Have you come across sensational headlines discussing a surge in foreclosures within today’s real estate market? If these articles have left you with a sense of uncertainty about the future and what to do, it’s essential to recognize that such clickbait titles often lack the comprehensive context needed to make some well-informed decisions.

In reality, when you juxtapose the present data with historical market trends, you’ll quickly realize that there’s no cause for alarm. These headlines tend to focus on isolated events rather than the broader, more stable market picture. By considering the bigger picture, you can make more confident and well-informed decisions regarding your real estate endeavors. Rest assured, that San Diego foreclosure rates remain below average and continue to exhibit resilience and offer opportunities for both buyers and sellers alike.

Putting the Headlines into Perspective

The media’s recent emphasis on the increase in foreclosure rates can be somewhat misleading. This emphasis arises from their comparison of current figures to a period when foreclosures were at historically low levels, creating an impression of greater significance than the actual situation warrants.

In the years 2020 and 2021, a combination of the moratorium and forbearance programs proved instrumental in assisting countless homeowners in maintaining their residences. These initiatives provided a lifeline, allowing homeowners to regain their financial footing during an exceptionally challenging period or what we usually refer to as the pre and post-pandemic years.

With the conclusion of the moratorium, it was only natural to anticipate a rise in foreclosure numbers. However, it’s important to note that an increase in foreclosure rates doesn’t necessarily signal trouble in the housing market. It’s more a return to a more typical state of affairs rather than an impending crisis

Based on Data There Isn’t a Wave of Foreclosures Coming Anytime Soon

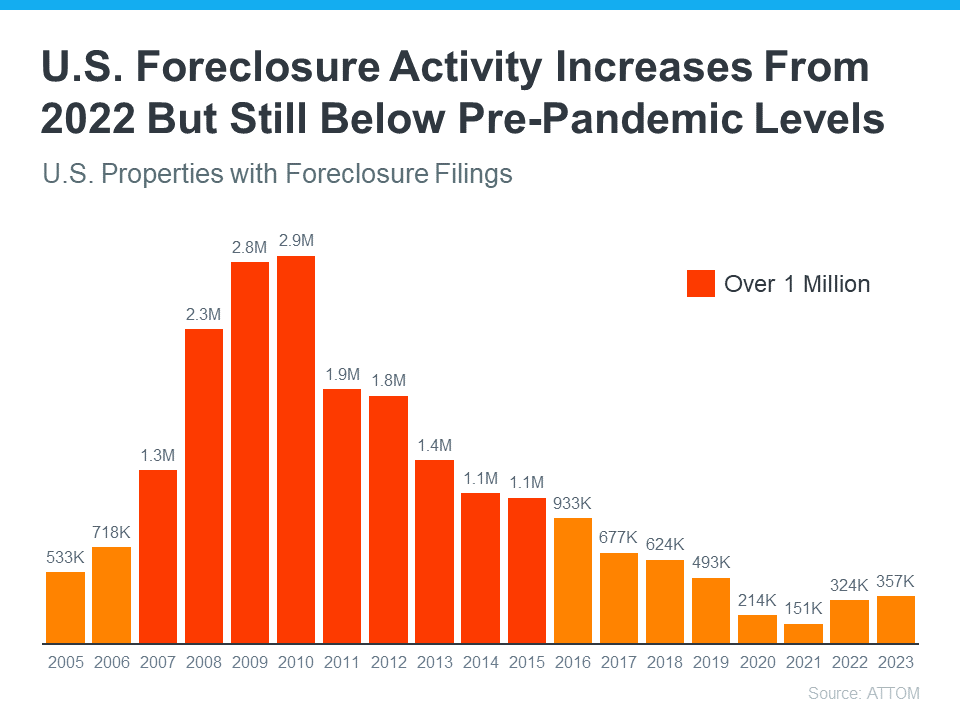

Let’s dig into the historical data to gain a clearer perspective on the current foreclosure situation. Instead of merely comparing recent figures to the anomalies of the past few years, a more insightful approach is to assess the long-term trends—specifically, those stemming from the housing market crash, a concern many share.

Direct your attention to the graph below, which draws on foreclosure data sourced from ATTOM, a trusted property data provider. The chart distinctly illustrates that foreclosure activity has consistently remained at lower levels (depicted in orange) since the tumultuous events of the 2008 housing crash (highlighted in red)

Now, let’s dive into the recent report on foreclosure filings. Although there has been an increase in these filings, it’s crucial to emphasize that the current situation bears no resemblance to the past housing crisis. In fact, we haven’t even reached the foreclosure rates seen in more typical years, such as 2019. Rick Sharga, Founder and CEO of the CJ Patrick Company, sheds light on this:

“Foreclosure activity is still only at about 60% of pre-pandemic levels. . .”

This trend primarily results from today’s buyers having stronger qualifications, making them less prone to loan defaults. Delinquency rates continue to remain at minimal levels, and the majority of homeowners possess substantial equity, safeguarding them from foreclosure. As Molly Boesel, Principal Economist at CoreLogic, aptly states:

“U.S. mortgage delinquency rates remained healthy in October, with the overall delinquency rate unchanged from a year earlier and the serious delinquency rate remaining at a historic low… borrowers in later stages of delinquencies are finding alternatives to defaulting on their home loans.”

In reality, although foreclosure rates are on the rise, the current market situation doesn’t indicate a full-blown crisis. Instead, it signals a shift in the market’s trajectory. The data reveals that we’re not currently facing a foreclosure crisis, nor is it the direction in which the market is moving

Conclusion on San Diego Foreclosure Rates

In summary, while the housing market is currently witnessing a predicted increase in foreclosures, it’s essential to stress that we are far from the dire crisis levels that occurred during the housing bubble collapse. These fluctuations are part of a natural market ebb and flow. If you find yourself perplexed by the information you come across regarding the housing market, don’t hesitate to reach out to an expert local real estate team like the McT Real Estate Group; We’re here to provide you with clarity and guidance, ensuring you make informed decisions during this dynamic real estate landscape.

Rise in Home Prices for 2024: What Industry Experts Forecast