If you’ve been staying updated on current events, you’ve likely stumbled upon reports discussing the rising trend of foreclosure rates in today’s housing market. This might stir up memories of the housing crash in 2008, possibly leaving you feeling concerned about what lies ahead, particularly if you experienced homeownership during that tumultuous time and saw how many San Diego foreclosures there were during that time period.

However, it’s essential to understand that despite the uptick, we’re not heading towards another foreclosure crisis. Let’s delve into the latest statistics and compare them with historical data to provide a clearer picture of the situation, especially in San Diego.

Unveiling the Truth: Putting the Current Foreclosure Rates into Perspective

Despite alarming foreclosure trends in San Diego, it doesn’t herald a crisis akin to 2008. Understanding the situation requires a closer look beyond sensationalism.

Firstly, let’s address the context. San Diego’s foreclosure surge contrasts sharply with historically low rates. Just a few years ago, initiatives like moratoriums and forbearance programs shielded countless homeowners, keeping foreclosure rates unusually low. With these protections now expired, it’s natural to see an increase in foreclosures. However, this uptick is expected and not cause for alarm. A rise in filings of foreclosed homes in San Diego doesn’t spell doom for the housing market.

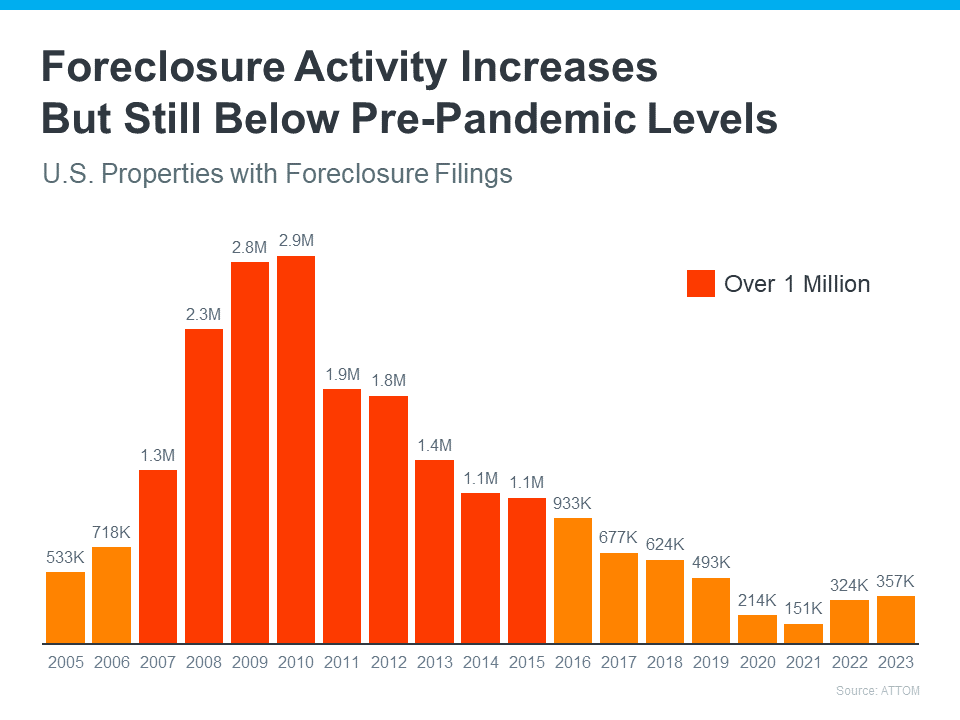

To put things in perspective, let’s compare the aftermath of the 2008 crash, which is still fresh in many minds. Data from leading property data provider ATTOM shows a consistent decline in foreclosures since then. This broader view highlights the market’s resilience and dispels fears of a repeat crisis.

San Diego’s Foreclosure Landscape: A Tale of Resilience and Recovery

The current data starkly contrasts with the conditions during the housing crash era. Unlike the alarming spikes in foreclosure filings, notably exceeding 1 million annually, San Diego’s foreclosure trend in 2023 reveals a considerably lower figure of approximately 357,000 filings. This significant disparity underscores a positive shift in the market dynamics.

Transitioning from the red bars symbolizing the distressing foreclosure peaks of the past to the present scenario unveils a notable improvement in San Diego’s real estate climate. In contrast to the tumultuous events of the housing crisis, characterized by widespread economic turmoil, the current situation reflects a more stable and resilient market.

A recent article from Bankrate delves into one of the key factors contributing to this stark contrast. By analyzing trends and data specific to San Diego, the article sheds light on the region’s robust recovery and the mitigating factors that have steered it away from the tumultuous conditions of the past.

“In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes.”

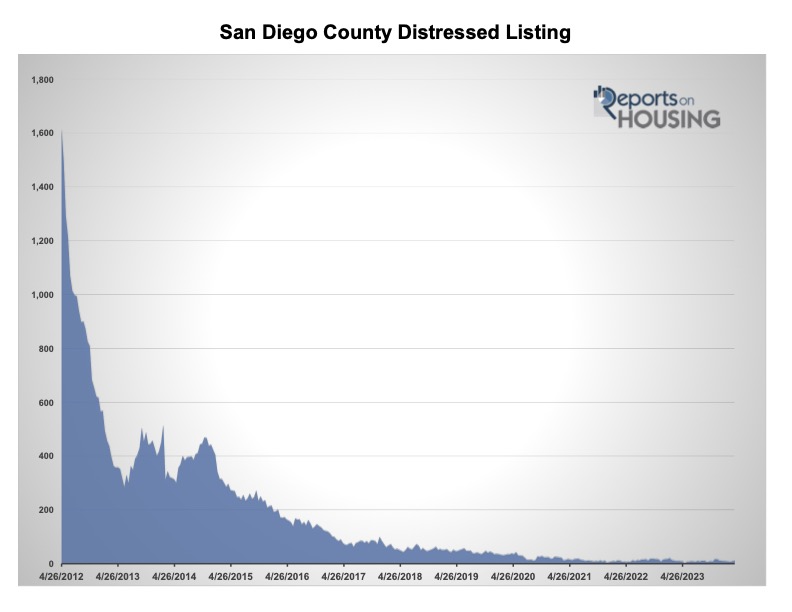

In essence, the data not only illustrates the stark differences between past and present but also underscores San Diego’s real estate market’s resilience and adaptability. Understanding these nuances is crucial for effectively navigating today’s real estate landscape. Below is a chart illustrating the number of distressed properties in San Diego. You can see there are not many.

Wrapping it All Up

San Diego foreclosures today contrast starkly with the turmoil of the 2008 housing crash. Unlike in the past, many homeowners in our region now hold substantial equity in their properties, acting as a sturdy defense against foreclosure risks. This positive development not only benefits homeowners but also enhances stability within the local real estate market.

Upon closer examination of the data, it becomes clear that San Diego’s current housing scene differs significantly from the foreclosure crises of the past. Instead, it portrays resilience and vigor, signaling a path diverging significantly from the challenges endured during previous economic downturns. While there is a noticeable increase in foreclosure homes in San Diego, it’s important to emphasize that this surge doesn’t reach the crisis levels witnessed during the housing bubble burst. This rise in foreclosures does not forebode an imminent crash in home prices in San Diego or elsewhere.