I assume many of us still can recall the housing downturn of 2008, even if most of us weren’t homeowners back then. I mean, who wouldn’t, right? it was very controversial and a sight for sore eyes. If you’re feeling a bit uneasy and some tension about a repeat of those events, here’s a comforting thought you might want to hear from us: the current real estate landscape differs substantially from that of 2008. A key factor to note is the shortage and inventory of homes on the market right now. Essentially, we’re looking at a situation where demand exceeds supply, which is the opposite of what triggered the 2008 market crash. For a market crash scenario, there’d have to be a glut of homes available, and the current stats just aren’t pointing in that direction quite yet.

So, where do we get our housing stock from?

- Current homeowners putting up their properties for sale

- Brand-new constructions

- Properties in distress, like foreclosures or ones being sold for less than owed

Let’s delve deeper into today’s property market to grasp why it’s distinct from the 2008 situation.

Current homeowners putting up their properties for sale

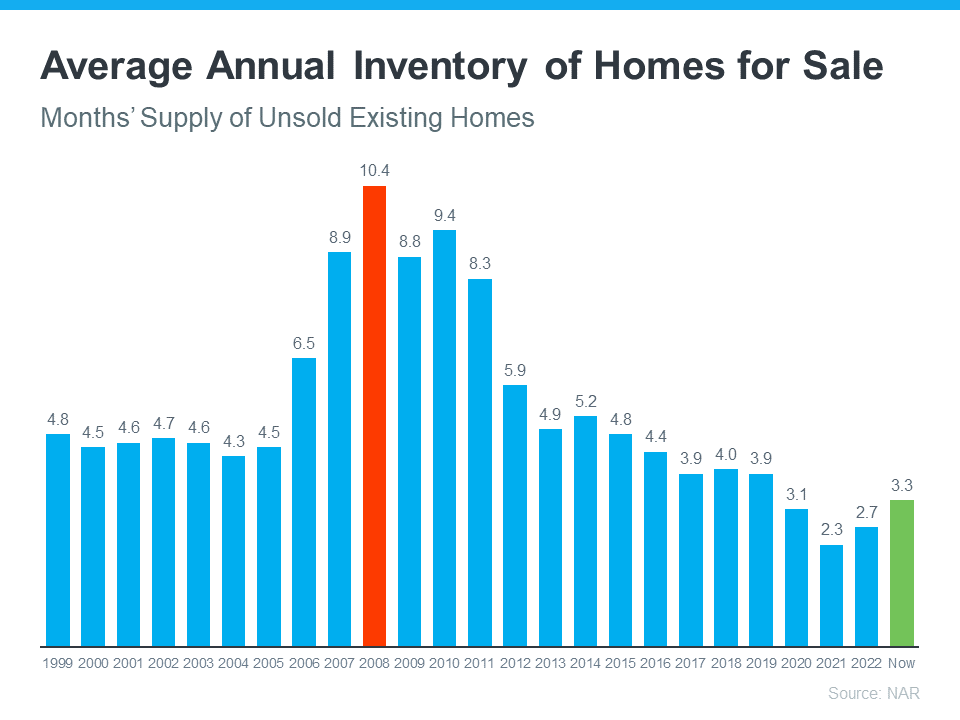

In our recent look at the housing market, even though there’s been a bit of a bump in the number of homes available compared to last year, we’re still not seeing heaps out there. When you put today’s numbers side by side with what we had in 2008, it’s a bit startling. The chart we’ve included below breaks it down, and you’ll notice that our present-day listings (highlighted in green) are only around a third of what we had back in the 2008 days (marked in red). It’s quite the change!

So, breaking it down simply: there’s a scarcity of homes on the market, which means property values aren’t going down any time soon. For us to relive the 2008 scenario, we’d see tons of homeowners selling with hardly anyone buying. And honestly, that’s just not the scene we’re witnessing at the moment.

