Over the past year, conversations around home affordability have been buzzing around the real estate market, especially with how challenging it has become for a lot of people venturing out to get a hold of their dream home. Yet, despite all of this, a silver lining has recently appeared. We’ve seen a dip in mortgage rates from their peak in October, offering a glimpse of relief. However, affording a home stretches beyond just the mortgage rates.

To help grasp the true picture of home affordability, we need to consider a trio of crucial elements: mortgage rates, home prices, and wages. Each plays a significant role. Let’s unpack the most recent figures for these factors and understand the positive shift in affordability.

1. Mortgage Rates

Recently, we’ve seen mortgage rates start to dip, bringing a wave of relief to prospective homebuyers. This trend isn’t just a fleeting moment; many industry experts, including Jiayi Xu, a renowned economist at Realtor.com, anticipate a continued decrease throughout the year. This forecast sets an optimistic tone for those looking to secure a home loan, making now a potentially strategic time to consider stepping into the housing market.

“While there could be some fluctuations in the path forward … the general expectation is that mortgage rates will continue to trend downward, as long as the economy continues to see progress on inflation.”

A slight shift in mortgage rates can significantly influence your buying power. This change can make the home of your dreams more attainable by lowering your monthly mortgage payments. Navigating these rate adjustments can lead to substantial savings, allowing you to secure the home that meets your needs and desires comfortably.

2. Home Prices

Now, let’s talk about the second crucial factor in home affordability: home prices. After experiencing a steady increase in the past year, we anticipate that this trend will persist in 2024. Why, you ask? Well, despite a projected uptick in inventory for the year, the demand for homes continues to outpace the available supply. Lisa Sturtevant, Chief Economist at Bright MLS, weighs in on this. She suggests that the limited number of homes available for sale is the driving force behind this ongoing rise in home prices. It’s a dynamic market situation that keeps the pressure on aspiring homebuyers.

“More inventory will be generally offset by more buyers in the market. As a result, it is expected that, overall, the median home price in the U.S. will grow modestly . . .”

Good news! Prices are less likely to shoot up rapidly, similar to what happened during the pandemic. However, waiting could lead to higher costs for you. If you’re prepared and eager to buy a home and come across the perfect one, it might be in your best interest to make the purchase now. Otherwise, you risk competing with new buyers joining the market, which is what we are experiencing at this very moment in San Diego while seeing prices continue to climb.

3. Wages

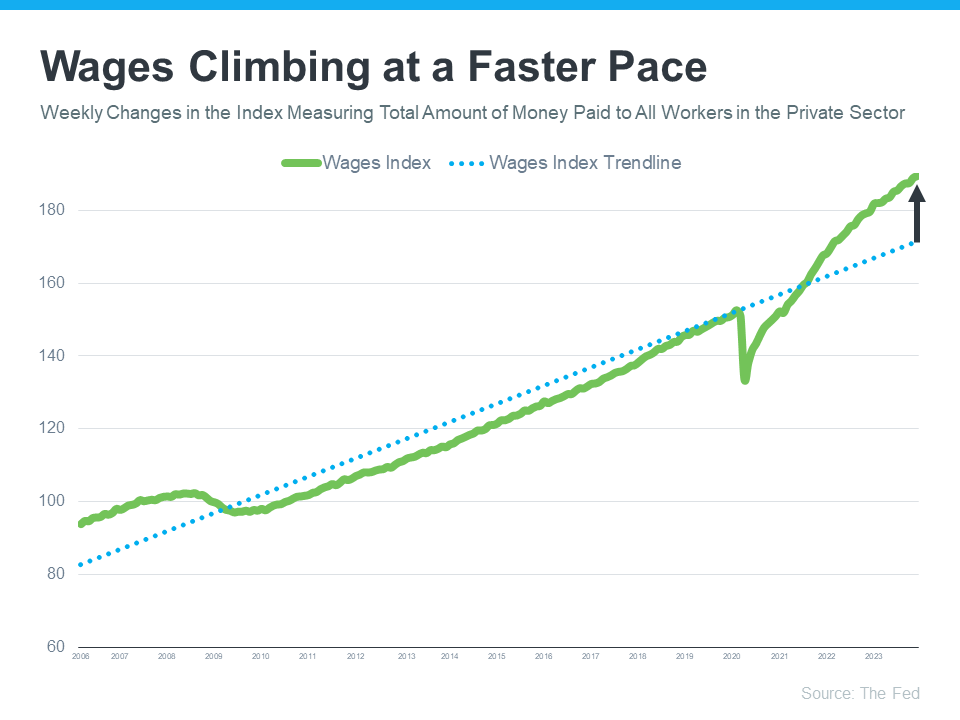

Let’s talk about another great aspect of affordability – rising incomes. Take a look at the graph below, which presents data from the Federal Reserve. It vividly illustrates the growth in wages over time. This increase in income is a significant factor that contributes to the overall affordability of homes today.

Take a look at the blue dotted trendline – it shows how wages usually increase over time. Now, on the right side of the graph, you’ll notice that wages are currently above that trendline. This means they’re rising faster than usual. Higher wages are great news for affordability! Why? Well, when your income goes up, you don’t need to allocate as much of your paycheck to cover your monthly mortgage. It’s that simple – more money in your pocket for other things!

Conclusion on Home Affordability

When it comes to affording a home, it boils down to three key factors: mortgage rates, home prices, and your income. The great news is that these factors are all aligning favorably for potential buyers. Let’s break it down for you.If you’re considering buying a home, it’s crucial to understand that the key factors affecting affordability are on the upswing. For the most recent updates on each of these factors, don’t hesitate to reach out to a trusted local realtor like the McT Real Estate Group and please feel free to connect with us.