Do you find yourself dreaming about owning a home but feel stuck on how to save up for the down payment? Trust us when we say this: you’re in good company. Many people entertain the idea of using their 401(k) savings to turn this dream into reality. However, before you make a move to use your retirement savings for a home purchase, it’s crucial to explore every other option and seek advice from a financial expert. Let us tell you why this is important.

Considering the Numbers: A Compelling Case

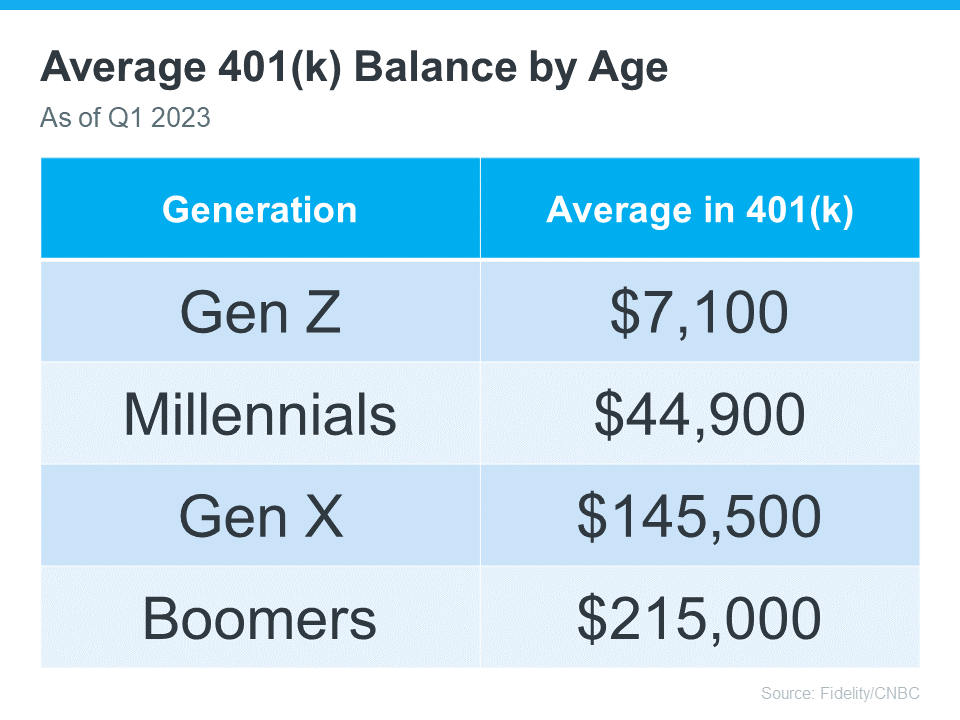

When we look closely at the figures, it’s clear why using a 401(k) to buy a home might seem attractive. A significant number of Americans have built up impressive retirement savings, as illustrated in the chart below. This accumulation of funds presents a tempting opportunity for potential homeowners. By examining these numbers, we can understand the growing interest in tapping into retirement accounts for real estate investments.

Seeing your dream home just within reach can be quite enticing, especially when you’ve built up a substantial amount in your 401(k). The thought of tapping into these savings might cross your mind more than once. However, it’s crucial to pause and consider the bigger picture. Withdrawing from your 401(k) retirement savings early isn’t just about facing potential penalties; it’s also about the long-term impact on your financial health. That’s why thoroughly examining all your options for a down payment is vital. Saving for a home requires careful planning and consideration. As Experian highlights, it’s important to weigh the pros and cons before making such a significant decision. This ensures you’re making the best choice not just for today but for your future financial well-being.

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Exploring Different Home-Buying Strategies Aside from 401(k)

Thinking about buying a home? Tapping into your 401(k) retirement savings can be a path to consider, but it’s definitely not your only choice. Let’s dive into a few alternative methods that might just be the perfect fit for you, with insights from Experian:

- FHA Loan: This is a fantastic option for many homebuyers. If you qualify, an FHA loan lets you put down as little as 3.5% of the property’s price. This percentage can vary based on your credit score, but it’s a great way to make homeownership more accessible, especially if you’re just starting out.

- Down Payment Assistance Programs: Don’t forget about the various assistance programs out there! Whether it’s through national schemes or local initiatives, these programs are designed to lend a helping hand to both first-time and repeat buyers. They can significantly ease the burden of gathering that all-important down payment.

Both these options are worth considering as you navigate the exciting journey of purchasing your new home. Remember, each path has its own set of advantages, and the best choice really depends on your individual circumstances.

First and Foremost, Craft a Solid Plan

Embarking on the journey to homeownership is an exciting venture, and having a well-thought-out plan is crucial. Before diving into any home-buying process, it’s essential to consult with a financial expert. This ensures you’re making informed decisions every step of the way. Collaborating with a knowledgeable team to map out a detailed plan sets the foundation for a successful home-buying experience. As Kelly Palmer, the Founder of The Wealthy Parent, often emphasizes:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Final Thoughts on Using 401(k) for Buying a Home

Are you still mulling over the idea of tapping into your 401(k) retirement savings for a down payment on a home? It’s a big decision, and there’s a lot to weigh. Before you take the plunge, it’s crucial to explore all the avenues available to you. We highly recommend consulting with a financial expert. They can help you navigate through your choices, ensuring you’re making a well-informed decision that aligns with your long-term financial health and home-buying goals. Remember, taking this step can be a game-changer, so getting professional advice can really make a difference.