Are you thinking of buying a home in San Diego this year?

People often receive various pieces of advice about homebuying, yet the most common advice you would hear is:

- Just wait for interest rates to decrease or drop.

- Home prices currently stand at unaffordable levels, so it’s best not to buy right now.

- The current market conditions make this the ideal moment to purchase a property.

Well, here’s the thing: no one really has a crystal ball that can predict the future. The decision to buy now depends on how long you intend to remain in your home.

Real estate success depends most heavily on time. Let’s break it down and give you the best home-buying tips we can offer.

The Longer You Stay, The More You Gain

The decision to buy a home should be avoided when you plan to stay in a house for less than two years. The combination of closing expenses, property taxes, and maintenance costs will quickly exceed what you can gain from home appreciation before you sell. The calculation does not include capital gains and tax liabilities that occur when you sell your home within two years of purchase. Also, if you buy a house in San Diego, you don’t know what the market will be like in less than two years. What if you have to sell, and at that time, the market is taking a dip?

But, what if you plan to stay longer? The average American homeowner maintains residence in their home for approximately 11.8 years, according to Redfin data. Historical data shows that home price appreciation will benefit you more in the long term if you intend to stay in your home for an extended period of time.

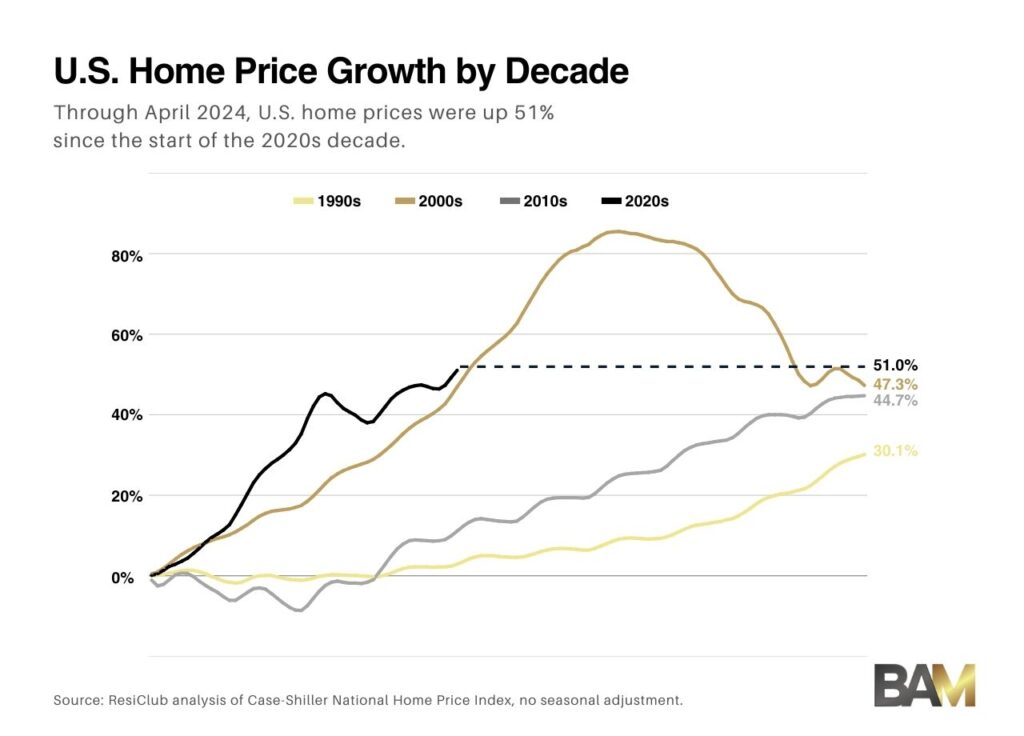

ResiClub conducted an analysis that revealed that U.S. home prices have escalated by at least 30% every decade. Also, the great recession did not stop homeowners who owned their properties for ten years or longer from experiencing price appreciation at the time of sale. Here’s a great homebuying tip: the market experiences short-term fluctuations, but long-term homeowners achieve better results, according to data.

Zillow reports that home prices have increased by 45.3% since February 2020 according to the latest data which shows that home values have grown by a decade’s worth of growth in just five years.

Home Buying vs. Renting: What Makes Sense for You?

The main question is not “Is now a good time to buy?”—it is “How long am I staying?”

Buy if you’re planning to stay for at least 10 years.

- You’ll have time to build equity and ride out market fluctuations.

- Home prices historically trend upward over the long run.

- You’re locking in a fixed cost instead of dealing with rising rents.

Rent if you might move in the next one to two years instead of home buying.

- Selling too soon could mean losing money on transaction costs.

- You’ll have more flexibility if your job or lifestyle changes.

- Renting may be the smarter financial move for short-term plans.

What if you’re in the middle, planning to stay for five to seven years?

- Look at local appreciation trends. Some cities see faster price growth than others.

- Compare your potential mortgage vs. rent. In some areas, buying still wins.

- Consider buying a property with rental potential, so you have options if you need to move.

The Bottom Line on Homebuying Tips: Should You Buy a Home in 2025?

The task of perfectly timing market movements remains almost impossible for investors. Your decision to buy a home now makes sense if you plan to stay in your next house for at least 10 years and have enough money for the current monthly payments.

We should discuss more homebuying tips if you need help determining your best course of action. We will examine your current situation before evaluating all available choices. The decision to purchase a home extends beyond current market conditions. Your future plans determine the decision you should make.