Understanding Home Equity in San Diego

Equity is a straightforward concept. As Freddie Mac puts it:

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.”

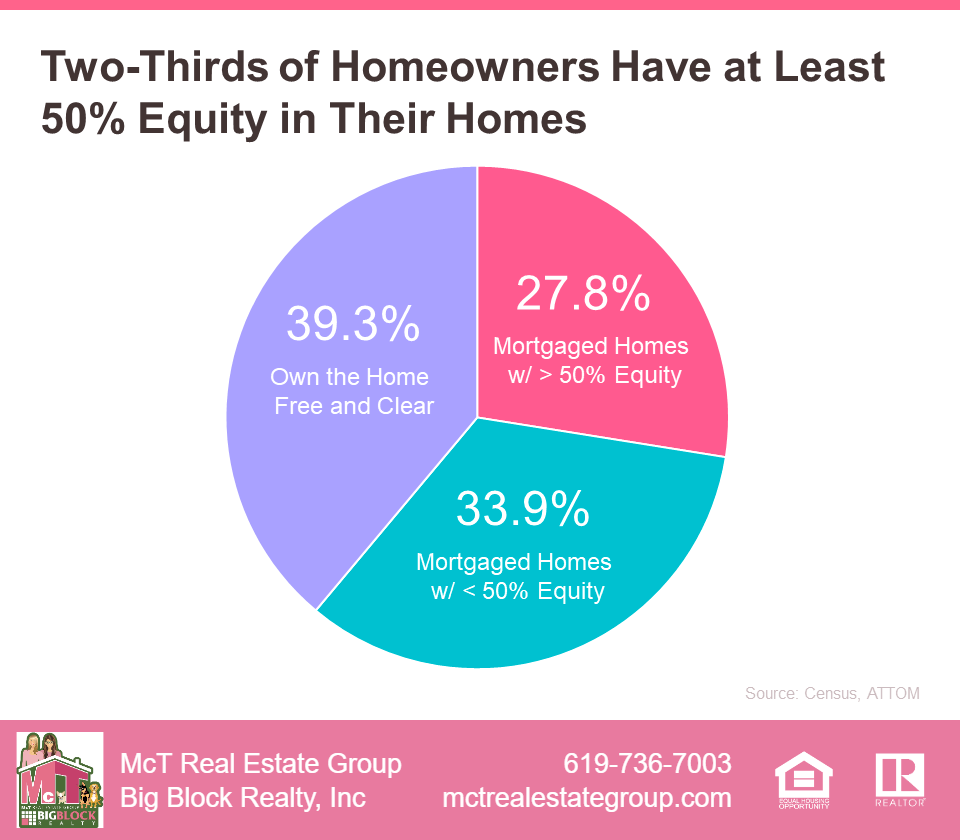

Equity builds as you pay off your mortgage and as home prices rise. Thanks to recent years’ significant home price appreciation, you likely have more equity than you realize. Recent data from the Census and ATTOM reveals that more than two-thirds of homeowners have either completely paid off their mortgages or have at least 50% equity in their homes. This means that most homeowners now have substantial equity, which can be transformative.

This increase in equity is especially advantageous in San Diego. The real estate market, diverse neighborhoods, and attractive living conditions make it a prime area for leveraging home equity. Whether you’re looking to upgrade to a larger home, downsize, or invest in another property, your increased equity can provide the financial means to make these moves possible.

You’re in a great position with San Diego’s strong real estate market and your growing home equity. Take this opportunity to explore your options and maximize your investment in one of California’s most desirable locations.

How Your Equity Can Help Fuel Your Move

Selling your house can provide substantial equity, greatly simplifying your next move, even with today’s mortgage rates. As Danielle Hale, Chief Economist for Realtor.com, points out:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

This is particularly important in San Diego’s booming real estate market. Here are some ways you can use you can unlock your equity when buying your next home:

-

Become an all-cash buyer

If you’ve lived in your current home for many years, your equity might be enough to buy your next home outright, eliminating the need for a loan and concerns about mortgage rates.

-

Make a larger down payment

You can use your equity to make a bigger down payment on your next home. This reduces the amount you need to borrow, making current mortgage rates less impactful.

A strong equity position can be a significant advantage in San Diego’s popular neighborhoods, such as North Park and South Park. Whether upgrading, downsizing, or relocating within the city, leveraging your home equity can make your move smoother and more financially rewarding.

The First Step: Determine Your Home’s Equity

Want to find out how much equity you have? Here’s what you need:

- Your current mortgage balance

- The current value of your home

Your mortgage balance is easily found on your monthly mortgage statement. To know your home’s market value, you could pay for an appraisal or contact a local real estate agent for a free professional equity assessment report.

By connecting with a trusted local agent and getting these numbers, you’re one step closer to making a move you might not have thought possible—all thanks to your equity. In San Diego’s competitive market and desirable neighborhoods, knowing your equity can open up many opportunities for buying a new home or investing in property.

Bottom Line to Unlock Your Equity to Buy a Home in San Diego

If you’re curious about how much equity you have and how it can help you make your next move in San Diego, let’s connect. San Diego is a vibrant city with beautiful neighborhoods like North Park and South Park, offering a variety of opportunities for both buyers and sellers. Whether you’re looking to upgrade, downsize, or invest in a new property, understanding your equity is a crucial step. Reach out to the McT Real Estate Group today, and we’ll guide you through the process, ensuring you make the most informed decision for your future in this amazing city.