Brand-New Constructions Inventory

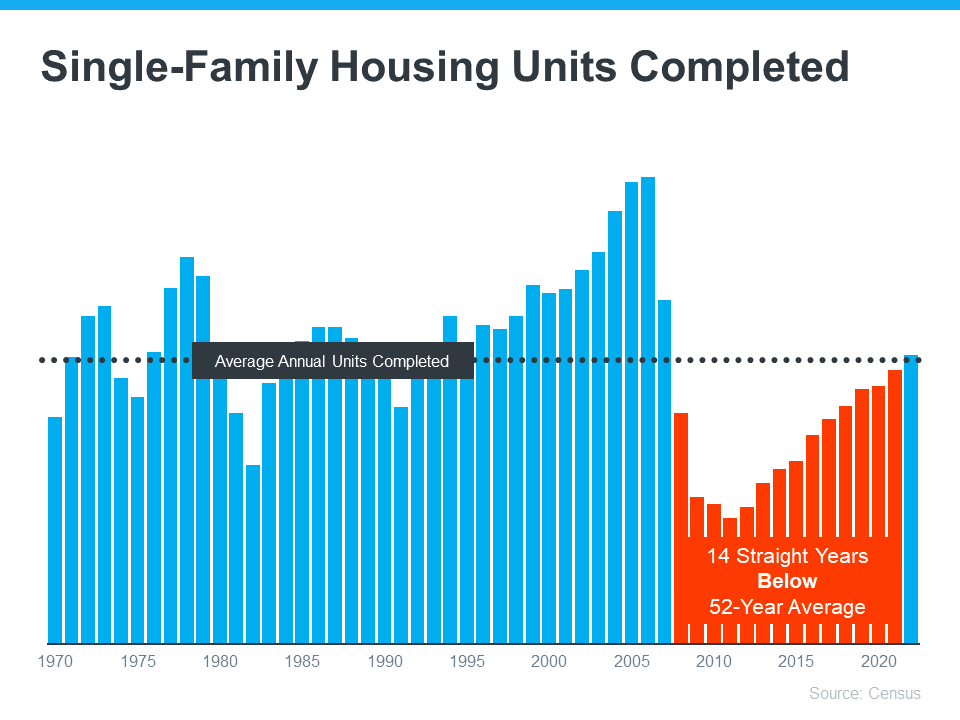

Folks seem to be buzzing about the trends in newly constructed homes lately. This might lead you to ponder, “Are builders perhaps going a bit overboard?” Take a look at the chart below, which displays the count of new homes constructed over the past half-century.

For the past 14 years, marked in red, there’s been a noticeable shortfall in home construction. Essentially, homebuilders haven’t been producing enough residences for quite some time, leading to a marked dip in available housing.

Even though the last blue bar on the chart indicates a resurgence in building, nearing the long-term average, it won’t immediately lead to a surplus of homes. The existing deficit is just too vast to close swiftly. Furthermore, builders are now more cautious, aiming to avoid the mistakes of overproduction that occurred during the housing bubble.

Properties in distress, like foreclosures or ones being sold for less than owed

The final source of property listings can sometimes be homes in distress, such as those under short sales or foreclosures. Remember the housing turmoil a while back? That period saw a surge in foreclosed homes, mostly because quite a few folks got mortgages that, in hindsight, stretched their budgets too thin.

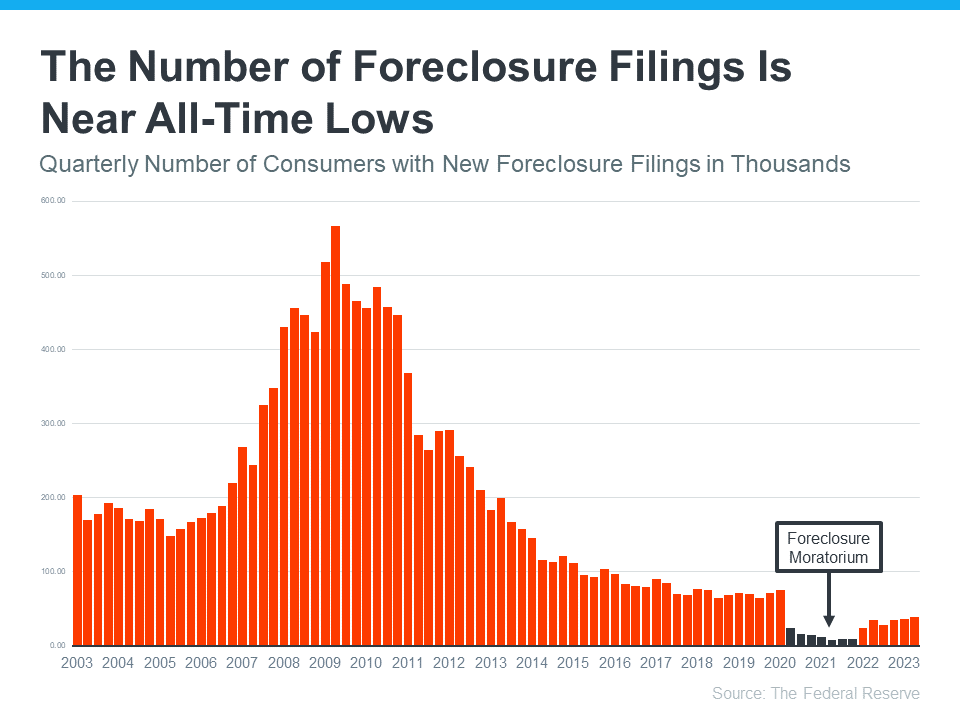

Fast forward to today, and the scene has transformed. With stricter lending criteria in place, we’re seeing more genuine homebuyers and a significant drop in foreclosures. Check out the graph below, which leans on Federal Reserve data, to grasp the striking difference since those turbulent times:

The chart shows a clear trend: as lenders became stricter and buyers more informed, foreclosure rates began to drop. The years 2020 and 2021 saw a significant change. Thanks to the introduction of the moratorium on foreclosures and the forbearance program, we didn’t experience the foreclosure surge reminiscent of 2008.

The forbearance initiative was pivotal. It introduced homeowners to previously unavailable alternatives such as loan deferrals and alterations. Current statistics reveal that 4 out of 5 homeowners exiting forbearance have either settled their dues or established a repayment strategy to bypass foreclosure. These factors strongly suggest that we’re unlikely to witness a large influx of foreclosures in the market.

How Does This Impact You, Personally?

For our readers curious about the housing market, it’s worth noting that we currently don’t have enough homes on the market to see a significant drop in prices or a major downturn. Based on insights from Bankrate, this trend doesn’t seem to be changing in the near future, especially with buyers continuing to show keen interest.

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equationsimply won’t allow a price crash in the near future.”

In Summary

Given the current housing supply, we’re not in a position to see a rerun of the 2008 property downturn. The signs from the available inventory indicate that we’re not headed for a market collapse in the foreseeable future. So, if you’re ever planning on buying or selling a home, feel free to reach out to the McT Real Estate Group team for your real estate needs.