Thinking about selling your home but not quite sure just yet? With the housing market in San Diego gradually becoming more affordable this year, it’s understandable if you’re still a little bit hesitant. However, the real game-changer could be your home equity. Knowing just how much equity you’ve built up in your San Diego home throughout the years can significantly simplify your decision-making process. A helpful piece from Bankrate sheds light on this, highlighting how understanding your home’s equity can unlock new possibilities for homeowners like you.

“Home equity is the difference between your home’s value and the amount you still owe on your mortgage. It represents the paid-off portion of your home.You’ll start off with a certain level of equity when you make your down payment to buy the home, then continue to build equity as you pay down your mortgage. You’ll also build equity over time as your home’s value increases.”

Let’s break down equity into a straightforward concept—it’s basically your home’s current value minus any outstanding mortgage balance. And here’s some exciting news: your equity might have increased significantly without you even realizing it.

Over the recent years, we’ve seen home prices in San Diego soar to new heights. This surge means the value of your home—and consequently, your equity—has probably climbed much higher than you anticipated. For many homeowners, this translates into a pleasantly surprising boost in their financial position, thanks to the vibrant San Diego real estate market. So, you might be sitting on more equity than you initially thought, giving you a fantastic advantage if you’re considering selling.

Unlocking Your Home Equity: A San Diego Homeowner’s Guide

Are you thinking about making a move in sunny San Diego? Your home’s equity might just be the key to your next big step. With our city’s vibrant neighborhoods and stunning coastal views, San Diego’s real estate market is uniquely positioned. CoreLogic’s latest insights reveal…

“. . . the average U.S. homeowner with a mortgage still has more than $300,000 in equity . . .”

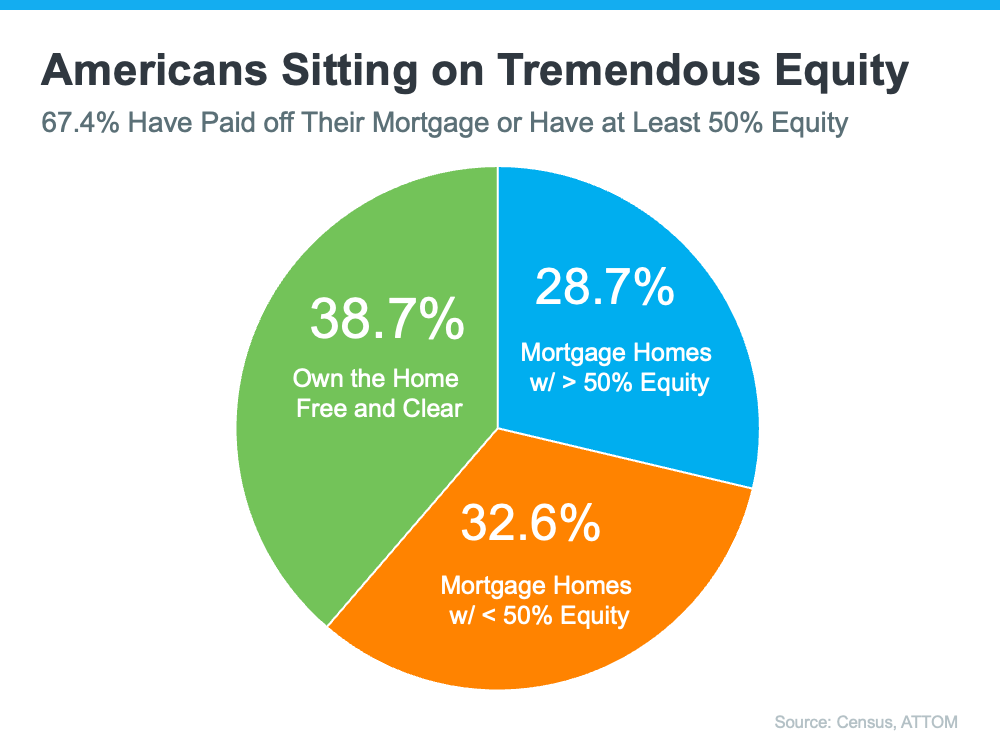

If you own a home in San Diego, these are exciting times. Recent data from the Census and ATTOM reveals a promising trend: over two-thirds of homeowners are sitting on a significant financial cushion. Many have fully paid off their mortgages, highlighted in green on the chart below, while others boast at least 50% equity in their homes, marked in blue. This financial boon positions homeowners throughout the country in a unique spot to capitalize on their home equity, reflecting the robust health of the real estate market in this sun-kissed city.

In San Diego’s real estate market, a whopping 70% of homeowners are sitting on a goldmine of equity in their current homes. This substantial equity isn’t just a number on paper; it’s a powerful tool that can pave the way for your next big move.

When it’s time to sell your home, this equity can transform your buying experience. Imagine stepping into the market as an all-cash buyer. For many who’ve called their San Diego home for years, this isn’t just a dream. The equity you’ve built up over time could be enough to purchase your next home outright, freeing you from the need to secure a new mortgage. This means no loan applications, no interest rate worries, and a much smoother buying process.

Be An All Cash Buyer

Investopedia highlights the advantages of being an all-cash buyer, including stronger offers and a faster closing process. In a competitive market like San Diego, where every advantage counts, leveraging your home equity could be the game-changer that sets you apart.

“You may want to pay cash for your home if you’re shopping in a competitive housing market, or if you’d like to save money on mortgage interest. It could help you close a deal and beat out other buyers.”

Leverage Your Home Equity for a Bigger Down Payment

Unlocking the potential of your home equity can significantly impact your next property purchase. Imagine using that built-up value to boost your down payment on a new home. In San Diego’s vibrant real estate market, this strategy could not only reduce the amount you need to borrow but also position you advantageously for a smoother financial future. The concept is straightforward: the more you can put down upfront, the less you’ll need to finance. This approach not only lowers your monthly mortgage payments but could also result in more favorable loan terms. According to The Mortgage Reports, utilizing your equity in this manner is a smart move that can pay off in both the short and long term, making your transition to a new home in San Diego smoother and more financially manageable.

“Borrowers who put down more money typically receive better interest rates from lenders. This is due to the fact that a larger down payment lowers the lender’s risk because the borrower has more equity in the home from the beginning.”

Unlocking Your Home’s Value in San Diego

Unlocking the true value of your San Diego home begins with understanding the equity you’ve built over time. To get a clear picture, consider reaching out to a trusted real estate professional for a Professional Equity Assessment Report (PEAR). This crucial step not only reveals your home’s current market value but also guides you in making informed decisions, whether you’re thinking of selling or refinancing. In our ever-changing San Diego real estate market, having up-to-date equity information is essential for homeowners looking to capitalize on their investments.

Final Thoughts

Considering a change of scenery in San Diego? Your home’s equity could be the key to a smooth transition. Let’s touch base to explore how much equity you’ve built up and discuss how it can be your advantage in securing your next dream home. With San Diego’s vibrant market, leveraging your equity could open doors to incredible opportunities.