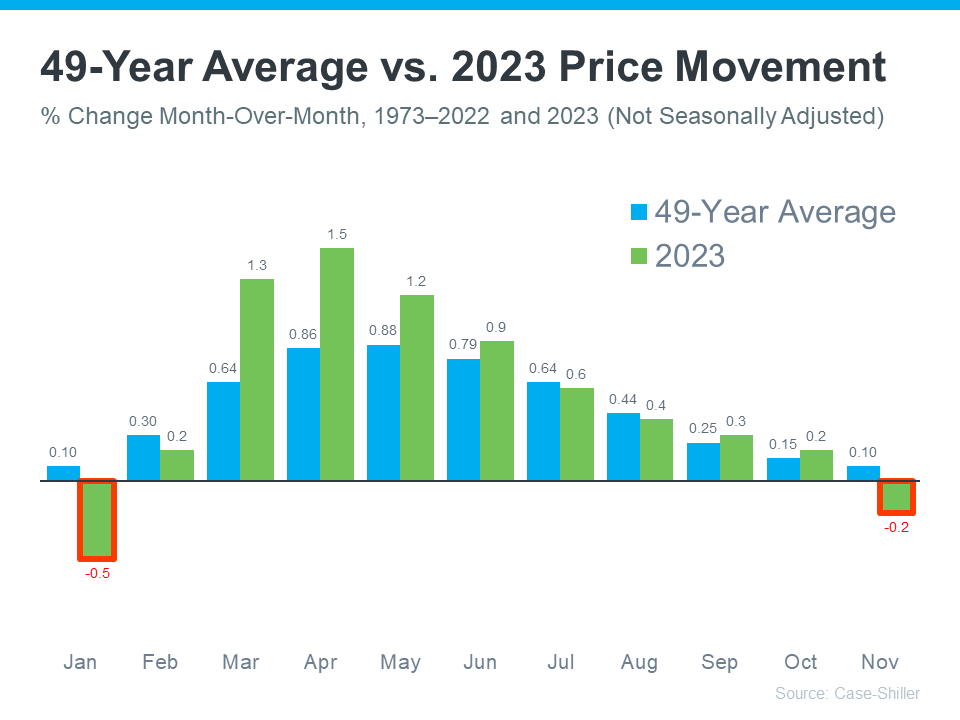

Examining the data for 2023, illustrated by the green bars atop the long-term trend (depicted in blue), reveals a convergence with historical trends on home prices as the year progresses. Notably, the green bars closely align with the blue bars in the latter part of the year, indicating a more consistent level of appreciation.

Despite this nuanced analysis, media headlines predominantly spotlighted specific data points, overlooking broader contextual insights. It’s crucial to understand that moderate price adjustments during fall and winter months are typical, reflecting seasonal patterns. Considering the 49-year average, which hovers close to zero during these periods, slight declines are not uncommon and should be viewed as transient fluctuations within a broader upward trajectory in home prices throughout the year.

What You Should Keep in Mind

Rather than getting caught up in the minor fluctuations from month to month highlighted in headlines, it’s crucial to look at the broader, year-long trends. Focusing solely on these short-term changes can paint an incomplete picture of the real estate market.

Consider the shift we witnessed last year, where seasonality returned to the housing market—a positive development following the unsustainable surge in home prices during the pandemic’s peak years.

And if you’re concerned about a potential decline in home prices, rest assured that such worries may be unfounded. Projections for this year suggest that prices will continue to rise. This expectation stems from factors such as decreasing mortgage rates compared to last year, enticing more buyers back into the market. Simultaneously, the supply of homes for sale remains limited, further driving up prices as demand intensifies.

In San Diego, these trends hold particularly true, with the local market exhibiting similar dynamics. Understanding these broader trends can provide a clearer perspective for homeowners and prospective buyers alike, allowing for more informed decisions in navigating the real estate landscape.