The rental market for holiday homes has changed significantly with the advent of Airbnb in 2008 and the rebranding of Vrbo in 2019. Now, more people realize that their second or even third home might be a source of income, just like renting out a spare bedroom. Rather than staying in a pricey hotel, homeowners who invest in vacation properties may see the world and hone their real estate investing skills all at once. However, many people are turned off by the idea of having another mortgage, even though owning several homes allows owners to engage in regional arbitrage and gain various tax advantages. Nonetheless, in most jurisdictions, investing in a second home may be a straightforward and lucrative venture. In this blog, we’ll be going over tips for buying a vacation home in San Diego.

Spend only what you can comfortably afford

Nowadays, it’s not hard to figure out how much you can spend. There are several mortgage calculators available online to help you with this. Type in your monthly income and total debt, and the calculator will tell you how much of a loan you can get from the bank.

In the recent decade, there have been significant changes to the economic environment. Following the cessation of the frantic lending practices of recent years, banks have started applying tighter criteria to loan applicants. A 20% down payment is necessary, and your housing and transportation costs combined shouldn’t exceed 36% of your monthly gross income.

Don’t count on rental revenue from a vacation property to cover the mortgage payments. It’s important to keep in mind that you don’t have to buy a beachfront estate with soaring atriums and a boathouse if you don’t want to. It’s fine to take baby steps.

Spend your heart on it

Many people decide to invest in a second house after coming back from a holiday with the itch to buy something. Before making such a sizable purchase, buyers should do their homework to ensure they fully understand the pros and cons.

In our experience, the most common mistake made by those looking to purchase a second home is overestimating the frequency with which one will use the home. It is also crucial for buyers who want to use the property as a vacation or short-term rental to have a firm grasp on their financial goals. Don’t jump to conclusions. Rather, give serious thought to big decisions.

Consider how you will utilize the area

One of the best tips for buying a vacation home in San Diego is to think about how you want to use the space. According to experts from bravo-moving.com, most people move to vacation houses with large yards, outdoor cooking facilities, and proximity to water. Places like this are great for people who want to spend most of their time outside socializing with loved ones. Would you instead remain in, prepare tasty meals, and read a good book? Cottages and cabins with fireplaces, plush bedrooms, and spacious kitchens could be at the top of your list. Or is your home going to be on a smaller scale? Having a plan for how you’d like to spend your vacation time helps you select a vacation home.

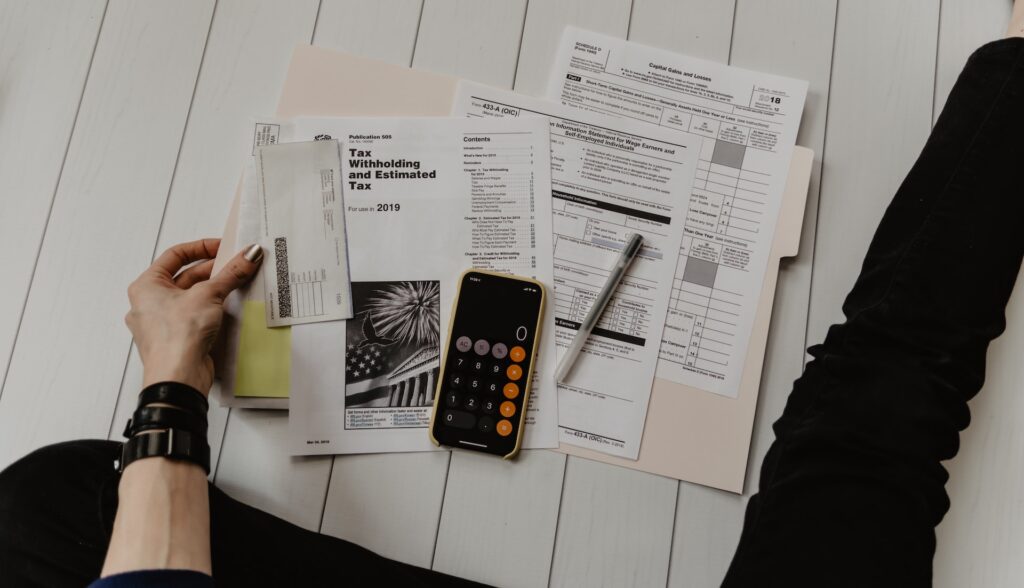

Take the tax consequences into account

Another one of the tips for buying a vacation home in San Diego is to consider the taxes. Don’t assume you know the tax ramifications of owning that home just because you’ve had a primary residence before. It might be trickier with second homes.

Taxes on rental income are something to consider if you want to put the home on the market. You may want to speak with your accountant about this. Your property taxes may increase from what you’re now paying because the vacation area’s tax rate is higher than where you live. Or because this is a second home rather than your primary residence. In some cases, taxes on second homes are usually much higher than taxes on primary homes.

A real estate agent who knows the area well will be able to point some of this out and may even suggest ways to avoid them, like buying property on the edge of town.

Determine how much time you will actually spend there

Spending so much on a piece of real estate implies you want to visit it frequently. Or at least a few times every year. In addition, how many times you intend to use it is certainly beneficial, but it is also a tough measure to pin down because, as we all know, life happens. The breakeven point will change based on variables such as market value, the amount you invest in the house, and the furnishings and decor you wish to have. For example, you need to calculate moving costs and decoration in your budget. Moving furniture or other things to San Diego and hiring movers can be done with a simple transfer with moving experts. However, it can take a while before you make back your initial investment in the house. The cost could be justified if you plan on spending a lot of time there.

Decide if you’ll be on or off the grid

While seclusion is likely crucial to you, it may not come without a price. How important is having access to the Internet? In the most remote areas, coverage could be spotty. Let’s pretend you’ve located the perfect cottage, only to learn that it’s disconnected from the grid and needs a generator to provide power. That’s inconvenient, and depending on whether or not it runs on gas, it might cost you money. Some people just don’t see why they should go through all the trouble.

The question is, “From where will you get your water?” This may be important in cottage country. Is there already water suitable for human consumption, or would you have to construct a treatment facility? Winter road upkeep is another crucial aspect. Certain municipalities or chalet communities may send out snowplows in the event of significant snowfall, while others may not. Having a firm grasp on your absolute must-haves in a getaway home can help you choose the perfect place without any unwanted surprises.

In conclusion

Just chill out, gather your thoughts, and think about these tips for buying a vacation home in San Diego. Don’t move until you’ve verified your own math. The last thing you want to do is lose both your vacation time and your savings on a poor investment.