Curious about what the housing market will look like in 2025? You’re not alone. The latest expert predictions point to some encouraging trends, particularly around two of the biggest factors affecting your real estate decisions: mortgage rates and home prices.

If you’re planning to buy or sell a home, these insights could have a big impact on your timing and strategy. Let’s dive into what the experts are forecasting for the upcoming year and how it might influence your next move in San Diego’s competitive market. Whether you’re considering settling in North Park, South Park, or any of the metro neighborhoods, staying informed on these market shifts will help you make smarter choices.

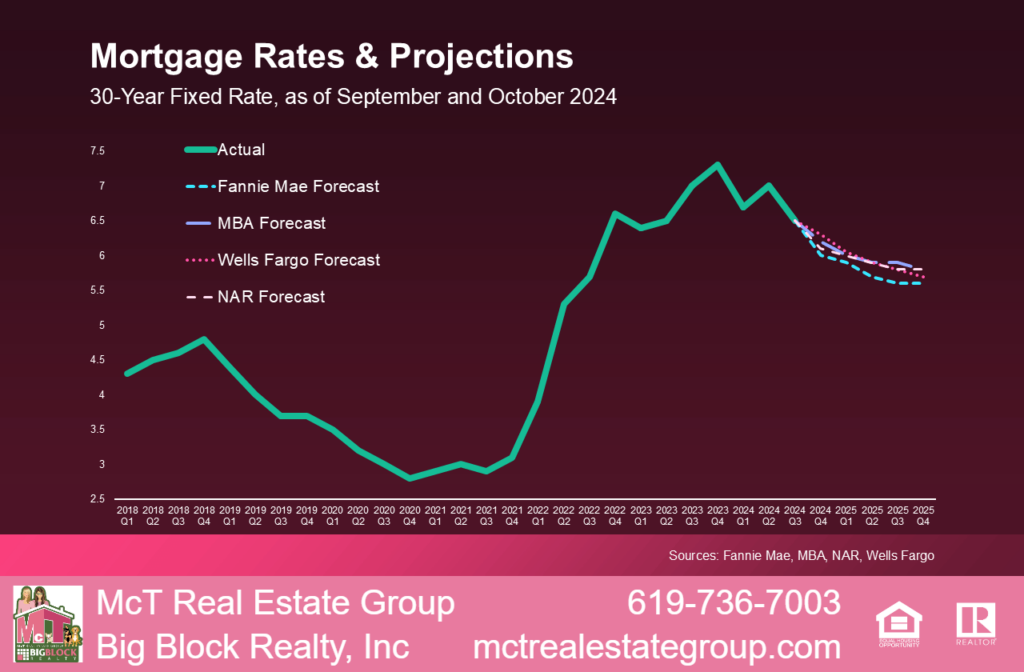

Mortgage Rates in 2025 Are Expected to Drop

Mortgage rates are a major factor when you’re considering buying or selling a home, and there’s good news on the horizon. Experts predict that after the sharp increases in recent years, rates will gradually ease throughout 2025.

While we won’t see rates drop in a straight line, the overall trend should move downward as the year progresses. There might be some fluctuations along the way, with rates responding to fresh economic data and inflation reports, but don’t let these short-term changes distract you. It’s the long-term trend that matters most for your decision-making process.

Lower mortgage rates translate to increased affordability. When rates come down, your monthly mortgage payment will decrease, allowing you more flexibility in what you can afford. This shift makes buying a home more accessible, which is a big win if you’re looking to enter the market in neighborhoods like North Park, South Park, or other popular neighborhoods in San Diego.

However, as mortgage rates fall, more buyers are likely to jump back into the market.

Charlie Dougherty, Director and Senior Economist at Wells Fargo, highlights this by saying

“Lower financing costs will likely boost demand by pulling affordability-crunched buyers off of the sidelines.”

When that happens, competition for available homes will increase, and inventory could tighten.

So, what’s the takeaway? By understanding these shifts now, you can position yourself ahead of the crowd. Work with your real estate agent to stay informed on how mortgage rates are influencing buyer demand in your local market. Being prepared helps you navigate the competition and make smart decisions, whether you’re buying or selling.

Home Prices Are Projected to See Modest Growth

Mortgage rates are set to decline, but home prices will still rise, just at a much slower rate than we’ve seen recently. Experts predict home prices will increase by about 2.5% nationwide in 2025, a significant shift from the rapid, double-digit growth of past years. This steady rise makes it much easier for buyers to enter the market.

So, what’s driving the continued rise in prices? It all boils down to supply and demand. As more buyers re-enter the market due to falling mortgage rates, demand will rise. At the same time, sellers who were previously hesitant due to high rates are more likely to list their homes, increasing inventory. With more homes available, prices should rise at a more sustainable pace—creating a healthier balance for both buyers and sellers.

Local Market Conditions May Vary

While these national projections offer a general outlook, the housing market can vary greatly from one region to another. For instance, some areas might experience faster price growth, while others could see more gradual increases or even flat prices.

As Lance Lambert, Co-Founder of ResiClub, points out:

“Even if the average national home price forecast for 2025 is correct, it’s possible that some regional housing markets could see mild home price declines, while some markets could still see elevated appreciation. That has been, after all, the case this year.”

Even in markets where prices may flatten or dip slightly, the substantial appreciation of recent years means that homeowners are still in a strong position. That’s why it’s essential to consult with a local real estate expert who understands the trends in your specific area—whether you’re looking to buy or sell in neighborhoods like North Park, South Park, or other metro areas of San Diego. Local market knowledge is key to navigating the next steps with confidence and making informed decisions.

Bottom Line on What to Expect with Home Prices and Mortgage Rates in 2025

With mortgage rates expected to drop and home prices forecasted to grow at a steadier pace, 2025 is looking like a more favorable year for both buyers and sellers. Whether you’re planning to purchase your first home or sell your current property, these trends could present great opportunities.

If you have any questions about how these changes could affect your specific situation, reach out. Having a local expert like the McT Real Estate Group by your side will help you navigate the San Diego market with ease and take advantage of what’s coming next.